money

Money is the generally recognized means of exchange and payment in a society .

etymology

The word comes from the Old High German gilt , which means something like "remuneration, interest, wages, sacrifice, income, value, apply" and appeared for the first time in 790. Later, it took over the Middle High German as a money / gelt (already in the importance of money or cash), as yet with the terms today pay or compensate in the art. In practical use, money is a means of payment that differs from simple means of exchange in that it does not directly satisfy the needs of an exchange partner, but can be used for further exchanges due to general acceptance . Ultimately, the definition prevailed that money is the means of payment issued by the state or an authority authorized by it as a medium of value for circulation and intended for public transport.

General

The various individual sciences that deal with money as an object of knowledge have produced classic definitions. These include economics , sociology and law . From an economic point of view, for Friedrich Bendixen money is an “ instruction on the national product ”, the individual monetary unit represents a “hypothetical owner share in the national national product, an ideal claim to the potential for economic satisfaction”. He thus understood money as legitimation to receive consideration based on previous services . Günter Schmölders saw in money a “documented value proposition of general validity”. From a legal point of view, money is the legal tender with specified denominations prescribed by the state , a "creature of the legal system ".

species

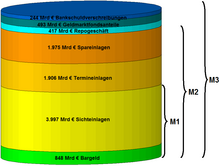

With regard to its physical presence, a distinction is made between cash , which is available in the form of coins and banknotes as cash on hand , and book money (or bank money ), a payment claim by a non-bank to a credit institution on a current account . According to the definition of the European Central Bank, cash is contained in the aggregate outside the central bank (including cash balances of the commercial banks ) plus the central bank money stock of the credit institutions on accounts at the central bank. The aggregate records the currency in circulation at non-banks (i.e. excluding cash on hand at commercial banks ) plus sight deposits from non-banks. The other aggregates and contain only book money.

That in monetary constitution of a State as legal tender certain money is called currency .

Functions

Money functions

In economics , money is functionally defined. In his main work, Das Kapital, Karl Marx describes the function of money as a “specific equivalent commodity”, as a “measure of values” in the process of “commodity circulation”, which in turn is the starting point of capital through money.

- Money has the function of a means of payment : A means of exchange or payment is understood to be an object or an acquired right that a buyer gives to a seller in order to purchase goods or services . Money simplifies the exchange of goods and the taking up and repayment of debts .

- Money is a store of value .

- Money is a measure of value : through the denomination ( nominal values of banknotes and coins), the monetary consideration can be measured as the market value and market price for goods and services .

- Money is a unit of account : the value of a unit of money is called purchasing power . With an invoice, for example, money also enables arithmetic operations .

The only constitutive function of the essence of money is its function as a transaction- dominating medium of exchange. This gives the money the highest liquidity of one, because it has to be accepted at face value without a discount .

The better a good fulfills its money function, the more likely it is to be viewed as money.

Money creation

Nowadays, money is usually created in the two-tier banking system consisting of a central bank and (commercial) banks .

Central bank money consists of the cash and the commercial banks' balances with the central bank. If the commercial banks of the central bank sell bills of exchange, foreign exchange or securities, they receive central bank money in the form of bank notes, coins or central bank deposits. Central bank money can also arise through interest-bearing lending by the central bank to commercial banks in return for collateral. The central bank can control the process of central bank money creation through its monetary policy instruments (in particular key interest rates and open market policy ). Money is also created when the central bank makes expenses for which it pays with central bank money.

Deposit money is mainly created when a bank grants a loan and credits the customer with the corresponding amount on his account ( deposit money creation ). This leads to a balance sheet extension; the assets side of the bank balance sheet grows by the loan amount, the liabilities side grows by the customer's account balance. However, banks can not be increased by lending the money supply because they are bound to these loans, depending on the credit risk of up to 8% equity to inferior . Other limiting factors are generally the willingness of banks to lend and customers to borrow (in the event of banking, economic or financial crises, deposit creation may decline and the deposit amount may decrease - see net borrowing ).

Money supply

The money supply is an important economic variable because it is related to the overall economic demand for goods and services and provides information on future price developments. The definition of the amount of money is not entirely uniform; The following is an example of the European Central Bank's definition of the amount of money. The money supply M0, also called the monetary base , captures the central bank money . In order to measure the amount of deposit drawn up, the central bank observes the money supply M1-M3, which records the money stock of non-banks. The amounts of money M1-M3 are divided according to the degree of availability of the money for the bank customers.

- The money supply includes cash and sight deposits , i.e. the bank balances that can be called up within one day ( current account , overnight money account ).

- The money supply includes and savings deposits with a notice period of up to three months and time deposits with a term of up to two years.

- The money supply includes plus repurchase agreements , money market fund shares and money market securities and bank bonds with a maturity of up to two years.

Balance in the money market

Central banks can use the money market to influence the relationship between money supply and demand . The central bank can largely control the supply of money. The demand for money depends on the behavior of economic agents ( companies , private households , the state and its subdivisions).

Monetary causes of inflation and deflation : If the money supply exceeds the money demand, prices rise (inflation). If the money supply is less than the money demand, prices fall (deflation). Central banks have a monetary policy dilemma. On the one hand, they want to stimulate the economy through low interest rates on central bank money, because low interest rates encourage investment and economic growth . On the other hand, the money supply (the ECB mainly monitors the money supply M3) should not exceed the money demand so that inflation remains low. This may have to be countered by increasing interest rates. Interest rate hikes make it more expensive to create money from central bank money. The central banks must therefore always find the right interest rate path for the situation.

Real economic causes: Inflation is not always a monetary phenomenon; it can also have real economic causes. On the goods market , certain goods such. B. crude oil scarcity, this leads to price increases, which are propagated as price increases in downstream markets (e.g. transport industry).

Monetary theory

The monetary theory is a discipline of economics , money are investigated in the nature and functions, value and effects. Sub-areas of monetary theory include the theory of money demand , the theory of money supply (see money creation ), the explanation of the monetary policy transmission mechanism , inflation theory , interest theory and the theory of monetary policy .

Legal issues

The Federal Court of Justice (BGH) also had to deal with the (criminal) concept of money. According to this, money is "... any means of payment certified by the state or an agency authorized by it as a medium of value and intended for circulation in public transport, regardless of any general acceptance obligation". This expresses the previously mentioned basic functions of money. The state or an agency commissioned by it is regularly responsible for issuing this marketable means of payment, which is intended to act as a value carrier. This monopoly of the state to print money and to bring it into circulation therefore precludes unauthorized persons from also printing money and putting it into circulation, so that their actions are regarded as criminal forgery of means of payment (see counterfeit money ).

According to German law, money is equated as a legal term with bearer papers ( Section 935 (2 ) BGB ). This means that money can still be acquired in good faith even if it has been stolen, lost or otherwise lost from the rightful owner. For other movables not (§ 935 para. 1 BGB) applies because with money and bearer securities whose marketability is not to be restricted.

Coins and notes become the property of the holder ; the often asserted statement that the European Central Bank is the owner, the owner only entitled owner, does not apply to the euro. The ownership of money is as bearer securities by simple agreement and handover gives ( § 929 clause 1 BGB). Euro bills are items in the sense of § 90 BGB. Anyone can acquire property in accordance with general civil law regulations. Banknotes and coins therefore belong to the person to whom they have been assigned. The owner can handle things belonging to him at will within the limits set by the legal system. For the euro, the destruction of means of payment is neither illegal nor punishable. In Germany, § 903 BGB applies , according to which the owner can generally deal with his property at will. Every owner of money can decide never to spend his money again and thus take it out of circulation forever. If the means of payment are irreversibly damaged, money is not destroyed, but only irreversibly removed from circulation. However, the Bundesbank does not provide any compensation for intentionally damaged banknotes.

In some countries (such as the USA) the destruction of means of payment can be punishable, for example if the destruction of a head of state or protected symbols is damaged and such damage is punishable.

history

Money is what fulfills the function of money. In everyday life these days these are mainly coins and banknotes. But immaterial money in the form of bank balances and cards with a monetary function also plays a major role today. Today's forms of money have evolved from primitive money , e.g. B. mussels or rice, which were accepted as a medium of exchange in business life. Money initially belonged to the cultic and legal sphere and referred to "that with which one can repay or pay penance and sacrifice". It was not until after the 14th century that it assumed its current importance as a “coined currency”. From the middle of the 19th century, the gold standard existed in many countries in which the exchange of legal tender (coins, banknotes) for a fixed amount of gold was promised. By around 1930, almost all of the major states abandoned the gold standard. Such a standard was replaced by monetary policy measures by the central banks, which were intended to ensure price level stability . With the introduction of blockchain technology, digital money, so-called crypto currencies, was made possible .

Popular names

Due to the universal distribution and the great importance of money for everyday life, numerous synonymous names are used in the vernacular , whereby the naming motifs can be of different kinds.

For money in general

Many names come from another language, such as the widespread expressions

- Cash ( English for "cash")

- Gravel ( Yiddish kis , "purse")

- Mice (Yiddish meus , "money")

- Moneten ( Latin moneta , "coin"; see English money )

- Moss (Yiddish and Rotwelsch moss , mous (plural), "money")

- Zaster (rotwelsch he sast , "iron")

- Möpse (adopted from Henese Fleck in the German student language since 1749 , from "Mopp": button)

A number of terms come from the word field fuel , so they are representative of the fact that money can be used to purchase things that provide the warmth and energy for life, such as:

- Wood, coal (after the Second World War, coal was used as a substitute and informally for a short period of time as a means of payment), coke , and the secondary product ash

- Powder (meaning ignition powder ; cf. pulverizing your money , out of date: igniting )

Synonymous terms for money are also related to food, which is the fuel for physical energy and thus represent the money with which the basic needs of life can be satisfied. (In many cultures, therefore, the amount of food available, primarily grain or livestock, was or is synonymous with a person's prosperity, and animals are there also considered to be the unit value for barter.)

- Grain: Bims / Bimbes (from the Rotwelschen word bimbes = "bread"), Diridari (from the old Bavarian word Diradey = mixture of rye and barley)

- Animals and animal products: toads, mosquitoes, eggs and fat, but also Penunzen / Pinunze (via Berlin Penunse from Polish pieniądze , this in turn borrowed from West Germanic, cf. Old High German pfenning )

For example, the following words are used for certain types of money:

- for change, coins: gravel, stones, gravel (Yiddish kis, "purse"), disparaging negro money

- for paper money: bills, rags

- for a small, insignificant amount: peanuts , obolus (from obolos , ancient Greek coin denomination; for a small, mostly voluntary contribution to something)

- for a large indefinite but significant amount: Zaster (see above), Mammon (from the Aramaic or Arabic word aman = "that which one trusts")

- for counterfeit money : bloom, false fifty (primarily as a metonymy for dishonest people)

Some other terms, often only regional, limited in time or used by certain groups of people, have different origins:

- Wire, flakes, clubs, Kikerlinge, blocks, Knaster , buttons, Knosse, Sticks, Krazacken, Marie, Moss, Ocken / Öcken, Flap, Beeping, Pimperlinge, Pinke / Pinkepinke, Schabangas, Loops, Snow, Sickel, Stutz, Tacken, Valleys

- The common casual term putty probably comes from the youth language of the 1970s .

For special denominations

For special denominations , for certain monetary values, mainly phonetic variants and corruptions of the corresponding numerals are formed or are usually in other direct connection with the respective coin or bill, for example:

- Banknotes: Ant (on the old Swiss 1000 note was displayed an ant), Riese / Tausi / Taui (in Austria :) Blue (thousands) hunni / Blue (hundreds, Blue only for the D-Mark), Bauer tens / Burazehner (Hundreds; in the Bregenzerwald ), Lappen (hundreds; in Switzerland), Fuffi (fifties), Lübecker (the Holsten Gate was shown on the 50 D-Mark note ), peach (forty), Zwanni / Zwackel / pound (twenties) , Blue tile (in the GDR the 100-mark note of the “ Westmark ”).

- Coin money: Groschen (10 pfennig or rarely 10 euro cents), Heiermann (5-mark piece), sixes (for a long time still in Berlin for the 5-pfennig piece), five -pennies (5-franc piece in Switzerland), gusset ( 2-mark piece, 2-euro piece), Fünferli ( 5- centime piece in Switzerland)

For certain currencies

In the case of popular names for certain currencies, a joking character is often evident. With such new words, however, often not (only) the currency as such is meant, but the material equivalent, i.e. coin or note, and the value 1 of this currency. Therefore, in such cases, the expression is primarily used together with a numeric word.

- Alpendollar (for the former Austrian currency; should characterize the schilling positively as a hard currency based on the example of the US dollar)

- Euronen (plural form of euro )

- Stutz (Swiss for Francs ; from the student and soldier language; probably originated from the old word stutzen = "to swap")

- Kujambel (currency from overseas)

- Greenback (US dollars)

reception

Mythology and psychology

Money also plays a role in myths and fairy tales. The ancient legend that King Midas of Asia Minor wished the gods that everything he touched should turn into gold, and who therefore threatened to starve and die of thirst, is probably an echo of the fact that coins historically first came in Lydia has been coined.

In dreams and fairy tales , money can mean wealth and power as well as life energy, but also that of morally filthy things.

The scarcity of money and living out of abundance are two aspects that are examined in more detail in the book Mysterium Geld by Bernard A. Lietaer , using CG Jung's theory of archetypes . The thesis is advocated that different currency mechanisms - creation of money, circulation and security of scarcity - also lead to different perceptions and attitudes towards money.

educational Psychology

Money education imparts an understanding of material values and the value of work, an understanding of numerical amounts of money and the handling of all kinds of means of payment, as well as invisible capital and money as a whole. In the foreground of the money education are pocket money , additional earnings in the house and with student jobs as well as the handling of savings books and student accounts. Research has shown that increasing possession worsens social behavior.

Money as a reward

philosophy

According to Karl Marx in his main work, Capital , exchange value as a commodity fetish receives its own mode of existence in money . In contrast to other goods, money is not of any material use value , but only - similar to a " fetish " - as an exchange value that is generally recognized in society.

“A commodity does not seem to become money first because the other commodities represent their values on all sides in it, but, conversely, they seem to represent their values in general in it, because it is money.” In money, the other commodities “find their own value form ready-made as a body of goods that exists outside and next to them. "

Several classics (such as Georg Simmel and Alfred Sohn-Rethel ) have made significant contributions. The sociological analysis of Sohn-Rethel is noteworthy, that the abstract form of value , which the money embodied since its introduction as coinage in Lydia in the 7th century BC, also pioneered intellectual abstractions in other areas (as in the early Ionic natural philosophy ). This money-spirit connection seen by Sohn-Rethel is underpinned by the more recent work of the classical philologist Richard Seaford. Othmar Franz Fett provided an economic theoretical and sociological analysis of the historical findings at the beginning of this parallel development.

Effective and important in terms of the theory of signs and values is the approach developed early (1897) by the philosopher and founder of sociology in Germany Ferdinand Tönnies of a detachment of concepts from a natural way of thinking towards a terminology appropriate to science . With an analogy between “concept” and “money”, Tönnies undertakes to establish the meaning of signs - and then the category of values - and the understanding of money as a sign . A terminology that is initially based on a situation experience strives towards a construction principle of a pure science that is decontextualized independently of other ideas and thoughts, namely that actual science uses its "terms exclusively for their own purposes, as mere thoughts, indifferent to their occurrence in any experience, yes with the knowledge of the impossibility of such an occurrence ”. Through the natural emergence of general terms or term names, which Tönnies calls “general ideas”, the sign-meaning relation is further developed up to the “ invention ”; H. Construction and fictionalization of the object to be named, which is thought of as “thing or process”. In contrast to the impoverishment of the general conception in the abstraction process, the implied identity of object and idea enables the constructed concept to be endowed with specific, tendentially almost unlimited features, which thus corresponds to its own idea, the idea of a general that is at the same time singular (individual). Therefore, like the terms, money is also important . Just as concepts can be traced back to natural language and are given empirically, so also “abstract” money has empirical meaning only through its reference to natural, that is, minted money .

Tönnies differentiates between "original money", which is established through use as a salable good, i.e. as a generally valid medium of exchange , but only receives a certain weight and thus a certain meaning through public belief as a coin minted by the community with a guarantee stamp . Owing to the community's obligation to recognize money as a credit from the state government, conventional paper money - initially only commercial credit - is similar to money, and by virtue of an artificial social will it is assigned importance as a legal tender. The meaning of money as something that does not exist, but only means and is valid , becomes a sign of material value in the banknote, but due to the fact that it is derived from metal money, it is still considered as an object. In this way, Tönnies puts the social function of the respective signs - here for example money - in relation to the respective requirements of social organizations with regard to the generation and stabilization of normative regulations of social life, which are becoming increasingly abstract and purposeful .

Physics and Information Theory

For a long time, material goods, especially gold, were used to secure the value of money. However, this does not yet result in an equivalence of matter and money, only a relationship between money and the value of gold was established. It is popular to assume that money can be compared to energy. However, the law of conservation of energy would then apply, and money could neither be created nor destroyed. In 1887, the mathematician Georg Helm established a relationship between money and entropy . In his theory of energy , he postulated that money was the economic equivalent of low entropy. In economics, the acceptance of physical analogies to money is rather low, but Nicholas Georgescu-Roegen brought Helm's thoughts back to mind in 1971. In physics, the concept of entropy can now be explained from information theory; accordingly, when applying the concept of entropy to money, there is no physical analogy, but an information-theoretical interpretation. With the description of the increase in entropy as a loss of information, the possibility of “money destruction” can be explained. This also includes the description of irreversibility in economics and its importance for exchange rate models.

sociology

Often times in modern times a discomfort about money and an associated feeling of injustice emerged. That is why there were many drafts of utopian societies that tried to get by without money. However, they were all linked to a community- oriented moral duty to work that restricted individual freedom. Such designs come from Robert Owen , Francois Babeuf and Pierre-Joseph Proudhon .

In the beginning there were tribal economies and economies that managed without money until the present day . Such forms of economy are known as natural economy or subsistence economy . In these there is either a distribution economy (in tribal cultures the harvest is brought in collectively and distributed to the tribe members according to certain rules), or there is extensive self-sufficiency , in which hardly any trade and then only barter trade prevails .

Sociologically, reference is made to the fact that the original establishment of minted money in the 6th century BC met with great historical difficulties and that the ancient temples were the first custodian banks to facilitate its introduction because they initially gave minted money a diffuse symbolic (sacred) guarantee ( compare the temple of Juno Moneta in ancient Rome).

The importance of the newly created coinage for abstract thinking, first in the Ionian natural philosophy , has Alfred Sohn-Rethel pointed (theorem of " real abstraction ").

The more recent systems theory, which goes beyond sociology, abstracts the concept of money and sees it as a “symbolically generalized communication medium”.

Religious Studies / Theology

The relationship between religion (s) and money is historically controversial insofar as money is sometimes criticized as a false god in the form of mammon (whom one cannot serve at the same time) or as an “earthly got” (H. Sachs) or as “the most common Idol on earth ”(M. Luther). But there are also religions in which a positive, affirmative relationship to money can be found as a representative of economic prosperity, for example in Confucianism, with certain Hindu deities such as Lakshmi or, according to Max Weber's thesis, in Protestantism.

language

Karl Friedrich Wilhelm Wander collected 1420 proverbs about "money" in his five-volume edition of Deutsches Sprich emphasis-Lexikon ( Wanders Deutsches Sprich emphasis-Lexikon ) in the first volume, apart from the words combined with them (purse, moneybrotz, donor, etc.) .

criticism

- In addition to criticism of the monetary system, the role of money was also criticized and calls for its abolition were made. Demands were made to limit trading in money to certain quantities or people, and to search for alternative means of distributing wealth and redistributing goods and services. Criticism of money was initially morally motivated. Since the emergence of capitalism money is also criticism with criticism of this form of economy connected u. a. in Marxism . Another direction of criticism of money led to modern anti-Semitism . This was intensified because Jews were excluded from the majority of manual trades and agriculture and, on the other hand, believing Christians were prohibited from trading in money.

- Criticism of money and calls for the reform of the monetary constitution made up a large part of the history of money . These disputes resulted in different schools of thought in monetary theory .

- The criticism of money also leads to research thinking about possible post-monetary forms of coexistence and economic activity. There are also complex attempts to try out and establish forms of moneyless coexistence in smaller groups.

literature

- introduction

- Karl Marten Barfuß , in Economics: Money and Currency . Ed .: Neubäumer, Hewel. Gabler Verlag, Wiesbaden 2001, ISBN 3-8349-1704-4 .

- Deutsche Bundesbank (Ed.): Monetary Policy: A Booklet for Secondary School II . 2014, ISBN 978-3-86558-998-9 ( bundesbank.de PDF; 21 MB).

- Hans Harlandt: The money: An introduction to nature and functions . Schäuble-Verlag, Rheinfelden / Berlin 1994, ISBN 3-87718-542-8 .

- Thorsten Schilling (Red.): The subject of money . In: Federal Center for Political Education (Ed.): Fluter . No. 41 . DUMMY Verlag, 2011, ISSN 1611-1567 ( online ( memento of March 24, 2012 in the Internet Archive ) [PDF; 3.2 MB ]).

- Wolfgang Trapp: Small handbook of coinage and money in Germany , Philipp Reclam jun., Stuttgart 1999, ISBN 3-15-018026-0 .

- history

- Caspar Dohmen : Let's Make Money - What does the bank do with our money? orange press, Freiburg 2008, ISBN 978-3-936086-41-6 . Investigation and documentation of the global connections between national debt , tax havens , speculative profits , sweatshops and subprime crises ; Book for the documentary of the same name Let's Make Money by Erwin Wagenhofer

- Selma Gebhardt: From cowrie shells to credit cards. Money development in the civilization process . Rosenholz Verlag, Kiel / Berlin 1998, ISBN 978-3-931665-10-4 .

- Michael North : The money and its history. From the Middle Ages to the present . CH Beck Verlag, Munich 1994, ISBN 3-406-38072-7 .

- Michael North: From stocks to customs. A historical lexicon of money . CH Beck Verlag, Munich 1999, ISBN 3-406-45002-4 .

- Hanno Pahl: Money in the modern economy: Marx and Luhmann in comparison . Dissertation University, Bielefeld 2008, ISBN 978-3-593-38607-2 .

- Dieter Schnaas: A short cultural history of money . Wilhelm Fink Verlag, Munich 2010, ISBN 978-3-7705-5033-3 .

- Wolfram Weimer : History of Money: A Chronicle with Texts and Pictures . Insel-Verlag, Frankfurt am Main / Leipzig 1992, ISBN 3-458-16265-8 .

- Stephen Zarlenga: The Myth of Money. The history of power . Conzett Verlag, Zurich 1999, ISBN 3-905267-00-4 .

- theory

- Christoph Asmuth , Burkhard Nonnenmacher and Nele Schneidereit (eds.): Texts on the theory of money . reclam, Stuttgart 2016, ISBN 978-3-15-019370-9 .

- Josette Baer, Wolfgang Rother (Ed.): Money. Philosophical, literary and economic perspectives . Schwabe, Basel 2013, ISBN 978-3-7965-2913-9 .

- Friedrich August von Hayek : Denationalization of Money: An Analysis of the Theory and Practice of Competing Media . Mohr Verlag, Tübingen 1977, ISBN 3-16-340272-0 .

- Otmar Issing : Introduction to Monetary Theory . Vahlen Verlag, Munich 2003, ISBN 3-8006-2993-3 .

- Bernhard Laum : Holy money . Semele Verlag, Frankfurt am Main 1924 (reprint: 2006, ISBN 3-938869-02-X ).

- Jens Martignoni: Reinventing money - understanding and using alternative currencies. Versus Verlag, 2018. ISBN 978-3-03909-228-4 .

- Karl Marx : Capital. First volume, first section: Goods and money and second section: The transformation of money into capital , Dietz Verlag Berlin 1972, pp. 49–191

- Ludwig von Mises : Theory of money and the means of circulation . 2005, ISBN 3-428-11882-0 ( online [PDF; 23.1 MB ] First edition: 1924).

- Georg Simmel : Philosophy of Money . Suhrkamp Verlag, Frankfurt am Main 2003, ISBN 3-518-29184-X .

- Alfred Sohn-Rethel : The money, the face of the apriori . Wagenbach Verlag, Berlin 1990, ISBN 3-8031-5127-9 .

- Ferdinand Tönnies : Philosophical terminology in a psychological-sociological view . Leipzig 1906.

- Problem

- Bernd Senf : The fog about money. Interest rate problems - monetary systems - economic crises. An educational book . 10th edition. Projekt-Verlag Cornelius, Kiel 2009, ISBN 978-3-87998-456-5 .

- Ansgar Knolle-Grothusen, Stephan Krüger, Dieter Wolf, in monetary goods, money and currency. Basics for solving the problem of the money commodity: Social practice and the problem of the money commodity . Argument Verlag, Hamburg 2008, ISBN 978-3-88619-345-5 .

- Peter Seele: "The earthly god is to be found": considerations on a religious economy of money . In: Theological Faculty of the University of Basel (ed.): Theologische Zeitschrift . No. 4 . Friedrich Reinhardt, Basel 2009, p. 346–365 ( abstract (PDF 45.7 kB)).

- Oliver Fohrmann: In the mirror of money. Education and Identity in Times of Economization . transcript, Bielefeld 2016, ISBN 978-3-8376-3583-6 .

- Literary

- Evelyne Polt-Heinzl and Christine Schmidjell (eds.): Das liebe Geld , with 19 illustrations, Philipp Reclam jun., Stuttgart 1998, ISBN 3-15-009728-2 .

Web links

- Money Museum of the Deutsche Bundesbank

- Monetary Policy ( Memento of May 14, 2006 in the Internet Archive ) (PDF)

- Money Museum of the Austrian National Bank

- Modern Money Mechanics - A Workbook on Bank Reserves and Deposit Expansion (PDF) Federal Reserve Bank of Chicago, 1994 (English)

- The world's banknotes - current and historical banknotes

- The Capitalocene - Geological Age of Money Lecture by Harald Lesch from December 2, 2018 from the Audimax of the TU Ilmenau on the iSTUFF YouTube channel

See also

Individual evidence

- ↑ Gerhard Köbler , Etymological Legal Dictionary , 1995, p. 150

- ↑ a b money . In: Wolfgang Pfeifer: Etymological Dictionary of German

- ↑ Friedrich Bendixen, Das Wesen des Geldes , 1918, pp. 5 ff.

- ^ Günter Schmölders, Gutes und Bades Geld: Geld, Geldwert und Geldentwertung , 1968, p. 21

- ↑ Georg Friedrich Knapp , State Theory of Money , 1923, p. 3

- ^ Springer Gabler Verlag (ed.), Gabler Wirtschaftslexikon , keyword: money

- ^ European Central Bank, Monetary aggregates , accessed August 16, 2011

- ^ Bundesbank, Glossary, Central Bank Money , accessed on August 16, 2011

- ^ G. Crowther: An Outline of Money. Nelson, London 1940. cited in Open University The Fundamentals of Finance. Open University, Milton Keynes, 2003, ISBN 0-7492-5726-1 .

- ^ Karl Marx: The capital. First volume, 3rd and 4th chapters, Dietz Verlag Berlin 1972, pp. 109–191

- ↑ Dirk Piekenbrock, Gabler Kompakt-Lexikon Volkswirtschaftslehre , 2009, p. 149

- ^ Springer Gabler Verlag, Gabler Wirtschaftslexikon, keyword: monetary theory

- ↑ Money and Monetary Policy - School Book for Secondary School II. (PDF) Deutsche Bundesbank , p. 70.

- ^ Springer Gabler Verlag (Ed.): Gabler Wirtschaftslexikon. Keyword: money supply

- ^ A b Springer Gabler Verlag (editor), Gabler Wirtschaftslexikon, keyword: money supply

- ↑ Money and Monetary Policy - School Book for Secondary School II. (PDF) Deutsche Bundesbank , p. 69.

- ↑ Dietmar Dorn, Rainer Fischbach, Volker Letzner: Economics. Volume 2, 5th edition. Oldenbourg Wissenschaftsverlag, 2010, ISBN 978-3-486-59094-4 , p. 96 ff.

- ↑ Dietmar Dorn, Rainer Fischbach, Volker Letzner: Economics. Volume 2, 5th edition. Oldenbourg Wissenschaftsverlag, 2010, ISBN 978-3-486-59094-4 , p. 103 f.

- ↑ BGH WM 1984, 222

- ↑ Destruction of money. In: The time . No. 40/2003.

- ↑ Damaged money ( memento of the original dated August 7, 2013 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. , Deutsche Bundesbank, accessed on July 30, 2013.

- ↑ 18 USC § 333: US Code - Section 333: Mutilation of national bank obligations

- ↑ Money and Monetary Policy - Student Book for Upper Secondary School (PDF) Deutsche Bundesbank , p. 12.

- ↑ Christoph Gutknecht: Mice, moss and pugs - How the Hebrew coin became the Yiddish word for money. Jüdische Allgemeine, August 8, 2013, accessed April 9, 2018

- ↑ Bimbes with Bimbes. SPON , January 31, 2000, accessed on June 16, 2017 (reproduction of the print edition of Der Spiegel 5/2000).

- ^ Rhein-Zeitung , September 12, 2007, quoted from the text corpus of the Institute for German Language, project page (with registration requirement) . Cf. Georg Schramm: Rotarians and Lioners. In: Georg Schramm: Let me put it that way. Munich 2007, ISBN 978-3-89667-348-0 , p. 108 f.

- ↑ Origin of the term modeling clay for money . On the Society for German Language e. V. Accessed April 26, 2016.

- ↑ Jochen Paulus: Money makes you stingy . In: badische-zeitung.de, Bildung, Wissen , December 24, 2011, accessed on January 2, 2011.

- ↑ Othmar Franz Fett: The unthinkable third. Pre-Socratic beginnings of the eurogenic relationship to nature. (= edition diskord, Perspektiven. Volume 18). Tübingen 2000, ISBN 3-89295-693-6 .

- ↑ Ferdinand Tönnies: Philosophical terminology in a psychological-sociological view. Leipzig 1906, p. 30 f.

- ↑ Ferdinand Tönnies: Philosophical terminology in a psychological-sociological view. Leipzig 1906, pp. 31 and 32.

- ↑ Ferdinand Tönnies: Philosophical terminology in a psychological-sociological view. Leipzig 1906, p. 33.

- ^ Nicholas Georgescu-Roegen : The Entropy Law and the Economic Process. 1971, p. 283.

- ↑ Arieh Ben-Naim: Statistical Thermodynamics Based on Information: A Farewell to Entropy. 2008, ISBN 978-981-270-707-9 .

- ^ Gilbert Newton Lewis : The Symmetry of Time in Physics. In: Science . 71, 1930, p. 569.

- ^ Richard Hule: Irreversibility in the economy. 2000, ISBN 3-631-36788-0 .

- ^ Niklas Luhmann : Money as a communication medium. In: The Economy of Society. 1988, ISBN 3-518-28752-4 , pp. 230-271 (chap. 7)

- ↑ Douglas Oakman: The radical Jesus: you cannot serve God and Mammon. In: Biblical theology bulletin. 34, 2004, pp. 122-129.

- ↑ Peter Seele: "The earthly god is valid". Reflections on a religious economy of money. In: Theological Journal. 65, 2009, p. 348 f.

- ^ Gerhard Hanloser : Crisis and Anti-Semitism. A story in three stations from the early days through the global economic crisis to today. Unrast Verlag, 2004.

- ↑ cf. on this, among other things, the essays in the anthology of the project group Die Gesellschaft nach dem Geld (Ed.): Post-monetary thinking: opening a dialogue . Springer VS, 2018.