Deposit facility

| interest rate | height |

|---|---|

| European Central Bank (valid from: September 18, 2019) | |

| Deposit rate (deposit facility) | −0.50% |

| Base rate (main refinancing operations) | 0.00% |

| Marginal lending rate (marginal lending facility) | 0.25% |

| Swiss National Bank (valid from: June 13, 2019) | |

| SNB policy rate | −0.75% |

| Federal Reserve System (effective March 16, 2020) | |

| Federal funds rate target range | 0.0 to 0.25% |

| Primary Credit Rate | 0.25% |

| Bank of Japan (effective December 19, 2008) | |

| Discount rate (basic discount / loan rate) | 0.30% |

| Bank of England (effective March 19, 2020) | |

| Official Bank Rate | 0.1% |

| Chinese People's Bank (valid from: February 20, 2020) | |

| Discount rate (one-year lending rate) | 4.05% |

A deposit facility (from Latin facilitas , “lightness”) is a way for commercial banks in the euro area to deposit money that is not required at short notice with the European Central Bank (ECB). As interest, they receive or pay the deposit rate specified by the central bank . It is therefore an option to invest money, which is granted by the central bank and represents an important monetary policy instrument of the ECB.

The introduction of the deposit facility by the European Central Bank has replaced the discount policy of the Deutsche Bundesbank in Germany.

execution

The initiative for deposit transactions comes from the commercial banks. If these are approved for transactions with the ECB, they can temporarily invest money that is not required with the central bank. Due to the short- term nature of such transactions, this form of financing is also referred to as overnight investment or overnight money.

If the bank has outstanding credit balances on the ESCB accounts at the end of the day , these automatically become deposit facilities. As the price for using the deposit facility, they receive or pay the deposit rate (sometimes also the deposit facility rate).

Deposit facilities are offered permanently and in unlimited volumes; therefore it is also known as the standing facility .

classification

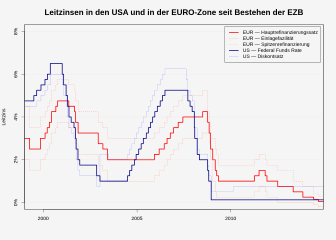

The deposit rate is commonly referred to as one of the three key ECB rates . The interest rate is set by the Governing Council and forms the lower limit of the interest rate corridor . As a rule, it is always one percentage point below the main refinancing rate. However, the ECB deviated from this shortly after the introduction of the euro and during the financial crisis from 2007 onwards. The deposit is the counterpart of the marginal lending facility . Longer-term liquidity is made available to the banks primarily through the main refinancing instrument.

With the transfer of responsibility for monetary policy to the ECB, the deposit facility has replaced the previous rediscount quotas.

Importance for the money market

The deposit facility primarily fulfills two functions:

The primary importance of this instrument is that commercial banks can invest liquidity on their own initiative at any time and thus avoid liquidity surpluses.

Second, the deposit facility has a monetary policy significance: In principle, commercial banks can also make overnight investments via the money market ( interbank market ). However, overnight investments made there must inevitably be more expensive (i.e. higher interest rates) than the deposit facility, since otherwise no transactions can be made on the interbank market. The deposit rate therefore forms the lower limit of the interest charged for overnight investments. If the ECB increases (lowers) the deposit rate, the commercial banks will also increase (decrease) their interest rates for overnight investments - consequently, the deposit rate also serves to enforce the interest rate policy on the market.

Use of the Deutsche Bundesbank's deposit facility

Web links

- ( Page no longer available , search in web archives: Eurosystem's deposit facility )