Currency reforms in Austria

This article describes the currency reforms and changes in the history of Austria . From 1804 to 1866 it was the Austrian Empire , from 1867 to 1918 it was the Austro-Hungarian Dual Monarchy . From November 1918 the compilation concerns the state of German Austria , since autumn 1919 the Republic of Austria , which was enlarged by Burgenland in 1921 and belonged to the German Empire from 1938–1945 .

| Period | currency | abbreviation | Subdivision |

|---|---|---|---|

| since 1999 | Euro | € | 100 cents |

| 1945-1999 | Shilling | S, öS | 100 groschen |

| 1938-1945 | Reichsmark | RM , ℛℳ | 100 Reichspfennig |

| 1925-1938 | Shilling | S, öS | 100 groschen |

| 1892-1925 | Crown | K, kr | 100 lighter |

| 1858-1892 | gulden | F, Frt, Ft (Hungarian)

Fl (Latin) |

100 new cruisers |

| 1748-1858 | Convention thaler | cruiser | |

| 16th century - 1748 | Reichstaler | Rthlr. , Rthl. , rthl. , Thl. | |

| until the beginning of the 16th century | penny | Initially obol |

National bankruptcy in 1811

The Austrian bankruptcy of 1811 was the result of the disruption of the Austrian state finances during the Napoleonic Wars . The national debt had been realized mainly through paper money issued by the government . Austria had already issued the first paper money as early as 1762 during the Seven Years' War . In 1797, a compulsory rate was set in order to stop the ongoing price loss of the papers. During the coalition wars, the circulation of paper money was massively expanded. A first attempt to reduce the amount of paper money in circulation on so-called banco notes was the patent dated February 26, 1810. It offered in vain the voluntary exchange of the notes for redemption tickets , which in turn were to be repaid through a wealth tax . On February 20, 1811, the Austrian government formally declared bankruptcy and partially suspended payments. The banknotes were declared invalid on January 31, 1812. With the beginning of the Sixth Coalition War in the same year, however, Austria was already taking on debt again.

Currency reform 1816

In 1813 so-called anticipation certificates were issued again to finance the war in the amount of 45 million guilders . After the end of the Napoleonic Wars , which led to ongoing quasi-national bankruptcy, the newly founded National Bank withdrew the paper money it had issued in 1816. Gulden were spent instead, with a loss of around 90%. The Austrian National Bank now had a monopoly on the issue of banknotes , which led to a calming down in the Austrian monetary system and an increase in the value of paper money. The guilder, introduced in parallel to the makeshift Viennese currency , remained valid until 1900, while the Viennese currency only remained in circulation until 1857.

Currency conversion 1820 ff.

From 1820 the National Bank exchanged the Viennese currency at a ratio of 2.5: 1 for guilder convention coins. The course was based on the Coin Convention 1753; ten thalers were equivalent to 20 guilders. From 1822 onwards, a “Viennese currency main office” was opened for this purpose.

Currency conversion in 1858

In 1858 the value of the guilder was revalued by 5% and from then on it was referred to as the “guilder Austrian currency” to distinguish it. This took place on the basis of the Vienna Mint Treaty of 1858 , according to which 45 guilders should be minted from one pound of fine silver , and served the planned standardization of coins in the German Customs Union .

Currency conversion in 1892

In 1892 the guilder was replaced by the 100 Heller Krone . The conversion rate was two kroner for one guilder (→ gold crown ). The guilder was allowed to be used in parallel with the krona currency until 1900.

Currency reform 1924/25

The currency reform of the First Republic replaced the banknotes of the kroon currency from the Austro-Hungarian monarchy , which had been stamped with German Austria since 1919 . The Austrian krona, which lost a lot of its value due to the inflation after the First World War , was replaced by the 100 groschen shilling in accordance with the currency conversion law of December 20, 1924, effective March 1, 1925 . Originally, 100 Stüber planned as a currency. 10,000 Austrian crowns had to be exchanged for one schilling. The shilling, which was kept stable through appropriate currency policy , was colloquially known as the Alpine dollar .

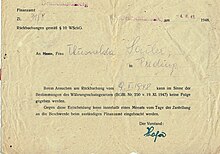

Currency reform 1938

After the “Anschluss” in 1938, the Schilling was exchanged at a rate of 1.5 Schilling for 1 Reichsmark, which was apparently favorable for the Austrians - with the simultaneous confiscation of the gold and foreign exchange treasure of the Austrian National Bank . As a result, the completely exhausted foreign exchange reserves of the National Socialist state could be replenished: 78.3 tons of fine gold worth 467.7 million schillings as well as foreign exchange and foreign currency worth 60.2 million schillings (based on the lower Berlin exchange rates) became the Reichsbank transferred to Berlin.

Currency changeover in 1945

After the end of the war, the schilling was reintroduced on November 30, 1945 and converted 1: 1 to the Reichsmark. But only 150 Reichsmarks per head were exchanged. The rest was kept in a blocked account . Currency exchange began on December 13th and ended on December 20th, 1945.

Currency reform 1947

On December 10, the two-week exchange period of the currency reform of 1947 began, during which the schilling was devalued to a third of its value, while part of the savings was siphoned off by the state to enable reconstruction. On presentation of their grocery purchase card , anyone could exchange 150 schillings for 150 new schillings; any amounts of money that went beyond this were exchanged at a ratio of 3: 1 in accordance with the Currency Protection Act of November 19, 1947.

However, the devaluation did not affect small coins. At that time, one, five and ten pfennig coins and the new 10 groschen coins were still in circulation, which for the time being retained their value because the state was unable to mint new coins. Before the changeover, this led to massive hoarding of these coins, since they retained their value in contrast to the larger denominations. Fifty groschen coins, one and two shilling coins were newly issued; the five and fifty shilling banknotes were similar to those used until 1938, the ten and one hundred shilling banknotes had a white border on the side with the note Second Edition .

This reform was a prerequisite for receiving funds from the Marshall Plan . Only the Soviet Union received an exchange rate of 1: 1.75 for its approval in the Allied Commission .

The prices of goods tripled in real terms overnight. Marianne Pollak , a member of the National Council at the time , of the Austrian Socialist Party , defended this in a radio lecture by stating that after all there was three times as much money as goods on the market and that people would thus be saved from inflation as in 1921. There was no resistance from the socialist side, although there were protests by communists .

The exchange period until December 24, 1947 was very short at two weeks, after which the old schilling was declared forfeited. The declared goal of the government was to primarily eliminate stocks of black money, which, as it put it, were primarily generated through rogue transactions.

The Lower Austrian diocese of St. Pölten asked the population to send these banknotes, which could not be redeemed for many, to the provost of the cathedral - also anonymously - in order, as the church newspaper said, to use the money for a good cause.

Euro changeover in 2002

The change from the shilling currency to the euro , which took place cashless in 1999 and for cash in 2002, was just a currency changeover . One euro was received for ATS 13.7603.

As of January 31, 2008, there were still 705.13 million euros in unexchanged schillings, including 290.73 million euros in coins and 264.29 million euros in banknotes, which had legal solvency at the time of the changeover to euros . You can exchange them with the Austrian National Bank without any time or amount limit . The exchange of banknotes with a value of 150.11 million euros that have already lost their legal solvency is limited in time. They could be exchanged for up to twenty years after they ceased to be legal tender.

Individual evidence

- ↑ II / 4 Viennese currency (WW) In: oenb.at .

- ^ Conventions coin in the Vienna History Wiki of the City of Vienna

- ↑ a b https://www.oenb.at/Ueber-Uns/Bankhistorisches-Archiv/Archivbestaende/II-4-Wiener-W-hrung--WW-.html

- ^ German monetary history before 1871 # Vienna Mint Treaty (1857)

- ↑ Again the Austrian Schilling currency . In: Arbeiter-Zeitung . Vienna December 2, 1945, p. 1 ( berufer-zeitung.at - the open online archive - digitized).

- ↑ § 4 para. 1 lit. b of the Currency Protection Act of November 19, 1947, ( Federal Law Gazette No. 250/1947 of December 9, 1947; PDF, 577 kB)

- ↑ The new schilling is here! In: Arbeiter-Zeitung . Vienna December 12, 1947, p. 3 ( berufer-zeitung.at - the open online archive - digitized).

- ^ The currency reform and women . In: Arbeiter-Zeitung . Vienna December 9, 1947, p. 2 ( berufer-zeitung.at - the open online archive - digitized).

- ↑ Better to burn than to pay taxes . In: Arbeiter-Zeitung . Vienna December 9, 1947, p. 3 ( berufer-zeitung.at - the open online archive - digitized).

See also

Web links

- From the shilling to the euro. (No longer available online.) Austrian National Bank, archived from the original on January 20, 2013 ; Retrieved April 10, 2016 .