Deutsche Bank

| Deutsche Bank Aktiengesellschaft | |

|---|---|

|

|

| Country |

|

| Seat | Frankfurt am Main |

| legal form | Corporation |

| ISIN | DE0005140008 |

| Bank code | 500 700 10 |

| BIC | DEUT DEFF XXX |

| founding | March 10, 1870 in Berlin New establishment January 1, 1957 |

| Website | www.db.com |

| Business data 2019 | |

| Total assets | 1,298 billion euros (Dec. 31, 2019) |

| Employee | 87,597 (Dec. 31, 2019) |

| management | |

| Board |

Christian Sewing ( Chairman ) Karl von Rohr Fabrizio Campelli Frank Kuhnke Bernd Leukert Stuart Lewis James von Moltke Christiana Riley Werner Steinmüller |

| Supervisory board |

Paul Achleitner ( Chairman ) |

The German Aktiengesellschaft ( ) is the by total assets largest number of employees and bank in Germany. The company, which is based in Frankfurt am Main , operates as a universal bank and has significant branches in London , New York City , Singapore , Hong Kong and Sydney . In 2018, around 41,600 people worked for the bank in Germany and 91,700 worldwide. The bank attaches particular importance to investment banking with the issue of shares , bonds and certificates . Under the DWS Investments brand, Deutsche Bank is the largest provider of mutual funds in Germany with a market share of around 26 percent. In 2010, their market share in retail banking in Germany, including Postbank, was around 15 percent. After the savings banks and the group of cooperative Volks- und Raiffeisenbanken , Deutsche Bank is number three in its home country.

The bank has been classified as a systemically important financial institution by the Financial Stability Board (FSB) and has been on the list of global systemically important banks since 2011 . It is therefore subject to special monitoring and stricter requirements for the endowment with equity . Due to the international links, a failure of the bank is considered to be associated with a high risk for the international financial markets. It must therefore have a surcharge of 1.5 percentage points on equity based on the Basel III standards .

Business activity

Deutsche Bank has an important international position in investment banking and also in private customer business. In order to manage the business, the bank is structured in several levels according to business areas and regions. The headquarters of the company is Frankfurt. Individual business areas in investment banking are based in London or New York. The bank differentiates between institutional clients in the bond and securities business. These are looked after in the Global Markets division . The Corporate Finance division is available for special financing in corporate banking (company acquisitions, IPOs ) . The Transaction Banking division provides its customers with systems and resources to handle their ongoing (including international) business. There are two segments in the private customer business: particularly wealthy customers are offered special individual support in Asset & Wealth Management ; the Private & Business Clients division conducts standard business with the majority of private customers as well as with small and medium-sized companies.

Europe is the DWS Group with more than 150 billion euros managed fund assets of a leading mutual fund societies and also plays in the Islamic banking system now with partners at the global players with. Here, Deutsche Bank and Dar al Istithmar run a global think tank for the Islamic finance industry in London .

Shareholders

| proportion of | Shareholders |

|---|---|

| 4.49% | BlackRock |

| 3.14% | Douglas L. Braunstein (Hudson Executive Capital LP) |

| 3.10% | Capital Group Companies , Los Angeles |

| 3.05% | Paramount Services Holdings , British Virgin Islands |

| 3.05% | Supreme Universal Holdings , Cayman Islands |

| 3.00% |

Cerberus Capital Management (Stephen A. Feinberg) |

Deutsche Bank has been one of the leading German listed companies since the end of the Second World War. Its shares are traded on the Frankfurt Stock Exchange and, since 2001, on the New York Stock Exchange and are part of various indices, including the DAX . Since the share had lost value from mid-2015 and market capitalization had shrunk to around EUR 18 billion, it was temporarily removed from the Euro Stoxx 50 on August 8, 2016. In 2018, it was the company with the lowest index weighting, with a 0.73% share.

In 2001, Deutsche Bank merged its mortgage banking business with that of Dresdner Bank and Commerzbank in Eurohypo AG . In 2005, Deutsche Bank sold its stake in the joint company to Commerzbank.

organization

Development of the management structure

On February 1, 2006, the bank broke the tradition of the board spokesman that had existed since the 19th century, who only represented the uniform decisions of the board of directors, and appointed Josef Ackermann as chairman of the board as part of his contract extension . This was justified with an adjustment to general practice.

Organizational structure

The organizational structure of the Deutsche Bank Group corresponds to a double matrix . The operative business is managed in divisions, which are subdivided into corporate divisions and, in a further subdivision, partly into business divisions. In addition, there is central responsibility for the individual regions in which Deutsche Bank is represented. At group level there are three central cross-sectional functions in addition to the chairmanship of the board. All heads of this management organization together form the Group's 'Group Executive Committee'.

| Group management (cross-sectional functions) | ||||||||

|---|---|---|---|---|---|---|---|---|

|

CEO Christian Sewing is responsible for corporate banking and investment banking |

CFO James von Moltke Commercial Management |

Stuart Wilson Lewis , Chief Risk Officer , is also responsible for Compliance, Anti-Financial Crime, Business Selection and Conflicts Office |

Deputy CEO Karl von Rohr is responsible for law, governance, private customer banking, asset management and the Germany region |

Chief Technology Officer Bernd Leukert Data and Innovation |

Board member America Christiana Riley |

Chief Operating Officer Frank Kuhnke Operational Management; is also responsible for the capital release unit |

Board member Asia-Pacific Werner Steinmüller |

Fabrizio Campelli, Chief Human Resources Officer, Chief Transformation Officer |

| Group divisions | ||||||||

| Corporate and investment bank | Private customer bank and asset management | North / South America | Asia / Pacific | |||||

| Divisions | ||||||||

Mark Fedorcik investment bank |

Corporate bank |

Private customer bank Manfred Knof |

Asset Management / DWS Group Asoka Wöhrmann |

|||||

| Business areas | ||||||||

| Sales & Trading Ram Nayak |

Global Transaction Banking

Stefan Hoops |

Postbank | Wealth management

Claudio De Sanctis |

|||||

In addition to the management of its own investments (corporate investment), which is located in the head office, Deutsche Bank is organized around six operational business areas that have very different weights in terms of the number of employees, sales and earnings contribution and internationalization.

Individual business areas

| year | Income | Earnings (before taxes) |

|---|---|---|

| 2014 | 13,742 | 3,266 |

| 2013 | 13,526 | 3.158 |

| 2012 | 15,073 | 2,904 |

| 2011 | 13,899 | 3,684 |

| 2010 | 17,490 | 5,094 |

| 2009 | 16,197 | 3,520 |

| 2008 | 428 | −8,476 |

| 2007 | 16,507 | 4,202 |

| 2006 | 16,574 | 5,379 |

The division results published in the annual reports as part of the segment reporting are figures at the level of the corporate divisions according to internal management reporting (all values in million euros).

The Global Markets division is geared towards the needs of large international corporations, governments and international institutional investors. The management is based in London, with major divisions located in New York and Frankfurt. Around 6,000 employees in 39 trading departments and 72 countries work to raise capital, manage risks ( hedge ) and invest. The division deals with the issue and placement (primary market) as well as trading (secondary market) of shares and fixed-income securities (bonds and promissory notes), currencies, commodities, derivatives (especially options, futures and swaps ) and money market instruments (business with credit institutions and central banks ). In accordance with the variety of customer groups and products in this spectrum, the area is further differentiated into business lines and product-related groups. More than 10% of the employees work in the area of analysis and research. The area was strengthened in 2005 with the acquisition of the Turkish brokerage house Bender Securities. In the following year, the remaining 60% shares in the Russian United Financial Group (UFG) were acquired. With MortgageIT Holdings, DB took over a real estate investment trust (REIT) in January 2007 , which is involved in the financing of residential real estate in the USA and which had over 2,000 employees at the time of the takeover. A few months later, the subprime crisis began in the USA , which in 2009 and 2010 also affected the real economy worldwide.

| year | Income | Earnings (before taxes) |

|---|---|---|

| 2014 | 4.146 | 1,198 |

| 2013 | 4,069 | 1.107 |

| 2012 | 4,200 | 664 |

| 2011 | 3.816 | 1,029 |

| 2010 | 3.223 | 905 |

| 2009 | 2,609 | 795 |

| 2008 | 2,774 | 1.106 |

| 2007 | 2,585 | 945 |

| 2006 | 2,228 | 705 |

The Corporate Finance division with over 4,000 employees in 40 countries includes the advice-intensive business for financing special events in companies. These include policy analysis, support for larger public tenders, purchase and sale of companies and parts of companies ( M & A M & A), IPOs ( Initial Public Offerings IPO), issuance of corporate bonds and promissory notes, finance major real estate and other major projects in the infrastructure and Transport (ships, aircraft) through, among other things, closed funds and private placements, as well as global lending to companies supported by regional and topic-specific teams.

In the area of Global Transaction Banking are also more active than 4,000 employees. A comprehensive service for the processing of foreign trade transactions (trade finance), the processing of payment transactions ( cash management systems) and the liquidity management of companies and institutional customers, including electronic banking, will be offered . This area also includes looking after securities custody and administration, especially for institutions (pension funds, insurance companies and other banks, including Postbank and Sal. Oppenheim ). The assets managed as a service (assets under custody) amount to over 1.5 trillion euros. The department acts as a paying and registration office for numerous institutions. This area also includes specialties such as the service for trading in carbon dioxide emission rights in over 30 countries or the processing of payment transactions with mobile phones (in cooperation with Luup International ).

| year | Income | Earnings (before taxes) |

|---|---|---|

| 2014 | 2,601 | 1,027 |

| 2013 | 2,441 | 782 |

| 2012 | 2,282 | 154 |

| 2011 | 2,315 | 941 |

| 2010 | 3,907 | 100 |

| 2009 | 2,688 | 200 |

| 2008 | 3,264 | −525 |

| 2007 | 4,374 | 913 |

| 2006 | 4.166 | 894 |

The area Asset Management , of 2010 assets of more than 800 billion euros, with more than 3,000 employees under management, the German bank is divided into four divisions. The fund business for the general public is operated by DWS and, in the USA, by DWS Scudder. This includes the range of Riester products in Germany.The specialist company RREEF offers alternative investments for private investors, for example participation in large properties or real estate funds. Asset management for institutional investors such as pension funds is carried out by DB Advisors. The Deutsche Insurance Management division is responsible for managing the investment requirements of insurance companies. The stake in Harvest Fund Management, the third largest asset manager in China, and 40% in the Russian UFG Invest can be assigned to this area.

The Private Wealth Management Deutsche Bank is focused on high net worth individual clients advised by individual account manager. In this business area, the bank looks after over 90,000 wealthy private customers in 31 countries with client assets under management of over 150 billion euros. Coordinated investment strategies are to be developed on the basis of individual preferences and risk perceptions, and the existing systems are to be continuously monitored accordingly. This business includes looking after foundations and processing and managing inheritance. The forms of investment range from securities through structured products and real estate to investments in art objects. Deutsche Bank also works as a service provider with independent investment advisors in this area. An important starting point for this division was the takeover of the private bank Grunelius in 1990, which was renamed Deutsche Bank Trust AG and integrated into Deutsche Bank. In the USA, the division is represented by Deutsche Bank Trust Company Americas, the remaining activity of Bankers Trust , which was taken over in 1999 . Another step in expanding the business was the takeover of the Swiss private bank Rüd, Blass & Cie , which has been part of Deutsche Bank since 2003. More recent acquisitions in this area were the integration of the British asset management company Tilney and the acquisition of Wilhelm von Finck AG in Munich.

| year | Income | Earnings (before taxes) |

|---|---|---|

| 2014 | 9,639 | 1,335 |

| 2013 | 9,550 | 1,555 |

| 2012 | 9,540 | 1,519 |

| 2011 | 10,397 | 1,902 |

| 2010 | 6.136 | 890 |

| 2009 | 5,576 | 458 |

| 2008 | 5,777 | 945 |

| 2007 | 5,755 | 1,146 |

| 2006 | 5,149 | 1,041 |

The Private & Business Clients division looks after the broad mass business of Deutsche Bank (retail banking). The division operates in eight countries. In addition to Germany, these are primarily Italy, Spain, Poland, Belgium, Portugal and, more recently, India and China. There has been a cooperation with the Hanoi Building Commercial Joint Stock Bank (Habubank) in Vietnam since 2007. It is sold in more than 1,800 branches. There are also more than 3,000 independent financial advisors. The bank also works with financial distributors such as Deutsche Vermögensberatung ( DVAG ) or Banco Posta in Italy. In Germany there is still a sales cooperation with the ADAC . Since acquiring the Berliner Bank with 61 branches and the norisbank with 96 branches, Deutsche Bank has pursued a multi-brand strategy. This division also includes the online broker maxblue and a stake in the Chinese Hua Xia Bank , which in 2010 was 19.99%.

During Rolf-E. Breuer , this area was spun off into Bank 24 and there were considerations to separate the area from the business of the rest of the bank. However, under the chairmanship of Josef Ackermann , this development was reversed and the business segment , which until 2018 was known as Deutsche Bank Privat- und Gewerbekunden Aktiengesellschaft , is again under the uniform brand of Deutsche Bank. Since around 2005, considerable growth efforts have also been made internationally in this area. A strengthening in this area was the acquisition of the majority of the shares in Postbank in November 2010. The number of employees in the division rose to over 50,000 as a result. With well over 20 million customers, both institutes have a combined market share in Germany of around 15% in this segment.

Central functions

Since Deutsche Bank has outsourced a significant part of its purely administrative functions, more than 20,000 employees work in cross-departmental control, processing and administrative functions, the so-called infrastructure areas.

The bank defines the corporate center as the departments that monitor and control the company and thus directly support the management board in its management, especially with regard to its supervisory and risk-related tasks. These include staff departments such as auditing , taxes, legal, risk management , investor relations , communication and social responsibility, corporate development, internal management consultancy and the legally independent DB Research , which is responsible for business- independent market research, economic issues and general basic studies. In addition, there are central tasks from the general infrastructure areas such as controlling , reporting , corporate planning , personnel development and organizational development including information technology.

In the area of Finance (Finance) are more active than 5000 employees at 50 locations. One task is to support and monitor the implementation and accounting of the activities of the business areas. The Credit Risk Management Group has around 3000 employees. The area is organized in a matrix according to business areas and regions. A second core task is to meet the legal requirements for documentation and reporting (e.g. Sarbanes Oxley Act or IFRS ). Finally, the department is responsible for management information, strategic planning and risk control.

The Human Resources department is organized regionally and, in addition to the classic tasks in recruiting and personnel development, including training and further education, deals with corporate culture and change management issues . Instruments of modern personnel management up to and including an Internet academy in Asia are used. To promote young talent, the bank is a corporate partner of the university network CEMS . There are internationalized projects to promote the professional development of women, environmental management and topics in the area of corporate social responsibility . Employees who are socially committed are given special support. The HR department is also responsible for general administration and facility management.

The bank's IT department is known as Group Technology & Operations and, with over 15,000 employees, is the bank's largest organizational unit. He is responsible for the provision of infrastructures, software and support services. In the organization of the area, a distinction is made between technology, which carries out the development of the applications, and operations, in which the ongoing processes and transactions are supported. The separate infrastructure area provides the hardware and software platforms. In addition to data centers and networks, this also includes hosting and messaging. Technology and operations are divisionally structured for the areas of investment banking, asset management and private & corporate banking.

Outsourcing and offshoring

In the early 1990s, the Deutsche Bank founded a subsidiary in India for software development. In 1999 she outsourced the transaction management for the securities business and payment transactions to european transaction bank ag (etb). In the following year, user support and the help desk at Sinius GmbH were made independent . Sinius and etb should use the experience of the bank in the administration of standardized processes and market their know-how to external third parties. In 2003, Deutsche Networks Services was founded in Bangalore .

This approach expresses a new view of the bank's business processes, brought in in particular by Hermann-Josef Lamberti , who joined the bank's board as the former managing director of IBM Germany. Like an industrial company, the bank now regards its business processes as a production process that can be broken down into the elements infrastructure - applications - products - sales. For each element of these production stages, a decision about in- house production or external procurement must be examined as to whether it makes sense to provide the service yourself or whether it is better to buy it in. In addition to the costs, a decisive role in the evaluation is whether the elements of the process chain are strategically important and whether their specialization contributes to the differentiation from the competition, i.e. whether they can generate a comparative competitive advantage . With the aim of concentrating on core competencies , these are customer processes, sales, product development and risk management for the bank. In the area of products, too, there was a concentration on core competencies. As part of this strategy, the insurance business of Deutscher Herold was sold to Zurich , sales financing via GEFA-Leasing GmbH to Société Générale and passive securities custody to State Street . The mortgage banking business was brought into Eurohypo and the shares were sold to Commerzbank .

A first step was spectacular, the outsourcing of European data centers with 750 employees at IBM in 2002. The bank promised by the agreement worth 2.5 billion euros in annual savings of 100 million euros. At the beginning of 2003, the majority of Sinius with 1250 employees was transferred to Siemens . Payment transactions were split off from etb and organized independently as DBPayments . Another large outsourcing project was the transfer of the purchasing function to Accenture in 2004. The data and voice networks were transferred to AT&T in North America and to Deutsche Telekom in Germany . Also in 2004, the bank sold DBPayments to Postbank and etb to the service provider Xchanging . In 2013, Deutsche Bank took over the 51% stake that was sold to the British service provider Xchanging in 2004 and changed the name of this company to DB Investment Services GmbH . In 2006, Siemens received the order to supply and support 19,000 thin clients and over 10,000 PCs. In addition to central IT departments in Eschborn , London and New York, there are service delivering hubs with a total of more than 6,000 employees in Jacksonville , Florida , Birmingham , Great Britain, Mumbai , Bangalore and, since 2008, in Jaipur and the Philippines . The systematic outsourcing abroad ( offshoring ) is carried out to reduce administrative costs . The original software development in India was given to a service provider. In 2004, Deutsche Bank purchased software services in the following countries:

- Ireland (application modules, product development, adaptation to the European market)

- USA (product development, adaptation to the US market)

- India (product development, software development and maintenance)

- Australia (software development and maintenance)

- Russia (high-end software engineering).

history

Founded in 1870 and the first beginnings

Since the spring of 1869 Adelbert Delbrück had tried in vain to convince the Mendelssohn bank of his idea of "creating a large bank, mainly for overseas trade, which should make us independent from England". On the other hand, he found favor with the well-traveled banker and politician Ludwig Bamberger , who at the time had to process South American and East Asian credit transactions via London and was therefore familiar with the problem that Delbrück had addressed from his own experience. Bamberger later wrote in his memoirs:

“These experiences gave me the impetus that when, at the end of the sixties, during my first long stay in Berlin, Adelbert Delbrück, the head of the Delbrück, Leo & Co. bank, spoke to me about the company of a Deutsche Bank to be founded with the request, to participate in their formation and organization, I willingly responded with regard to the expansion of the German banking system into transatlantic areas, for which I believed I had some knowledge. "

Over the next few months, Delbrück and Bamberger solicited other entrepreneurs who wanted to participate in the project. The founding committee finally included:

- Hermann Zwicker ( banking house Gebr. Schickler, Berlin )

- Anton Adelssen ( Bankhaus Adelssen & Co. , Berlin)

- Adelbert Delbrück ( Bankhaus Delbrück, Leo & Co. , Berlin)

- Heinrich Hardt (Hardt & Co., Berlin, New York)

- Ludwig Bamberger

- Victor Freiherr von Magnus ( F. Mart Magnus Bank )

- Adolph vom Rath (Bankhaus Deichmann & Co., Cologne)

- Gustav Kutter (industrialist as representative for the banking house Gebrüder Sulzbach , Frankfurt)

- Gustav Müller (Württembergische Vereinsbank, Stuttgart)

In July 1869, the committee passed a memorandum stating:

“The German flag is now carrying the German name in all parts of the world, a further step would be taken here to honor the German name in more distant regions and finally to conquer Germany in the field of financial mediation - appropriate to those who our fatherland already occupies in the field of civilization, knowledge and art. [...] But this company does not need exclusively German participation to support it, which should adopt the cosmopolitan standpoint. "

This memorandum was attached to the application for a license to become a stock corporation , which had previously only been granted to one bank in Prussia, the A. Schaaffhausen'schen Bankverein . The headquarters of the company should be in Berlin, not least because the founding of Deutsche Bank "sprang from a truly patriotic idea". These "economic [...] and national [...] goals at the same time from the outset" seemed to have been decisive for the granting of the concession. In any case, the Prussian Ministry of Commerce accepted the agreement just twelve days after the founding meeting on January 22, 1870 Preliminary decision issued. The proceedings had been promoted by Minister Itzenplitz and the benevolent Prussian Prime Minister Otto von Bismarck .

Itzenplitz wrote to Bismarck on February 10, 1870:

“If society pursues and achieves its purpose, it can indeed become of great importance for the development of commercial relations. It seems important to us that such a company has its seat in Berlin. "

The founding statute was approved on March 10th by the "highest decree of Sr. Majesty the King of Prussia " of Deutsche Bank; this date is considered the official date of incorporation of the stock corporation. The share capital was five million thalers (after the founding of the empire in 1871: 15 million marks; today's equivalent of around one billion euros). The business purpose was "the operation of banking transactions of all kinds, in particular the promotion and facilitation of trade relations between Germany and the other European countries as well as overseas markets." Of the share capital, 2 million talers were offered to the market at par and almost 150 times oversubscribed by the end of March .

The public initially viewed the start-up very critically. The Frankfurter Wirtschaftszeitung Der Aktionär, for example, questioned the founders' ability to “manage such an institute in accordance with modern requirements [...], even if it were to be true that the reef pirates, the Kaffirs and the Black Footed Indians want to establish commanders. "

On April 9, 1870, Deutsche Bank commenced business operations in a two-story apartment building at Französische Strasse 21. A year later it moved into more representative rooms with 50 employees in Burgstrasse 29 in the immediate vicinity of the stock exchange . The first directors were Wilhelm Platenius , Georg von Siemens and Hermann Wallich . They had to conduct the business of the "in accordance with the instructions given to them by the Board of Directors". The 24-person board of directors was significantly more powerful than a modern supervisory board and assumed its operational responsibility through a weekly committee of five. The new bank should not compete with the shareholders. Because of these restrictions, Platenius resigned as early as 1870 and his successor only stayed until 1872. In 1873 Max Steinthal joined the board and was primarily responsible for the international foreign exchange business and the issuing business. In 1878 Rudolph von Koch was added, who was primarily responsible for administration, and was spokesman for the board from 1901 to 1909, then on the supervisory board and its spokesman from 1914 to 1923.

As it turned out, Berlin was less suitable for international business than Hamburg or Bremen, for example. Therefore, in July 1871, it was decided to open the first branch in Bremen . Hamburg followed a year later . It also seemed necessary to have a presence in the world trading metropolis of London . This led to the founding of the German Bank of London in 1871 , in which Deutsche Bank held over 40 percent as a limited partner . After the start-up proved to be incapable of acting due to capital restrictions, the bank company opened its own branch in London ( Deutsche Bank (Berlin) London Agency ) in 1873 . In 1879 the bank finally sold the shares in the German Bank of London with a loss of 117,000 marks. The branch, however, worked successfully.

The Asian business, in which Deutsche Bank entered in 1872 with the opening of branches in Shanghai and Yokohama , brought losses. The reason was the devaluation of silver coins in 1873, on which the working capital in Asia was based. The branches had to be closed again in 1875. The bank earned well from the sale of the silver holdings of the German Empire, which it was entrusted with after the conversion from the silver to the gold currency in 1871. From 1872 to 1877 and 1882, Deutsche Bank participated as a limited partner in companies in Paris and New York City .

The German domestic business was based primarily on the large deposits (1910: 558 million marks), a business that the Deutsche Bank operated as the first private bank on Georg von Siemens' initiative in competition with the savings banks from the beginning. Hermann Wallich saw this as the only possibility for permanent profiling in Germany. He warned against “disguised speculations” and refused to “seek the focus of our sphere of activity in the stock exchange.” The bank, which had not yet entered into any significant industrial commitments, profited from the founding crisis in 1873 by acquiring other banks. Various takeovers, including those of the Berliner Bankverein (1876) and the Deutsche Union-Bank (1876), made Deutsche Bank the largest bank in the German Empire in terms of total assets and overtook its major rivals Disconto-Gesellschaft and Dresdner Bank . The takeover of Deutsche Union-Bank gave us the opportunity to move into a magnificent headquarters on Behrensstrasse / Mauerstrasse . The yields developed positively during this period. From 1875 the result rose from 1.4 million marks to 6 million marks in 1880. As early as 1876 a pension and support fund was set up for the "bank officials".

In 1886, the establishment of the Deutsche Übersee-Bank was a step towards opening up the South American market, which shows a change in corporate strategy: under Adelbert Delbrück, who had resigned as chairman of the supervisory board in 1889, attempts were made to slowly expand the international market with the To establish their own branches, Hermann Wallich and Georg von Siemens, who no longer represented the traditional private bankers, but instead acted as future-oriented managers , tried to dominate overseas markets through subsidiary institutions. With this new form of foreign engagement, business developed with "regular, satisfactory progress". Accordingly, in 1889 the bank took a stake in the German-Asian Bank , which was founded by a consortium of 13 institutes. This was the first joint project with the Disconto-Gesellschaft , whose managing director Adolph von Hansemann had suggested the start-up. The new Shanghai-based institute, which initially limited itself to trade finance, initially faced stiff (especially British) competition. The German-Asian Bank developed successfully by 1913 and seven branches were opened in China (including Hong Kong and Tsingtao ), two in Japan ( Yokohama and Kobe ), and one each in Singapore and Calcutta . The Deutsch-Asiatische Bank was the predecessor of Deutsche Bank (Asia Pacific) , which is still a subsidiary of Deutsche Bank in Asia today.

Since it was founded in 1870, the bank has been run by a board of directors. However, the board of directors had far-reaching control and decision-making rights. The stock corporation law reform of 1884 ( Stock Corporation Act of July 18, 1884) brought about the division of responsibilities between the executive board and the supervisory board that has been in effect since then. Since then, the board has been headed by a board spokesman, which should clarify the role of primus inter pares . It was customary to make decisions unanimously. The bank implemented the renaming of the board of directors to the supervisory board after long-time chairman Adelbert Delbrück left the company in 1889.

Increasing industrial projects from 1880

In the first corporate phase of the bank, the expansion of the branch network was only a secondary goal and all important business was carried out via the Berlin headquarters. After the branch openings in Bremen and Hamburg, which were closely connected to the foreign trade business - the two important overseas ports were not initially part of the customs territory of the German Reich - only the Frankfurt Bank Association, which was taken over by Dellbrück in 1886, was incorporated . Further branches were only established at the beginning of the 20th century.

Since Delbrück's departure, Georg von Siemens placed his main focus on international monetary transactions on the one hand (including South America and East Asia, the Ottoman Empire and, to a lesser extent, the German colonies ) and close contact with German industry on the other. Deutsche Bank had been Krupp's credit institution since 1874 , and later also involved in the textile industry . In 1881 Deutsche Bank took part in the takeover of the "Aktien-Gesellschaft für Anilinfabrikation" with an amount of 2.5 million marks. Other major customers were Bayer (since 1886) and BASF . As a major shareholder, Deutsche Bank held shares in AEG (the bank had financed their establishment in 1887) and Siemens & Halske . Furthermore, on the advice of Werner von Siemens, Deutsche Bank was represented on the Supervisory Board of Mannesmannröhren-Werke from 1890 and held Mannesmann shares worth 3 million marks. The institute also financed the transformation of Siemens-Schuckertwerke into a stock corporation.

In 1900 Carl Klönne moved to the board of directors of Deutsche Bank. Siemens had succeeded in winning one of the most prominent experts in corporate finance, particularly in the area of the West German coal and steel industry, for the institute. With him, in addition to a close collaboration with the Essener Credit-Anstalt (1903), a cooperation began with Klönne's ancestral major customers, including the Bochumer Verein , the Schalker Verein , the Harpener Bergbaugesellschaft and the Essener Bergwerkverein König Wilhelm . Thanks to Klönne, the industrial business was placed on a broad basis for the first time. The new member of the Board of Management also had a lively correspondence with August Thyssen .

Meanwhile, overseas business was developing at breakneck speed. In 1893 , the Deutsche Ueberseeische Bank had just under 1.7 billion marks in sales ; in 1899 it was 5.6 billion marks and in 1913 almost 22 billion marks. The Banco Alemán Transatlántico proved to be an important pillar of Deutsche Bank's business. The good development in Argentina , from where 20% of world wheat production came from in 1900 , gave hope for further growth in the booming South American market.

When the Disconto-Gesellschaft founded the bank for Chile and Germany in 1895 with branches in Berlin and Valparaíso , Banco Alemán Transatlántico did not hesitate long to open a branch in Chile . The decentralized economic structure of Chile made it necessary to open further branches, in 1897 in Iquique and Santiago de Chile . Despite the Chilean economic crisis in 1898, the branch network was tightened with the opening of branches in Concepción and Valdivia . Further branches were established in Argentina, up to the First World War in Bahía Blanca , Córdoba , San Miguel de Tucumán , Bell Ville , Mendoza and Rosario . Finally, the expansion into all of Latin America followed: Mexico (1902), Peru and Bolivia (1905), Uruguay (1906) and Brazil (1911, São Paulo and Rio de Janeiro ).

In addition, the subsidiary Zentral America Bank supplied the Central American market. The initiator of this unprecedented expansion was Ludwig Roland-Lücke , a board member of Deutsche Bank from 1894 to 1907 and director of Deutsche Überseeische Bank. A joint project by Deutsche Bank and AEG , the Deutsch-Überseeische Elektricitäts-Gesellschaft (founded in 1898) was the largest electricity supply company in Argentina as early as 1909 and made huge profits.

Georg von Siemens also saw great opportunities in the American market. In 1883 he wrote to Kilian von Steiner :

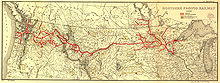

He was particularly pleased when he was invited to the pompous opening ceremony of the Northern Pacific Railroad that same year . Blinded by the eloquent president of the railway line, Henry Villard , and the glamorous festivities, Siemens, exuberantly, agreed to participate in the precarious financial situation of the Northern Pacific railway line. During the celebration, the share lost almost half of its value. But Siemens stuck to its decision and in the meantime created the German-American Treuhand-Gesellschaft AG to promote German investments in the USA with a capital of 20 million marks. The Northern Pacific continued to decline until 1895, before a cooperation with the Great Northern Railway resulted with James J. Hill . In 1896 the course had reached its introductory value again. Nevertheless, the Northern Pacific remained a losing business of several million marks. Georg von Siemens, for whom the whole thing was a major setback anyway, provided a large part of his own fortune to cover the financial loss.

On June 27, 1903, an agreement was reached between the Wiener Bankverein , Deutsche Bank and the Romanian government : Deutsche Bank had decided to take over the majority of the Romanian oil company Steaua Romana and Arthur von Gwinner , who had been Wallich's successor since 1894 Head of the bank responsible for the major international financial transactions, demonstrated more negotiating skills than the representatives of John D. Rockefeller's Standard Oil Company and the Disconto-Gesellschaft . This was followed by the reorganization of the oil company. One year after the acquisition of Steaua , Deutsche Bank combined all of its oil business activities in a holding company , which also included Deutsche Petroleum-Aktiengesellschaft (DPAG).

Emil Georg von Stauß made his career through his involvement in oil : in 1904 he was still general director of DPAG, in 1914 he took over the management of Steaua and in 1915 became a board member of Deutsche Bank. The rivalry between Disconto-Gesellschaft and Deutsche Bank intensified through the anticipation of the acquisition of Steaua . In addition, Standard Oil always sold its oil where the oil delivery from Deutsche Bank's petroleum holding company was supposed to arrive one day later. So the business was absolutely not profitable and the English shareholders of the holding noticed that they should "rather pour that stuff into the Rhine". In this tricky position, Gwinner felt compelled to negotiate with the Americans, which in 1907 meant that Standard Oil was able to dictate German oil and petroleum prices. Gwinner protested to the Reich government and demanded the establishment of a Reich petroleum monopoly , but this failed until the end because of the veto of the Disconto-Gesellschaft, which had signed a cooperation pact with Standard Oil. Looking back, Arthur von Gwinner wrote:

“After all, Deutsche Bank made a lot of money from the business. But if I had to do it again, I would never touch the petroleum business as a banker again. "

The financing of the Baghdad Railway was one of the largest industrial projects of the first few decades . Initiated by an initiative by the Württembergische Vereinsbank, which was represented on the Deutsche Bank's supervisory board, Deutsche Bank took over the lead in a consortium that received the concession for the route from Constantinople to Ankara from the Ottoman government on October 4, 1888 . Attempts to include English banks in the financing failed. Participation by France, which until then had played a dominant economic role in the Ottoman Empire , was undesirable. The construction management was carried out by the Anatolian Railway Company , which was founded by the consortium for this purpose. On the construction, among others, were Philipp Holzmann (track construction), Krupp (rails), Krauss & Co. , JA Maffei (locomotives) and the Maschinenfabrik Esslingen involved. In public, Deutsche Bank repeatedly emphasized the positive contribution that this project made to the German economy. After the construction of a further branch line, in 1899, pressure from Sultan Abdülhamid II and after a promise by Wilhelm II to the Sultan, was persuaded to sign the extension from Ankara to Baghdad. In a letter from Siemens to his colleagues, von Siemens commented on the agreement, on the basis of which a bond had to be issued for the Ottoman state:

“You will think me crazy if, in spite of our agreements, despite panic in the European squares, despite my conviction since March of baisse stock exchanges , American grain imports, etc., etc., I give the Turks an advance of 200,000 Ltq [Turkish pounds] = Want to give 3,800,000 marks at 7%, while you can buy good German houses at the same discount. The so-called Baghdad Treaty is just a slip, and yet I pay 200,000 Ltq for it. "

After Georg von Siemens left, Arthur von Gwinner was in charge of the project. Financing was only available in 1903 and the route began in Konya , so that the route ran further south than originally desired and fewer mountains had to be overcome. This time the financing took place with the involvement of the French (Banque Imperiale Ottomane), whereby the Germans insisted on the lead. This time, too, participation by British banks could not be achieved. After long attempts, which in the meantime repeatedly failed, it was finally possible in the spring of 1914 to include England and to include the last stretch to Basra on the Persian Gulf in the plans, which was particularly important for the route for economic reasons. However, with the First World War , the German participation in this large company ended abruptly. It was not until 1940 that the last gaps in the route were closed.

Branch network and mergers until 1929

At the end of the 19th century, there was a change in strategy at Deutsche Bank. So far, the institute has focused on foreign trade finance , industry finance and issuance processing. These transactions could be carried out easily from the Berlin headquarters. Now more contacts should be established in the province. This field was previously left to the shareholders. But a broader base was needed for further growth and so the establishment of an extensive network that was not only based on personal contacts was started.

Initially, there were only branches in Bremen, Hamburg and Frankfurt. The beginning of the expansion was the establishment of another branch in Munich in 1892. In 1901, Deutsche Bank took over the building of the insolvent Leipziger Bank, which was under construction . In the same year branches were founded in Dresden , 1905 in Nuremberg and 1906 in Augsburg .

Much more effective than the arduous route through own branches, however, was the cooperation and interlinking of capital with regional banks. To this end, the institute initially connected with the companies that had been among the subscribers when Deutsche Bank was founded or that had become part of the supervisory board over time through business relationships. A first decisive step was the takeover of 75 percent of the shares in Bergisch-Märkische Bank in Elberfeld and the Schlesisches Bankverein in Breslau through a share swap in 1897 . The participation value shown in the balance sheet rose from 2.99 million marks to 47.29 million marks while the share capital increased from 100 to 150 million marks. This was followed in 1899 by investments in the Hannoversche Bank and the Oberrheinische Bank , Mannheim. The takeover of the majority of shares in the Ruhrorter Bank in 1903 and the exchange of these shares for shares in the Essener Credit-Anstalt in the following year were important. This relationship, which goes back to Carl Klönne, gave rise to significant access to West German industry.

After the Oberrheinische Bank got into difficulties as a result of the economic crisis in 1901, the problem was solved by the institute transferring the shares to the larger and more stable Rheinische Creditbank , Mannheim. Max Steinthal remarked:

“The difficulty with the provincial banks always lies in the debtors . There is always mistrust of banks that offer themselves. "

Nevertheless, the bank kept its strategy. This was followed in 1905 by investments in Emder Bank and Oldenburgische Spar- und Leihbank as well as Niederlausitzer Kredit- und Sparbank , Cottbus, and Privatbank zu Gotha . The regional banks, strengthened by the participation of Deutsche Bank, contributed to the densification of the network by in turn increasingly taking over smaller banks in their sphere of influence. For this purpose, Deutsche Bank made funds available for the capital increase. Another important component was the participation in the Württembergische Vereinsbank in Stuttgart through the takeover of a large block of shares on the occasion of its capital increase in 1906. The Deutsche Bank had been associated with this institute for a long time through, among other things, the railway business in Turkey.

In 1914 another strategic change was made. After large competitors such as Diskonto-Gesellschaft and Dresdner Bank had built up a growing branch network, Deutsche Bank also wanted to have a stronger presence in the regions with its own name. In 1914 it merged with Bergisch-Märkische Bank and in 1917 with Norddeutsche Creditanstalt in Königsberg and the Schlesisches Bankverein. This created a branch bank with 38 new branches and at the same time the largest universal bank in the world. During the First World War , Deutsche Bank was able to accommodate 6.5 billion marks in Reich bonds and in 1917 was one of the co-founders of Universum-Film-Aktiengesellschaft UFA . On behalf of the military administration, it was supposed to use the new medium of film for more effective propaganda.

The policy begun in 1914 was continued in the Weimar Republic . Deutsche Bank continued to expand through mergers, acquisitions, or share swaps with many regional banks, including:

- 1920 with the Hannoversche Bank , the Braunschweiger Privatbank AG , the Privatbank zu Gotha, the Elberfelder Bankverein

- 1922 Takeover of branches of the Pfälzische Bank ( Ludwigshafen am Rhein ) in Bavaria and Frankfurt.

In 1923 the number of branches was 146. This was followed by:

- 1924 the Württembergische Vereinsbank,

- 1925 the Essener Credit-Anstalt and the Siegener Bank

- 1927 the Lübeck private bank

- 1928 the Hildesheimer Bank and the Osnabrücker Bank

The German defeat in the First World War brought setbacks and burglaries for Deutsche Bank in many ways. The most important foreign branch in London had already been closed at the beginning of the war and was closed after the war. It no longer had access to large international deals that had been a focus of business for the bank. Foreign investments in the railways, oil and electricity industries had to be given up in some cases with losses. The concentration and growth in the domestic market did not compensate for this on an equal basis.

German foreign investment was also prevented by the burden of reparations . These overwhelmed the German economic power, so that the failure to meet the requirements for the occupation of the Ruhr and hyperinflation in 1923 came. Like the other large banks, Deutsche Bank had not suffered much damage. The losers were the small investors who had invested their money in savings accounts and bonds. The winners, however, were industry, which was able to keep its assets in real assets and foreign exchange. Before the war, Deutsche Bank was still the largest German company in terms of capital and reserves, but in a comparison of the Goldmark opening balance sheets on January 1, 1924, it only ranked ninth behind eight industrial companies.

In the period that followed, there were also a number of mergers in industry, which although accompanied the banks - Deutsche Bank often in the lead - but detrimental to the banks' relative importance. Exemplary mergers were those with the United Steelworks including Gelsenberg and IG Farben . Large companies such as Flick and Stinnes had also formed. Their fortunes had arisen from war or inflation gains and these actors had no traditional ties to the banks. These large companies developed their own skills, from raising international capital to issuing foreign bonds and their own banking activities (IG Farben).

In the German banking landscape of 1929, seven major banks were counted, but they were of insufficient importance internationally. The four D-banks were leading .

| Bank | Total assets | Bills of exchange and accounts receivable |

Accounts payable | Equity |

|---|---|---|---|---|

| December 31, 1925 | ||||

| Deutsche Bank | 1,540 | 1,024 | 1,240 | 205 |

| Danatbank | 1.012 | 676 | 859 | 100 |

| Dresdner Bank | 1,162 | 713 | 1.003 | 101 |

| Disconto Society * | 1,115 | 702 | 893 | 147 |

| Commerzbank | 694 | 483 | 600 | 64 |

| December 31, 1926 | ||||

| Deutsche Bank | 1,853 | 1,204 | 1,509 | 225 |

| Danatbank | 1,511 | 912 | 1,327 | 100 |

| Dresdner Bank | 1,567 | 960 | 1,353 | 129 |

| Disconto Society * | 1,365 | 830 | 1,073 | 199 |

| Commerzbank | 902 | 560 | 789 | 64 |

| August 31, 1929 ** | ||||

| Deutsche Bank | 2,991 | 1,920 | 2,531 | 240 |

| Danatbank | 2,346 | 1,453 | 2,102 | 120 |

| Dresdner Bank | 2,222 | 1,273 | 1.995 | 134 |

| Disconto Society * | 2,086 | 1,172 | 1,778 | 202 |

| Commerzbank | 1,737 | 1,098 | 1,452 | 113 |

| *Incl. North German Bank and Schaffhausen; ** Figures from the "Reichsanzeiger" | ||||

In 1929, it finally merged with its big rival, the Disconto-Gesellschaft , to form the Deutsche Bank and Disconto-Gesellschaft , with 289 branches. The most important subsidiaries Norddeutsche Bank from Hamburg , A. Schaaffhausen'sche Bankverein from Cologne , Rheinische Creditbank from Mannheim , Bankhaus Böcking, Karcher & Cie from Kaiserslautern and Süddeutsche Disconto-Gesellschaft from Mannheim were also merged into the new bank . The institution popularly known as “DeDiBank” achieved total assets of RM 5.5 billion and became the dominant bank in Germany. Internationally, it only came a good deal closer to its leading competitors. The front runners were the National City Bank in New York (9 billion RM), Midland (8.5), Lloyds (7.8), Guaranty Trust (New York, 7.1), Barclays (6.5), Westminster ( 6.4) National Provincial (6.3)

One of the most important goals of the merger was to improve the profitability and thus the sustainable competitiveness of the joint institute. The later board member responsible for this, Rummel, noted:

“The bank's workforce was out of date due to the many mergers that followed the inflation. The expenses were stuck, the balance sheet volume shrank, and the conditions were too high for the economy. "

Not least because of the improved cost structures, Deutsche Bank und Diskonto-Gesellschaft was the only major German bank that was able to survive the banking crisis of 1931 without government intervention.

Great Depression and the National Socialism

The global economic crisis from 1929 to 1932 left deep marks on DeDiBank's balance sheets . After the merger, the joint share capital was RM 285 million with RM 160 million in reserves. The declining business in the crisis and write-downs on loans and securities of 400 million RM in 1930 and 1931 made a capital adjustment necessary. After this the capital was only 144 million RM with reserves of 25.2 million RM. In addition, the bank took out RM 50 million government loan for which it had to deposit shares of RM 72 million. Compared to Dresdner Bank, in which the DANAT Bank, which collapsed on June 17, 1931 , and Commerzbank, DeDiBank got off lightly. The state had to take over more than 90% of the capital of the two competitors. Even during the banking crisis , the bank continued to expand domestically and in 1930 took over the under-capitalized banking houses L. Pfeiffer in Kassel, J. Frank & Cie in Krefeld, Doertenbach & Cie in Stuttgart and E. Ladenburg in Frankfurt / Main their stores integrated into their respective branches.

The development of the crisis, especially the restrictive lending, had seriously damaged the banks' public reputation. Many medium-sized companies had to close during this time due to a lack of liquidity, which increased unemployment. This promoted the criticism of big capital from both the Communist and the National Socialist side and contributed to political radicalization. The departure from the deflationary policy of the von Papen - Schleicher cabinets in 1932 could no longer stop further political developments.

The takeover of power by the Nazis had direct consequences in the management of the bank. Oscar Wassermann , who has been on the board since 1912 and spokesman for the board since 1923, originally planned to retire at the end of 1933 at the age of 65. Due to the aggression of the National Socialists against Jewish capital , however, problems were feared in the bank. On April 6, Hjalmar Schacht addressed the chairman of the supervisory board, Franz Urbig, directly that it was opportune to remove Jewish board members from the board. Urbig took up this point of view and accused Wassermann of weak leadership in the context of the banking crisis. Even before the general meeting in June 1933, Wassermann and his colleague Theodor Frank resigned . In 1933 there were only men on the management board ( Peter Brunswig , Karl Kimmich , Hans Rummel , Ernst Karl Sippell and Fritz Wintermantel ) who came from the bank and followed its tradition. Georg Solmssen (the son of the discount partner Arthur Salomonsohn , the first chairman of the supervisory board of Deutsche Bank with Disconto from 1929), who was already critical of his own position, took over the role of speaker . In a letter to Urbig on April 9, 1933, he wrote:

"Dear Mr. Urbig, The expulsion of the Jews from civil service, which has now been carried out by law, raises the question of what consequences these measures, also taken for granted by the educated part of the people, will have for the private economy. I fear that we are still at the beginning of a development which, according to a well-planned plan, is aimed purposefully at the economic and moral annihilation of all members of the Jewish race living in Germany, completely without distinction. The complete passivity of the classes not belonging to the National Socialist Party, the lack of any sense of solidarity that emerges on the part of those who have hitherto worked shoulder to shoulder with Jewish colleagues in the companies in question, the increasingly clear urge to get out of the To take advantage of posts and the silence of the shame and harm that are indivisibly inflicted on all those who, though innocent, see the basis of their honor and existence destroyed overnight - all of this shows a situation so hopeless that it would be a mistake Not to look things in the face without trying to gloss over things. "

Solmssen also had to give way in 1934 and was replaced as spokesman by Eduard Mosler . Solmssen was a member of the supervisory board until 1938. From the founding generation of the bank, Max Steinthal remained on the supervisory board, but left in 1935 in order to “not cause any difficulties” for the bank. He and his wife Fanny were later expropriated and died penniless in the Eden Hotel Berlin in 1940 . In 2008, the chairman of the board, Josef Ackermann , stopped the scholarships at the Abraham-Geiger-Kolleg in Potsdam , which are reminiscent of this and other tragic biographies, and received criticism from the German Bundestag for not wanting to face the bank's historical responsibility.

The climate also changed at the employee level. There was considerable internal and external pressure on the bank to take action against non-Aryan employees. A National Socialist Company Cell Organization (NSBO) was formed, which moved into the Supervisory Board in 1933 with two representatives. On November 30, 1933, the works cell chairman Franz Hertel organized a “first general works meeting with a march of all members of the SA, SS and the 'Stahlhelm'”. A total of 4,000 employees and most of the board members took part.

The bank tried to prevent extreme excesses of National Socialist activity within the company. Sippell, who was responsible for the personnel department, wrote to the director of the Bochum branch “that as a National Socialist he not only had increased rights but also greater duties” and forbade him to include quotes from Mein Kampf in the Bochum company regulations. Many minor problems resulted from the fact that no members of the NSDAP sat on the bank's board as their contact persons. In order to be able to cope better with this, Karl Ritter von Halt from the Aufhäuser Bank , a medal-awarded front-line fighter from the First World War who organized the 1936 Olympic Games in Garmisch, joined the banking company. Von Halt concentrated the bank's internal Nazi activities on company sports and professional competitions. He maintained contacts with the party in the Heinrich Himmler Circle of Friends , a group of around 40 people from business and the military. In 1938, von Halt was the first party member to become a member of the executive committee. He was primarily loyal to the company. In this way he succeeded in dismissing particularly harsh factory supervisors at several locations, including Hertel in Berlin, who then made a career as Hauptsturmführer of the SS and enriched himself with Aryanizations in the Czech Republic.

In 1933, the bank was able to sell the previously vacant Diskonto-Gesellschaft building on Behrenstrasse to the German Reich and in return received part of the shares deposited as collateral in the amount of 14 million RM. Since there was no need for equity, a further capital reduction was made from 144 to 130 million RM. In 1935 a dividend was paid for the first time again, but at 4% it was low. In 1937 the institute was renamed Deutsche Bank again by resolution of the general meeting .

While Deutsche Bank had in some cases had significant influence on political personalities since the end of the 19th century, this had largely come to a standstill in the first years of the Nazi era. Relations with politics were only perceived through members of the supervisory board. Philipp Reemtsma , who has been on the supervisory board since 1933 and has good connections to Hamburg's economy and above all to Hermann Göring , and Emil Georg von Stauß , member of the board from 1915 to 1932, who also sat on a number of supervisory boards that he already had, were of particular importance here as a member of the Management Board and which were of particular interest to the bank due to their economic commitment. These included Ufa , Lufthansa , BMW and Daimler-Benz and a few more. As a DVP deputy in the Reichstag, Stauß had sought contact with the NSDAP leadership before 1933 and, among other things, made Hitler's first contact with the American ambassador in his house in 1931 . Stauß remained in the Reichstag after 1933 as one of two DVP members and thus had access to a number of Nazi personalities. However, he did not join the NSDAP until his death in 1942.

During the period of National Socialism was the German Bank under the linearization involved in the most costly for the seller transfer of shares in companies of Jewish citizens, as in the Aronwerke electricity AG in Berlin, the Ullstein publishing or salamander , Kornwestheim. The board of directors of Deutsche Bank recommended restraint in the Aryanization. In the interest of maintaining the foreign credit, the bank should not turn out in this context. The participation in the aryanization of more than 363 companies (as of November 1938) (e.g. Bankhaus Mendelssohn , Bondi & Maron ) took place in particular through granted loans, but also through own acquisition and profitable resale, such as with Hubertus AG des Petschek -Group or Adler & Oppenheimer AG. Overall, the brokerage of assets for sale was a profitable commission business and thus helped the National Socialist dictatorship in the implementation of its racist goals. On the other hand, in some cases the Deutsche Bank helped the previous Jewish owners to preserve at least part of their assets, which some of them also expressly appreciated after the war.

During the global economic crisis, Deutsche Bank had taken on an important role in the administration of German foreign debts. In order to avoid further foreign exchange outflows, a standstill agreement (German credit agreement) was concluded with foreign creditors with the participation of the German gold discount bank . Gustaf Schlieper , on the board of DeDiBank responsible for international business, headed the German debt committee, which negotiated annually about the continuation of this agreement. After Schlieper's death in 1937, Hjalmar Schacht informed the bank that he would transfer this task to Hermann J. Abs from the Delbrück Schickler & Co. bank. The bank then tried to get Abs and from January 1938 was able to win him over as a member of the board - like Schlieper responsible for international business. Thus, the supervision of foreign debts remained in-house and when a board member was first appointed since 1933, the choice fell on a non-party member.

As a result of the occupation of Europe by the National Socialist regime, Deutsche Bank also expanded. She took over u. a. In 1938 first in the Sudetenland and later also in Bohemia and Moravia the Böhmische Union-Bank and in Austria until 1942 the majority of the Creditanstalt-Bankverein in Vienna . In particular, the later business of the Böhmische Union-Bank was characterized by the purchase of Aryanized (i.e. ultimately expropriated) companies in Eastern Europe and the sale, above all, to the Reichswerke Hermann Göring or to the economic empire of the SS . Deutsche Bank also earned at least indirectly from trading the gold of murdered Jews and from financing companies that were active in Auschwitz on the IG Farben Buna works construction site or for the SS there. According to the historian Manfred Pohl , the finds of the Deutsche Bank in Hanover document a “complicity [sc. der DB] on the corpses of Nazi terror. ”According to this, Deutsche Bank“ helped build Auschwitz with loans for construction companies. ”

Planned demolition after the Second World War

After the Second World War, the Americans considered indicting members of the board of directors of Deutsche Bank and the other major banks in Nuremberg as war criminals, but this did not happen because they did not expect a conviction. In view of the entanglement of the three major German banks, including Dresdner Bank and Commerzbank , in the Nazi crimes, the US military government recommended OMGUS to break up this banking network even before the Nuremberg verdicts. In the Eastern Zone (SBZ) all major banks were expropriated, and the head office in East Berlin had to cease operations immediately. In the western zones , the most extensive decentralization took place, particularly at the initiative of the USA. The background to this was, on the one hand, the mistrust of the American administration, shaped by the New Deal , of an agglomeration of power in big business , and, on the other, the involvement of large companies in the crimes of National Socialism.

As a result, Deutsche Bank was active with ten smaller regional banks from April 1, 1948.

- The Bavarian Credit Bank , based in Munich

- The Disconto Bank based in Bremen

- The Hessische Bank based in Frankfurt am Main

- The Südwestbank based in Stuttgart / Mannheim

- The North German Bank based in Hamburg

- The Nordwestbank based in Hanover

- The Rheinisch-Westfälische Bank AG , based in Dusseldorf

- The Oberrheinische Bank based in Freiburg im Breisgau

- The Rheinische Kreditbank based in Ludwigshafen am Rhein

- The Württembergische Vereinsbank based in Reutlingen

Recentralization 1952–1957

In view of the dispute with the Soviet Union , which from the point of view of the Western powers made it necessary to strengthen the market economy orientation, economic efficiency and independence of the Federal Republic of Germany, the pressure on the former big banks and their old staff decreased from 1948 at the latest. As a result, the old management staff of the big banks gradually moved back into key positions in the German financial world, including Karl Blessing , Otto Schniewind and, despite initial American resistance, Hermann Josef Abs . They increasingly argued that the reunification of the banks was essential to strengthen German economic power. Since the reservations of the Allies could not be completely dispelled, the representatives of the banks argued for tactical reasons only for a partial merger of the successor institutions of the former big banks. In the course of the Korean War and the introduction of the D-Mark , these efforts were successful.

The general bank law called Act on the Regional Scope of banks from 29 March 1952 formed the basis that the German banks were spun off into three successor companies. According to the extraordinary general meeting on September 25, 1952, the ten regional banks of Deutsche Bank became the three successor banks:

- Norddeutsche Bank AG based in Hamburg ,

- Süddeutsche Bank AG based in Munich ,

- Rheinisch-Westfälische Bank AG with headquarters in Düsseldorf , since April 1956 Deutsche Bank AG West

When the three institutes were spun off from the old bank, each old shareholder received shares from all of the successor institutes. For each old share with a nominal value of 1,000 Reichsmarks, these were registered shares with a total value of DM 625 at a ratio of 20% NDB, 40% SDB and 40% RWB. To cover the expropriated assets in the former eastern areas, the shareholders also received new shares in the old bank ( remaining quotas ). The Deutsche Bank , based in Berlin, thus continued to exist alongside the above institutes and later alongside Deutsche Bank AG . The old bank managed without naming the legal form , since it was founded before the introduction of the Stock Corporation Act . The legislature changed this situation in 1980, after which the company renamed itself to Aktiengesellschaft Deutsche Bank .

After the Luxembourg Agreement had been concluded in 1952 and the London Debt Agreement in 1953, with Abs in particular, the creditworthiness of Germany rose. The export boom that started at the same time made it necessary to strengthen German export financing. After the Federal Republic of Germany received further sovereignty rights in 1955, further concentration of the banking system was only a matter of time. With a new law on the branch area of credit institutions of December 24, 1956, the legal possibility for the final merger of the successor institutions was created.

As early as September 1955, the sub-institutes concluded a contract on profit and loss compensation with retroactive effect to January 1 , “in order to strengthen the financial strength of each of the three successor institutes by compensating for profits and any losses and to protect their shareholders from economic disadvantages from the division of Deutsche Bank to protect". In the same year the banks appeared for the first time as the Deutsche Bank Group , and in April 1956 the Rheinisch-Westfälische Bank changed its name to Deutsche Bank AG West . At the end of April 1957, the general meetings of the three successor institutes of Deutsche Bank passed the corresponding resolutions, so that on May 2, 1957, retrospectively to January 1, 1957, the (new) Deutsche Bank AG , based in Frankfurt am Main , was founded. In West Berlin , the bank initially operated under the name 'Berliner Diskonto-Bank AG', later under the name of Deutsche Bank Berlin AG . The board spokesman was Hermann Abs, who had been on the board of the old Deutsche Bank since 1938.

Due to lack of assets, the old bank was deleted from the commercial register in 1983 and trading with the remaining quotas was discontinued. The hope of retransferring the old assets expropriated between 1945 and 1949 was not fulfilled after reunification , as this was excluded according to the two-plus-four contract . With the reunification in 1990, the branch network of the State Bank of the GDR was taken over. In 1993 the branch network of Deutsche Bank reached its greatest density. Since then, the number of branches in Germany has been gradually reduced.

Development of a broad public business

Deutsche Bank had already advertised the investment of savings accounts in 1870, the year it was founded. These "deposits" were viewed as cheap refinancing and subsequently a number of "deposit kiosks", as the branches were originally called, were opened. The bank has only been operating the more modern retail business with standard products since the late 1950s. A standardized product in bulk business was first offered on May 2, 1959 with the “Personal Small Loan” (PKK), a loan for everyone up to DM 2,000. This was followed by the “Personal Acquisition Loan” (PAD) in 1962 and the “Personal Mortgage Loan” (PHD) in 1968. A parallel development on the investment side resulted from the fund business of the German Society for Securities Savings (DWS) founded in 1956 .

The inclusion of “consumer banking” in traditional business meant new forms of advertising, account management and the expansion of the bank across the board. When Deutsche Bank entered the mass market, it had 250,000 private customers and 364 local branches. In 1999 Herbert Walter announced the plan to increase the number of bank customers from 7 to 10 million by 2003, and one year later the bank sought a merger with Dresdner Bank, which did not materialize.

In 2008, the number of customers in private banking rose to just under 10 million. After the integration of the East German market, the number of branches and branches had its highest level in Germany at over 2000. As a result, it fell significantly and in 2008 was just under 1,000. This development was strongly promoted by the introduction of EDP. In 1955, the "punch card technology" was used for the first time in the Wuppertal branch. The growth in the consumer business was favored by the increasing number of companies that no longer paid wages and salaries in cash, but by transferring them to salary accounts.

Through acquisitions, Deutsche Bank has also expanded its broad branch business in some European markets, for example in Italy, Spain and Portugal, Poland and Belgium. In addition to modern retail business, the services offered have been expanded more and more over the years. They range from building society savings to insurance, credit cards and electronic banking .

In the middle and end of the 1990s, the bank's general business with private customers was spun off. This was transformed via Bank 24 AG into the successor Deutsche Bank 24 , which today operates under the name DB Privat- und Firmenkundenbank AG. The area had its own logo, the customers of this area were assigned new bank codes, which ended with -24 instead of the previous -10.

Investment banking, corporate customers and wealthy private customers ( private banking ) and very wealthy customers ( private wealth management ) remained in the AG. The previous private bank Grunelius, which from then on traded as Deutsche Bank TrustAG, was also brought in.

The external separation of bulk business was revised in 2005, but the assignment of customers via bank code was retained.

In 2006, Deutsche Bank expanded its private customer business in Germany by acquiring Berliner Bank in June 2006 and norisbank in August 2006 . In the same year, it began offering banking services in the Turkish language nationwide under the “Bankamız” label. From April 2017 it should be possible to pay with an account at Deutsche Bank also with the smartphone , which the bank wants to use in mobile payment . On 21 December 2018, the German bank started with the broadcast of a television commercials to Be advertising of Apple Pay .

Networking with industry

Capital links

Deutsche Bank's business was tied to large industrial companies from the start. Before joining the bank, Georg von Siemens had already worked for his cousin Werner von Siemens and had set up a telegraph line to Tehran. In addition to foreign trade finance, the issue of shares and bonds was part of the core business not only for the state and municipal purposes, but above all for industrial companies. Deutsche Bank was the house bank of the later industrial giants Bayer and BASF from an early age and accompanied their growth. One of the entrepreneurial highlights of the early days was the handling of large-scale transactions in international railway construction. The close contacts with Philipp Holzmann arose during this time, and the rise of Mannesmann would have failed without the commitment and perseverance of both Siemens cousins. Georg von Siemens also built up close relationships with Emil Rathenau early on - to the annoyance of his cousin - and financed the development of AEG and got involved in power plant construction. Deutsche Bank issued the first industrial bond from Krupp as well as the first bond from Siemens.

Outstanding individual events in the industrial business of the 1920s were the founding of Ufa, the merger of Daimler and Benz, and the founding of Lufthansa through the merger of Aero Lloyd and Junkers . These industrial policy projects were promoted by Georg von Stauß. Other important businesses were the liquidation of Stinnes and the mergers in the steel industry to form the United Steel Works and in the chemical industry to form IG Farben .

Deutsche Bank was less represented in the mining and steel industries. The number one in this business was the most important competitor, Disconto-Gesellschaft . The merger of 1929 increased industrial dominance. The institute got involved with Stollwerck in 1923 when the family was unable to raise the capital required for expansion. (The box was sold to the entrepreneur Hans Imhoff in 1972. ) In the course of the economic crisis after 1929, Deutsche Bank helped the crisis-ridden companies Didier-Werke , Karstadt and Girmes in the early 1930s . When Krauss and Maffei merged , the bank injected capital (sold to the then Flick subsidiary Buderus in 1955 ) and Lanz's receivables were converted into equity capital .

The expansion of the industrial portfolio continued after the Second World War. German tax law had a considerable influence on the size of the participations . If a shareholder owned a "box" of at least 25%, the dividends received would remain tax-free ( box privilege ). Alternative investments had to bring in roughly double that in order to be equally attractive. Accordingly, it made sense to sell off smaller holdings and add to other packages. Another way of using the nesting privilege was with ballast companies. The metal company was a case in point. In order to prevent the competitor Dresdner Bank from dominating, Deutsche Bank founded the Allgemeine Verwaltungsgesellschaft für Industriebeteiligungen with Siemens and Allianz and in this way held a 28% stake. Calculated, the bank owned 10.9%. The opposite pole was formed by the Society for Metal Values, led by the Dresdner Bank.

As early as the 1960s, there had been criticism of the banks' large investment portfolios and the banking power associated with them. The bank had always emphasized that the investments did not arise from the motive of power. Rather, there are very different business processes and profit considerations behind it. From the beginning of the 1970s, Deutsche Bank began to systematically sell a large number of investments that were of lesser importance from an investment perspective:

- 1973 46.5% Stollwerck, 25.1% Augsburger Kammgarn spinning mill

- 1974 25% Hoffmann's starch factories , over 25% Maschinenfabrik Moenus

- 1975 31.6% of the Manz shoe factory

- 1976 almost 50% Bavarian electricity works

- 1978 11.6% Continental , 10.7% Phoenix (remaining 10%)

- 1983 48% Pittler

- 1986/88 26.9% Hapag-Lloyd (remaining ownership 12.5%)

- 1989 36.5% Bergmann-Elektrizitätswerke, 25% Hutschenreuther, 15.5% Didier-Werke

Further investments with a strategic value or where a sale would result in high tax payments due to a low book value remain in the portfolio.

| Equity capital (in millions of DM) |

Of which% Deutsche Bank |

Course on June 30, 1989 |

Market value in million DM |

|

|---|---|---|---|---|

| Direct investments | ||||

| Daimler-Benz AG | 2,117.90 | 28.24 | 694.50 | 8,307.54 |

| Deutsche Beteiligungs AG | 30.00 | 46.30 | 173.00 | 48.06 |

| Philipp Holzmann AG | 112.50 | 30.00 | 985.00 | 664.88 |

| Karstadt AG | 360.00 | 25.00 | 588.00 | 1,004.40 |

| Süddeutsche Zucker AG | 120.58 | 23.05 | 461.50 | 256.59 |

| Holdings through intermediate companies | ||||

| Metallgesellschaft AG | 320.00 | 10.90 | 462.00 | 322.29 |

| Hoard | 250.00 | 18.80 | 271.00 | 254.74 |

| VEW | 1,000.00 | 6.30 | 199.00 | 250.74 |

| Hutschenreuther | 21.33 | 37.50 | 483.00 | 77.27 |

| Didier-Werke AG | 92.40 | 15.50 | 273.50 | 78.34 |

In addition to these holdings named in the annual report, the bank owned other industrial holdings with a share of over 10% in 1989, but these were not expressly mentioned. These include Phoenix, Linde , Krauss-Maffei and, in particular, Allianz and Munich Re . From the mid-1990s, the bank began to systematically reduce its holdings.