yen

| yen | |

|---|---|

| Country: |

|

| Subdivision: | 100 Sen , 1000 Rin (historical) |

| ISO 4217 code : | JPY |

| Abbreviation: | ¥ (international), 円 (Japan) |

|

Exchange rate : (August 24, 2020) |

1 EUR = 125.26 JPY 1 CHF = 116.4 JPY |

The yen ( Japanese 円 en , literally round object ) has been the Japanese currency unit since July 1871. The international symbol for the yen is ¥ .

This was introduced in Japan with the minting of modern round coins in silver and gold. In addition to the US dollar and the euro , the yen is part of their own money reserves for currency stabilization in many countries. The yen is divided into Sen ( 銭 , 1 Yen = 100 Sen) and Rin ( 厘 , 1 Sen = 10 Rin), coins of both units were withdrawn from circulation in 1954. Today they are only of mathematical importance. In the Latin script, the currency symbol of the yen is represented by the character ¥ and in Japanese with the kanji 円 . The name for the ISO currency code is JPY and has the code number 392. After the end of World War II, the yen was pegged to the US dollar. Since 1973 when the Bretton Woods system collapsed, the yen has been released for and determined by the currency market. Currently, the yen exchange rate is around 106 yen to one US dollar and around 125 yen to the euro.

Pronunciation and etymology (word origin)

In Japanese, the currency is pronounced en , going back to the Chinese word 圓 , yuán - "round object". In China this character was abbreviated to the character 元 due to the same pronunciation , but the meaning is different. This can also be found on old Japanese coins, e.g. B. Copper coins from 1695. In Japanese, however , 元 is pronounced as gen , so this abbreviation was not used, but 円 instead .

In the 16th century the Japanese e ( エ ) and we ( ヱ ) were pronounced as [je] (see also Central Japanese language ). Portuguese missionaries also wrote or spelled it in this way at the time. In the mid-18th century, e / we were pronounced as [e], as in modern Japan, although some regions retained the pronunciation [je]. Walter Henry Medhurst (1796-1857) was an English missionary in China. Although he has never been to Japan, he interviewed some Japanese in Batavia . In his English-Japanese / Japanese-English Vocabulary Paperback (1830), Medhurst spelled some "e" s as "ye".

In the early Meiji period, James Curtis Hepburn , an American missionary and linguist in Japan, spelled all “e” s as “ye” in his Japanese and English language dictionary (1st edition 1867), following Medhurst. This was the first fully comprehensive Japanese-English / English-Japanese dictionary, which had a strong influence on western foreigners in Japan and most likely influenced the spelling "Yen" significantly. In the 3rd edition (1886), Hepburn replaced all “ye” s with “e” to reflect the contemporary pronunciation. The yen was an exception. This was probably already firmly anchored and has remained as such ever since.

history

Introduction of the yen

In 1871, the Yen was introduced as a currency by the Meiji government based on the European model. The government replaced the monetary system that was valid during the Edo period . The first currency reform in 1871 established the use of the decimal system . The decimal system or the decimal system divides the yen into 100 sen or 1000 rin. For the time being, both the gold and silver standards applied to the new Japanese currency. In most of the Asian countries, which are Japan's main trading partners, calculations were made in silver. The main trading coin of the time was the silver Mexican dollar . The silver coins were introduced in order to conduct trade with the countries along the Pacific Ocean that had adopted the silver standard. However, the United States and those European countries that could afford it switched to the gold standard in the course of 1873. Thus, in 1871 a golden yen coin was minted for the first time, which, unlike the silver coin, was only intended for national trade. According to the law, the value of a yen was set at 26.956 grams or 0.8667 troy ounces of silver . The yen coin was minted in a round shape based on western currencies.

The rise of the yen as an internationally traded currency

Weak starting position

The yen has been one of the strongest currencies in the world for several years.

In 1897 the gold standard was introduced in Japan, which, like in many other countries, had to be abandoned during the First World War . After the attempt to return to the gold standard failed in 1930, the gold standard was officially abolished the following year . The reason for the failure was on the one hand the stock market crash in 1929 and on the other hand the global economic crisis that followed .

After the Second World War, the monetary and financial system was as shattered as the Japanese economy itself. After a strong inflation process to which the Japanese currency suffered for a number of years, successful stabilization measures brought the yen back on track. In order to be able to function as a means of payment in an international context, one of the most important requirements is the convertibility of the currency. Convertibility is guaranteed if a currency has the property that it can be exchanged for other currencies without limitation by foreigners and residents.

The yen did not acquire convertibility until 1964, while the USD became convertible after the Second World War, and most Western European countries achieved this status as early as 1958. However, in the first years of interchangeability, the yen remained a neglected currency internationally. The reasons for this lay in their rigid organizational form and in the almost complete delimitation of the credit and monetary system from abroad, which left little room for mobility. This was expressed, for example, in the considerable stipulations of the business activities of banks abroad and the strict state controls of various interest and credit conditions.

As early as the beginning of the 1970s, foreign currency had to be resold to money dealers, postal savings banks or foreign trade banks within a month of their acquisition. Furthermore, these could also be used for private money transfers or trips abroad. These regulations were based on the foreign exchange regulations of the Foreign Exchange Control Board in 1950. These regulations were further developed in 1952 by the Ministry of Finance . In addition, there was the restriction that the banks were only allowed to use certain currencies in their foreign exchange operations, for example in May 1971. The following currencies were used here:

The starting conditions

At the beginning of the 1980s, Japan's economic and financial power was gaining ground. Japan made the leap into the international arena. There have been a number of actions and events that helped the yen to become a serious currency around the world. One of these measures was the accumulation of extensive currency reserves , which gave Japan the necessary maneuverability for activities abroad. Furthermore, the Japanese financial capital gained a foothold in the financial markets of other countries, which enabled Japan to develop a wide network of foreign branches of the Japanese banks. In the period from 1970 to 1983, the number of branches, foreign departments and representative offices of the Japanese banks rose from 85 to 400. At the beginning of 1984, intensive discussions between Japanese and American financial experts took place in the “ Yen Dollar Committee ” about the relationship and problems of the in both currencies. As a result of these discussions, Japan made decisions on the further implementation of free trade in the monetary system. Thus, in October 1984, the foreign financial institution received approval to trade in public securities. Only a year later, foreign trust banks were licensed in Japan. So to speak, the money and financial market of Japan was opened to foreign countries. Much progress has been made in the internationalization of the yen since then.

The undervalued yen

In 1971 the Japanese currency was severely undervalued. As a result, Japanese exports cost too little on the international market and imports from abroad were at the same time too price-intensive for the Japanese. This was reflected at the time in the foreign trade balance (there was a surplus of 5.8 billion US dollars in 1971). This belief that some major currencies, including the yen, were undervalued, prompted the United States to intervene in 1971.

The Japanese monetary authorities are cautious

From a comprehensive perspective, the yen has only made it into the group of international currencies with some delay. In addition, the positioning of the yen in the international currency system did not do justice to Japan's role as an economic and now also a financial power, which was largely due to the behavior of the Japanese monetary authorities. They had previously acted cautiously and cautiously and usually only agreed to open up measures under pressure. The increasing circulation of the yen abroad made it difficult to control it according to domestic economic requirements. Because of the very low level of interest rates in Japan by international standards, there were fears that capital outflows would be too great.

Bretton Woods Agreement

The Bretton Woods Agreement is the name of the international monetary system of fixed exchange rates that was reorganized after the Second World War, which was determined by the key currency, the gold-backed US dollar. The American Central Bank committed itself to converting its currency into gold at any time (35 dollars / ounce). The aim of this agreement was to stabilize the exchange rates between the currencies. This should have a stimulating effect on the economy, with the International Monetary Fund and the World Bank playing a major role in achieving this goal.

After an unstable period in 1949, the exchange rate was set at 360 yen for 1 US dollar. The determination was made within the framework of the “Bretton Woods System” on the basis of a US plan to stabilize the price level on the Japanese domestic market.

As long as the foreign trade surplus in the United States was large and the dollar was scarce as a result, the Bretton Woods Agreement worked. With the increase in the amount of dollars circulating outside the country, the gold cover decreased accordingly, with the consequence of a steady increase in the risk of inflation.

An appreciation of the yen was first considered in 1968, then intensified in 1969 after the appreciation of the German mark against the US dollar. The pressure to revalue came from the USA , which despite the need to devalue the dollar, wanted to stick to the gold parity of its currency and let the other currencies appreciate. The Japanese government refused, however, because the Japanese currency reserves were small and the integration into the world economy had not yet been completed.

The yen's exchange rate was fixed until 1971, when the US abandoned the gold standard and President Nixon canceled the obligations under the Bretton Woods Agreement on August 15, 1971. Until 1971 the exchange rate was 360: 1, in 1972 one US dollar was valued at 308 yen. To rebuild the world economy after the end of the Second World War, many loans flowed from the USA to Europe. The consequent sharp devaluation of the dollar led to the collapse of the system of fixed exchange rates and the abandonment of the gold standard because the United States no longer had sufficient gold reserves . In 1973 the Bretton Woods Agreement was finally repealed. Exchange rates were then released in most countries.

Smithsonian Agreement

On December 18, 1971, an agreement was signed between the ten most important western industrialized nations to begin consultations on the reorganization of global economic relations and on immediate measures to overcome the crisis in the global currency order. These immediate measures included the setting of new central rates or parities in a collective realignment, the depreciation of the dollar against gold (devaluation by 7.89% to 38 dollars per gold troy ounce), and against the currencies of the most important industrial nations by an average of 9 %, as well as the bandwidth expansion from ± 1% to ± 2.25%. This agreement has ceased to exist since March 1973. The system of fixed exchange rates was abandoned and replaced by the system of flexible exchange rates against the US dollar. The Washington conference building of the same name coined the name Smithsonian .

The yen in the currency markets

In order to be able to assess a currency, the external value, i.e. the exchange rate, is also of great importance. The development of a currency rate depends on many different factors. In general, the exchange rate development is indirectly or directly related to the overall economic development of the respective country. The rate of the currency is a kind of mirror image of this. Currently, the exchange rates are mainly determined by supply and demand on the foreign exchange markets , which also applies without restriction to the yen. The Japanese government also intervened on the foreign exchange market. In the 1970s, this government and businessmen were very concerned that the appreciation of the yen would hurt export growth by making Japanese products less competitive and damaging the industrial base. As a result, the Japanese government continued to intervene in the foreign exchange market by buying or selling US dollars , even after the 1973 decision to release the yen. Despite the intervention, market pressure caused the yen to appreciate further. The high was 271 yen per US dollar until the impact of the 1973 oil crisis made itself felt. The increased cost of imported oil caused the yen to devalue to 290 to 300 yen between 1974 and 1976. The trade surpluses brought the Japanese currency back to 211 yen in 1978. This strengthening of the currency was again undone by the second oil crisis in 1979. By 1980 the yen had fallen to 227 yen per dollar.

The yen in the early 1980s

Despite a positive trade balance, the yen failed to appreciate in the first half of the 1980s. The average value of 222 yen in 1981 fell to 239 in 1985. The rise in the trade balance created greater demand for the yen in the foreign exchange market. However, trade-related yen demand was offset by other factors. The large difference in interest rates between the US and Japan, with the US having very high interest rates compared to Japan, and the ongoing efforts to deregulate the flow of capital, resulted in an enormous outflow of capital from Japan. This increased the yen supply on the currency markets. Japanese investors exchanged their yen for other currencies (mostly dollars) to invest overseas. As a result, the yen remained weak against the dollar, fueling the sharp rise in Japan's trade surplus in the 1980s.

The Impact of the Plaza Agreement

In 1985 a profound change began. On September 22, 1985, the representatives of the G-5 countries ( USA , France , Great Britain , West Germany and Japan) passed the “ Plaza Agreement ” in the Plaza Hotel New York . The aim of this agreement was to achieve a depreciation of the dollar against the yen. This should be implemented through a controlled influence on the international currency markets. Over the next two years, the yen rose in value against the US dollar, peaking at 128 yen per dollar in 1988. This almost doubled its value. The rapid appreciation of the yen led both international investors and the Japanese themselves to invest large amounts of capital in Japanese real estate and stocks. The continuous appreciation of the yen could not be stopped by the Louvre Agreement passed in September 1987 , which aimed to stabilize the exchange rate. Japan was in the midst of a bubble economy . In 1990 the bubble burst and had dire consequences. The real estate and stock markets lost significantly in value. Large banks and insurers filed for bankruptcy and the yen fell. In 1995, however, it hit a new high of 80 yen per dollar.

The years after the speculative bubble burst

The yen depreciated during the real estate bubble. This decline in value continued even after the bubble burst, reaching a low of 134 yen per dollar in February 2002. The Bank of Japan's zero interest rate policy led to an investment decline in the yen.

Many investors took out yen currency loans and invested the money they received in other currencies with higher interest rates. For example, many investors invested the yen currency loans, which had an interest rate of around 0.5%, in the USA, which had comparatively very high interest rates (4%) ( currency carry trade ). This kept the yen rather low against other currencies. The volume of these transactions is estimated at around one trillion dollars. The Economist wrote in February 2007 that the yen is 15% undervalued against the dollar and 40% against the euro. By February 2008, the yen had rallied, reaching 90 yen per dollar.

Aggressive monetary policy and economic stimulus plan 2013

As the third largest economy in the world ( GDP : 5,981 billion US dollars (2012)), with a high level of dependency on exports, the country's economic growth has been below average worldwide for decades, with deflationary tendencies. According to the government in Tokyo, gross domestic product (GDP) fell in the fourth quarter of 2012 by 0.1 percentage points. It was the third break-in in a row. Government circles in Tokyo see an overly strong yen as the main factor behind the poor economy.

Japan's Prime Minister Shinzo Abe therefore announced an ambitious economic stimulus program in January 2013, the sources of which are to be fed by the monetary policy of the Japanese central bank ( Bank of Japan ). 20.2 trillion yen (169 billion euros), more than half of Austria's annual economic power, should be put into the economy as quickly as possible. This high volume is in fact achieved thanks to the Bank of Japan's extremely low key interest rate - the key monetary policy rate is close to zero (target range: 0 to 0.1%). The at least legally independent central bank has responded to the government's explicit call for an inflation target of two percent (previously 1%). And until this goal is achieved, the central bank will buy Japanese government bonds without restriction. According to the Bank of Japan, the securities program has a volume of 101 trillion yen.

As a result of the measures taken by the central bank, the yen fell to a temporary two-and-a-half year low in mid-February 2013. One dollar rose to 89.61 yen, representing a 12% drop in the yen in just three months. As early as 2012, the yen fell 15% against ten major world currencies - as much as it has not since 1979 (according to a Bloomberg index).

Among the central bankers and the G7 governments, this aggressive monetary policy of the Bank of Japan, aimed at the rapid and strong devaluation of the yen, is known as a currency war , the effects of which on the Japanese economy could only be of a short-term nature, increasing stock speculation and betting on the yen currency , but could induce other central banks (e.g. the Fed in the USA) to devalue their currencies ( devaluation race ).

Output form

Coins

The coins were introduced in 1870. There were silver coins in the versions 5, 10, 20 and 50 sen, 1 yen, as well as gold coins in the value of 2, 5, 10 and 20 yen. The 1 yen gold coin was introduced in 1871. In 1873 copper coins with the expressions 1 Rin followed; ½, 1 and 2 sen. In 1889 a copper nickel coin of 5 sen was introduced. In 1897, the 1 yen silver coin was withdrawn from circulation and the sizes of the gold coins were reduced by 50%, issued as 5, 10 and 20 yen coins.

In 1920, the 20-sen cupronickel coin was introduced. In 1938 the production of silver coins was stopped. During the Second World War, less noble metal mixtures were used instead of silver to produce 1, 5 and 10 sen coins. In 1945, 5 and 10 sen coins were made from clay, but not put into circulation. After the war, 1, 5, and 50 yen brass coins were produced and introduced between 1946 and 1948. In 1949 today's 5-yen coin type, which is characterized by a hole in the middle of the coin, was introduced. In 1951, the 10 yen bronze coin was introduced. This type of coin is still in circulation today.

Coins with a face value less than 1 yen expired in late 1953. In 1955 the still valid 1-yen aluminum coin and the non-perforated 50-yen nickel coin were introduced. In 1957, the 100 yen silver coin was put into circulation. These were replaced in 1967 by today's cupronickel coin, along with the perforated 50 yen coin. In 1982 the first 500 yen coin was introduced. The date, expressed as the year of the reign of the current emperor, is on the reverse of all coins. The name of the country and the value in Kanji are in most cases shown on the face of the coins. The current 5 yen coin is an exception. Here is the name on the back.

The 500 yen coin is the most valuable coin in circulation alongside the Swiss 5 franc coin. A 500 yen coin is worth around 3.99 euros or 4.3 Swiss francs. Because of its value, the 500 yen coin was popular with coin counterfeiters. The high proportion of counterfeits ultimately led to a new coin being issued in 2000 with a range of security features. Even so, counterfeiting of the 500 yen coin has not yet been stopped.

Commemorative coins are minted on numerous occasions. Often gold and silver are used for these coins, the face value of the coins is up to 100,000 yen. The first commemorative coins were issued on the occasion of the 1964 Summer Olympics with a face value of 100 and 1000 yen. Although these can also be used as a means of payment, they are usually only viewed as collector's items and are therefore not in circulation.

In contrast to coins from other countries, the yen does not show the year of issue according to the Gregorian calendar , but the year of the current imperial rule. B. the date Heisei 21, corresponding to the 21st year of the reign of Emperor Akihito .

The coins are easy to distinguish for the visually impaired.

| Face value | front | back | motive | material | Weight | diameter | thickness | edge | First issue |

|---|---|---|---|---|---|---|---|---|---|

| 1 ¥ |

|

|

Young tree | 100% Al | 1 g | 20 mm | 1.2 mm | smooth | 1955 |

| 5 ¥ |

|

|

Rice ear, water wheel, water | 60-70% Cu 30-40% Zn |

3.75 g | 22 mm | 1.5 mm | smooth | 1949 |

| 10 ¥ |

|

|

Phoenix Hall of the Byōdō-in | 95% Cu 3-4% Zn 1-2% Sn |

4.5 g | 23.5 mm | 1.5 mm | corrugated | 1951 |

| smooth | 1959 | ||||||||

| 50 ¥ |

|

|

Chrysanthemums | 75% Cu 25% Ni |

4 g | 21 mm | 1.7 mm | corrugated | 1967 |

| 100 yen |

|

|

Cherry blossoms | 75% Cu 25% Ni |

4.8 g | 22.6 mm | 1.7 mm | corrugated | 1967 |

| 500 yen |

|

|

Paulownia | 72% Cu 20% Zn 8% Ni |

7 g | 26.5 mm | 2.0 mm | Label "Nippon 500" (until 1999) / diagonally corrugated (from 2000) |

1982 |

Banknotes

Banknotes in circulation

The first yen banknotes were printed in 1872 by the C. Naumann printing company in Frankfurt am Main. Until the founding of the Japanese central bank in 1882, which has the sole authorization to issue banknotes to this day, the banknotes were issued by a total of 153 national banks.

The current E series, released November 1, 2004, consists of 1,000 yen, 2,000 yen, 5,000 yen, and 10,000 yen. The 2000 yen banknote is rare.

| Face value | front | back | Portrait / subject | format | |

|---|---|---|---|---|---|

| front | back | ||||

| 1000 ¥ |

|

|

Noguchi Hideyo | Fuji and cherry blossoms | 76 mm × 150 mm |

| 2000 ¥ |

|

|

Shurei-mon | Genji Monogatari | 76 mm × 154 mm |

| 5000 yen |

|

|

Higuchi Ichiyō | Ogata Kōrins Kakitsubata-zu | 76 mm × 156 mm |

| 10,000 yen |

|

|

Fukuzawa Yukichi | Byōdō-in phoenix | 76 mm × 160 mm |

Banknotes suspended

Two years after the currency was introduced, the first issue of yen banknotes began in 1872. Throughout its history, face values have existed between 10 and 10,000 yen.

Before and during the Second World War, there were various institutions that issued the yen banknotes, e.g. B. the Ministry of Finance and the Imperial National Bank . Shortly after the war, the Allies also issued some banknotes. Since then, the Bank of Japan has held the banknote monopoly. Since the Second World War, the "Bank of Japan" published five series of notes.

| Face value | front | back | motive | format | First edition |

|---|---|---|---|---|---|

| 1 ¥ |

|

|

Ninomiya Sontoku | 68 mm × 124 mm | March 1946 |

| 5 ¥ |

|

|

Guilloche | 68 mm × 132 mm | March 1946 |

| 10 ¥ |

|

|

Parliament building | 76 mm × 140 mm | February 1946 |

| 50 ¥ |

|

Takahashi Korekiyo | 68 mm × 144 mm | December 1951 | |

| 100 yen |

|

|

Itagaki Taisuke | 76 mm × 148 mm | December 1953 |

| 500 yen |

|

Iwakura Tomomi | 72 mm × 153 mm | November 1969 | |

| 1000 ¥ (Series D) |

|

|

Natsume Soseki | 76 mm × 150 mm | November 1, 1984 |

| 2000 ¥ (Series D) |

|

|

Shurei-mon | 76 mm × 154 mm | July 19, 2000 |

| 5000 ¥ (Series D) |

|

|

Nitobe Inazō | 76 mm × 155 mm | November 1, 1984 |

| 10,000 yen (Series D) |

|

|

Fukuzawa Yukichi | 76 mm × 160 mm | December 1, 1993 (for serial number in brown) |

| 10,000 yen (Series C) |

|

|

Shōtoku Taishi | 84 mm × 174 mm | December 1958 |

Note: The red inscription み ほ ん (in Hiragana ) or 見 本 (in Kanji ), both mihon , stands for "pattern".

Occupation marks

During the Second World War, so-called occupation notes were issued by the Japanese government. These first appeared in 1942. These occupation notes were used in many countries in Southeast Asia. At the time, these were subject to the laws of the Japanese government; these banknotes are no longer valid today. Such banknotes exist from the following countries:

- Dutch East Indies (values of ½, 1, 5, 10, 100 and 1000 Roepiah, ½, 1, 5 and 10 guilders, as well as 1, 5 and 10 cents)

- Malaysia (values of 1, 5, 10, 100 and 1000 dollars, as well as 1, 5, 10 and 50 cents)

- Philippines (values of 1, 5, 10, 100, 500 and 1000 Peso as well as 1, 5, 10 and 50 Centavo)

- Burma (values of ¼, ½, 1, 5, 10 and 100 rupees, as well as 1, 5 and 10 cents)

- Oceania (values at 1 pound)

In some cases, there are different versions of the homogeneous values, which is mainly due to the regional differences within the states.

Military money

From the Russo-Japanese War (1904/05), the Japanese government issued military money for use by soldiers in the war and occupied areas. In Manchuko in 1931/45, in China in 1937/45 and in the Pacific War in 1941/45, this military currency was valid parallel to the civil currency in circulation, in Japanese-occupied Hong Kong it was even the only valid currency. On September 6, 1945, all military money was invalidated by the Japanese Ministry of Finance .

Fakes

While the yen coins changed little over time, the older banknote series were repeatedly replaced by new ones. This is mainly due to the fact that the yen notes were relatively easy to forge at the time, which led to chaos and unrest on the capital market. The optimization of the protection against forgery of new banknotes was often only insignificant in the past. As a result, the banknote series current at the time had to be replaced by new ones after just a few years. Most recently, the new E series of yen banknotes was put into circulation in 2004, which experts believe to be largely forgery-proof. Despite all this, Japan still has the largest number of counterfeit banknotes in the world.

With the introduction of the E series and with it the new banknotes and security features, the counterfeit rate has fallen sharply.

Security features of the banknotes

According to a report dated August 23, 2004 by the Japanese central bank, the currently valid banknotes were issued on November 1, 2004. The newly introduced E-series has special safety features, which are explained using the following table.

|

|

| Overview of security features 1000 yen | |

|---|---|

|

|

| Overview of security features 5000 yen | |

|---|---|

|

|

| Overview of security features 10,000 yen | |

|---|---|

The use of new methods for creating the security features made it possible for the first time that visually impaired people can distinguish banknotes using keys. Until then, it was only possible to differentiate between values for coins.

Criteria for exchanging damaged banknotes

The bank replaces damaged banknotes with new banknotes. This is divided according to the criteria of the degree of damage. It is assumed here that both sides of the banknote are preserved. The owner can take the damaged banknote to the head office of the bank or a branch. The same criteria apply for exchanging burnt banknotes, provided that the remaining ash can be proven to belong to a banknote.

If two thirds or more of the original note are left over from a damaged bank note, it will be exchanged at its full face value. A damaged bank note in which two fifths or more of the original note are retained, but less than two thirds of the original, will only be replaced at half the face value. A damaged banknote that is less than two fifths of the original bill is completely worthless and will not be replaced.

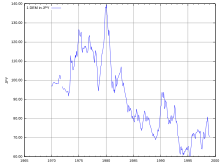

External value of the yen

|

|

|

|

|

|

|

|

The yen as a reserve currency

| 1970 | 1980 | 1990 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD | 77.2 | 67.2 | 62.8 | 70.5 | 70.7 | 66.5 | 65.8 | 65.9 | 66.4 | 65.5 | 64.1 | 64.1 | 62.1 | 61.8 | 62.2 | 61.2 | 61.0 | 63.3 | 64.1 | 63.9 | 62.7 | 61.7 | 60.9 | |||||||

| EUR | - | - | - | - | 17.9 | 24.2 | 25.3 | 24.9 | 24.3 | 25.1 | 26.3 | 26.4 | 27.6 | 26.0 | 25.0 | 24.2 | 24.4 | 21.9 | 19.7 | 19.7 | 20.2 | 20.7 | 20.6 | |||||||

| DEM | 1.9 | 14.8 | 19.8 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||

| JPY | - | 0.1 | 4.6 | 9.4 | 5.2 | 4.5 | 4.1 | 3.9 | 3.7 | 3.1 | 2.9 | 3.1 | 2.9 | 3.7 | 3.5 | 4.0 | 3.8 | 3.9 | 4.0 | 4.2 | 4.9 | 5.2 | 5.7 | |||||||

| GBP | 10.4 | 2.9 | 2.4 | 2.8 | 2.7 | 2.9 | 2.6 | 3.3 | 3.6 | 4.4 | 4.7 | 4.0 | 4.3 | 3.9 | 3.8 | 4.0 | 4.0 | 3.8 | 4.9 | 4.4 | 4.5 | 4.4 | 4.6 | |||||||

| FRF | 1.1 | 1.7 | 2.7 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||

| CHF | 0.7 | 3.2 | 0.8 | 0.3 | 0.3 | 0.4 | 0.2 | 0.2 | 0.1 | 0.2 | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.3 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 0.2 | |||||||

| other | 8.7 | 5.9 | 4.9 | 1.4 | 1.2 | 1.4 | 1.9 | 1.8 | 1.9 | 1.8 | 1.8 | 2.2 | 3.1 | 4.4 | 5.3 | 5.8 | 6.5 | 6.8 | 6.7 | 7.6 | 7.6 | 7.8 | 8.0 | |||||||

|

Sources: |

||||||||||||||||||||||||||||||

The use as reserve currency is another important point at which the extent of the internationalization of a currency can be quantified. A currency that can be used internationally due to its interchangeability and its strength is traded by the foreign central banks as a world money reserve. The reserves of a currency serve the worldwide liquidity (solvency) of a country. Such currency reserves are always based on the amalgamation of currencies from different countries. The yen achieved this status of a currency reserve in the 1980s. After the yen was completely insignificant in the 1960s, it quickly developed into the world's third most important reserve currency. However, if you compare it to the US dollar, it is still not a large amount in quantitative terms. While the dollar accounted for almost two thirds of all currency reserves in international banks in 1990, the yen accounted for just 6 to 8% and the D-mark for 12 to 14%. The extent of use of a currency used abroad as a reserve medium also depends to a certain extent on the monetary policy will and the currency policy of the country concerned. It should be said here that the Japanese are generally very cautious and cautious in their actions.

The yen's inflation rate in direct comparison to the US dollar

After a very high rate of price increase in the mid-1970s, Japan pursued a strict anti-inflation policy and thus pushed the inflation rate in Japan below the rate of inflation in the United States. In the United States, the inflation rate was 4.7% per year between 1979 and 1993. The Japanese rate of inflation during this period was significantly lower at an average of 2.3% per year.

Currency symbols

- ¥ : (Unicode: U + 00A5) international symbol yen

- 円 : (Unicode: U + 5186) Japanese symbol for yen, pronounced en in Japan

- 圓 : (Unicode: U + 5713) older symbol for en , which corresponds to the South Korean won or the North Korean won and the Taiwan dollar . It is only used when special tradition and accuracy are to be conveyed, e.g. B. on bank documents and check forms .

- 銭 : (Unicode: U + 92AD) Sen

- 厘 : (Unicode: U + 5398) Rin

Web links

- Chart: yen in euros

- Banknotes and Coins ( Memento from December 31, 2010 in the Internet Archive )

- Short Essays on Monetary History Contained in Monetary and Economic Studies ( Memento of May 2, 2012 in the Internet Archive )

- Japanese coins catalog with images (Engl.)

Individual evidence

- ↑ Professor Dr. Erich Thiess, series of publications by the Institute for Banking and Credit Management at the Free University of Berlin, structural analyzes of foreign banking systems: Japan, 1971, p. 8

- ↑ lexas.net ( Memento of May 7, 2010 in the Internet Archive ), accessed on November 20, 2009

- ↑ "Yen" , finanz-lexikon.de, accessed on 19 November 2009

- ^ "Money Museum, Silver and Gold Standard" ( Memento from January 23, 2010 in the Internet Archive ), accessed on November 26, 2009

- ↑ "Japanese Yen General Overview", accessed on November 21, 2009 ( memo of November 26, 2009 in the Internet Archive )

- ↑ "black friday", accessed on 1 December 2009

- ↑ a b Stock exchange history. Retrieved November 30, 2009 ( Memento December 6, 2008 in the Internet Archive )

- ↑ Klaus Kolloch, The Rise of the Yen, Currency and Banks of Japan, 1990, pp. 56f

- ^ "Yen-Dollar-Adhoc-Committee", accessed on November 20, 2009 ( Memento from May 30, 2011 in the Internet Archive )

- ↑ Klaus Kolloch, The Rise of the Yen, Currency and Banks of Japan, 1990, p. 57f

- ↑ Klaus Kolloch: The rise of the yen, currency and banks of Japan , 1990, p. 58

- ^ "Bretton Woods Conference"

- ↑ ( page no longer available , search in web archives )

- ↑ “Bretton Woods System,” accessed November 21, 2009

- ^ "Smithsonian Agreement", accessed November 21, 2009

- ↑ Klaus Kolloch: The rise of the yen, currency and banks of Japan , 1990, p. 66 f.

- ↑ Klaus Kolloch: The rise of the yen, currency and banks of Japan , 1990, p. 69

- ↑ World Economic Outlook Database, October 2012 of the International Monetary Fund , characteristics NGDPD and NGDP_RPCH

- ↑ Jens Weidmann according to Handelsblatt January 23, 2013 "Weidmann worries about Japan"

- ↑ Martin Hock, faz.net , January 30, 2013: "When will Japan run out of debt?"

- ↑ Martin Lanz, nzz.ch , January 31, 2013: "Much ado about the« currency war »"

- ↑ a b "Coins", accessed on November 21, 2009 ( Memento from December 31, 2010 in the Internet Archive )

- ^ Yen coin “Open online numismatic encyclopedia, accessed November 20, 2009

- ^ "Coins", accessed on November 21, 2009

- ↑ Coins Presently Minted ( Memento from October 18, 2009 in the Internet Archive )

- ^ History of Japanese Currencies ( Memento of February 12, 2010 in the Internet Archive )

- ↑ a b Outline of Banknotes and Coins (English) ( Memento from December 1, 2010 in the Internet Archive )

- ↑ This banknote was introduced in an ad hoc campaign on the occasion of the G9 summit meeting in Okinawa in 2000 (the gate to Shuri Castle in Naha is shown).

- ^ "Occupation Notes" Open Numismatic Online Lexicon, accessed on November 20, 2009

- ↑ Bankenmagazin_2007_3.pdf, p. 9

- ↑ a b Security Features of the New Bank of Japan Notes (English) ( Memento from November 19, 2009 in the Internet Archive )

- ↑ Criteria for Exchange of Damaged Banknotes (English) ( Memento from July 17, 2009 in the Internet Archive )

- ↑ to 2008: “Exchange Rates to USD”, accessed November 20, 2009

- ↑ from 2009: Internal Revenue Service : Yearly Average Currency Exchange Rates: Translating foreign currency into US dollars. Retrieved March 4, 2020 .

- ^ "Exchange rates for the German Mark", accessed on March 24, 2014

- ↑ "Euro reference rate of the ECB", accessed on March 4, 2020

- ↑ Klaus Kolloch, The Rise of the Yen, Currency and Banks of Japan. "Reserve currency" 1990, p. 62f

- ↑ Krugman and Obstfeld, Internationale Wirtschaft, Theory and Politics of Foreign Trade 2003, 6th edition, p. 540

- ↑ “The Theory of Balassa and Samuelson”, p. 4 (PDF; 448 kB) ( Memento of the original from January 18, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.