fee

A fee is the remuneration to be paid by an economic entity for the service used .

etymology

The word origin goes back to the old high German "giburt" from the year 790, which meant something like "happening, event, fate". In 1376 the word (“gebuern”) appeared for the first time in Breslau with today's content , the current spelling was first found in 1615. The fee with the same meaning first appeared in 1556. The verb “fees” uses the legal language in the sense of “claim”: “ If the action for which the reward is suspended has been performed several times, the reward is due to the person who performed the action first ”( Section 659 (1) BGB ). “Charging distance” is a sufficient distance.

General

Fees are often associated with the public purse and are therefore seen as a consideration for the government service used by an individual economic entity. Economic entities liable to pay fees can be private individuals , companies or other associations of persons . Fees are often viewed as a special case of taxes in public finance . On the other hand, the fee is to be understood as a “fee that has to be paid for individually attributable public services and the amount of which is based on political goals taking into account the structure of demand”. Section 4 (2) of the KAG NRW provides a precise legal definition : "Fees are cash payments that are levied in return for a special service - official or other activity - by the administration (administrative fees) or for the use of public facilities and facilities (user fees)."

However, the concept of fees is not limited to public administration , because fees are also charged in wide areas of the private sector .

Public administration fees

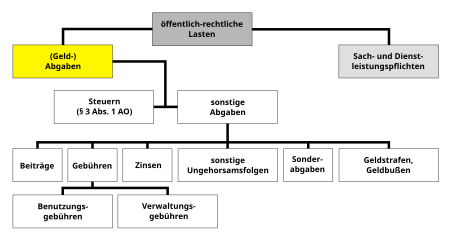

Together with taxes , contributions and interest , public fees are part of public charges . Fees play a major role in public administration because they represent the price of a service provided. Their legal basis can be found in numerous legal norms. "Fees are public-law cash benefits that are imposed on the debtor of the fee by a public-law standard or other sovereign measure on the basis of individually attributable public services and are intended to cover the costs of this service in whole or in part". According to the judgment quoted above, the legislature is not prevented from using a fee regulation not only to cover costs but also to counteract frivolous or even abusive filing of legal remedies .

Legal regulation

The formal authorization to levy fees and expenses for public services is based on Section 1 (1) BGebG or the corresponding state fee laws. Fees are to be provided as consideration for a “special service of the tax creditor triggered by special use of the administration” (Section 1 (1) BGebG in conjunction with Section 3 (1 ) AO ). According to the legal definition of the BGebG, fees are public law payments that the fee creditor collects from the fee debtor for individually attributable public services ( Section 3 (4) BGebG). Fees are intended to cover all or part of the costs incurred by the authorities in providing the service. However, according to case law and prevailing opinion , the cost recovery principle does not enjoy constitutional status. According to the BVerfG, a fee is a public-law payment that is unilaterally imposed on the fee debtor by a public-law standard or other sovereign measure on the occasion of individually attributable public services and is intended to fully or partially allocate the costs of this service cover.

The principle of appropriateness (proportionality in the narrower sense) also applies in the BGebG and states that in addition to the justified interest of the general public in reimbursement of costs for individually provided state services, the economic value or other benefits that the service recipient receives is also adequately taken into account. A balance must be struck between the two interests.

According to Section 9 (1) to (3) BGebG, fee rates are therefore to be calculated in such a way that there is an appropriate relationship between the amount of the fee, which takes into account the administrative effort, and the importance, economic or other benefit of the service ( principle of equivalence ). In order to set fees, it is therefore imperative to determine the average administrative effort that arises from an official act and to estimate the average value or benefit or the significance of the official act for the service recipient. Both sizes, administrative expenses and economic value or benefit of the official act for the recipient, must be taken into account when setting the fee and put in an appropriate relationship.

The fees to be derived can be divided into the following categories based on their contribution to the costs of administration:

- fees that cover costs,

- cost-covering fees ( cost-covering principle ) and

- Cost-covering fees.

The General Fee Ordinance of the Federal Government contains specifications for determining the cost-covering fee under the Federal Fees Act . In addition, the various federal ministries must issue their special fee regulations by October 1, 2021 , in which subject-specific fee facts are to be bundled. The Federal Ministry of the Interior was the first federal ministry to issue its Special Fees Ordinance on October 1, 2019 as a model. The calculation of the fee rates was carried out by the Federal Statistical Office .

In the context of the equivalence principle, surcharges should generally apply for favorable official acts. A favorable official act can be understood to mean all those public services that enable the recipient of the service to enjoy a legal, economic or other advantage. The public service also has a beneficial effect if it reduces the likelihood of possible disadvantages. Non-favoring official acts are either to be performed against cost-covering fees or, if the official act is in the main interest of the state, can be performed against cost-covering fees. The cost recovery principle is described in Section 9 (1) sentence 1 BGebG. In contrast to the generally applicable principle of equivalence, it is a subordinate principle that only applies by virtue of an express statutory provision. It thus represents a fee structure to be specially specified by the legislator. For reasons of equity or in the public interest , fee reductions and exemptions are permitted (Section 9 Paragraph 4 and Paragraph 5 BGebG).

Fee rates

The Federal Fees Act recognizes three different types of fees ( Section 11 BGebG):

- fixed rates (fixed fees),

- Fees based on time spent (time fees),

- Framework rates ( framework fees ).

In the case of fixed rates , an amount must be specified for a certain official act, which is to be raised by the authorities for the official act (e.g. issuing a permit 50 €). It is also permissible to refer the fixed rate not only to a completed official act, but it can also be formulated in relation to effort (e.g. 15 € / hour worked). Framework rates ( framework fees ) are characterized by a minimum and a maximum amount (e.g. issue of an operating license between € 2000 and € 50,000). The specific fee is to be set by the authority in each individual case at its own discretion and in compliance with Section 13 (2) BGebG. Framework rates apply if the fee to be determined according to the principle of equivalence for an official act can fluctuate considerably due to different administrative expenses or the economic value for individual service recipients.

species

The types of fees are:

- According to the type of service :

- User fees for the use of a public facility (e.g. wastewater fee ),

- Administrative fees for the official act of an authority (fee for the granting of a building permit );

- Realization of the cost recovery principle :

- Fees with the nature of a contribution to costs (e.g. tuition fee ),

- Fees with a profit result (e.g. at the registration office after facilitating foreign travel );

- Fees by type of administration: Fees in the judiciary ( court costs ), health care ( prescription fee ), schools ( school fee ), transport ( toll ), traffic ( parking ) or other administration ( registry office fee ).

According to Section 64 (1) SGB X, no fees and expenses are charged for the social administration process and social data protection .

Numerous special administrative laws also include fees such as the Food and Feed Code ( Section 63 LFGB) or the Animal Health Act ( Section 5 TierGesG).

Others

Municipal fees must be set by fee statutes to be lawful; this statute is based on a state law ( municipal tax law ). Some administrations still use gummed fee stamps today ; these are acquired by the debtor with "real" money and stuck on the relevant documents as proof of payment.

Private sector fees

Fees are not limited to the public sector , but are also common in the private sector. While they are “collected” in the administration, they are “calculated” in the private sector. Fees are particularly important in banking as bank fees . While debit and credit interest and commission are calculated as a percentage of the capital amount, fees are independent of the amount. Service companies in the non-banking sector in particular charge processing fees for services that are not priced. License fees or fees for similar industrial property rights are to be paid by the licensee to the licensor for the right of use . For many professions , the fees are fee schedules set by law, such as the fees for doctors , fees for Psychological psychotherapists and child and adolescent psychotherapists or the fee schedule for dentists . Lawyers 'fees are regulated in the Lawyers ' Remuneration Act , court and notary fees in the Court and Notary Fees Act. Dunning fees apply in both public and private law.

In the context of pricing, fees apply as ancillary costs or price components that influence the pricing and are to be classified as costs from the point of view of the fee payer .

Delimitations

In contrast to contributions, fees burden the individual who actually uses the public service, whereas contributions burden a group as a whole (e.g. the road construction contribution from the residents ). For example, since 2013 no license fee has been charged in Germany , but a license fee . This makes it clear that the radio license fee has to be paid even if a private household does not receive any radio broadcast.

The intended side effect of fees can be to impede the unnecessary or excessive use of public facilities by levying them; Levies as a generic term for taxes, on the other hand, are neither imposed as consideration for a special service by the state. Non-tax levies are imposed on individual citizens or groups in addition to their tax burden and regardless of it. The Federal Constitutional Court (BVerfG) enables the state to exercise freedom of collection, because "under special conditions, in addition to taxes, fees and contributions as well as special charges, other charges are constitutionally possible".

International

In Switzerland , the cantons and communes finance themselves to a considerable extent through fees. The federal government's fee income is relatively low at 2% of its state income ; its share is far larger for the cantons (12%) and municipalities (16%). The cantons of Solothurn , Friborg and Jura each finance 91 to 94% of the examined services or uses of public facilities through fees. Tax revenues are used for the rest. The Swiss average for fee financing is 76%. According to the Swiss indicator for fee financing, the fees in the road transport sector are higher than the costs caused there. The main legal basis is the cantonal fee laws. In the canton of Nidwalden, the "Law on Official Costs" (GebG) of June 2001 regulates in Art. 1 "the collection of official costs by the cantonal administration for official acts, services, orders and decisions or the use of public property and facilities." According to Art. 3 GebG, the official costs include administration and user fees as well as expenses .

In Austria the Fees Act 1957 (GebG) is a federal law . According to § 1 GebG, the fees are subject to documents and official acts, whereby documents according to § 10 GebG are to be understood as entries and enclosures, official copies, protocols, invoices and certificates. The fees are either fixed fees or fees at the rate of one hundred percent ( Section 3 GebG).

In the United States charges play ( english fees, charges ) in everyday life an important role. The authorities charge administrative fees ( english government fees ) due to a previous fee assessment s ( English fairy notice ). It is common for colleges an application fee ( english application fee ) as compensation for the costs of Application Specialist ( English admission officer ) require. This varies from college to college. A variety of fees in banking in syndicated loans ( english syndicated lonas ) to: when the contract once ( English front-end fee ), while the repayment period will receive the consortium ( English lead manager on a regular basis a special fee) ( English managing fee ), the manager ( english agent ) an annual management fee ( english agent fee ) to be paid a commitment fee coat ( english commitment fee ) and prepayment an early repayment ( english termination fee ) to.

Web links

Individual evidence

- ↑ Gerhard Köbler , Etymological Legal Dictionary, 1995, p. 145

- ↑ Georg Korn, Breslauer Urkundenbuch , 1870, p. 246

- ^ Ludwig Samuel von Tscharner, Das Statuarrecht des Simmentales (until 1798) , 1914, p. 102

- ↑ Ute Sacksofsky, environmental protection through non-tax levies , 2000, p. 89

- ^ Peter Bohley, Fees and Contributions , 1977, pp. 62 ff.

- ^ Karl-Heinrich Hansmeyer / Dietrich Fürst, The Charges , 1968, p. 34

- ^ Peter Bohley, Public Funding , 2003, p. 9

- ↑ BVerfG, decision of February 6, 1979, Az .: 2 BvL 5/76 = BVerfGE 50, 217 , 226

- ↑ BVerfGE 7, 244 , 251

- ↑ BVerfG, decision of March 10, 1998, Az .: 1 BvR 178/97 = BVerfGE 97, 332 , 345

- ↑ BVerfG, judgment of February 6, 1979, Az .: 2 BvL 5/76 = BVerfGE 50, 217 ; EuGRZ 1979, 442

- ↑ General Fee Ordinance (AGebV)

- ^ Structural reform of the federal fee law. Retrieved April 16, 2020 .

- ↑ BMIBGebV - Special Fee Ordinance of the Federal Ministry of the Interior, for Building and Home Affairs for individually attributable public services in its area of responsibility. Retrieved April 12, 2020 .

- ↑ Haider et al .: Determination of cost-covering fee rates - methodology and application . In: Federal Statistical Office (Ed.): Economy and Statistics . No. 5 . Wiesbaden 2019 ( destatis.de [PDF]).

- ↑ Springer Fachmedien Wiesbaden (ed.), Compact Lexicon Public Finance , 2013, p. 85

- ↑ Broadcasting contribution is legal Die Welt , March 18, 2016

- ↑ Springer Fachmedien Wiesbaden (ed.), Compact Lexicon Public Finance , 2013, p. 85

- ↑ BVerfGE 55, 274 , 303

- ↑ BVerfGE, 82, 159 , 181

- ↑ comparis.ch, Fees: Where are the fees?

- ↑ L. Christian Hinsch / Norbert Horn, The Contract Law of International Syndicated Loans and Project Financing , 1985, p. 86