Market equilibrium

As a market equilibrium is called in economics the market developments on a market in which the amount of the bid equal to the quantity demanded is. This amount is called the equilibrium amount .

General

Market equilibrium is a state that all market participants strive for because market disruptions have a negative effect on supply, demand or price. According to Heinrich von Stackelberg , if there is no stable market equilibrium , either the form of pricing or the form of the market must change in some direction. Since there are generally more buyers (and fewer sellers) the lower the price , and the more suppliers (and fewer buyers) the higher the market price, the price functions as a balancing variable. The price that leads to market equilibrium is called the market price or equilibrium price .

The equilibrium in pricing is a central element of neoclassical theory and general equilibrium theory .

history

To determine attempts, such as supply and demand are related, have their origin in the book The Wealth of Nations by Adam Smith , first published in the 1776th In this book, Smith started from the assumption that although demand depends on the price of the good, conversely, there is no influence on the price of demand. David Ricardo published the book Principles of Political Economy and Taxation in 1817 , in which the first idea of an economic model was proposed. In it he set out the basic ideas of the assumptions that led to the formation of the theory of equilibrium price.

In the late 19th century the idea of the marginal price arose . The main founders of this new school were Stanley Jevons , Carl Menger and Léon Walras . The idea behind this was that the price was set by the highest price a buyer was willing to pay, that is, the marginal price. That was a substantial improvement on Adam Smith's idea of determining the asking price.

Ultimately, Alfred Marshall, and especially Léon Walras, combined their ideas about the bid and ask price and looked at the equilibrium point where the two curves intersected. They also began to look at the influences of different markets on one another. The theory of supply and demand has hardly changed since the late 19th century. The greatest attention is now directed to cases in which market failure occurs, for example in the case of monopolies or irrational behavior on the part of market participants, and on the consideration of transaction costs .

Assumptions and Definitions

The theory is based on several assumptions that must be fulfilled in order to clear the market and to form an equilibrium price . This requirement cannot be strictly fulfilled, which is why the equilibrium price rarely exists in reality. In a perfect market , that is, a market with many small, rationally acting suppliers and buyers, none of whom can influence the market price at their own discretion, an equilibrium price arises. This assumption is fundamental to the simple theory of equilibrium price taught in introductory economics courses. In most real markets, however, this assumption does not hold true, be it for reasons of poor market transparency or because individual buyers or sellers have sufficient market power to influence the price in their favor. In such situations the simple equilibrium price model is insufficient and requires further study. It is also assumed that there are no transaction costs , which is rarely the case in reality. Transaction costs refer to those costs that arise in addition to the actual purchase, i.e. the costs for price information and transport costs. In addition, there must be no feedback, e.g. B. in the way that the amount of the supplier and demand prices are a unit. This is e.g. B. the case in the labor market, where prices are determined by wage costs. At the same time, however, income forms the basis at which prices can be purchased. Despite these weaknesses, the model can be used as a first approximation for market developments.

Economics pays particular attention to cases in which so-called market failure leads to a suboptimal allocation , i.e. a suboptimal allocation of scarce resources. For example, a monopolist will always charge excessive prices, which leads to a shortage of the quantity on offer. In such cases, economists can try to find rules to avoid or at least alleviate this market failure and the resulting loss of welfare for society . The state could intervene directly through legal measures (maximum or minimum prices) or indirectly through market regulation, for example in the form of taxes .

demand

Demand is the amount of goods that consumers want to buy at a given price. One can create a demand table that shows the quantity demanded at all possible prices. This table can also be displayed as a graph in the market diagram or as a mathematical formula. The main criteria of the price that is paid are typically the quantity of the good, the level of one's own income, personal taste, the price of substitute goods (“substitutes”) and complementary goods . The goods “car” and “gasoline”, for example, are complementary, since their consumption is mutually reinforcing.

The variable amount of demand q results as a function D from the independent variables p (price), p 1 , p 2 , ..., p n (the prices of other goods), Y v (available household income) and ED (expectations of the demand of the market in terms of price developments, etc.). Mathematically:

offer

Supply denotes the quantity of a good that producers are willing and able to produce at a certain price.

Analogous to the theory of the demanded quantity, the offered quantity q results as a functional relationship S with the independent variables p (price), p 1 , p 2 , ..., p n (the prices of other goods), w 1 , w 2 , ..., w n (the costs of the factors of production or the provision of services), F (the state of production technology) and ES (the expectations of the providers on the market in terms of price developments, etc.). Mathematically:

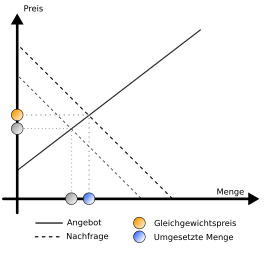

Determination of the equilibrium price

The graphics, also known as the price-sales function , show the price-dependent quantities of supply and demand. In contrast to what is usual in mathematics, the independent variable "price" is plotted along the vertical axis, while the dependent variables supply and demand ("quantity") are plotted along the horizontal axis. This representation is common in economics.

The product line starts with a small offer at a low minimum price and grows as the price rises. The demand line starts with a small demand at a high maximum price and increases in quantity as the price falls. As you can see from these two lines, there are more and more suppliers and goods the higher the asking price. Conversely, there are more and more customers who buy more and more the lower the price asked for the goods. Since the price requests of sellers and buyers are in opposite directions, an equilibrium is established in the market at the interface between supply and demand, which determines the equilibrium price and the maximum turnover.

Change in demand

If more people want a particular good, the amount in demand will increase at all prices. The cause of higher demand can be, for example, a new fashion, different living conditions or higher income. As a result of the higher demand and the associated shift to the right in the demand line, the equilibrium price and the amount sold rise.

If, for example, more people want to buy coffee, the providers will first be able to increase the price because there is more demand than supply. As a result of the price increase, more providers will be added or existing providers will expand their range, as it is now worthwhile for them at the higher price. This reaction of the market creates a new market equilibrium with a new equilibrium price and a new sales volume.

Conversely, when demand falls, the opposite happens. The demand curve shifts to the left, the equilibrium price falls, and as a result, supply will also fall.

Change in the offer

An increasing supply depresses the price and increases the amount sold. When the supply falls, the price rises and the quantity falls.

For example, if an improved, cheaper method of growing wheat were introduced, more suppliers could sell wheat for the price they were bidding. This can lead to an oversupply of wheat. In order to be able to sell all of their wheat, suppliers have to reduce the price. As a result, wheat is becoming more interesting for more buyers, for example bakers, because they can use it to produce cheaper bread and sell more for their part. As a result, a new equilibrium is formed in the wheat market with a lower equilibrium price and a larger market volume.

elasticity

An important concept for understanding equilibrium price is price elasticity . It indicates how much a change in the price of a product or service affects demand or supply.

Anomalies

The idealized theory assumes that all trading takes place at the equilibrium price. On the one hand, this assumes that all market participants have a complete overview of the market at all times. Almost always, however, only part of the overall market can be seen by the actors. On the other hand, there is also trade next to the equilibrium price, albeit with reduced sales.

Supply anomalies

There are shifts on the supply side because the possible price depends very much on the quantity that is subsequently sold (not just offered). A manufacturer can easily produce twice the amount with the same fixed costs , so that the fixed costs are divided over a much larger amount.

Surveying the market costs both buyers and suppliers not insignificant money, such as travel expenses or advertising. It is therefore more interesting for the manufacturer to sell higher quantities to fewer customers. At the same time, customers can bundle their demand and take advantage of it.

Shortage of supply or demand : A market in which there are only a few buyers or only a few suppliers reacts differently than the Polypol . In both cases, a market power arises that allows the price to be changed in its favor. In theory, it doesn't matter if a manufacturer sells more at a lower price or less at a higher price. Due to the number of units (see above), this is not linear, but the loss of a major customer (with the same market volume) can ruin a company because it can then no longer produce at the market price. Conversely, there is less competition among a few manufacturers, since all of them can produce very effectively. There is more likely to be price fixing or simultaneous price increases, as nobody is afraid that they could lose market share as a result.

Monopoly : There is only one manufacturer or buyer (monopsony) who can, in principle, determine the price at will. In this case there is actually only one price, but this is no longer determined on the market. The market laws then only determine the amount requested or offered. This leads to market failure , as the available resources are no longer optimally used and the market volume is reduced.

Decoupling of demand and need : The model assumes that demand arises in the market in accordance with the possible price. This is especially true for luxury goods such as a CD. You might want to own these, but not for any price. A price increase for gasoline, on the other hand, will only lead to behavior changes in the long term in response to the higher price. In principle, there is a certain basic demand for drinking water regardless of the price, since nobody can refrain from drinking because it is too expensive.

Price anomalies

In the market equilibrium one assumes that at the prevailing price the demanders can buy the desired quantities and the suppliers can sell them. The assumption that the market will be constantly cleared is not realistic, however, because prices would have to adapt without delay to changes in supply and demand. But the prices are often fixed over several years , for example through contracts (collective agreements for wages, book prices ). The clearing approach assumes that all prices and wages are flexible, but in reality wage and price rigidities exist.

A rising price with falling demand occurs, for example, in local public transport, in drinking water and in the manufacture of small series of products previously manufactured in large series.

At the end of a product's production cycle or later, demand drops sharply. When it is still needed, the price is much higher than in the middle of the production cycle.

Definitions

In a demand market, also known as a buyer's market, demand determines supply. In this market situation the price falls. There is either a supply surplus (increasing supply and constant demand) or a demand deficit (decreasing demand while supply remains the same).

In the supply market, supply is below demand. The price increases. There is either a supply deficit (falling supply and constant demand) or an excess demand (increasing demand and constant supply).

One example is the introduction of the first MP3 player. The supply was low, the price high, and buyers were satisfied when they bought a device. Over time, the supply market changed to a demand market. The customer can choose from a large number of products, which means that high prices can no longer be achieved.

Market forms

The price arises in different ways depending on the various forms of market ( polypol , oligopoly , monopoly ). Both mono- and polypolists have to consider the marginal cost curve in the market equilibrium . While the polypolists seek the intersection with the demand function, the monopolists achieve the maximum profit when intersecting with the marginal sales function . Since the marginal turnover is below the demand function, the price on the monopoly market is higher for a smaller quantity. This means that a polypole market is theoretically cheaper for the customer.

Market form table according to Stackelberg

Markets can be divided into different market types according to the number of suppliers and buyers. The most common division of the market goes back to Heinrich Freiherr von Stackelberg:

| Enquirer | ||||

|---|---|---|---|---|

| lots | few | a | ||

| providers | lots | Polypol | Oligopsony | Monopsony |

| few | Oligopoly | bilateral oligopoly | limited monopsony | |

| a | monopoly | limited monopoly | bilateral monopoly | |

Polypol

The formation of prices on a polypolistic free market takes place through the interaction of supply and demand. The price levels off on a competitive market in such a way that it balances supply and demand (market equilibrium). If the supply is greater than the demand, the price falls. More consumers are willing to buy the product at a lower price, but fewer suppliers are willing to offer the good. Demand increases and supply decreases. The price at which demand and supply are equal is called the equilibrium price.

The market participants in a Polypol take the price for granted and act as volume adjusters. At a higher price, a larger amount is offered, for example when new providers enter the market, or the expansion of production beyond the existing supply volume by increasing the production capacity.

Depending on the type of market and the market conditions, a distinction is made between pricing z. B. at the Polypol

- perfect competition

- imperfect competition.

monopoly

As the number of suppliers and buyers of a good decreases, pricing becomes more difficult and unsteady.

In the case of a unilateral monopoly, the provider or buyer alone determines the price. The monopolist accepts the demand function as a date. He will always choose a price / quantity combination on this demand function, since if it were exceeded, it would generate a supply (quantity) surplus, if it were not reached, it would generate a demand (quantity) surplus.

The profit maximum for the monopoly is the Cournot point (intersection of marginal costs and marginal revenue). This is below the revenue maximum.

In a bilateral monopoly, pricing is often arbitrary.

Depending on the type of market and the market conditions, a distinction is made between pricing z. B. in the supply monopoly

- perfect competition,

- imperfect competition

Oligopoly

In an oligopoly, profit depends on the reactions of others. In the oligopoly there are few suppliers and many buyers.

The core problem of the oligopoly theory is therefore the development of realistic hypotheses about the reaction of others. The following hypotheses were made for Dyopole :

- Cournot's hypothesis : The dyopolists operate independent quantity strategies

- Stackelberg's hypothesis : The latter reckons with a more inelastic behavior of the other. It determines the profit that represents a maximum after the adjustment of the second as expected.

- Camerlin-Fellner Hypothesis Both dyopolists cooperate and thus behave like a monopoly

- Theory of the kinked demand curve: Competitors follow price cuts immediately, there is no reaction to price increases

- Equilibrium area solution according to Krelle

criticism

First of all, a distinction must be made between where and how the concept of market equilibrium is used. It is used in very different contexts and, for example, in individual markets. A criticism could target the mathematical properties of supply and demand functions (or goods properties) or the simplicity or complexity of the framework model. It must also be considered whether market equilibria are criticized directly or the economic equilibrium concept per se (see equilibrium (economic theory) ).

Criticism of macroeconomic equilibria is often based on the methods of aggregating individual data (see interpersonal comparison of benefits in utilitarianism).

Neoclassical and General Equilibrium Theory

The equilibrium in pricing is a central element of neoclassical theory and general equilibrium theory.

In connection with welfare economics , for example, it is to be criticized that a cardinal understanding of utility is used as the basis. Only this enables interpersonal comparisons of benefits and thus an aggregation of individual benefits. This assumption is highly problematic, which Kenneth Arrow expressed in his impossibility theorem (cf. Arrow theorem ).

Critics of the theory of equilibrium price formation refer to it as a theoretical model that cannot be generally applied ( market failure ). They refer, among other things, to actual deviations from the model assumption that a higher price leads to less demand but more supply.

Selected markets

In the labor market, for example, falling wages can lead to more labor supply, including from family members, if the employers try to maintain their income. According to the efficiency wage theory, a market-clearing wage does not occur because companies pay wages that are higher than the equilibrium wage, because they hope that this will result in higher labor productivity for employees.

Another example is the financial markets , where some actors sell securities when they fall below a certain price. Conversely, the demand for securities may rise when their price rises ( herd behavior ). According to critics, the model of equilibrium price formation is therefore (if at all) only applicable to goods that have an immanent direct use, such as bread from the baker, and which cannot be “abused” as objects of speculation.

However, it is precisely the financial market that shows the model's relevance to reality: If the majority of securities owners wanted to sell below a certain price, the price would drop to zero. In reality, however, this can only be observed if the security is actually no longer given any value by the investor - rather, the security owners who are ready to sell usually find sufficient potential buyers so that a new (lower) equilibrium price arises. Proponents of models therefore only explain this sales behavior with the availability of new information and a subsequent re-evaluation of the goods by the owners.

Reactions

Despite the criticism, the model provides a high level of explanatory content for many everyday examples, as they were also mentioned in the sections above, precisely through the simplified assumptions. But it must always be checked whether the requirements for applicability are met. With the appropriate extensions for special market situations, it can be used for most cases if the speculative objects are left out.

See also

- Market equilibrium with monopoly competition

- Giffen paradox

- Snob effect

- Bubble effect

- Structural crisis

- Price-sales function

literature

- Hal R. Varian : Fundamentals of Microeconomics. 6th, revised and expanded edition. Oldenbourg, Munich / Vienna 2003, ISBN 3-486-27453-8 .

- Georg Vobruba : No balance. The economy in crisis. Beltz Juventa, Weinheim / Basel 2012, ISBN 978-3-7799-2847-8 .

Web links

- Nobel Prize Winner Prof. William Vickrey: 15 fatal fallacies of financial fundamentalism-A Disquisition on Demand Side Economics

- Supply and Demand by Hubert D. Henderson ( Project Gutenberg ).

- David D. Friedman: Price Theory

- Market and Market Mechanism Ralf Wagner: Guide to Economics

- Forms of representation of a market (PDF; 20 kB)

- Market regulates production

Individual evidence

- ^ Heinrich von Stackelberg, Market Form and Equilibrium , 1934, p. 204

- ↑ Definition: buyer's market | Gabler Economic Lexicon. In: gabler.de . Retrieved March 9, 2016.

- ↑ Definition: seller's market | Gabler Economic Lexicon. In: gabler.de . Retrieved March 9, 2016.

- ^ Heinrich von Stackelberg, Market Form and Equilibrium , 1934, p. 195