Budget balance

Budget balance (also: financial balance or budget balance ) is the difference in expenditure and income of a public budget with the exception of net borrowing .

Budget balance and net borrowing

A budget is the summary representation of public finance , expressed in terms of income and expenditure. In Germany, budget-managing bodies are obliged to draw up a formally balanced budget ( Article 110, Paragraph 1, Sentence 2 of the Basic Law , Section 8 of the Federal Budget Code ). According to this, expenses must be covered by income, including net borrowing. This is known as formal budget balancing .

The budget balance corresponds to the net borrowing with the opposite sign: if, for example, the newly borrowed loans exceed the repayments made in the same year, the net borrowing is positive and the budget balance is negative; their sum is always zero. In the case of a material budget balance , the net borrowing and the budget balance, taken individually, are equal to zero.

A material balance of the budget is difficult to achieve because the income is based on tax estimates, while most of the expenditure is already legally established. Coverage problems can thus arise during budget implementation if the actual income is lower than the planned one. In Art. 109 para. 3 GG is prescribed that the budgets of federal and countries are generally without compensating revenue from loans. In contrast, the demand for budget balancing according to Article 110.1 sentence 2 of the Basic Law only requires formal balancing.

A local budget is then equalized when the supply from the administration to the capital budget is at least equal to the scheduled redemption payments. If the amount allocated to the asset budget is higher, the budget-managing body has a “free tip”; if it is lower, the budget has a budget deficit. Budget balancing is part of the principle of budget truth and thus one of the budgetary principles .

Positive and negative budget balance

A positive budget balance is called a budget surplus (also: budget surplus or financial surplus ), a negative budget balance is called a budget deficit (also: budget deficit or financial deficit ). If a municipal administrative budget shows a surplus, this must be transferred to the asset budget; deficits are compensated for by dissolving reserves or disposing of them in the asset budget. These transfers to or from the property budget always lead to a balance in the administrative budget. In terms of budget law, the term “free tip” is the positive balance of the administrative budget after deduction of the scheduled loan repayments, which is to be paid to the asset budget. The budget balance is the normalized result, expressed in budget deficit or budget surplus (“free peak”). Most countries have almost always had budget deficits for decades, which is leading to ever increasing national debt worldwide . This can lead to crises, e.g. B. the sovereign debt crisis in the euro area .

A budget deficit must - for the purpose of formally required budget balancing - be balanced by reserves and / or borrowing. According to § 103 HessGemO, reserves serve to compensate for fluctuations in income and to ensure solvency. If a reserve is not available, borrowing is the only option left. This is basically the case at the federal level, so that a budget deficit there equates to borrowing. A deficit reveals that expenses can no longer be covered by current income and that new loans must therefore be taken out to finance the shortfall.

The term financial balance is mainly used synonymously with budget balance. ( Section 13 (4) BHO) provides for minor adjustments, particularly with regard to the coin profit.

Key figures

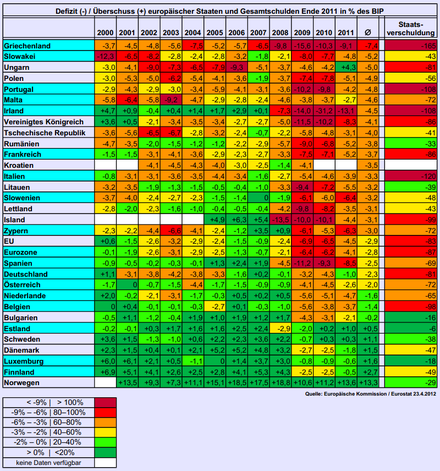

If one looks at different countries, a comparison of their budget balances does not make sense because the different countries differ from one another in their economic strength. A useful economic indicator for comparisons is the deficit ratio , which is defined as the ratio of budget deficit and gross domestic product :

The stronger the economic power of a state, the more national debt it can afford. Because the debt service resulting from the national debt is the main cause of a budget deficit. If the interest rate rises - all other things being equal - the deficit ratio deteriorates and vice versa. Lower public debt leads to an improvement in the deficit ratio and vice versa.

Similarly, in the case of positive budget balances, the surplus ratio is calculated . The Stability and Growth Pact basically prohibits deficit ratios of more than three percent of the gross domestic product. The table opposite shows the deficit and surplus ratios of the European countries in the years 2000 to 2011.

Budget surplus

In the case of a budget surplus, the state generates a surplus of income over expenditure. This surplus reduces the existing debt level.

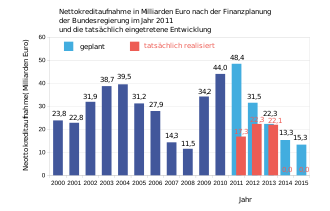

So far (2019) there has been a budget surplus in the Federal Republic of Germany since the 1950s (see Juliusturm ) in eight years. Budget deficits were the rule. For a long time 1969 was the last year with a balanced budget. It was not until 2007 - almost 40 years later - that a balanced overall national budget could be achieved again in Germany. Four more years of budget deficit followed. Since 2012, the general state budget (consisting of the budgets at federal, state and municipal level as well as social security ) has been balanced again, and since 2014 the federal budget as well . From 2014 to (probably) 2019, Germany was able to achieve an annual surplus of the general government budget. A surplus of 2.7% of GDP is expected for 2019 .

As a result of its oil wealth, Norway has had budget surpluses for years, some of which it pays into and manages the state pension fund (several hundred billion euros).

Consequences of a budget deficit

In order to enforce the postulate of a budget balance, statutory sanctions are provided for in the event of a budget deficit. However, these do not take effect in the event of a one-off and low budget deficit, but only in the case of permanent and high deficits. In Art. 109 para. 3 GG is intended that the federal and state budgets must be balanced normally without income from loans ( "debt brake" ). This requirement is deemed to have been met if the budget deficit does not exceed 0.35% of the nominal gross domestic product ( Art. 115 (2) sentence 2 GG). This means a material budget balance. According to Art. 126 TFEU , excessive deficits are to be avoided, so that budget deficits are not fundamentally prohibited under European law. However, if the deficit in the federal budget exceeds 3% of gross domestic product, the sanctions listed in Art. 126 (11) of the TFEU are threatened . Since the national permissible budget deficit is significantly lower than that under European law, compliance with it automatically leads to compliance with the deficit limit under European law.

At the municipal level, failure to achieve budget balance is also associated with legal consequences. If a balanced budget cannot be submitted, the so-called budget security concept applies with the aim of being able to achieve a balanced budget again in the future (Section 76 GemO NRW). A third of the reserve may be used up to enable a balanced budget. If this threshold is exceeded, the budget security concept is triggered. It is then assumed that a reduction in the reserve for two consecutive fiscal years indicates structural budget deficits. The municipal supervision is involved in the process of approval and monitoring .

The importance of budget deficits is a controversial topic in economics , see the main article on national debt .

Individual evidence

- ^ Willi Albers, Concise Dictionary of Economics , 1980, p. 55

- ↑ Josef Isensee / Paul Kirchhof, Handbook of Constitutional Law of the Federal Republic of Germany , 2007, p. 844

- ↑ Paul Engel Kamp / Friedrich L. Sell, Introduction to Economics , 2013, p 511

- ↑ a b Germany: First balanced budget since 1969 , Die Zeit , January 15, 2008

- ↑ Federal Statistical Office: State achieved a surplus of 18 billion euros in 2014, press release No. 062 of February 24, 2015, accessed on February 24, 2015

- ↑ [1] , State generates a surplus of 45 billion euros, Die Zeit Online, August 27, 2019

- ↑ Die Welt, August 15, 2011: Thanks to the billions of the oil fund, Norway no longer has any debt. Retrieved January 12, 2013.

Web links

- Federal debt 1962-2001 , Konrad-Adenauer-Stiftung's working paper on the relationship between interest (on national debt ) and net borrowing ( PDF ; 210 kB)

- Monthly report of the Federal Ministry of Finance