Hunt Brothers Silver Speculation

As the largest silver speculation is speculation bubble in the silver market mid-1970s, regarded by the year 1980, in particular with the brothers Nelson Bunker Hunt and William Herbert Hunt is associated. Together with wealthy business people from Saudi Arabia, they bought huge amounts of silver and silver contracts on the commodity futures exchanges and tried to dominate the silver market. Lured by rising prices and intensive media coverage, more and more investors jumped on the speculative train and increased the price increase.

In total, the Hunts and their partners bought around 150 million ounces (4,665.5 tons) of physical silver and around 200 million ounces (6,220.7 tons) of silver on the COMEX commodity exchange in New York.

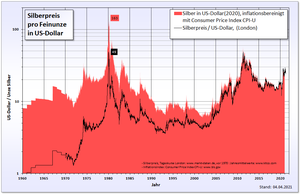

The Hunts had some of the physical silver brought to Zurich and London in specially chartered cargo planes , also because they did not trust the American state and feared confiscation . (In 1933, President Roosevelt banned private gold ownership in the United States under threat of draconian penalties, and all gold that was not exchanged for paper money in time was confiscated. This gold ownership ban was in effect until 1974). The price of an ounce (31.1035 grams) of silver went from under $ 2 in 1973 to $ 50 in January 1980, only to collapse. In the following years the price of silver fell below US $ 5 per troy ounce and remained at this price level for over 20 years.

The end of speculation

While the Hunts managed to get their physical silver safe, doing business on the commodity futures exchange was their undoing. As the price of silver continued to rise, they bought ever larger quantities of silver contracts on the New York Commodities Exchange (COMEX), most recently partly on credit.

In mid-January 1980 - the price of silver was almost $ 50 an ounce - the American financial establishment struck back: The rules on the COMEX were changed overnight by the stock exchange regulator . No further purchases were allowed, i.e. no new long positions could be entered into. It was a liquidation-only arranged Forex trading, it could only existing long positions against existing short positions are compensated.

This meant that the silver price could only fall, and it did so immediately, especially since the short-positioned big banks put their buy bids down sharply. Additionally, the decline in the silver price was accelerated by the panicked sales of thousands of small speculators and investors who had followed the example of the Hunts. In addition, large quantities of physical silver had appeared on the market because private individuals were selling and melting down silver objects, jewelry, cutlery and silver coins on a large scale due to the price increase - the price of silver had increased more than twentyfold in a few years . The old 5 DM coin containing silver was also exchanged for a silver-free one in 1975.

This led to dramatic losses in the long positions of the Hunts, which had to compensate for this drop in value immediately in cash - but could not. In order to meet their payment obligations, they had to sell parts of their long positions at any price, which further accelerated the price decline.

Many billions of dollars had to be paid within a few weeks, which consumed the entire fortune, until finally bankruptcy had to be declared.

The aftermath of Hunt's silver speculation

The increase and subsequent collapse of the silver price, which was linked to the Hunt brothers and their speculation, which at the time also resulted in considerable losses for countless private investors , has had lasting psychological damage to the silver market. After 1980, there was a 20 year long bear market for silver with falling or stagnating prices, which only seemed to have come to an end in 2004. Hunt's trauma and the legends of its deep fall are still deeply rooted in the psychology of the silver market and have undoubtedly brought silver into disrepute among the broad masses of investors and financial professionals as an investment medium. Even today - more than 30 years after their failure - there is hardly a contribution about silver intended for the broader public that does not cite the Hunt brothers and their failure in the silver market as a chilling example.

The fiscal environment of the 1970s

The Hunts' silver purchases were not the only reason, probably not even the main reason, for the sharp rise in silver prices. The 1970s were characterized by great uncertainty in the financial world, the oil crisis , threatening wars and crises ( Yom Kippur War , overthrow of the Shah in Iran , war in Afghanistan in the USSR ), the massive increase in the US national debt due to the Vietnam War , and massive expansion the (paper) money supply , high inflation rates combined with high inflation fears and subsequent flight of capital investors into real assets. The price of gold rose from US $ 35 in 1970 to US $ 850 in 1980.

literature

- Stephen Fay: Great Silver Bubble . Hodder & Stoughton General Division, London 1982, ISBN 034028370X .

Individual evidence

- ^ Silver Fixings. (No longer available online.) LBMA , archived from the original on February 9, 2014 ; accessed on January 20, 2014 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Gold Fixings. (No longer available online.) LBMA , archived from the original on February 1, 2014 ; accessed on January 20, 2014 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.