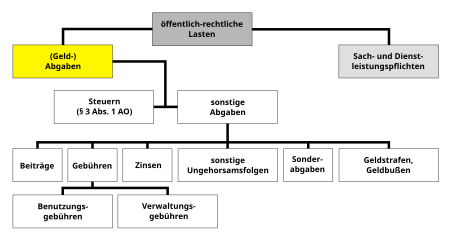

Special charge (Germany)

A special charge is a non-tax charge and a generic term for a wide range of various public charges. It is therefore not possible to formulate a general definition.

backgrounds

In a series of decisions, the Federal Constitutional Court did not qualify the payment obligations imposed by law on a limited group of people with regard to specific economic or social contexts as tax levies or preferential charges , but as special levies and viewed as permissible under constitutional law. It denied that in these cases an express special constitutional authorization would be required to impose the special charges; Rather, it has derived the legislature's competence to introduce extra-tax charges as well as the regulation of their use from the general competences according to Art. 73 ff. GG .

The material content of a tax is decisive for qualifying as a special tax. Since it is a question of delimiting areas of competence, it cannot depend on how the Tax Act itself classifies a public-law tax. It is not in the power of the federal or state legislature to take a charge that falls under the concept of tax by expressly contrary provision, i.e. by expressly denying the tax status or by expressly classifying it in another tax category, to take this legal qualification and thereby to establish its jurisdiction.

The collection of a special charge presupposes a specific relationship (factual proximity) between the group of taxpayers and the purpose pursued with the collection of the tax.

- The group burdened with the tax must be evidently closer to the purpose pursued by collecting the tax than any other group or the general public of taxpayers.

- This factual proximity must result in a special group responsibility for the fulfillment of the task to be financed with the extra-tax levy.

A social group can only be claimed with a special tax if it can be distinguished from the general public and other groups by a common set of interests specified in the legal system or in social reality or by special common circumstances, i.e. if it is a in this sense homogeneous group acts.

Special charges may not be levied to generate income for the general financial needs of a public community and their revenue may not be used to finance general government tasks.

Examples of special taxes

- Submission of the notaries in the area of activity of the Notarkasse Munich or Landotarkasse Leipzig

- Contribution to the German Wine Fund

- Sales in the milk sector (valid from April 1, 2004)

- Charges for the commissioning of goods ships and push boats

- Wastewater levy

- Railway police compensation payment

- Contribution to the sewage sludge compensation fund

- Contributions to the sales promotion of the German agriculture and food industry

- Contributions to deposit protection and investor compensation for securities trading companies at the Reconstruction Loan Corporation

- Contributions to the compensation scheme of the Federal Association of Public Banks

- Contributions to the compensation scheme of German banks

- Contributions to the promotion of the forest and wood industry

- Vocational training tax

- DRG system surcharge

- Case-related surcharge for the Institute for Quality and Efficiency in Health Care

- Field and mining tax

- Film levy from the cinema and video industry

- Financing grant to the Museum Foundation Post and Telecommunications

- Investment surcharge for hospital investment financing in the new federal states and Berlin (eastern part)

- Sugar production tax

- Quality assurance allowances

- Compensation levy for severely disabled persons

- Allocation for the insolvency money

- Allocation according to the milk and fat law

- Administration cost allocation of the Federal Financial Supervisory Authority

- Administration cost allocation for the Federal Banking Supervisory Office

- Administration cost allocation for the Federal Insurance Supervisory Office

- Administration cost allocation for the Federal Supervisory Office for Securities Trading

- Winter employment levy

- Additional levy in the milk sector (valid until March 31, 2004)

- Surcharge to finance training centers and training allowances

See also

- Parafiscal levy

- Property tax , credit profit tax , mortgage tax profit based on the Compensation Act

- House interest tax (1924–1943)

Individual evidence

- ↑ Scheffler, Wolfram (2007): Taxation of Companies, Heidelberg.

Web links

Decisions of the Federal Constitutional Court on special charges: