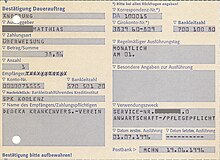

Standing Order

The standing order (or permanent transfer ) is a cashless transfer in payment transactions that is regularly carried out by a credit institution repeatedly at a specified execution time with a constant amount of money to a specific payee for an initially indefinite period of time.

history

The standing order is a German invention. The Hamburg postal check office first introduced standing orders in 1961 and, with around 200,000 standing orders, soon developed into the largest standing order office of all 13 postal check offices. Standing orders spread very quickly in the German banking industry and developed rapidly. In 1963, the leading associations issued “Guidelines for the Execution of Standing Orders When Using Continuous Forms”. Since then, some countries have also introduced standing orders, such as the Netherlands ( doorlopende machtigingen in Dutch ), Japan ( Japanese口 座 自動 振 替 ) or Great Britain ( English standing order ). This form of standing order is not common in the USA, as check payments predominate.

Legal issues

The standing order is subject to the payment service law of the BGB . Payment service law does not use the term, but rather describes it in Section 675n (2) BGB as “execution on a specific day or at the end of a specific period”.

A payment service framework agreement in accordance with Section 675f (2) of the German Civil Code is a prerequisite for a standing order . The payer issues a one-time instruction to his bank in accordance with § § 675 , § 665 BGB to carry out repetitive transfers with constant amounts of money on certain dates until revoked from his account to a specific recipient account, without the need for further instructions. The execution of a standing order constitutes a payment service in accordance with Section 675c (3) BGB in conjunction with Section 1 (1) sentence 2 no.3 letter c ZAG , for which the payment service provider as the main contractual service in accordance with Section 675f (5) sentence 1 BGB Can demand payment. As a payment service, the subject of a standing order is a payment transaction within the meaning of Section 675f (4) sentence 1 BGB, which is initiated by a payment order within the meaning of Section 675f (4) sentence 2 BGB. This instruction is revocable in accordance with § 675p BGB.

Despite the revolving payment transactions, each standing order is viewed as a single payment order. Changes to the standing order (amount, time of execution, rhythm of execution, account numbers) are possible at any time. Depending on the institute group, there is only a certain number of fixed execution times and execution rhythms. Execution times are usually the end of the month and the 15th of the month, the execution rhythm can be chosen monthly, quarterly or annually. The cancellation of the standing order is possible according to § 675j Abs. 2 BGB up to the end of the business day before the agreed payment date ( § 675p Abs. 3 BGB). The bank must notify the customer of non-executed standing orders due to insufficient funds in the account . The Federal Court of Justice (BGH) sees the suspension or deletion of a standing order as a revocation that may not trigger bank charges .

Use

A standing order serves the fulfillment of recurring, constant payment obligations, in particular from continuing obligations . This is the case with rents , insurance premiums , contributions , maintenance payments , repayments , profit savings or long-term savings orders, unless the payees themselves take care of this by direct debit . The standing order frees the payer from having to reserve dates so that timely payments are not forgotten. A special form of standing order is the skimming order , in which a fixed amount remains in the account.

Web links

Individual evidence

- ↑ Helmut Schröder, EDP pioneering achievements in complex applications , 2012, p. 60

- ^ Gerhard Müller / Josef Löffelholz, Bank-Lexikon , 2013, Col. 430

- ↑ Justus Meyer, Wirtschaftsprivatrecht , 2012, p. 158

- ↑ Georg Obst / Otto Hintner, Geld-, Bank- und Börsenwesen , 1991, p. 523

- ↑ Otto Palandt / Hartwig Sprau, BGB commentary , 73rd edition, 2014, § 675f Rn. 17th

- ↑ BGH, judgment of February 13, 2001, Az .: XI 197/00

- ↑ BGH, judgment of September 12, 2017, Az .: XI ZR 590/15