Bank code

The bank code ( BLZ ) is in Germany and Austria a code to uniquely identify a financial institution . The bank code in Germany always consists of eight digits , in Austria of five digits. In Switzerland and Liechtenstein , the bank clearing number ( BC number ) has the same meaning. The bank sort code must be specified for many business transactions in payment transactions (e.g. bank transfer ).

The establishment of the European Payments Area (SEPA), which has the national payment systems are replaced from 1 February 2014 the bank codes in the participating States were BIC (Business Identifier Code), also SWIFT code named replaced. At the same time, in some countries, including Germany, the bank codes have become part of the international bank account number (IBAN) together with the account number .

Germany

The bank code was introduced in Germany in 1970 and is usually also the account number of the credit institution at the Deutsche Bundesbank (bank code-linked Bundesbank giro account). With these current accounts, the local number usually indicates the branch of the Deutsche Bundesbank that manages the account. The Bundesbank publishes updates to the directory of German banks every quarter, as well as the bank code file structure.

construction

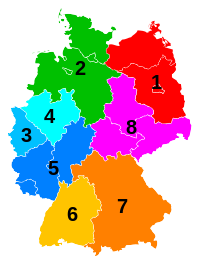

The first digit of the bank code generally designates the clearing area in which the bank is based:

The digits one to three of the bank code form the local number, which identifies a bank location (location of the Deutsche Bundesbank branch) and the associated banking district (bank location and the adjacent area) (formerly called LZB-Platz).

The fourth digit of the bank code denotes the network (banking group):

| 0 | Deutsche Bundesbank branches |

| 1 | Credit institutions, if not included in another group, and Postbank branch |

| 2 | Credit institutions, unless recorded in another group (previously: regional, local, special, house and branch banks - e.g. Unicredit Bank ) |

| 3 | Credit institutions, if not included in another group (formerly private bankers ) - e.g. B. Consorsbank |

| 4th | Commerzbank and its subsidiaries |

| 5 | Savings Banks and Landesbanken |

| 6th | Cooperative central banks and Raiffeisen banks |

| 7th | Deutsche Bank and its subsidiaries |

| 8th | Commerzbank , formerly: Dresdner Bank and its subsidiaries |

| 9 | Volksbanken |

The first four digits of a new bank code are determined by the Deutsche Bundesbank. The credit institute determines the institute's own numbering (digits five to eight of the bank code) - in consultation with the Deutsche Bundesbank - in principle. Additional bank sort codes for credit institutions for the separate processing of payment transactions in certain business areas with significant payment transactions are numbered differently from the bank sort code in digits seven and eight.

example

640 901 00 (Volksbank Reutlingen e.G.):

- 640 = the bank is in the Bundesbank area of Reutlingen

- 9 = it is a Volksbank

- 0100 = individual

The 01 - often also 00 - suggests that the bank has its seat in the same place as the branch of the Deutsche Bundesbank, which is responsible for it. So if the fifth digit - read from the left - shows a zero, the bank in question is (or was, after many Bundesbank branches are closed) at a so-called "bank location".

Special regulations

For Deutsche Postbank AG, digits four to six of their bank code are always provided with the digits “100”, which are not assigned to other credit institutions. The last two digits of your bank code correspond to the first two digits of the old (!) Zip codes of the respective branches (e.g. 46 for Dortmund or 67 for Ludwigshafen).

Credit unions without a Bundesbank giro account linked to a bank code have the same local and banking group number in their bank code as the cooperative central bank branch responsible for them. In these cases, the number nine is reserved as a uniform identifier in the fifth position to differentiate. However, this special regulation only applies in clearing areas two to seven.

reunion

After reunification , the credit institutions based in the five new federal states were assigned the bank code according to a modified scheme. The reason for this was that in the GDR the account number already contained a form of bank code.

The system of account numbers was uniformly defined for all credit institutions in the GDR: xxxx-xx-xxxxxx (example 5121-10-123456): The first three digits defined the location (e.g. 512 = Radebeul), the fourth the credit institute (e.g. 1 = State Bank of the GDR ), the fifth digit denotes the type of account (e.g. 1 = current account ), the sixth digit the check digit , the seventh to twelfth digit the actual account number (one to six digits). Example: An account number in the form 4962–4x-xxxxxx stated that the current account was held with the Kreissparkasse Bautzen (4962).

After reunification, digits 1–4 of the federal German bank code were created according to the scheme described above (clearing area, banking group), and the GDR bank code was appended to them. For example, the bank code 85054962 was created for the Kreissparkasse Bautzen, but was changed to 855 500 00.

Notation

The bank code is written in two blocks of three and one block of two (e.g. 390 601 90).

Austria

The clearing numbers named Austrian bank codes have five digits. The republic itself is an exception; the payment transaction office of the Republic of Austria, whose accounts are managed by BAWAG PSK, received a four-digit clearing number with the bank code 1000. The Austrian National Bank has various bank codes with only three digits. The bank codes can be searched for in the credit institute directory on the website of the Oesterreichische Nationalbank .

Notation

The bank code is usually preceded by a bank code and - unlike the IBAN not written grouped -.

Other countries

France

The clearing numbers are in two parts. They consist of a five-digit bank number, the “Code Banque”, which is issued by the clearing house, and a subsequent five-digit branch number, the “Code Guichet”. These two numbers, together with the following account number and the following two-digit check digit "Code RIB", are part of the complete French account number.

Italy

The clearing numbers are in two parts. They consist of a five-digit institute number, the “Codice ABI”, which is assigned by the Italian Bankers Association, and a subsequent five-digit branch number “CAB”, the Codice di Avviamento Bancario. These two numbers, together with the single-digit alphanumeric check field "CIN" and the following account number, are part of the complete Italian account number.

Sweden

In Sweden the clearing numbers are part of the account number , the front part of which they form. They usually have four digits, only at Swedbank the clearing numbers have five digits.

Switzerland

The Swiss clearing numbers are called "BC numbers" and are up to five digits long. They are issued by SIX Interbank Clearing on behalf of the Swiss National Bank .

Spain

In Spain, the bank code is the first part of the account number. The first 4 digits determine the bank, followed by 4 digits for the branch; these 8 digits together correspond to the bank code. The following two digits are a check number and the last ten digits are the account number. In the IBAN format, the letters ES and two check digits are added in front.

United Kingdom

The clearing numbers are called "Sort Code" and have six digits. They are awarded by the British Bankers' Association and published in the Industry Sorting Code Directory . Each branch of a bank has its own number. The layout corresponds to the scheme 00-00-00.

United States

In the USA, a routing transit number (RTN or ABA for short) is used, which is used on all referrers. The clearing number consists of nine digits in the format XXXXYYYYC. The first four digits are a clearing code that is set by the central bank, with the first two digits defining a fixed classification of the transaction. The middle four digits designate the bank according to the specifications of the American Bankers Association , with the first digits describing the metropolis or the state - with 1 to 49 the populous cities are assigned their own numbers (1 = New York) and with the numbers 50 to 99 the states with the remaining territories (99 = Wyoming). The last digit is a check digit.

Canada

In Canada, the clearing number is called the transit number for short , in contrast to the USA, it is often also called the Canadian transit number . The clearing number is issued by the Canadian Payments Association and has the format XXXXX-YYY on paper. The first part is a five-digit branch number followed by a three-digit bank number. The hyphen is an integral part of the number in the paper version. For the electronic format, the layout is reversed, the hyphen is omitted and a zero is placed in front: 0YYYXXXXX.

The following general rules apply:

The first branch of the Bank number starts for normal banks with 0, 2, 3 or 6, in cooperative and popular banks ( Credit Union or Caisse Populaire ) with the number 8 and the Trust Company with 5 examples:

- XXXXX-001 Bank of Montreal

- XXXXX-002 Bank of Nova Scotia

- XXXXX-003 Royal Bank of Canada

- XXXXX-004 Toronto-Dominion Bank (today operates under the TD Canada Trust logo )

- XXXXX-006 National Bank of Canada

- XXXXX-010 Canadian Imperial Bank of Commerce (including President's Choice Financial)

- XXXXX-016 HSBC Canada

- XXXXX-039 Laurentian Bank of Canada

- XXXXX-117 Government of Canada

- XXXXX-127 Canada Post (money orders)

- XXXXX-177 Bank of Canada (Central Bank)

- XXXXX-219 ATB Financial

- XXXXX-260 Citibank Canada

- XXXXX-290 UBS Bank (Canada)

- XXXXX-308 Bank of China (Canada)

- XXXXX-309 Citizens Bank of Canada (Canada)

- XXXXX-326 President's Choice Financial (no longer assigned)

- XXXXX-338 Canadian Tire Bank

- XXXXX-340 ICICI Bank Canada

- XXXXX-509 Canada Trust (prior to the merger of TD & Canada Trust)

- XXXXX-540 Manulife Bank

- XXXXX-614 ING Direct Canada

- XXXXX-809 Credit Union Central of British Columbia

- XXXXX-815 Caisses Desjardins du Québec

- XXXXX-819 Caisses populaires Desjardins du Manitoba

- XXXXX-828 Credit Union Central of Ontario

- XXXXX-829 Caisses popular Desjardins de l'Ontario

- XXXXX-837 Meridian Credit Union (formerly Hepco)

- XXXXX-839 Credit Union Heritage (Nova Scotia)

- XXXXX-865 Caisses populaires Desjardins acadiennes

- XXXXX-879 Credit Union Central of Manitoba

- XXXXX-889 Credit Union Central of Saskatchewan

- XXXXX-899 Credit Union Central Alberta

With a few exceptions, the last digit of the five-digit branch number indicates the province of the branch.

- 0 stands for British Columbia and Yukon

- 1 stands for western Québec with Montreal and the surrounding area

- 2 stands for Ontario with Toronto and the surrounding area

- 3 stands for Nova Scotia , Prince Edward Island and Newfoundland excluding Labrador

- 4 stands for New Brunswick

- 5 stands for eastern Québec and Labrador

- 6 stands for eastern Ontario with Ottawa and the surrounding area

- 7 stands for Manitoba and Northwestern Ontario

- 8 stands for Saskatchewan

- 9 stands for Alberta , the Northwest Territories, and Nunavut

Australia

Australia uses a prefix of the account numbers as a clearing feature, which consists of six digits. This Bank State Branch in the format XXX-XXX describes the bank in the first two or three digits and the branch number in the following three digits. Originally only the first two digits were used for the credit institution and the third digit described the state.

New Zealand

New Zealand uses a similar format to Australia, but with only four digits for the BSB prefix.

IBAN and BIC

In the course of internationalization , the bank code was combined with the account number to form the international bank account number (IBAN). This must z. B. for the EU transfer together with the SWIFT address (also BIC or Business Identifier Code). However, the BIC does not need to be specified in national payment transactions; for international transfers, this is expected from February 1, 2016.

A German IBAN contains the bank code after the first four characters (“DE” and check digits ), an Austrian IBAN “AT” and check digits, and a Swiss IBAN “CH” and check digits.

The German bank sort codes are mapped to the BICs of the German credit institutions in the bank sort code file of the Bundesbank; however, there can be several bank codes for one BIC (see e.g. BIC "SCFBDE33XXX") and several BICs for one bank code (see e.g. BLZ " 87070000 "). However, only the data records with characteristic “1” in field 2 are relevant for payment transactions; with these, the bank code is always unique.

Web links

Individual evidence

- ↑ Leaflet bank sort code file Deutsche Bundesbank , dated August 13, 2018

-

↑ State accounts: Republic has its own bank code . APA article on DiePresse.com , April 24, 2012, accessed on November 12, 2016.

BAWAG PSK Post payment transaction office of the Republic of Austria, bank code 1000 . ( Memento of the original from March 4, 2016 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. bankkondionen.at, accessed on November 12, 2016. - ↑ Canadian Payments Association: Institution Numbers and Clearing Agency / Representative Arrangements ( Memento from April 19, 2009 in the Internet Archive )

- ↑ Finances A - Z: Bank Identifier Code (BIC), now also Business Identifier Code. Youth and Finance. School service portal of the Volksbanken Raiffeisenbanken, archived from the original on May 19, 2014 ; accessed on November 12, 2016 .

- ↑ The SEPA transfer. ( Memento of December 3, 2013 in the Internet Archive ) Deutsche Bundesbank (sepadeutschland.de), accessed on May 23, 2014