Euro

| Euro, Ευρώ, Евро | |

|---|---|

|

Euro symbol |

|

| Country: |

Associated “Passive” euro users: other: |

| Subdivision: | 100 cents |

| ISO 4217 code : | EUR |

| Shortcut: | € |

|

Exchange rate : (December 31, 2021) |

1 EUR = 1.0331 CHF |

| Issuer : | ECB |

The euro ( Greek ευρώ , Cyrillic евро ; ISO code : EUR, symbol : € ) is the currency of the European Economic and Monetary Union according to Art. 3 Para. 4 TEU , a policy area of the European Union regulated in Art. 127–144 TFEU (EU). It is issued by the European Central Bank and acts as the common official currency in 19 EU member states, which together form the euro zone , as well as in six other European countries. After the US dollar , the euro is the most important reserve currency in the world.

The euro was introduced as book money on January 1, 1999 and three years later as cash on January 1, 2002 . In doing so, he replaced the national currencies as a means of payment . The euro coins are minted by the national central banks of the 19 countries of the Eurosystem and currently four other countries, each with a country-specific reverse side. The only difference between the euro banknotes from different countries in the first printing series is the letter in the first position of the serial number, which indicates the national central bank on behalf of which the note was printed. In the second print series from 2013, which is supposed to offer greater protection against counterfeiting, the serial number begins with two letters, the first of which designates the printer.

Since 2020, the European Central Bank, like many other central banks and the Bank for International Settlements , has been investigating whether it makes sense to issue a digital euro or e-euro as digital central bank money.

History of the euro

The euro as a political project

The idea of a single European currency, which should facilitate trade between the member states of the European Economic Community (creation of a "common European market [es]"), arose quite soon in the history of European integration . In 1970 the project was specified for the first time in the " Werner Plan "; accordingly, a European monetary union should be implemented by 1980. In 1972 the project led to the establishment of the European Exchange Rate Association ("currency snake"). This could not be implemented as planned after the collapse of the Bretton Woods system (March 1973). The following years were marked by the consequences of the first oil crisis : in autumn / winter 1973/74 the oil price quadrupled ; In some European countries, trade unions implemented double-digit wage increases on this occasion (→ Kluncker Round ). It is controversial whether there was a wage-price spiral or a price-wage spiral ( what was the cause, what was the effect? ). Many European countries had stagflation (i.e. stagnation and inflation); the crisis phase at that time was and is also known as Eurosclerosis .

Several states left the exchange rate union by the end of 1978. The European Community focused its activities strongly on the agricultural sector ( Common Agricultural Policy (GAP)); A net payer debate began in many countries and lasted for decades. Industrialized countries like Germany and Great Britain became net contributors; agricultural countries like France, Spain and Portugal were net recipients.

In 1979 the European Monetary System (EMS) was established. It should prevent fluctuations in the national currencies beyond a certain range. Hence the European currency unit ECU was created. The ECU was a basket currency that can be described as the forerunner of the euro. The ECU only served as a unit of account and did not exist as cash, even if some special symbolic coins were minted. Some EC Member States issued government bonds in ECU (they were traded on stock exchanges like other government bonds) and borrowed in ECU.

In 1988 a committee headed by the President of the European Commission, Jacques Delors , drew up the so-called " Delors Report ". In the course of Germany's reunification , according to newspaper reports, the then French President François Mitterrand linked France's consent to reunification with the consent of then German Chancellor Helmut Kohl to "deepen the economic and monetary union", i.e. with the introduction of the euro. Kohl contradicted this representation, but, as he later wrote in his book Aus Sorge um Europa , would have considered the common European currency to be a reasonable price for German unity. He agreed to the project to introduce the euro without consulting Bundesbank President Hans Tietmeyer beforehand . As suggested in the Delors report, the European Economic and Monetary Union was created in three steps :

- The first stage of monetary union was initiated on July 1, 1990 with the establishment of the free movement of capital between the EC states. After the legal basis for further implementation had been laid in the Maastricht Treaty of 1992,

- The second stage began on January 1, 1994 with the establishment of the European Monetary Institute (EMI, the predecessor institution of the ECB) and the review of the budgetary position of the member states.

- The last stage was reached with the establishment of the European Central Bank (ECB) on June 1, 1998 and the final determination of the exchange rates between national currencies and the euro on January 1, 1999. From then on, the exchange rates (also called currency parities ) of the participating countries were fixed.

On May 2, 1998, the heads of state and government of the European Community decided in Brussels to introduce the euro. Chancellor Kohl was aware that he was acting against the will of a broad majority of the population. In an interview from March 2002 that became known in 2013, he said: "In one case [introduction of the euro] I was like a dictator". But he made the decision because he saw the euro as “a synonym for Europe” and a unique opportunity for Europe to grow together peacefully.

participating countries

- 1999: Belgium, Germany, Finland, France, Ireland, Italy, Luxembourg, Monaco 1 , Netherlands, Austria, Portugal, San Marino 1 , Spain and Vatican City 1

- 2001: Greece

- 2002: Kosovo 2 and Montenegro 2

- 2007: Slovenia

- 2008: Malta and Cyprus

- 2009: Slovakia

- 2011: Estonia

- 2014: Latvia and Andorra 1

- 2015: Lithuania

Realization of the euro project

EU convergence criteria and the Stability and Growth Pact

In the Maastricht Treaty of 1992, the EU member states agreed on certain “convergence criteria” that states had to meet in order to adopt the euro as their currency. In detail, they include the stability of public budgets , the price level , the exchange rates with the other EU countries and the long-term nominal interest rate . At the initiative of the then German Finance Minister Theo Waigel, the first of these criteria was laid down at the 1996 summit in Dublin, even after the entry into the euro. This stability and growth pact allows the euro countries an annual new debt of a maximum of 3% and a total debt of a maximum of 60% of their gross domestic product .

However, both before and after the introduction of the euro, there were repeated violations of these regulations by the member states. Greece in particular was only able to introduce the euro on the basis of refined statistics, and numerous member states, including Germany and France , violated the Stability and Growth Pact on several occasions. The sanctions it provides against euro countries with excessive deficits, which can be imposed by the finance ministers of the other member states, have not, however, been applied once. As a result of the sovereign debt crisis in some European countries in particular , this led to a political debate from 2010 onwards about the European Economic and Monetary Union as a possible fiscal union .

Naming

After initially the name of the old accounting currency ECU was also expected for the planned common currency, criticism was voiced in the early 1990s because it - as an abbreviation for European Currency Unit - was too technical and impersonal. The fact that the name could be understood based on the French Écu , which has been known since the Middle Ages , was largely overlooked. Helmut Kohl complained that “Écu” was similar to the word “cow” in German. On December 16, 1995, the European Council in Madrid therefore decided on a different name for the new currency: "Euro". In accordance with the rules, the term should only be used in the singular (see below, plural forms ).

Alternative proposals were also discussed beforehand. Important candidates were European francs (the Spanish in his translation Franco , however inappropriately to Francisco Franco would have remembered), European crown and European guilders . The use of an already known currency name was intended to signal continuity and to strengthen the trust of the population in the new currency. In addition, some participating states could have kept the previous name of their currency. However, it was precisely this that met with criticism, as it would have indicated that certain member states had priority over others. Ultimately, all proposals failed due to the reservations of individual states, especially Great Britain . As a reaction, the German delegation around the then Finance Minister Theodor Waigel suggested the name “Euro”. In the resolution of the German Bundestag, there was still talk of expanding the currency name regionally with the names of the previous currencies, ie “Euro-Mark” in Germany and “Euro-Franc” in France.

In a video published in 2017 at tagesspiegel.de , Theodor Waigel told how he invented and implemented the name Euro in 1995.

The symbolic value of the euro on a medal can be proven for the first time for an issue from 1965. Another private coinage with this denomination was made in the Netherlands in 1971. The first letter of the term Euro is written as a C with an inserted short, slightly meandering dash. The first letter of the inscription EUROPA FILIORUM NOSTRORUM DOMUS ( Latin : Europe [is] our children's house ) is written in the same way.

Introduction of the euro as book money

On December 31, 1998, the exchange rates between the euro and the individual currencies of the member states were irrevocably fixed; on January 1, 1999, the euro became the legal accounting currency. It replaced the earlier basket currency ECU (European Currency Unit) with a conversion ratio of 1: 1. One day later, on January 2nd, the European stock exchanges were already listing all securities in euros.

Another change in the temporal connection with the introduction of the euro was the change in the method of displaying prices for foreign currencies . In Germany, the price quotation (1 USD = x DEM) was the usual form of representation up to the reporting date . Since January 1, 1999, the value of foreign currency in all participating countries has been shown in the form of a quantity quotation (EUR 1 = x USD). Furthermore, since January 1, 1999, transfers and direct debits have been issued in euros. Accounts and savings books could alternatively be denominated in euros or the old national currency.

The European Council in Santa Maria da Feira in June 2000 decided, on the recommendation of the European Commission , to admit Greece to the euro area. Greece joined the euro on January 1, 2001, two years after the other Member States.

The final transition to the euro

Germany

Cash exchange

In Germany, the euro was distributed to banks and retailers from September 2001 as part of the so-called "frontloading process" . Retailers should be included in the exchange process by issuing euros and accepting D-Marks .

As of December 17, 2001, a first mix of euro coins, also known as the “ starter kit ”, could be purchased in German banks and savings banks . These starter kits contained 20 coins with a value of 10.23 euros and were issued for 20 D-Marks, whereby the rounding difference was taken over by the state treasury.

In order to avoid queues at the banks' counters after the Christmas holidays and the turn of the year 2001/2002, it was made possible to pay in D-Mark at retail outlets in January and February 2002 as well. The change was given by the trade in euros and cents. In addition, from January 1, 2002, euro cash came into circulation through withdrawals at ATMs and at bank counters . Furthermore, there were queues at the exchange desks of banks and savings banks in the first two weeks of January. From the end of January 2002, cash payments were mainly made in euros. One imponderable aspect of the introduction of euro cash was that the texture, appearance and formats of the new banknotes were deliberately not published in advance in order to avoid counterfeiting in the introductory phase. The security features , e.g. B. watermarks, security threads, hologram foils and microscripts were not announced in advance.

While the changeover of the ATMs was largely unproblematic, the machine industry feared a loss of sales, as the machines accepted either euros or D-Mark (other payment options such as the GeldKarte were of no noteworthy importance at the time). Some transport companies, such as the Rhein-Main-Verkehrsverbund , had converted around half of the machines to euros on the reporting date, so that customers in many places found an 'old' and a 'new' machine. The transition was less problematic than feared, so that many machines were converted to euros earlier than initially planned.

Conversion of accounts and contracts

The accounts at banks and savings banks could, on request, be kept in euros since January 1, 1999. As part of the introduction of euro cash, the accounts were then automatically converted to euros on January 1, 2002; however, some institutes implemented this change for all customers in December 2001. The changeover was free of charge. In the transition years from 1999 up to and including 2001, transfers could either be made in DM or in euros; depending on the currency in which the target account was kept, an automatic conversion was carried out; From January 1, 2002, transfers and check payments were only possible in euros.

Existing contracts remained valid. As a rule, amounts of money were converted on January 1, 2002 (with a factor of 1.95583), so that both receivables and liabilities remained unchanged in value. Nonetheless, it was still possible to settle the old DM claim in DM up to the end of the transition period on February 28, 2002, within the framework of the cash holdings that were still available.

Cash exchange for latecomers

In Germany, the transition period for the parallel acceptance of D-Mark and Euro ended at the end of February 28, 2002. Since then, the exchange of D-Mark for Euro has only been unlimited and free of charge at the branches of the Deutsche Bundesbank (formerly state central banks ) possible. As part of special promotions, some German retail chains and retailers occasionally accept the Deutsche Mark as a means of payment.

Despite the simple and free exchange mechanisms, DM coins and notes worth the equivalent of 12.76 billion euros were still not exchanged in July 2016 . In the opinion of the Deutsche Bundesbank, however, most of this is money that has been lost or destroyed.

The euro is thus the fifth currency in German monetary history since the establishment of the Reich in 1871. Predecessors were Goldmark , Rentenmark (later Reichsmark ), Deutsche Mark and the Mark of the GDR (previously Deutsche Mark or Mark of the German Central Bank ).

Austria

In Austria, the Oesterreichische Nationalbank began pre-distributing euro coins and banknotes to credit institutions on September 1, 2001. They could immediately start supplying corporate customers and retailers with the new means of payment. For this purpose, the National Bank issued cassettes with coin rolls, officially called the trade starter package , worth 145.50 euros with an equivalent of 2,000 schillings for the tills in the trade. Regardless of this, each company could register its individual euro requirements with its bank.

The officially named starter package was issued to private individuals from December 15, 2001. They contained 33 coins with a total value of 14.54 euros with an equivalent of 200.07 schillings and were issued for 200 schillings. The general issue of money - especially the new banknotes - began on January 1, 2002.

As in Germany, the so-called parallel circulation phase ran in Austria from January 1 to February 28, 2002, in which cash could be paid in both currencies, i.e. either with schilling or with euro - but also with a mixture. The schilling lost its validity as an official currency with effect from March 1, 2002; However, since schilling banknotes and coins at the Oesterreichische Nationalbank and schilling coins at the Austrian Mint can be exchanged for an unlimited period of time and free of charge, many transactions continued to accept the schilling beyond the legally stipulated time. The changeover at the ATMs went largely without any problems; the banknotes issued there were initially only 10 and 100 euro bills. The limit on the daily possible cash withdrawals from ATMs was increased with the change from 5000 schillings (363.36 euros) to 400 euros. In cashless payment transactions, all accounts and payment orders were automatically converted on January 1, 2002.

While other vending machines, such as those for cigarettes, were gradually converted from schilling to euros, the candy, chewing gum, condom and postage ticket machines operated by Ferry Ebert were withdrawn from the market. For the company, it was not possible to finance the retrofitting of around 10,000 machines in Austria alone; their machines have become coveted collectibles.

As of March 31, 2010, according to the National Bank, there were still schilling holdings of 9.06 billion schillings with an equivalent of 658.24 million euros in circulation. Of this amount, 3.45 billion schillings (250.9 million euros) that can be exchanged for an unlimited amount in euros were accounted for by banknotes and 3.96 billion schillings (287.5 million euros) for coins. The difference, around 18%, 1.65 billion schillings (119.8 million euros), however, is due to the last two banknotes, some of which are still in circulation, which have a preclusion period until April 20, 2018 and which were long before that the introduction of the euro had lost their legal solvency. These are the 500 Schilling notes " Otto Wagner " and the 1000 Schilling notes " Erwin Schrödinger ".

In order to offer Austrians as well as foreign guests an easy way of exchanging their remaining schillings for euros, the Oesterreichische Nationalbank's euro bus has been traveling through Austria during the summer months since 2002 . A secondary purpose of the campaign is to inform the population about the security features of the euro bills.

The changeover to the euro was the sixth currency reform or changeover in Austrian currency history since 1816 after the Napoleonic Wars . Predecessors of the euro in Austria were the guilder , the crown ( Austria-Hungary ), the shilling ( first republic ), the Reichsmark (after the annexation to the “ Third Reich ”) and the shilling ( second republic ). In 1947 there was a currency reform a shilling devaluation to a third.

Other eurozone countries

For all previous participants, euro cash was introduced at the beginning of the year.

In a short transition period after the introduction of euro cash, cash in euros and the old national currency was in circulation in every participating country. The former national currencies were, however, at this time, usually no legal means of payment but more were, on account of payment accepted; the conversion into euros was carried out at the officially established exchange rate. The time of the parallel cash circulation was set differently, for example until the end of February or until the end of June 2002. Most currencies can or could still be exchanged for euros at the respective national central bank .

Exchange of old cash

The handling of earlier currencies is regulated differently in the euro countries. Even after these are no longer legal tender, there is or was the option of exchanging them. The exchange periods differ, however:

- Bills and coins can be exchanged for an unlimited period: Germany, Estonia, Ireland, Latvia, Lithuania and Austria

- Only notes can be exchanged for an unlimited period, coins limited in time: Belgium, Luxembourg, Slovakia and Slovenia (each deadline has expired)

- Bills and coins only for a limited period (but sometimes with different expiry dates):

- Coins no longer exchangeable: Portugal (until February 28, 2022), the Netherlands (until January 1, 2032, but not Gulden notes from shops after January 27, 2002)

- Deadlines expired: Finland, France, Greece, Italy, Malta, Spain and Cyprus

Acceptance of the euro

Acceptance in Germany

Two and a half years after the introduction of the euro , a research team from the Ingolstadt University of Applied Sciences in Germany presented a study on its acceptance among the German population. According to this, at the time of the survey (2004) almost 60% of the German population had a positive view of the euro. However, many of the respondents mourned the loss of the D-Mark. Many of the respondents also converted prices from euros to D-Marks, more often for higher amounts than for lower ones. 48% of those questioned converted for all prices, but 74% for prices over 100 euros. This was made easier by the simple conversion factor (almost 1: 2, exactly 1: 1.95583). In addition, the population associates the introduction of the euro with a general price increase that parts of the retail trade carried out. In some of the euro countries (for example in France and the Netherlands) price increases were prohibited by law during the period of the introduction of the euro, in Germany a voluntary commitment by retailers was relied on. When it comes to trips abroad and holidays in its area of application, the euro is becoming more popular. The better price comparison within Europe is also noted positively. According to the study mentioned, many of the respondents also welcome the fact that the common EU currency has created an opposite pole to the US dollar and yen .

According to the 2006 Eurobarometer , a relative majority of 46% of the German population was of the opinion "The euro is good for us, it strengthens us for the future", while 44% were of the opinion that the euro "tends to weaken the country". In 2002, supporters of the euro (39%) were still in the minority compared to eurosceptics (52%). However, a study by Dresdner Bank on behalf of the Wahlen research group showed that at the end of 2007 Germans' acceptance of the euro had fallen to 36% compared to 43% in 2004.

According to the 2014 Eurobarometer , a clear majority of 74% of Germans are in favor of the euro, while a minority of 22% reject it.

Acceptance in Austria

According to the Eurobarometer , Austrians are more positive about the euro than Germans. In 2006, 62% of the Austrian population were of the opinion: "The euro is good for us, it strengthens us for the future", while 24% were of the opinion that the euro tends to weaken the country. In Austria as early as 2002, the euro supporters (52%) were in the majority compared to the euro skeptics (25%).

Acceptance in Latvia

In the course of the introduction of the euro in Latvia, according to the market research company SKDS, only 22% of the Latvian population agreed, the majority of 53% were against. This ratio changed significantly in the following years: in 2018, 83% of Latvians supported the euro.

European Central Bank

The euro is controlled by the European Central Bank (ECB) in Frankfurt am Main . This started work on June 1, 1998. However, responsibility was not transferred from the national central banks (NCB) to the ECB until the start of the European Monetary Union (EMU) on January 1, 1999. In addition to securing price stability as set out in Article 105 of the EC Treaty, the ECB also has the task of supporting the economic policy of the member states. Further tasks of the ECB are the definition and implementation of monetary policy , the administration of the official currency reserves of the member states, the implementation of foreign exchange transactions, the supply of money to the economy and the promotion of smooth payment transactions. In order to protect the independence of the ECB, neither it nor any of the NCBs may receive or seek instructions from any of the governments of the Member States. This legal independence is necessary because the ECB has the exclusive right to issue banknotes and thus has influence on the money supply of the euro. This is necessary in order not to succumb to the temptation to compensate for any budget gaps with an increased amount of money. This would weaken confidence in the euro and make the currency unstable.

The European Central Bank, together with the national central banks such as the Deutsche Bundesbank , forms the European System of Central Banks and is based in Frankfurt am Main . The decision-making body is the Governing Council, which is made up of the Executive Board of the ECB and the governors of the national central banks. The Executive Board in turn consists of the President of the ECB, his Vice-Presidents and four other members, all of whom are regularly elected and appointed by the members of the EMU for a term of office of eight years; re-election is excluded.

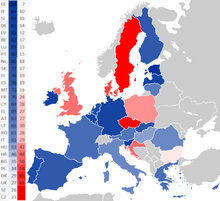

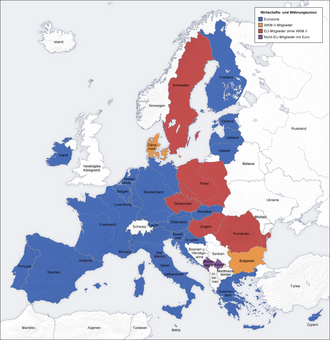

Eurozone

The group of 19 EU countries that take part in the third stage of the European Economic and Monetary Union and use the euro as an official means of payment ("Euro-19") is referred to as the euro zone in the strict sense of the word .

In a broader sense, it also means the states that have their own currency linked to the euro via an exchange rate system or that are non-EU member states, e.g. Partly unilaterally who introduced the euro. The non-EU countries that use the euro include the small states of Andorra , Monaco , San Marino and the Vatican, as well as Montenegro and Kosovo . The areas of Saint-Pierre and Miquelon and Saint Barthélemy , which are part of France but not the EU, continue to use the euro. In the military bases of Akrotiri and Dekelia in Cyprus , which are under British sovereignty and also not part of the EU, payments are only made in the euro.

Bosnia-Herzegovina and Bulgaria have a fixed exchange rate in Europe, as well as Cape Verde , São Tomé and Príncipe , the Comoros and the 14 countries of the CFA franc zone in Africa . The CFP franc , used in some of the French overseas territories in the Pacific , is also tightly pegged to the euro. Other exchange rate systems, such as Exchange Rate Mechanism II , of which Denmark is a member, allow a certain range of fluctuations around a central rate . Some countries like Morocco, on the other hand, have pegged their currencies to a currency basket with a certain proportion of which is based on the euro. The Switzerland continued from 2011 to 2015 an exchange rate fluctuation limit. In total, over forty countries use the euro or a currency that is dependent on it.

In de jure the Republic of Cyprus belonging Northern Cyprus applies de facto the Turkish lira as legal tender.

According to the provisions of the European Economic and Monetary Union that were first set out in the Maastricht Treaty , all EU member states are obliged to introduce the euro as soon as they meet the EU convergence criteria, which include two-year membership in Exchange Rate Mechanism II (ERM II). Only Denmark and the United Kingdom have been exempted from this - through exception protocols . However, the European Commission has so far allowed Sweden to deliberately fail to meet one of the convergence criteria by not joining Exchange Rate Mechanism II in order to avoid joining the euro.

Economic Consequences of the Single Currency

benefits

According to general currency theory, it is to be expected that the euro will lead to simplified trade between the members of the euro zone and decreasing or “no transaction costs ”. This is believed to be beneficial to euro area consumers and businesses as trade has historically been a major source of economic growth . It is estimated that between the introduction of the euro and 2009, intra-euro trade increased by 5–15%. European companies should benefit from the elimination of the "trade barriers between the member states": an expansion of the companies across the European market and the use of increasing economies of scale should set in. The euro can also be seen as the "completion of the common European internal market (free movement of goods, services, capital and people)" - one could, conversely, state that the European internal market would be missing an important component without a common currency.

When the euro was introduced, it was assumed that price differences for products and services in the countries of the euro zone would decrease ("elimination of price differentiation"): As a result of the balancing effect of arbitrage trading, existing differences should be quickly offset. This leads to increased competition between providers, lower prices for private households and thus to lower inflation and more prosperity for consumers. However, price differentiation is not entirely eliminated. Market participants will not have to deal with long transport routes and costs for everyday goods. An adjustment ("convergence") of the prices does not then take place.

The euro has particular advantages for travelers. You do not have to exchange or redeem money within the euro zone and save the associated fees. In addition, you can easily compare the prices in your country of travel with those in your country of origin. Outside the euro zone, euro bills, like US dollar bills, are accepted by money changers almost everywhere in the world and exchanged on favorable terms.

Previously existing intra-Community exchange rate risks and the resulting currency hedging would no longer apply to European companies (“reduction of exchange rate fluctuations”). In the opinion of many economists, speculation against the euro is much more difficult than against smaller currencies because of its size. Currency speculation in the 1990s led to severe upheavals in the European Monetary System (EMS) (for example on “ Black Wednesday ” on December 16, 1992). Currency speculation can lead to a pronounced undervaluation or overvaluation of a currency, with corresponding consequences for the inflation rate and the economic growth of the currency areas of both currencies of an exchange rate, and thus make efficient trade between two currency areas more difficult. They can also use up a state's currency reserves. The "reduction of uncertainty" through exchange rate fluctuations changes investment behavior. Future planning and costing of projects are made easier. An increase in investment leads to higher economic growth.

In political terms, the euro manifests the cooperation between European states and is a tangible symbol of European identity. It can contribute to the consolidation of the European Union and, as many expected and hoped for before the establishment of the European Monetary Union, contribute in the long term to the creation of a “political union”.

In general, the European Central Bank was able to fulfill its main task, i.e. its monetary policy to ensure that inflation was stable and that it was neither too high nor too low . The inflation target of “below but close to two percent” was mostly achieved or a long-term deviation was prevented.

disadvantage

In the past, almost no country consistently adhered to the EU convergence criteria for national debt . From a political point of view, economists who value the importance of a balanced national budget highly, it is questionable whether the ECB and the European Commission can urge the member states to exercise sufficient budgetary discipline: If individual countries or groups of countries evade their assumed budgetary responsibility, the inflation rate and financing costs for these countries will remain low for as long how most of the rest of the euro countries are not too heavily indebted. In debtor countries that are irresponsible for their budgetary policy, this can encourage delayed or insufficient corrections to budgetary policies and lead to a decline in prosperity.

In practice, monetary and interest rate policy in the heterogeneous economic area has proven to be difficult ("abandonment of national monetary policy") : Growth rates of over 5% in Ireland had to be reconciled with rates close to zero in the Iberian states: the Irish situation would be According to the "national" methods used up to now, it would have to be countered with increases in key interest rates and a tightening of the money supply , while in the opposite example, interest rate easing would have been common. Such regional differences can not be adequately mapped with the single monetary policy of the euro zone by the ECB. The "national economies" have lost "an individually applicable economic policy instrument."

A major economic problem at the beginning was the determination of the exchange rates of the currencies involved in the single currency. An economy that joins the single currency with an overvalued currency will have higher assets than, but also a higher price level (higher costs and prices) than States that are undervalued or real valued join the single currency. Due to the higher price level, there is a great import incentive and reduced export opportunities and, as a result, rising unemployment. In order to maintain the competitiveness of the economy, it is necessary to lower the price level (as a percentage of the overvaluation). In the monetary union, due to the lack of an exchange rate mechanism, an economic compensation of the overvaluation can only be achieved through internal devaluation .

Commodity prices

Another effect concerns the international raw material prices , in particular the economically important oil price . Oil is still mostly billed in US dollars , and OPEC has only accepted the US dollar since the 1970s. The Iraq had in 2000 under Saddam Hussein settled its oil sales already entirely in euros, but a month after the part of the USA on 10 June 2003, approximately conquest of the country was reversed. Within OPEC, discussions were held to convert prices to euros, which would also force many third countries to convert parts of their foreign exchange reserves for oil purchases from US dollars to euros, which would have extremely negative effects on the US dollar and the US economy is stabilized by the steadily growing trade in oil. Both Iran under President Mahmud Ahmadineschād and the then Venezuelan President Hugo Chávez were in favor of such a change in November 2007, but it did not materialize. In December 2007, Iran announced the complete conversion of its oil exports to "non-US dollar currencies" and also opened its own oil exchange on February 17, 2008, which is not linked to the US dollar and is based on the island of Kisch . The quantities of oil that the country exports via this trading center are said to be too small to seriously jeopardize the position of the US dollar as an “oil currency”.

inflation

Even before, but especially after the introduction of the euro in cash in January 2002, possible price increases due to the currency conversion were discussed.

Measured increase in price

The statistical authorities of the European countries determine monthly consumer price indices in order to determine the price trend. Only minimal differences were found in the German-speaking euro countries. In none of the German-speaking euro countries did inflation rise above levels in spring 2002 that it had not already reached in summer 2001. Overall, the inflation rate in 2002 and 2003 was very low and below the level of previous years.

Even over longer periods of time, inflation was somewhat lower than in the years before the euro. The German consumer price index rose by 7.4% in the five years before its introduction, while it rose by 7.3% in the five years after. In Austria, too, according to Statistics Austria, the Austrian consumer price index rose in the twelve years from 1987 to 1998 by an average of 2.45% per year, while the inflation rate fell from 1998 to 2003 to an average of 1.84%.

However, this inflation rate was not the same across all product groups. For goods and services of daily use, the Institut der Deutschen Wirtschaft carried out a detailed study of the data from the Federal Statistical Office in 2002 and determined a price increase of 4.8% in the first quarter. For individual product groups, significantly above-average price increases were found. The researchers came to the conclusion that the feeling of high price increases widespread in the population was not unfounded, as increases in this area were perceived more strongly than fixed costs such as rent or heating, which had remained unchanged. This study shows that prices rose considerably in various areas at the beginning of 2002, but could not show the further development of 2002. The data from the Federal Statistical Office show a price drop below the 2001 level towards the end of 2002 in various product groups, including food.

Perceived inflation

After the introduction of the euro, many consumers felt that goods and services were becoming more expensive than the inflation rate . The proportion of those who perceived faster inflation rose rapidly across the euro area from January 2002 onwards.

The term “ Teuro ”, introduced by the satirical magazine Titanic and subsequently used by many newspapers , was increasingly popular in everyday language . It was also voted Word of the Year 2002.

The perception of alleged price increases was greatest in Germany and the Netherlands. In the German media and in German politics there was a debate about alleged price distortions. In Austria, too, a majority got the impression that the euro was having a negative impact on price developments.

Explanation of the discrepancy

There are different explanations for the discrepancy between the measured, lower inflation and the subjectively felt inflation in the period after the introduction of the euro. In its 2002 study, the Institut der Deutschen Wirtschaft pointed out that certain goods bought every day, such as food, were actually more expensive than average, which was perceived much more strongly than the opposite development for products that are bought less often or for monthly costs debited from the account .

On the psychological side of the discrepancy, inter alia Investigations carried out by the psychologist Eva Traut-Mattausch, in which test subjects were asked to estimate price changes when the currency was converted. It turned out that the new prices were consistently estimated to be higher than they were in real terms. Price reductions were not perceived at all, and price increases were perceived as illusory. The psychological phenomenon that is held responsible for this is the so-called confirmation error , which has been known for decades , in which the assessment of information is influenced by the previous expectations. Information that meets expectations is considered more credible and important. In connection with the price assessment, this has the effect that conversion errors are more likely to be corrected if they run counter to expectations. In a very similar experiment in Austria, the results were the same.

It was also believed that the perception of price by rounding errors in the rough calculation is affected (in Germany about 1: 13.7603 2 instead of 1: 1.95583, or in Austria 1:14 instead of 1). However, no such effect could be found in the psychological studies on confirmatory errors.

The euro in the global monetary system

Due to the fixed exchange rate development of the euro against almost all other major currencies in recent years and the persistent fiscal policy difficulties in the USA, individual economists expect a gradual erosion and ultimately the replacement of the US dollar as a world reserve and reserve currency. This would mean the end of an era that began after the Second World War with the replacement of the British pound, which had dominated until then, with the US dollar.

Most scholars rate the recurring comments from developing and emerging countries regarding a rebalancing of their currency reserves or a re-invoicing of crude oil prices in euros more as a means of political pressure on the USA, rather than as a concrete intention.

In 2006, the euro was still significantly underrepresented - measured against the trade and financial relations of most third countries with the euro zone.

As the leading international cash currency, the euro replaced the US dollar in 2006. Since October 2006, the value of euro banknotes in circulation is 592 billion euros, higher than that of US dollar banknotes (579 billion US dollars). However, this is also due to the fact that in the USA purchases are significantly more often paid for by credit card . As a result, there is on average less cash in circulation per person.

| 1970 | 1980 | 1990 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD | 77.2 | 67.2 | 62.8 | 70.5 | 70.7 | 66.5 | 65.8 | 65.9 | 66.4 | 65.5 | 64.1 | 64.1 | 62.1 | 61.8 | 62.2 | 61.2 | 61.0 | 63.3 | 64.1 | 63.9 | 62.7 | 61.7 | 60.9 |

| EUR | - | - | - | - | 17.9 | 24.2 | 25.3 | 24.9 | 24.3 | 25.1 | 26.3 | 26.4 | 27.6 | 26.0 | 25.0 | 24.2 | 24.4 | 21.9 | 19.7 | 19.7 | 20.2 | 20.7 | 20.6 |

| TO THE | 1.9 | 14.8 | 19.8 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| JPY | - | 0.1 | 4.6 | 9.4 | 5.2 | 4.5 | 4.1 | 3.9 | 3.7 | 3.1 | 2.9 | 3.1 | 2.9 | 3.7 | 3.5 | 4.0 | 3.8 | 3.9 | 4.0 | 4.2 | 4.9 | 5.2 | 5.7 |

| GBP | 10.4 | 2.9 | 2.4 | 2.8 | 2.7 | 2.9 | 2.6 | 3.3 | 3.6 | 4.4 | 4.7 | 4.0 | 4.3 | 3.9 | 3.8 | 4.0 | 4.0 | 3.8 | 4.9 | 4.4 | 4.5 | 4.4 | 4.6 |

| FRF | 1.1 | 1.7 | 2.7 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| CHF | 0.7 | 3.2 | 0.8 | 0.3 | 0.3 | 0.4 | 0.2 | 0.2 | 0.1 | 0.2 | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.3 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 0.2 |

| other | 8.7 | 5.9 | 4.9 | 1.4 | 1.2 | 1.4 | 1.9 | 1.8 | 1.9 | 1.8 | 1.8 | 2.2 | 3.1 | 4.4 | 5.3 | 5.8 | 6.5 | 6.8 | 6.7 | 7.6 | 7.6 | 7.8 | 8.0 |

|

Sources: |

|||||||||||||||||||||||

Effects on Germany

After the introduction of the euro, Germany experienced a period of economic weakness. Economists see several reasons for this, some of which are related to the euro. For example, due to political errors, Germany entered the euro currency union with an excessive exchange rate, which resulted in prices that were too high. This reduced Germany's competitiveness. It was only through long-term wage restraint on the part of the collective bargaining parties that the price level fell again and that competitiveness improved. Hans-Werner Sinn summarizes the real devaluation ( internal devaluation ) as follows: "We have become cheaper and, in a certain way, poorer". In addition, with the introduction of the euro, the exchange rate risks no longer existed, and the financial market players then adjusted lending rates for the entire euro area to a uniform level. Interest rate convergence ensured that capital was withdrawn from euro countries with low inflation and flowed into euro countries with high inflation, where economic overheating and later payment difficulties arose. Countries like Germany suffered from investment weakness during this period.

The euro exchange rate, which is relatively moderate in terms of German economic power, has both positive and negative effects on Germany: exports are cheaper, while imports are more expensive. A reintroduction of the Deutsche Mark would, on the one hand, as the special report of the Expert Council on the assessment of the overall economic development of July 5, 2012 determined, lead to a considerable appreciation (price level increase compared to other currency areas) and thus permanently the international competitiveness of the German economy not only in Europe , but have a significant impact worldwide. On the other hand, imports to Germany would be significantly cheaper.

Exchange rates to the euro

Conversion of the old currencies into euros

| ¤ / EUR * | EUR / ¤ | ISO | Previous currency |

|---|---|---|---|

| 40.3399 | 0.024789 | BEF | Belgian francs |

| 1.95583 | 0.511292 | TO THE | German mark |

| 15.6466 | 0.063912 | EEK | Estonian crowns |

| 5.94573 | 0.168187 | FIM | Finnish mark |

| 6.55957 | 0.152449 | FRF | French Francs |

| 340.750 | 0.002935 | GRD | Greek drachmas |

| 0.787564 | 1.26974 | IEP | Irish pound |

| 1936.27 | 0.000516 | ITL | Italian lire |

| 0.702804 | 1.422872 | LVL | Latvian lats |

| 3.45280 | 0.28962 | LTL | Lithuanian litas |

| 40.3399 | 0.024789 | LUF | Luxembourg francs |

| 0.429300 | 2,32937 | MTL | Maltese lire |

| 2.20371 | 0.45378 | NLG | Dutch guilders |

| 13.7603 | 0.072673 | ATS | Austrian Schilling |

| 200.482 | 0.004988 | PTE | Portuguese escudos |

| 30.1260 | 0.033194 | SKK | Slovak crowns |

| 239.640 | 0.004173 | SIT | Slovenian tolar |

| 166.386 | 0.00601 | ESP | Spanish pesetas |

| 0.585274 | 1.7086 | CYP | Cypriot pounds |

In the run-up to the introduction of the euro in an EMU member state, the EU finance ministers decide on the final exchange rate. The exchange rate is always set to a total of six significant digits (i.e. before and, if necessary, after the decimal point) in order to keep rounding errors as low as possible.

The exchange rates of the currencies of the countries originally participating in the monetary union were set by the finance ministers on December 31, 1998. The basis was the conversion value of the previously existing ECU . For later accession to the euro (Greece in 2001, Slovenia in 2007 and Malta and Cyprus in 2008), the mean value within the framework of ERM II was used as the benchmark.

Since the introduction of the euro as book money, the participating currencies can only be converted into one another using a triangulation . You always have to convert from the source currency to the euro first and then from the euro to the target currency. Rounding is permitted from the third digit after the decimal point and in the target currency. Triangulation prevents rounding errors that could occur during direct conversion, which is why the European Commission has made the procedure mandatory.

When converting amounts to euros that are still in "old" currency units, the total amount to be paid may only be rounded at the end of the calculation. Rounding off individual calculation factors or intermediate results would lead to a different overall result. This would violate the legal principle that the introduction of the new currency does not affect the continuity of contracts.

Practical example: If a monthly rent to be paid was agreed in a rental agreement, which is calculated as the product of the rental area and the price per square meter, the price per square meter is not to be converted into euros and rounded off, but rather the monthly payment amount. A different approach would, under certain circumstances, result in significant reductions or increases in monthly payments (cf. judgment of the German Federal Court of Justice of March 3, 2005 - III ZR 363/04).

Historical exchange rate against the US dollar

| year | date | Deep | date | Maximum |

|---|---|---|---|---|

| 1999 | 03.12. | 1.0015 | 05.01. | 1.1790 |

| 2000 | 10/26 | 0.8252 | 06.01. | 1.0388 |

| 2001 | 06.07. | 0.8384 | 05.01. | 0.9545 |

| 2002 | 28.01. | 0.8578 | December 31 | 1.0487 |

| 2003 | 08.01. | 1.0377 | December 31 | 1.2630 |

| 2004 | May 14th | 1.1802 | 28.12. | 1.3633 |

| 2005 | 11/15 | 1.1667 | 03.01. | 1.3507 |

| 2006 | 02.01. | 1.1826 | 05.12. | 1.3331 |

| 2007 | 12.01. | 1.2893 | 11/27 | 1.4874 |

| 2008 | 10/27 | 1.2460 | 07/15 | 1.5990 |

| 2009 | 04.03. | 1.2555 | 02.12. | 1.5090 |

| 2010 | 08.06. | 1.1942 | 13.01. | 1.4563 |

| 2011 | 12/29 | 1.2889 | 04.05. | 1.4882 |

| 2012 | 07/24 | 1.2089 | 02/28 | 1.3454 |

| 2013 | 27.03. | 1.2768 | 12/27 | 1.3814 |

| 2014 | December 31 | 1.2141 | 06.05. | 1.3945 |

| 2015 | April 13 | 1.0552 | 02.01. | 1.2043 |

| 2016 | December 20 | 1.0364 | 03.05. | 1.1569 |

| 2017 | 03.01. | 1.0385 | 08.09. | 1.2060 |

| 2018 | 11/13 | 1.1261 | 02/15 | 1.2493 |

| 2019 | 30.09. | 1.0889 | 10.01. | 1.1535 |

| 2020 | March 20 | 1.0707 | 12/30 | 1.2281 |

| 2021 | 11/24 | 1.1206 | 06.01. | 1.2338 |

On January 4, 1999, the first day of trading in euros on the Frankfurt Stock Exchange , the new European currency had an exchange rate of 1.1789 USD per euro. The exchange rate of the euro initially developed negatively in relation to the US dollar and reached further lows over the first two years of trading on the stock exchange. On January 27, 2000, the euro fell below the euro-dollar parity ; the all-time low was then reached on October 26, 2000 at USD 0.8252 per euro.

From April 2002 to December 2004 the euro appreciated more or less continuously; parity was reached again on July 15, 2002, and on December 28, 2004 it hit a record high of $ 1.3633. Contrary to the expectations of many analysts, some of whom had even forecast an imminent rise to over USD 1.4 or even USD 1.6, the euro depreciated significantly again in the course of 2005 due to the interest rate hike policy of the US Federal Reserve November, at USD 1.1667, its annual low in 2005. However, this policy of increasing interest rates could no longer be continued in 2006 due to the weakening of the US economy; Since the second half of 2007, the subprime crisis has made matters worse, causing the US Federal Reserve to cut key interest rates several times, so that the euro appreciated again and the ECB reference rate reached its previous record high of USD 1.5990 on July 15, 2008, with the highest price ever traded on the market was USD 1.6038. For comparison: the D-Mark reached its highest value on April 19, 1995, when USD 1 cost 1.3455 DEM - the equivalent of 1.45361 USD per euro. The Austrian Schilling, which is linked to the D-Mark, reached its all-time high on the same day with a US dollar price of 9.485 Schillings, which is the equivalent of USD 1.45 074 per euro.

Due to the weak dollar, the gross domestic product of the euro area at market exchange rates in March 2008 was greater than that of the USA .

Exchange rate development of 6 major currencies since 1999 in relation to their mean ( weighted with GDP ).

Significance of the US dollar-euro exchange rate

A high euro exchange rate has both advantages and disadvantages for the European economy. The cheaper raw materials , which are still mainly traded in US dollars, are advantageous . The disadvantage is that exports are more expensive, which can lead to sales problems. However, due to the size of the euro area, the exchange rates and thus the exchange rate risks caused by exchange rate fluctuations are far less important than at the time of national currencies. In particular, at the beginning of 2007 the European domestic economy was able to decouple itself from the only moderately growing world economy with above-average growth.

The low euro exchange rate until 2002 is probably due in part to its non-existence as cash at the time, which is why the euro was initially valued lower than would have been appropriate based on the fundamentals alone. The economic problems in the European Community made investments in Europe unattractive for foreign investors, which further weakened the euro. Shortly after the introduction of cash, there was an appreciation of the euro. The economic recovery in Europe since 2005, especially exports, has further supported the appreciation of the euro. There are further explanations which also lead to the general assumption that the euro will continue to appreciate in the medium and long term; There are three main reasons given for this:

- The continuing rise in the budget and current account deficit and the associated increase in US debt,

- the foreseeable reallocation of currency reserves from states like China, India, Japan, Russia and other large states as well

- the increasing willingness of oil-exporting countries to accept the euro as a means of payment for oil in addition to the US dollar .

In July 2008 the euro reached its all-time high at a rate of US $ 1.5990 per euro (see table “Annual highs and lows” above); In the course of the financial crisis in Greece in 2009/10 , the exchange rate fell from 1.35 USD / EUR to around 1.20 USD / EUR (= by around 10%).

Euro Currency Index

The Euro Currency Index (EUR_I) shows the arithmetic ratio of four key currencies to the euro: US dollars , British pounds , Japanese yen and Swiss francs . All currencies are expressed in units of measure of currency per euro. The index was launched in 2004 by the Stooq.com stock exchange portal. The base value is 100 points on January 4, 1971. Before the European common currency was introduced on January 1, 1999, an exchange rate of 1 euro = 1.95583 German marks was calculated.

The trade-weighted Euro Effective Exchange Rate Index of the European Central Bank (ECB) is comparable to the arithmetically weighted Euro Currency Index . Compared to the Euro Currency Index, the ECB's index measures the value of the euro much more accurately, as the weighting of the ECB represents the competitiveness of European goods compared to other countries and trading partners.

Other companies also published Euro Currency Indices. However, the calculation was discontinued after a few years. Examples are the Dow Jones Euro Currency Index (DJEURO) from Dow Jones & Company from 2005 to 2009 and the ICE Euro Currency Index (ECX) from the futures exchange ICE Futures US , formerly the New York Board of Trade (NYBOT), from 2006 to 2011.

Euro Effective Exchange Rate Index

The Euro Effective Exchange Rate Index (Euro EER Index, also known as Euro Trade Weighted Index) is a key figure that compares the value of the Euro using a currency basket made up of different currencies. The index is the trade weighted average against these currencies. It was first published in 1999 by the European Central Bank (ECB). The ECB calculates the effective exchange rates in the index for three groups:

- a narrow group (EER-12 index),

- a group of 20 member countries (EER-20 index), consisting of the EER-12 countries, plus China and the seven non-euro area EU member states

- a broad group (EER-40 index) of trading partners consisting of the EER-20 countries plus 20 additional relevant trading partners

The ECB determines the weights of the individual partner countries based on the proportions of finished products as defined in the Standard International Trade Classification (SITC) . For the weights, the ECB uses the values from exports and imports, without taking into account trade within the euro area. Imports are weighted according to the simple share of partner countries in total imports into the euro area. Exports, on the other hand, are weighted twice because of the so-called “third market effects”. This includes the competition between European exporters in foreign markets versus domestic producers and exporters from third countries.

Name, symbols and codes

Currency name Euro

The name "Euro" was decided at the meeting of the European Council on December 15 and 16, 1995 in Madrid and was defined in Regulation (EC) No. 974/98 on the introduction of the Euro . In all languages of the countries in which the currency was introduced, its name is "euro". In contrast to this, in German the currency is capitalized (Euro), in Greek the Greek alphabet is used (ευρώ).

Despite the identical spelling, the name of the common currency is pronounced very differently in different languages:

- German [ ˈɔʏ̯ʁo ]

- English [ ˈjuːɹəʊ ]

- Finnish and Italian [ ˈɛuro ]

- French [ øˈʁo ]

- Greek [ ɛvˈro ]

- Latvian [ ˈejɾo ]

- Dutch [ ˈøro ]

- Spanish and Estonian [ ˈeuɾo ]

The correct designation of the common currency in the nominative singular as "Euro" can be found in all relevant legal acts of the European Union and is even checked by the European Central Bank in its regular convergence reports as a de facto convergence criterion :

"In view of the exclusive competence of the Community to determine the name of the single currency, any derogation from this provision is incompatible with the EC Treaty and must therefore be eliminated."

In a declaration on the Treaty of Lisbon on May 9, 2008, the governments of Latvia, Hungary and Malta stated that the standardized spelling "has no effect on the rules in force in the Latvian, Hungarian and Maltese languages".

In the official German language usage, the term Euro is also used unchanged in the plural . However, the colloquial usage deviates from this: In German, the plural forms are euros and cents when one speaks or writes of notes and coins (“a sack full of euros”); There is no -s when specifying a certain amount of money ("I have transferred a thousand euros"). In some other EU languages there are also officially separate plural forms.

Etymologically, the word “Euro” is derived as an abbreviation of the name of the continent of Europe and thus ultimately from the Greek Εὐρώπη .

Subunit cents

The sub-unit of the euro is “ cent ”. According to the interinstitutional rules for publications of the EU, nationally different designations are not excluded. This is a concession to the countries whose currency sub-unit was already denoted by a form of the word cent before the introduction of the euro. B. France and Belgium (centimes) , Italy (centesimi) or Portugal (centavos). In Finnish, the form sentti, which was used earlier for the sub-unit of the dollar, is also used. In Greek, λεπτό ( Lepto ) is used, which was also the name for the subunit of the Greek drachm .

Colloquially - also to distinguish it from the sub-units of the same name in other currencies - the term “euro cent” is also widespread. The words euro and cent are also written on top of each other on the coins themselves , although euro appears in smaller letters as cents .

The word “cent” comes from the Latin centesimus “the hundredth” or “the hundredth”. Variants have long been used in Romania for currency subunits (cf. Céntimo , Centime , Centavo and Centesimo ). The form “cent” itself had been conveyed into German via Dutch and English even before the euro was introduced, in particular as a name for the sub-unit of the dollar .

Euro currency symbol

The euro symbol was introduced in 1997 by the European Commission as a symbol for the European common currency. The fact that there is a symbol at all is more due to chance. Since there are only a few currencies for which a symbol exists, the Council never discussed a symbol either. Only when a logo for information campaigns was sought in early 1996 was the design found. This gave rise to the idea of introducing this logo as a currency symbol as well. On 23 July 1997 the Commission published a notice on the use of the euro symbol. The text explains:

- “The € is based on the Greek epsilon, which refers back to the cradle of European civilization, and on the first letter of the word Europe; it is crossed by two parallels that symbolize the stability of the euro. An early commitment to a distinctive symbol for the euro should also show that the euro is called to become one of the most important currencies in the world. "

It is based on a study made in 1974 by the former chief graphic artist of the European Community (EC), Arthur Eisenmenger . It is a large, round E with two horizontal, staggered dashes in the middle (or combined with an equal sign like a C). It is reminiscent of the Greek letter epsilon (ε). The abbreviation ECU was originally intended to be used. The euro symbol should not be used in this form in texts. It is typographically correct to use the euro symbol of the font used (U + 20AC).

However, a sentence with seven values of 1, 2, 5, 10, 20, 50 and 100 euros with the euro symbol “€” appeared - issued by the Paneuropa-Union (Union Paneuropéenne) in 1972 - which at the time was something looked different, but also consisted of a capital "C" with an added equal sign. The occasion of the edition was the 50th anniversary of the Paneuropean Union and the 20th anniversary of the European Coal and Steel Community, combined with the treaty on the northward expansion of the community. The pieces are inscribed with the text " CONFŒDERATIO EUROPÆA ". On the reverse side are shown Karl I , Karl V , Napoléon Bonaparte , Richard Nikolaus Graf von Coudenhove-Kalergi , Jean Monnet , Sir Winston Churchill and Konrad Adenauer . Another euro issue with two pieces was issued a year later on the 10th anniversary of the friendship treaty between Germany and France .

ISO currency code

The international currency code is "EUR". In the ISO standard , it deviates from the general system in several ways:

- Usually the first letter of currencies used in a monetary union is the "X". An abbreviation corresponding to the standard could be "XEU". In fact, this was also the international currency code of the European currency unit ECU from 1979 to 1998, which was replaced by the euro.

- If the first letter is not an "X", the first two letters stand for the country code according to ISO 3166 , the last is usually the first letter of the currency. Although the European Union is not a sovereign state, the abbreviation EU is defined for it in ISO 3166. According to this standard, the euro should actually have the abbreviation “EUE”.

Official spellings

The Publications Office of the European Union uses the euro symbol in its writing rules only for graphic representation, popular science publications and for advertising purposes. In official texts, on the other hand, the ISO code "EUR" is generally used for currency amounts.

Officially, there is neither a symbol nor an abbreviation for the cent. In official texts, amounts in the cent range are therefore given in fractions of euros, for example "0.20 EUR" for an amount of 20 cents. Unofficially, however, the subunit is often abbreviated (Ct, Ct., Ct, C or c). The symbol ¢ used for the US cent is not used for the euro cent .

Euro cash

| The euro coins |

|---|

| Eurozone |

| Associated euro users (with their own euro coins) |

| Passive euro users (without their own euro coins) |

| Possible future euro states |

| Exit clause |

At the end of 2010, € 862.3 billion was in circulation as cash, of which € 840 billion was in the form of notes (97.4%) and € 22.3 billion in coins (2.6%).

Coins

Utility coins

There are euro coins of 1, 2, 5, 10, 20 and 50 euro cents as well as 1 and 2 euros. The front of the coins of all euro countries are the same, on the reverse they have national motifs. Nevertheless, it can be used to pay in the entire currency area. Since 2007, the obverse of the coins has been gradually renewed in order to also represent the EU countries that were added in 2004. The German reverse side also has a mint mark indicating the place of minting. On the Greek coins, the face value is also listed in Greek, instead of cents the designation Lepto / Lepta is used. There is an offset double L on the face of the coins; the initials of the Belgian designer Luc Luycx .

The 1 and 2 euro coins consist of two different alloys (cupronickel and brass). Under conditions of use results in a electrochemical potential gradient , the nickel - ion dissolves out from the alloy. However, this does not trigger any allergic reactions (contrary to original fears) .

Since the Thai 10- baht coins are very similar in size and weight to the 2-euro coins and are also made of two different alloys, machines in the euro area that have an inadequate coin validation may recognize these coins as 2-euro coins. This can possibly also be done with other coins - for example the new Turkish 1 lira coin, the Kenyan 5 shilling coin or with remnants of the Italian 500 lira coin.

2 euro commemorative coins

Since 2004, 2 euro commemorative coins have been issued for circulation. They differ from the circulation coins only in the motif on the national side and are valid in the entire euro area.

The first edition was issued by Greece to commemorate the 2004 Athens Summer Olympics. In 2005 Austria issued a coin to mark the fiftieth anniversary of the State Treaty . Germany started with its first commemorative coin of the federal state series in 2006, on which the Holsten Gate to Lübeck is depicted. The circulation was 31.5 million. In accordance with the annually changing chairmanship of the Federal Council, in the following years and up to and including 2022 - with the exception of 2019 - commemorative coins dedicated to one of the 16 federal states, each with a circulation of around 31 million, were issued. It was therefore planned that Germany would not mint any 2-euro coins with the federal eagle (i.e. the “normal” 2-euro coin) in circulation for 16 years - with the exception of a small number of coin sets for collectors. Nevertheless, considerable numbers of 2 euro coins with the federal eagle were minted for circulation purposes.

On the fiftieth anniversary of the signing of the Treaty of Rome , March 25, 2007, all 13 euro countries issued a commemorative coin with a common image and lettering in the respective national language or in Latin. On January 1, 2009, a joint edition of the meanwhile 16 euro countries appeared again on the occasion of the tenth anniversary of the economic and monetary union. The date of issue is to be considered symbolic, as New Year is an official holiday. The German edition appeared on January 5th and the Italian coin was the last of the series on March 26th. At the beginning of 2012, the third joint issue followed by now 17 countries on the occasion of the tenth anniversary of the introduction of the euro as cash. On the occasion of the 30th anniversary of the EU flag, all 19 EU countries that used the euro as official currency issued a joint 2 euro commemorative coin in 2015.

Collector coins

In addition to normal circulation coins and 2 euro commemorative coins, the euro countries also issue pure collector coins . Sometimes the face values can run up to several hundred euros, and the coins contain silver or gold. Such collector coins are only recognized as valid means of payment in the respective issuing countries, i.e. they are not valid in the entire euro zone. The number of mints is usually limited. The nominal values are arbitrary, only the nominal values of normal euro currency coins may not be used for collector coins. A special edition of the Vienna Philharmonic has the highest nominal value to date, at 100,000 euros .

On April 14, 2016, a 5 euro coin was issued in Germany as a collector's coin with a blue ring, initially in small numbers and only available in the branches of the Deutsche Bundesbank. It is also of great public interest because the new production technology aims to improve the security against counterfeiting and the acceptance of this new nominal value is eagerly awaited.

Banknotes

Euro banknotes are available in denominations of € 5, € 10, € 20, € 50, € 100, € 200 and € 500.

The euro banknotes of the first series were designed by the Austrian Robert Kalina after an EU-wide competition and are identical in all euro countries. The notes show various motifs on the themes of the age and architectural styles in Europe . The front sides show a window or a window front as a motif, the back sides each show a bridge . No real buildings are depicted, but the style features of the individual epochs have been incorporated into a typical illustration: Antiquity on the 5 euro note, Romanesque on the 10 euro note, Gothic on the 20 euro note, Renaissance on the 50-euro note, baroque and rococo on the 100-euro note, iron and glass architecture on the 200-euro note and modern architecture of the 20th century on the 500-euro note.

The development of the second generation of euro banknotes, designed by Reinhold Gerstetter , began in 2005 and has been successively introduced since 2013.

- A comparison of the banknote series

Origin of the euro banknotes

Until the end of 2002, the first letter of the serial number on the back of a euro note could be seen on behalf of which national central bank it was printed. Germany had been assigned the letter X in this system. Since 2003, each value has only been produced by a few national banks in the so-called "pooling system" and transported by the printing plants to the entire euro area. Each national bank specializes in a maximum of four denominations.

Today, the origin can only be determined with the help of the printer's code, which is located on the front of every note, in the case of banknotes of the second series on the right at the top of the picture. In the case of notes in the first series, the exact position varies depending on the value of the note; for example, on the 10-euro note it is in the star at the 8 o'clock position. The first letter indicates the printer in which it was printed. For example, the letter R stands for the Bundesdruckerei in Berlin. The printer's code consists of a letter, three digits, a letter and a number. See more in the article Euro banknotes .

Discussions about the cash

Request for 1 and 2 euro bills

Austria demanded the introduction of a 2-euro note, Italy even that of a 1-euro note. Before the introduction of the euro, banknotes with relatively low values were in circulation in both countries - for example the 20 Schilling note (1.45 euros) in Austria or the 1000 Lire note (52 cents) in Italy.

On November 18, 2004, the Governing Council decided not to introduce any lower denomination euro notes. They would have a value similar to the then rarely used 5 DM note (2.56 euros).

Abolition of 1 and 2 cent coins

In some euro countries, 1 and 2 cent coins are not used for cash payments and are only minted in small numbers for coin collectors. In Finland they were not even introduced as a means of payment; since then, invoices that do not end in -, - 0 or -, - 5 euros have been rounded to these amounts when paying. You can also pay with 1 or 2 cent coins; however, they are not given as change. Even before the introduction of the euro, the smallest denomination of the Finnish mark was not the 1 penny piece but the 10 penny piece and amounts were rounded accordingly. In the Netherlands (since September 1, 2004; accordingly also with the guilder after the abolition of the 1-cent coin) this system was adopted later - due to the low currency of such coins. Even Belgium relies on this practice since the beginning of December of 2019.

Above all, opponents of the abolition fear a second “ Teuro effect” because many individual prices could be rounded up to a full five cents. The objection, however, is that this would not happen because of the psychologically important threshold prices , which are then more likely to be reduced from - .99 to - .95. However, there are still goods-related threshold prices in Dutch and Finnish stores, which often end in - .99. Only the sum at the till is rounded up or down.

On May 14, 2013, the EU Commission made proposals for a reduction or abolition of the 1 and 2 cent coins. Currency Commissioner Olli Rehn stated that the production and issuance of these coins exceeded their value. At the same time, the central banks would have to issue a particularly large number of these coins. A total of 45.8 billion such tiny coins have been put into circulation in the past eleven years. The issuance of the small coins has cost the euro countries around 1.4 billion euros since the common currency was launched in 2002. The cost of the cent coins could be reduced by using a different mix of materials or a more efficient minting process.

Counterfeit security

Banknotes

The counterfeit security of the euro banknotes is highly regarded in international comparison. To ensure this, the notes are equipped with several security features. During production, fluorescent fibers and a central security thread are inserted into the banknote paper, which appears dark in backlight and bears the value as a microprint. In addition, the notes are made of cotton fibers, which give them a characteristic structure. Furthermore, parts of the motif are made with fluorescent paint so that the fibers and the motif glow under UV light. When using infrared light , the notes reflect in different colors. A watermark in the notes reveals the respective architectural motif and the value number against the light .

The see-through register in the upper left corner of the front of the banknote also allows the value number to appear against the light, together with the motif on the back. This happens because only parts of the value number are printed on the front and back, which only come together when viewed through. On the edge of the 5, 10 and 20 euro banknotes there is a continuous metalized film strip that, depending on the lighting angle, either lets the euro symbol or the respective value of the bill appear as a kinegram . The higher value euro bills from 50 euros have a positioned foil element at this point, which when the banknote is tilted in the form of a hologram - depending on the viewing angle - shows the respective architectural motif or the value.

By the printing process of the notes, an intaglio printing method combined with - as rainbow printing has been executed - indirect high pressure , is produced on the bill front page a tactile relief , the more difficult the forgery of banknotes and at the same time visually impaired simplifies the distinction of the banknotes. In addition, the images of the windows and gates and the abbreviations of the European Central Bank (BCE, ECB, EZB, Greek ΕΚΤ (Latin EKT), EKP) can be felt.

The bills of low value have a gold-transparent pearlescent stripe on the back , while for values from 50 euros the color of the value number varies when tilted ( OVI = optical variable ink ). In addition, the euro bills have machine-readable identifiers that guarantee an automatic verification of authenticity. A special feature is the so-called “ Counterfeit Deterrence System ” (CDS), which is supposed to prevent reproduction on copier or PC . The Deutsche Bundesbank generally recommends that you never concentrate on just one security feature, and at the same time points out that there are other security features that are not published.

Europe series

Mario Draghi (President of the European Central Bank ) presented a new 5-euro note on January 10, 2013 in Frankfurt as the first of a new series of banknotes called "Europe Series" . It has additional security features, e.g. For example, a watermark depicting the mythological figure of Europe , a security thread, a number “5” that changes from emerald green to deep blue when tilted, a shiny hologram stripe and tactile lines on the edges. The new banknote is coated with a protective varnish to increase its durability and therefore feels waxy and smooth. The old banknotes circulating in parallel are gradually being withdrawn from circulation and “ultimately lose their status as legal tender [...] but retain their value in the long run”. The five, the most intensely circulating euro banknote, has a shelf life of just under a year in the old version.

What is new is that in the Europa series, which was continued in 2014 with a new 10-euro note and in 2015 with a new 20-euro note, the currency is not only used in Latin and Greek notation ( EURO or EYPΩ ), but also in Cyrillic (ЕВРО), and nine instead of five acronyms for the European Central Bank appear. Bulgaria is the only EU member to use the Cyrillic alphabet.

Coins

Because of their lower value, euro coins are not as affected by counterfeiting as banknotes, but they too must be protected from counterfeiters. They have a certain size and a precisely defined mass. The one and two euro coins are designed in two colors using a combination of two metals . This and a complex, three-layer manufacturing process ensure that the coins are forgery-proof. The middle part of real one and two euro coins is slightly ferromagnetic , while the one, two and five cent coins are strongly ferromagnetic. The outer ring of the one and two euro coins, on the other hand, is not ferromagnetic, just like the other three euro coins. Since fake cent coins are often made of different metals than the real ones, they often create a false sound when falling on a table top. They also often leave a pencil-like trail when you rub them over a piece of paper.

Counterfeit coins

Up to 2007, 1 and 2 euro coins withdrawn from circulation were not defaced (by bending or flattening their surfaces) in Germany, but gutted, i.e. separated into ring and core and sorted according to type of material. Such sorted scrap was among others. sold to china. These coin parts are said to have been fraudulently reassembled mechanically on a large scale. These newly assembled coins were z. B. introduced to Germany by flight attendants, offered as damaged coins to the Bundesbank for return and accepted by them. 29 tons were affected in 263 transactions in three years, with a (damage) value of 6 million euros. This is little compared to almost 70,000 t of coin deposits at the Bundesbank per year and was therefore not noticed. After a year-long investigation, the case was publicized in April 2011 as pending court. The coin deliverers pretended that "the coins were incurred in China while processing garbage, junk cars and old clothes". Some of the coins had disintegrated into pieces, with one part the ring and core did not match according to origin, some gaps were optically translucent or had glue on them. A new EU regulation has been in effect since January 11, 2011, according to which only coins damaged by normal use can be exchanged. All others will be withdrawn without replacement.