Submission

When charges are material costs - especially taxes to understand that committed to delivering services to persons authorized to receive or persons - institutions have withheld. In monetary economies , these are primarily monetary payments ; in natural economies , natural goods are transferred instead (cf. for example the medieval tithe ).

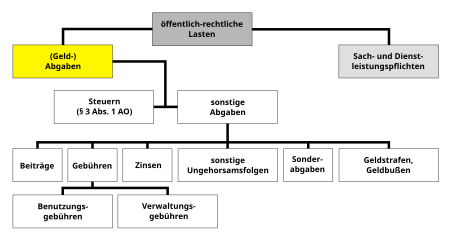

Public law charges

Public charges are cash benefits that citizens have to pay to the state on the basis of legal provisions . Taxes are levied without earmarking and therefore without any claim to consideration . For all other charges ( contributions , fees , interest , special charges , fines and fines as well as other consequences of disobedience such as conditions according to § 153a StPO , penalty payments or administrative fines ), special statutory regulations are required.

Legal basis

Directly in the tax code are set (AO) as one of the essential legal basis of the law of public charges only the taxes . Section 1 (1) AO explicitly states :

- This law applies to all taxes, including tax payments , that are regulated by federal law or the law of the European Communities, insofar as they are administered by federal authorities or by state tax authorities .

Thus, the tax code relates to the substantially procedure right of controlling and thus is closely related to the Finanzgerichtsordnung (FGO), which regulates the court proceedings in the area of the control law.

The other public charges therefore require an independent statutory regulation. However, these regulations mostly refer to the tax code with regard to the procedural rules. The municipal tax laws are an example of this .

Canon law taxes

In canon law, the term levies is a collective term for the services of the faithful to the church in order to provide them with financial strength.

Catholic canon law

In the organization of the Roman Catholic Church , taxes are an essential element for the formation and maintenance of the church's property . The Church therefore expressly claims the right to demand taxes from the believers and postulates a corresponding obligation of the believers. The Codex Iuris Canonici regulates the following:

Can. 1260: The Church has the innate right to demand from believers what is necessary for her purposes.

Can. 1222 § 1: The faithful are obliged to make contributions to the needs of the church so that the means are available to it which are necessary for divine service, the works of the apostolate and Caritas as well as for an adequate maintenance of those in her service .

In practice, various forms of canonical taxes have emerged:

- The requested contributions ( subventiones rogatae ), regulated in Can. 1262 ( The faithful are to give help to the Church through solicited assistance, according to norms issued by the conference of bishops. )

- Taxes levied by the diocesan bishop ( tributa ) according to Can 1263 ( the diocesan bishop has the right, after hearing the asset management council and the priestly council, to impose a moderate tax on the public legal persons under his leadership, corresponding to their income, for the necessary needs of the diocese; the other natural and legal He may only impose an extraordinary and moderate tax on persons in the event of a great emergency and under the same conditions, without prejudice to the particular laws and customs which grant him further rights. )

- Fees for individual acts of ecclesiastical administration or jurisdiction

- Voluntary contributions in the form of donations and collections.

Further levies, such as the church tax levied in Germany and Switzerland or the church contribution in Austria, are not based on canon law , but on state church law .