statement of account

An account statement is a document on which all transactions in a bank account, including the resulting balance, can be seen. A special variant is the electronic account statement, in which the account statement data , for example in online banking , is provided in file form.

Legal bases

The information obligation of the credit institutions is derived from Article 248 § 8 EGBGB, according to which the credit institution has to notify the account holder of the information details immediately after the execution of a single payment transaction. According to this, the credit institutions must, in particular, issue the giro account and enable the bank customer to check the dispositions made by issuing account statements and facilitate an overview of the account balance. Notwithstanding Article 248 § 8 EGBGB, information on account transactions can also be provided on a monthly basis (Article 248 § 10 EGBGB). This also applies to loan or deposit accounts. In addition to the provision of sales information by means of an account statement, the payment service provider and the payer regularly agree on a current account agreement ( Section 355 HGB). Afterwards, the payment service provider prepares an invoice at the end of the quarter at the agreed intervals and sends it to the account holder. With the customer's declaration of acceptance - which is usually made tacitly - an acknowledgment of the balance is made .

The holder of a current account has an extended right to information from the bank holding the account in addition to the information obligations for account movements in accordance with § 675 , § 666 BGB, and therefore also for transactions about which the bank has already informed the customer, insofar as they are used to check the correctness of individual bookings required are. However, the bank customer's right to information has also been limited by the BGH. According to this, the customer cannot demand any illegal, comprehensive accounting in the sense of a renewed exhaustive presentation of all account movements.

Types of bank statements

In terms of current account law , a distinction must be made between the daily statement and the statement of accounts. Within the terms and conditions , a distinction is expressly made between statements of accounts and other account statements.

Account statements must also be distinguished from the annual tax certificate that financial institutions issue to their customers free of charge upon request ( Section 45a Paragraphs 2 and 3 EStG ) and which list income from the past year as well as any taxes and deductions for the solidarity surcharge.

Daily extract

The daily statement is an informational interim statement that shows the current sales-related interim status of an account as part of the current account agreement. The daily balance contained therein is to be classified as the item balance, which is determined to facilitate the overview and the interest calculation. Account statements can be created in this form daily, weekly, monthly or on the move. They contain the starting balance, the account sales and the ending balance for the corresponding period. Only the form of the extracts has changed. Instead of the paper form sent by post, most credit institutions now offer daily statements in online banking or on account statement printers . With the issue of an account statement, a novation offsetting is carried out in the legal sense. This results in particular from the fact that the daily statement does not contain any statements about expenses and interest. However, if the customer does not call up a daily statement in this form in a quarter, he will be sent a billing statement by post at the end of the quarter.

Closing of accounts

In No. 7, Paragraph 1 of the General Terms and Conditions for Banks , an account statement is agreed at the end of a calendar quarter. Only at this point in time will the mutual claims be offset against each other. In addition to the usual account transactions, the interest, fees and costs of the previous quarter are also offset in the accounts . According to No. 7, Paragraph 2, No. 4 of the AGB-Banken and No. 7, Paragraph 3, No. 5 of the AGB-Sparkassen, bank customers have a period of 4 or 6 weeks to raise objections to the closing of the accounts. However, this period is not an unlimited period of limitation. The account holder can object to a debit entry based on a direct debit authorization for an unlimited period of time. Approval cannot be seen in the mere silence of a daily account statement received. A mere silence on such an extract does not constitute a conclusive legal declaration, let alone an approval of account debits . The provision in No. 7, Paragraph 3, Clause 2 of the General Terms and Conditions of Savings Banks, according to which financial statements are deemed approved if they are not objected to within four weeks of receipt, leads to the conclusion of an acknowledgment contract. With him the current accountable mutual claims and services are lost, only the claim from the balance acknowledgment remains. This effect should not be confused with a legal approval of all postings on which the closing of accounts is based. Debit entries, such as from direct debits, to which no claim by the bank corresponds, are neither legally nor readily approved by the acknowledgment of debt .

The banks have the right to cancel erroneous credits until the accounts have been closed .

content

Credit institutions mainly use the terms debit and credit instead of credit or debit for sales and balances . Debit means a charge for a customer, credit means a credit. A balance in nominal ( debit balance ) is an overdraft account (see overdraft or overdraft ), a balance in Have accordingly a credit balance . In the case of submitted checks , bills of exchange , direct debits or other collection papers , they are usually credited with the note receipt reserved (E.v.) . The credit institutions reserve the right to charge back the credited amounts at any time in the event that the paper is not redeemed by its debtor. E. v. Credited amounts only become part of the balance when they are redeemed by the debtor of the collection papers. Checks and direct debits are deemed to have been cashed if the debit entry has not been reversed no later than the second banking day after it was made.

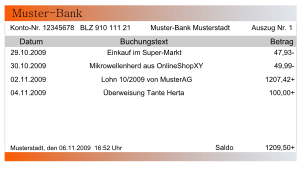

In detail, the account statement contains the name of the account holder (possibly also his address, account address), account number and bank code (in Switzerland bank clearing number ), possibly also the bank identifier code (BIC), account number or international bank account number (IBAN) , Date of statement creation and statement number, name of the bank, starting and ending balance for the corresponding period, individual posting items with posting date, value date, purpose and amount (divided according to debit or credit turnover ). On the back you can usually find general information on the account statement and the postings.

Account statements are misleading if the account balance also contains non-“ value-added ” amounts that cannot be accessed without debiting interest until the value date , even if the individual transactions show the different value dates. The customer must therefore be given the opportunity to recognize the different interest effects in the balance.

Applying for social benefits

The applicant is responsible for applying for benefits a duty to cooperate . It is therefore permissible to require applicants for an initial application or subsequent application for unemployment benefit II to submit account statements for the last three months on the basis of Section 60 (1) SGB I so that specific questions about the income and assets situation of the person seeking help can be clarified . According to a widespread opinion, the requirement is limited to 3 months after a judgment by the Federal Social Court . In fact, the court only had to decide on one case that was only about 3 months. The judgment emphasizes that the request was not the subject of the proceedings for long periods of time. However, the Federal Social Court has also stipulated that the evidence is not disproportionate in the case of an initial application and further approval. Thus, every person seeking help who receives unemployment benefit II can be expected to present relevant bank statements. A refusal to submit bank statements leads to ALG II benefit reductions or a refusal to provide benefits because the obligation to cooperate according to Section 66 (1) sentence 1 SGB I was not met. However, this is not a matter of clear legal requirements as to whether and to what extent the service provider may request the submission of account statements when applying for social benefits.

Black out individual bookings

In the case of smaller expenditure of up to 50 euros and the name of the organization, although the text such as “membership fee” or “donation” must remain legible, the text can usually be blackened out.

Checking the account statements

In principle, the banks are obliged to provide correct information, but in view of the large number of bookings in cashless payment transactions, the customer is obliged to support the bank in fulfilling its obligations and to check the account statement for correctness and completeness. If the customer does not raise any objections to the daily statement, it cannot be inferred that he approves the transactions carried out by the bank. Rather, it is the purely factual explanation that the customer has no objection to the booking. This only represents evidence in a possible later process. However, the customer may be liable for damages due to negligent inadequate control resulting from positive breach of contract. If current account transactions are continued without further ado after the account has been closed, this constitutes an implied acknowledgment on the part of the account holder.

A detailed examination of the content of the daily statements and financial statements enables the customer to object to individual bookings. This is not possible indefinitely. According to the terms and conditions, the account holder has only six weeks after receipt of the statement of accounts to revoke the debit of direct debits in writing by means of a direct debit authorization ( see also: Objection period after the statement of accounts for bank accounts ). He receives the information about such a direct debit on the account statement. This effect should not be confused with a legal approval of all postings on which the closing of accounts is based. Debit entries, such as from direct debits, to which no claim by the paying agent corresponds, are neither legally nor readily approved by the acknowledgment of debt. Even if the debtor has not objected to the debit entries for several months, this does not constitute an implied approval.

Balance acknowledgment

The balance acknowledgment is a legal transaction in which one party carries out the offsetting at the end of a period (the claims are offset) and offers the determined balance for acceptance. According to the prevailing view today, the acknowledgment of balance is an abstract acknowledgment of debt within the meaning of § 781 BGB. The regular notification of the balance also represents an application for the conclusion of an abstract acknowledgment of debt contract for the notified balance. This application is accepted by the other contracting party by declaring the recognition of the balance. Since the balance acknowledgment according to §§ § 780 BGB, § 350 HGB is not formal, the consent can also be implied. The case law accepts as implied acknowledgment, for example, the continuation of current account transactions after the account has been closed or the disposal of the credit.

With the conclusion of this new contract, the previously existing claims expire by way of novation , and the abstract balance claim takes its place, which is interest-bearing due to the express arrangement of Section 355 (1) HGB. It can be assigned , pledged or attached .

Retention obligation

The retention obligation is part of the tax and commercial accounting and recording obligations. Section 257 of the German Commercial Code (HGB) applies under commercial law and Section 147 AO under tax law. Consequently, the person who is obliged to keep books and records under tax or commercial law is also obliged to keep bank statements.

There is no general statutory retention requirement for bank statements for private individuals. However, bank receipts such as check deposits, wire transfers , direct debits, and bank statements serve as proof of payment. Since January 1, 2002, receipts for regular payments made over a longer period of time (e.g. rent) can be used as evidence for another four years. A period of two years applies to one-off payments. If a receipt is still missing after these deadlines, it can be requested from the bank. However, the banks only need to archive the relevant documents for ten years ( Section 257 HGB).

Since July 31, 2004, private individuals have had to observe a two-year storage obligation if they are clients of tradesmen's services in connection with owner-occupied residential property or real estate rented for their own residential purposes according to Section 14b (1) sentence 5 UStG . Then they are obliged to keep invoices, payment receipts or other conclusive documents for two years if the activity is commercial ( see also: Duty to keep private individuals ). Landlords are subject to a ten-year retention period.

The statutory statute of limitations (§ § 194 ff. BGB) cannot be used directly as standards for the retention periods for private documents. Rather, in order to facilitate evidence and to provide evidence, the documents are generally to be kept for as long as there is a risk that claims from the legal relationship can be asserted. However, in order to be able to provide easy evidence of the reason for payment, the amount or the time of payment in everyday business, account statements should be kept for three years, because after this period, everyday business is usually statute-barred and no one can assert enforceable claims.

Court judgments

Unsolicited sending ("compulsory account statement")

The Frankfurt / Main regional court forbade a bank to charge fees in the amount of 1.94 euros for the delivery of the so-called compulsory account statements. According to the consumer advice center (vzbv), however, the judgment has no direct impact on customers of other banks.

Costs for old bank statements

The Federal Court of Justice (BGH) ruled in December 2013 that Commerzbank may not charge a fee of 15 euros for account statements that are not older than six months. The Federation of German Consumer Organizations sued Commerzbank because the fee was inadmissibly high in its view. The actual costs for this service are significantly lower.

See also

Individual evidence

- ↑ OLG Celle, judgment of June 4, 2008, - Az .: 3 U 265/07

- ↑ a b BGH NJW 1985, 2699, 2700,

- ↑ BGH, NJW 2001, 1486

- ↑ No. 11 Paragraphs 4 and 5 AGB-Banken or No. 20 Paragraph 1g AGB-Sparkassen

- ↑ BGHZ 50, 277, 278 ff

- ↑ a b BGH, judgment of June 6, 2000, Az .: XI ZR 258/99

- ↑ BGH WM 1997, 1658, 1660

- ↑ BGHZ 80, 172, 176

- ↑ a b BGH WM 1994, 2273, 2274

- ↑ No. 8 para. 1 AGB-Sparkassen

- ↑ No. 9 Paragraph 1 General Terms and Conditions for Banks

- ↑ No. 9 Paragraph 2 General Terms and Conditions for Banks

- ↑ BGH, judgment of January 11, 2007, - Az .: I ZR 87/04

- ↑ Common information from the state commissioners for data protection in the federal states (PDF file) ( Memento of the original from August 25, 2014 in the Internet Archive ) Info: The archive link has been inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ^ BSG, judgment of September 19, 2008, Az .: B 14 AS 45/07 R

- ↑ independent state center for data protection Schleswig-Holstein

- ↑ No. 11 para. 4 AGB-Banken or No. 20 g AGB-Sparkassen

- ↑ a b BGHZ 73, 207, 210

- ↑ BGHZ 73, 207, 211

- ↑ a b BGH WM 1958, 620

- ↑ No. 7 para. 4 AGB-Sparkassen

- ^ BGH WM 1982, 291

- ^ BGH WM 1956, 1126

- ^ LG Frankfurt / Main, judgment of April 8, 2011, Az .: 2-25 O 260/10 (PDF; 467 kB)

- ↑ Press release of the vzbv ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice.

- ↑ BGH judgment against Commerzbank , last accessed on December 18, 2013.