Simplified capitalized earnings method

The simplified capitalized earnings method is the method provided for in accordance with Section 199 of the Valuation Act for tax purposes for the valuation of sole proprietorships, partnerships, unlisted shares in corporations and business assets of the liberal professions and is an essential part of the valuation of business assets for inheritance tax purposes .

background

The legislature had to change both the Valuation Act and the Inheritance Tax and Gift Tax Act on January 1, 2009. According to the legal situation up to then, holdings in partnerships were valued with the tax balance sheet values and shares in corporations (if not listed on the stock exchange) using the so-called Stuttgart method .

However, this valuation procedure led to unequal treatment in the valuation of assets and was therefore reprimanded by the Federal Constitutional Court with its judgment of November 7, 2006. The court demanded an assessment based on market values (common tax values). The legislature complied with this with effect from 2009.

The simplified income value method capitalizes the average annual return based on the past with a standardized capitalization factor. It is not to be confused with the simplified capitalized earnings method according to §§ 17 ff. ImmoWertV.

method

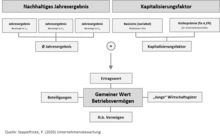

In terms of method, the procedure is similar to the earnings value procedure for company valuation . The procedure deserves the predicate "simplified", since simplifying assumptions can be used both when determining the sustainable income and when determining the cost of capital. The evaluation takes place in three steps:

- Determination of sustainable income: To estimate future income, an average of adjusted annual results for the last three financial years is formed. The average of the annual results in the past should represent the future level of earnings. The reported annual results may have to be adjusted for one-off income components.

- Determination of the capitalization rate: Up to 2015, the capitalization rate resulted from a (variable) base rate plus a (fixed) risk premium of 4.5%. The reciprocal of the capitalization rate is the capitalization factor. For valuation dates after December 31, 2015, the capitalization factor was fixed at 13.75 ( Section 203 BewG).

- Adding other components: By multiplying sustainable income and capitalization factor, you get the operative earnings value. To determine the fair value, the other, non-operational assets must then be added.

Determination of sustainable income

Past annual results are used to calculate future sustainable profitability. In doing so, an average is regularly formed from the adjusted results of the last three past financial years. The result of the current year can be used if this is important for determining the future values.

The initial values are the profits in accordance with Section 4 (1) and (3) EStG. Since a sustainable annual result is to be assessed, the initial values must be adjusted for components that are exceptional or one-off. The following table shows which additions or reductions should be made.

|

Additions

(§ 202 Abs. 1 Nr. 1 BewG) |

Cuts

(§ 202 Abs. 1 Nr. 2 BewG) |

|---|---|

| Investment deductions, special depreciations, increased deductions, valuation discounts and partial value depreciation | Profit-increasing amounts released from tax-free reserves and partial value write-ups |

| Deductions on goodwill or goodwill-like assets | One-time capital gains and extraordinary income |

| One-time sales losses and extraordinary expenses | Investment allowances included in profit, unless further investments of the same amount are expected in the future |

| Investment subsidies not included in profit, provided that further subsidized investments of the same amount can be expected in the future | An appropriate entrepreneur's wage, if no such wage has been taken into account in the previous income statement |

| Income tax expense (corporation tax, surcharge tax and trade tax) | Income from the reimbursement of income taxes (corporation tax, surcharge taxes and trade tax) |

| Expenses in connection with assets not required for business operations or assets invested within the last two years | Income related to assets not required for business operations, assets invested within the last two years |

| Losses assumed from participations that are part of the operating assets | Income from participations that are part of the business assets |

When formulating the Assessment Act, the legislature endeavored to ensure a legally neutral assessment. The adjusted earnings before taxes should therefore be uniformly charged with a fictitious tax expense of 30% on the annual earnings before income tax expense.

Determination of the capitalization rate

| Development of the base rate | |

|---|---|

| January 2016 | 1.10% |

| January 2015 | 0.99% |

| January 2014 | 2.59% |

| January 2013 | 2.04% |

| January 2012 | 2.44% |

| January 2011 | 3.43% |

| January 2010 | 3.98% |

| January 2009 | 3.61% |

| January 2008 | 4.58% |

| January 2007 | 4.02% |

The capitalization factor is set at 13.75 for valuation dates after December 31, 2015 in accordance with Section 203 BewG. This corresponds to a capitalization interest rate of approx. 7.27%. The new regulation came into effect retrospectively on November 9, 2016 and has resulted in lower ratings. The lower company value can, however, be disadvantageous in individual cases due to the associated poorer management assets ratio and the elimination of exemption discounts. According to the literature, these cases are inadmissible retroactive effects at least until June 30, 2016 (deadline for new regulation by the Constitutional Court).

Base rate for capitalization was until 31 December 2015, once each year on the first trading day of the year firmly set by the Bundesbank interest rate used by the Federal Ministry of Finance in the Federal Tax Gazette was published.

A flat-rate surcharge of 4.5 percentage points was added to the base interest rate, so that for 2013, for example, a base interest rate of 2.04% results in a capitalization interest rate of 6.54%, which as a reciprocal value leads to a capitalization factor of 15.29.

| Average yield according to § 202 BewG: | € 7,500 |

| Base interest rate according to § 203 Abs. 2 BewG: | 2.04% |

| => Capitalization interest rate = 2.04% + 4.5% | 6.54% |

| => Capitalization factor = 100% / 6.54% | 15.2905% |

| => Simplified earnings value = € 7,500 × 15.2905 | € 114,678.90 |

Adding other components

The non-operational assets include all assets that can be sold at any time without affecting the operating business. These include B. short-term and long-term financial assets, property not used for business purposes, works of art or excess liquidity.

Participations should be taken into account if the profits of the participations are not adequately reflected in the annual results of the company to be valued. This is especially the case if the associated companies retain profits to a not inconsiderable extent.

There are also assets that, in the opinion of the legislature, have not yet made a contribution to the annual result. These are called "young assets" and must be added to determine the common value. Young assets are all assets that were added to the company's assets within two years before the valuation date.

Lower limit

For tax purposes, the tax net asset value must always be determined ( § 95 to 97 BewG in conjunction with § 11 para. 2 BewG). This intrinsic value is a lower limit.

If the simplified discounted earnings method leads to an inappropriately high value, the taxpayer can try to declare a lower value by means of an individual valuation report based on the discounted earnings method, taking into account expected future income (usually according to the IdW S1 auditor standard ).

Appreciation

The simplified income approach has the advantage that it is based on historical data and is therefore easy to use. The process is therefore well suited for mass use in financial management. The entrepreneur's wage is the only value that does not result from the accounting, but must be determined individually. Halaczinsky describes the entrepreneur's wages as the main problem because the tax authorities in their inheritance tax guidelines do not give companies any essential information on how to correctly determine an appropriate imputed entrepreneur's wages.

However, the earnings prospects of a company are only inadequately recognized. It is very questionable whether the results achieved in the past represent a good forecast for the future. In situations of a drop in earnings, such as For example, during a financial and economic crisis, the results used from three previous “boom years” suggest that the future earnings trend will be too high. In contrast, the taxpayer for companies with strong growth expectations would be better off with the simplified income value method, since the future high earnings potential is not recorded.

The capitalization rate or the capitalization factor are often not in line with the market. The capitalization factor is currently 13.75. The companies are therefore valued at 13.75 times their "expected" annual profit. Such valuation ratios cannot be observed in the financial markets. The average price-earnings ratios (P / E) of German companies are often higher due to the historically low interest rates.

Therefore, constitutional concerns about the new regulations are occasionally expressed in the literature. The tendency towards overvaluation, especially for the liberal professions, requires additional effort for individual expert opinions.

property

There is also the simplified (and general) capitalized earnings method for the valuation of real estate .

literature

- Creutzmann, company valuation in tax law - revision of valuation law from January 1, 2009, DB 2008, p. 2784 ff. MwH

- Daragan / Halaczinsky / Riedel (eds.), Practical Commentary on ErbStG and BewG, 2010

- Halaczinsky, The inheritance tax and gift tax declaration, 2nd edition, Bonn 2010

- Knief, The imputed entrepreneur's wages for sole proprietorships and partnerships, A business management challenge from the BGH and the reform of the BewG and the ErbStG, DB 2010, p. 289 ff.

- Knief / Weipert, First practical experience with the simplified capitalized earnings method according to §§ 199 ff. BewG, in StBg 2010, p. 1 ff.

Individual evidence

- ↑ Inheritance Tax Reform Act - ErbStRG

- ↑ BMF letter of January 4, 2016. Retrieved February 12, 2017 .

- ↑ [1]

- ↑ Archived copy ( Memento of the original from January 4, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Archived copy ( Memento of the original from December 15, 2011 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ § 203

- ↑ cf. State decree of June 25, 2009, Federal Tax Gazette I, p. 698