Emerging market

An emerging country is a country that is traditionally still counted among the developing countries , but no longer has their typical characteristics. Therefore, such a country is conceptually separated from the developing countries.

The English term Newly Industrializing Economies originated in the 1970s and originally referred to the Asian tiger states . Occasionally such a country is also referred to as a “ take-off country ” because it has overcome the typical structural features of a developing country and is about to stand out from this group.

According to this definition, an emerging country is at the beginning or in an advanced process of industrialization , as measured by economic development indicators . At this stage, an emerging country is characterized by an extensive restructuring of its economic structures, leading from agriculture to industrialization. Emerging countries are usually characterized by a strong contrast between rich and poor. Differences between conservative forces and parties that want to achieve modernization often lead to tension.

In the German-speaking area, too, rapid industrialization is usually mentioned as a characteristic of the emerging countries. However, in some cases their economic structures are no longer characterized by the dominance of industrial production , but by rapidly growing service sectors . That is why there are more correct long names such as important industrialized and developing economies today .

So far, no emerging country has achieved the status of an industrialized country without a profound financial crisis.

The social development indicators of the emerging countries such as literacy rate , infant mortality , development of a civil society or protection of the environment often lag behind economic progress, but life expectancy is increasing as a result of improved access to medical care.

features

There is no binding definition of the characteristics of emerging markets. An emerging country usually has the following economic successes:

- Above-average growth rates are achieved, which in some cases significantly exceed the growth rates of the OWCE countries.

- At least in some segments, the federal states are developing the broad and deep structure of the manufacturing industry through to the manufacture of capital goods and, through targeted investments in material and social infrastructure , especially in the formation of human capital , create the prerequisites for leaps in development.

- Labor productivity is comparable to that of the OWCE countries, but with a significantly lower wage level.

- Emerging countries use niches in the world market and rely on the export of finished goods - but often also raw materials, for example Indonesia and South Africa. Depending on the definition, some predominantly oil exporting countries such as Saudi Arabia are also counted among the emerging countries.

- The average per capita income is growing rapidly. A broad middle class is emerging.

The example of the state of Singapore (which is surrounded by emerging countries) can be used to illustrate typical characteristics of emerging countries. Singapore attracts long-term major investments B. in malls, chemical plants or refineries because it has more to offer than money, land and tax breaks: Qualified workers, political predictability, security, protection of intellectual property, little corruption and a high quality of life. All of this leaves something to be desired in emerging markets. Rapid population growth is considered to be a cause of tension and problems.

Many currencies of emerging countries are characterized by high inflation and by strong exchange rate fluctuations against the major world currencies.

List of countries

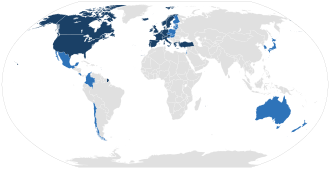

Various institutions (for example the World Bank , OWZE , IMF and EC ) have drawn up lists of emerging countries over the past few decades. There is no binding list of the emerging economies, their number varies between 10 and 55 depending on the list. There is also no binding translation into English; There are several English terms that can be translated as 'emerging country' ( emerging nation , newly industrializing country , threshold country , emerging market ).

There is a lack of generally applicable, measurable and accepted standards. The World Bank categorizes 55 countries as 'emerging economies' ( upper-middle-income economies ), including South Africa , Mexico , Brazil , Malaysia , Ukraine , Russia and Turkey . The International Monetary Fund (IMF) categorizes 150 countries as ' emerging and developing economies' , including South Africa, Mexico, Brazil, Pakistan , the People's Republic of China , India , the Philippines , Thailand , Malaysia, Ethiopia , Hungary , Poland , Lithuania , Ukraine, Russia and Turkey.

The BRICS countries and the MIST countries (a term coined by Jim O'Neill for Mexico, Indonesia , South Korea and Turkey, coined analogously to the BRICS countries ) are often referred to collectively as emerging countries.

The Federal Ministry for Economic Cooperation and Development (BMZ) and the European Union made a joint attempt to implement social and political indicators to identify emerging countries. The attempt was rejected at international level. The BMZ then withdrew its list of 30 emerging countries, which also included Ecuador and Nicaragua .

Emerging markets

Economists and investors called emerging countries as emerging markets (English emerging markets ). Depending on the point of view, this means the entire economy in the emerging market or just a sub-area such as the sales market or the stock market. Characteristics of the emerging markets are the high growth dynamics due to catching up industrialization and / or high raw material exports, high returns and high investments. This investment boom and the catching up industrialization of the emerging countries dampened the consequences of the financial crisis for the real economy (especially for the capital goods industry) in the USA and Europe during the 2008–2010 crisis. In 2014 it became apparent that this dynamic has its limits and that China in particular will no longer serve as the “locomotive of the world economy” in the long term. After the boom has subsided, the second row, the so-called "Frontier Markets", moves into the center of interest among investors. These include, for example, Vietnam , Bangladesh and many African countries.

Growth models and state intervention

The IMF recommends that the emerging economies withdraw from the economy in order to make room for the private sector. The competition would force companies to innovate more and thus make them more competitive. The British author and business journalist Joe Studwell criticizes this policy in his book How Asia Works . Countries that would have followed the IMF's recommendations - such as the Philippines, Thailand and Indonesia - are now facing economic problems because they liberalized their markets and cut subsidies far too early. China (1978), Taiwan and South Korea carried out land reform and divided the land, although the IMF considered large farms to be more effective, and thus successfully reduced their food imports, introduced strict financial controls, implemented protectionism, paid subsidies to dynamic exporters and thus to domestic entrepreneurs Air to breathe until they and especially the new industries became competitive (so-called “ infant industry protection ”). However, these subsidies were linked to the achievement of export surpluses. Studwell, however, criticizes the activity of the sovereign wealth funds z. B. in Malaysia; it is more nation building than a competitive industry. China, on the other hand, has neglected its domestic consumption in favor of generating export surpluses.

Critics of the neoclassical development model point out that, apart from Hong Kong, there has been no emerging country that has developed successfully without state intervention. Neoclassical criticism of development policy focuses on finding mistakes and suppressing successes. Taiwan's success, which she often cited, was due to the opening of the markets; but Taiwan is an example of a determined industrial policy through import substitution and export promotion as well as sectoral interventions and a high state share in industrial companies.

Debt crises in emerging countries

American tax and financial policy under Ronald Reagan led since 1979 to considerable inflation-related increases in interest rates and a rise in the dollar exchange rate. This caused difficulties around the world for many banks and economies that had borrowed heavily in dollars at variable interest rates in the 1960s and 1970s because they had to revalue their liabilities in domestic currency. The rise in US interest rates also led to capital flight from the emerging markets, and the devaluation of domestic currencies to inflation. In August 1982 Mexico - at that time the second largest debtor country in the world - could no longer pay its interest, shortly afterwards Brazil, Argentina and Venezuela followed. This crisis was the first to shake the entire financial world. The state structures of these countries were completely deformed by the new "debt service economy" (maximizing exports, reducing imports, cuts in social benefits) under pressure from the World Bank and IMF; incomes fell for years.

- See also Latin American debt crisis

Since the late 1990s, there have also been more frequent debt crises in the emerging countries, starting with the 1997/98 Asian crisis in Thailand, which spread to Indonesia, South Korea and other countries in Southeast Asia, and the crises in Latin America in the 1990s and 2000s ( especially the renewed Argentina crisis 1998–2002). The starting point of these regional crises was the indebtedness of many companies and the state in foreign currencies with the aim of financing growth on credit. With interest rate hikes in the countries in whose currency the debt was taken out (mostly US dollars), debt repayments in foreign currencies became more difficult or governments and banks even went into insolvency , with the crises affecting the real economy and the labor market their consequences were often felt for years.

The renewed US dollar indebtedness of the emerging markets at the beginning of the 21st century was encouraged by post-September 11, 2001 , policy of the US Federal Reserve to cut interest rates to their lowest level in 40 years. They remained at this low level for a long time due to the lack of inflation in the US. One reason for this was that China's entry into the world economy created general price pressure. Nevertheless, the dollar's exchange rate rose against the currencies of many emerging countries, which are participating in a race to devalue their currency in order to gain advantages in the booming export business.

Emerging economies growth crisis 2014–2016

In 2014, following a credit-financed raw material and export boom in many emerging countries, there was an almost simultaneous economic downturn, which, as a result of the fall in the oil price and other raw material prices , was mainly concentrated on the oil-producing emerging countries and in 2015 led to a growth crisis leading to the looming recession grew. For the latter development, the critical course of the restructuring of the Chinese economy from mass production based on low labor costs to a domestic market-oriented and knowledge-based economy, whose raw material requirements will be greatly reduced, was decisive. These and other factors resulted in a capital withdrawal of approximately $ 300 billion from emerging markets over four quarters, whose modest growth rates compared to previous years combined with rising inflation are deterring international investors.

prehistory

The emerging countries, especially the BRICS countries , were initially only affected to a relatively minor extent by the 2008 financial crisis. Before, but especially after the 2008/09 financial crisis, in anticipation of a globalization boom or in the hope of its continuation, extensive investments from the dollar and euro areas flowed into the extractive economies of these countries, especially in oil production, mining and cash crops . Initially, the BRICS countries since around 2001, later also the MIST countries (Mexico, Indonesia, South Korea, Turkey) as well as Kazakhstan, Malaysia, Thailand and others became targets of partly speculative capital investments, which are different from the assumed further increase in raw material prices the perspective of a dynamic globalization of the world economy and a forced catching-up industrialization of the emerging countries.

This forced industrialization meant that, unlike in the industrialized countries, where energy consumption rose only slowly, production was particularly energy-intensive in the emerging countries. China, Russia and South Africa are the three most energy-intensive production locations in the world. This increased the demand for energy and contributed to the rise in the oil price.

Numerous investment funds focused their investments on the emerging countries or on the raw materials mined or produced there such as oil, gold, copper, nickel, coal, palm oil , rubber, soy and coffee (i.e. on the continuation of colonial extractivism ).

After the financial crisis, the inflow of capital into the emerging markets increased due to the low or zero interest rate policy in the USA and Europe. A total of around 5 trillion US dollars flowed there from the raw materials and industrialization boom from 2000 to 2012. German capital exports tripled between 1999 and 2012; the share of emerging and developing countries rose particularly sharply. Many companies in these countries also used dollar and euro loans as well as loans in Swiss francs to expand their capacities. Above all, however, international mining corporations went into debt to secure access to raw material reserves. The national debt of the emerging countries and (especially in Malaysia and Thailand) the indebtedness of private households also increased. India, on the other hand, relied on state support for private consumption, which resulted in a high current account deficit.

The debt of Asia excluding Japan (government, corporate and private debt) reached a total of 205 percent of the gross domestic product in 2014 compared to 144 percent in 2007 and thus increased significantly more than that of Europe and the USA. Apart from Japan, five Asian nations besides Japan were in debt with more than double the gross domestic product in 2014, namely China, Hong Kong, Singapore, South Korea and Thailand.

The loan-financed investment boom in many emerging countries, with in some cases gigantic infrastructure and private real estate projects, led to a reduction in unemployment and a significant increase in the prosperity of many private households. The share of the BRIC countries in the global gross domestic product (adjusted for purchasing power) rose to approx. 27 percent by 2015 and thus doubled within almost 15 years. At the same time, the US and Europe's import quotas rose sharply from 2010 to 2013 in the wake of the recovery in world trade. In return, Germany's exports to the BRIC countries increased sixfold in the period from 1999 to 2011, from which the automotive, mechanical engineering, chemical and electrical industries in particular benefited. To a large extent, these are products that have contributed to increasing productivity in the emerging countries and increasing their trade surpluses.

The raw materials boom also affected industrialized countries such as Australia and Canada and fueled economic growth there, but led to the relative share of manufacturing and services in the gross value added of these countries declining and they again approached the factor-based economies, whose growth was mainly based on extractive industries based. The trade deficit of the USA and many EU states in relation to China could also be financed with cheap central bank money, which reduced the incentive for these states to maintain a competitive industry.

Local risk factors

Already in 2012 there was often talk of an “over-optimistic globalization euphoria”. The negative effects of the resource curse also became clear, which was due to the strong dependence of the business model of many countries on raw material exports. Achieved z. B. Brazil had a record foreign trade surplus of almost 30 billion dollars in 2011 due to the export of raw materials such as iron ore, soybeans, sugar and crude oil, but in 2013 it shrank to just under 2.6 billion dollars. The ongoing capital inflows were based less and less on realistic growth expectations; rather, growth expectations for the emerging markets were based on the speculative expectation of further capital inflows in view of presumably long-term low interest rates in the USA and Europe. In addition, there have been few attractive investment alternatives in recent years. More and more emerging economies from the second tier were targeted by speculative investors. The so-called “future emerging economies” such as Angola also moved into the focus of financial investors .

The strong inflow of capital from abroad encouraged corruption in countries with significant state participation in the economy such as Malaysia, Indonesia or Brazil (in the Petrobras case ), but it delayed the closure or rehabilitation of unprofitable and overindebted state-owned companies in many countries such as Vietnam, but promoted it at the same time the expansion of the shadow economy .

In addition, there were structural reforms (e.g. reduction of bureaucracy, reform of agriculture, expansion of infrastructure), which were not implemented in some countries because of the prosperity phase that sometimes lasted fifteen years, which hindered the effectiveness of investments and the increase in labor productivity.

Indonesia experienced a largely undisturbed boom phase from 1999 to 2014, which increased the modest prosperity in the cities, but remained centered on Java and was not used to develop human resources or the ailing infrastructure.

Political factors also play a role, such as the wave of strikes in 2013 and the generally troubled industrial relations in South Africa or the expansion of the education system in Brazil and Indonesia, which is much too slow in relation to population growth.

There are also major infrastructure problems in India. Record surpluses in food exports were achieved there in 2013/14, albeit at the cost of high government subsidies for producers, who are becoming increasingly unprofitable.

In Thailand, too, infrastructure expansion did not keep pace with growth, which was heavily concentrated in the Bangkok region . In 2014, the political unrest had a negative impact on tourism development. Car exports stagnated in 2014/15 as a result of the fall in the Australian dollar, travel exports came under price pressure and the price of rubber fell by around 60 percent from 2011 to 2015.

In Nigeria , which sees itself as an emerging country, but must be counted among the developing countries based on socio-economic indicators, the elites of numerous ethnic groups compete for the proceeds from oil exports. In addition to ethnic and religious tensions, terrorism, clientelism and ailing infrastructure are holding back development.

Russia's growth was dampened by the sanctions imposed by the EU and the US in the wake of the Ukraine crisis and falling oil prices. In 2014, more than 150 billion US dollars of capital flowed out of Russia.

Despite rising wage costs, especially in the raw material-producing sectors, it was not possible to reduce extreme social inequality in many emerging countries. In Brazil, Indonesia, Mexico, but also in India, in the form of the caste system, this has a clear growth-inhibiting effect. The Gini index, as a measure of inequality in income distribution, even increased further due to the investment boom in some emerging countries (exception: China). B. in South Africa (very clearly from 2000: 57.8 to 2011: 65), in Indonesia and Mexico.

A decisive factor in the worsening of the growth crisis in 2015, however, was the formation of bubbles in the real estate and financial markets in China, supported by low interest rates and Chinese government policy.

Falling oil and raw material prices

The main reason for the slump in export earnings in the emerging countries was the drop in oil prices since April 2014. This was due to the previous strong expansion in production, which - measured against the slowly growing demand as a result of the energy transition - led to overcapacities. The USA's rise to become an exporter of fracking oil made a decisive contribution to this, by doubling its oil production within four years. Until 2015, the export of US crude oil was banned. According to the BP 2015 World Energy Report , US oil production rose to a record 1.6 million barrels per day in 2014. The USA's gas production also continued to grow, displacing Russia as the world's largest producer of the two raw materials and Saudi Arabia as the largest oil producer . At the end of 2015, world oil stocks reached a record level of around 1.4 billion barrels , around 800 million of them in the United States.

While the development and production costs of oil and oil sands rose in many producing countries - especially in the USA and Canada, in Mexico, the polar region and the northern North Sea - and the competition from renewable energies increased, the OPEC countries reacted , above all Saudi Arabia, unlike past oil price crashes, does not involve a reduction in production volumes. The oil reserves of the large mineral oil companies, which had been stashed in anticipation of rising oil prices, had to be sold by them in 2015 and also put pressure on the market; nevertheless, global stocks increased. Saudi Arabia reached a new production peak at the end of 2015, Angola expanded production, and Iraq also set new records in 2015, albeit at the cost of the rapid depletion of oil fields.

Russia also did not cut its production, since the ruble rate in relation to the dollar fell faster than the oil price, so that the production costs incurred in rubles in relation to the dollar proceeds actually fell. Instead, Russia stepped up production in old, "mature" oil fields. In the second quarter of 2015 , Rosneft achieved significant sales and profit increases. Only the internationally more active, privately owned Lukoil group, which reports in dollars, suffered a slump in profits in the first half of 2015. The oil production of the four largest Russian groups reached a post-Soviet record in 2015, while the economy contracted at the same time.

- See also Russian Economic Crisis 2015

Only in Mexico did the subsidies fall so sharply that in 2013 parliament decided to lift the state monopoly of PEMEX , which could no longer raise the necessary investments, and to approve private subsidy companies.

In August 2015 the prices for a barrel of US oil reached 39 US dollars and in December for a barrel of North Sea oil with less than 40 US dollars each a six-year low, in January 2016 the prices of both types temporarily fell below 30 dollars, i.e. noticeably a twelve year low. As a result of the drop in oil prices, government revenues and corporate profits in the oil and gas producing and exporting countries fell, especially in the Arab countries (in Saudi Arabia, revenues from the sale of oil fell by 42 percent in 2015 compared to the previous year), but also in Brazil , Kazakhstan, Azerbaijan , Venezuela and Nigeria. As a result, the gas price also fell.

To compensate for the declining income from oil and gas sales, these and other countries threw other raw materials on the market, which, in addition to falling demand from China, also contributed to their price decline. The price of iron ore halved between the beginning of 2014 and the beginning of 2015 from 135 to 67 US dollars, due to the falling demand from China. The price of hot-rolled steel fell by about the same amount, as China tried to sell its surplus production on the world market. Likewise, the nickel price fell by 38% within the 12 months to August 2015, the copper price by 20% over the same period and the aluminum price by 20% from September 2014 to September 2015. Coal, zinc, lead and platinum prices also fell. Overall, raw material prices worldwide reached a 16-year low in August 2015, while production only declined slowly.

As a result of the fall in prices, the indebtedness of commodity-exporting countries, but also of commodity-extracting companies, which had taken out dollar and euro loans because of the low interest rates in the USA and Europe, rose within a short time. Countries like India, Turkey and especially South Korea, which are less dependent on raw material exports, but have to import more than 80 percent of crude oil, were initially able to escape the trend, but their foreign trade deficit also grew - in India and the like. a. due to the skyrocketing gold purchases since autumn 2014 by private individuals who own around 20,000 tons of gold.

From 2006 to 2014 the foreign debts of the MIST countries doubled; those of India grew two and a half times. Malaysia, which, with its economy largely controlled by sovereign wealth funds , defied IMF guidelines, again had an active foreign trade balance in 2014, even though the national debt increased.

When interest rate hikes were announced in the US for autumn that year in the summer of 2015, a massive flight of capital from the emerging markets began, which led to sharply falling stock exchange prices there. The exchange rates of the currencies of the emerging countries against the dollar and the euro collapsed or, as in the case of China, were deliberately devalued in 2015 in order to stimulate the economy. The Turkish lira lost around 28% of its value against the US dollar from January to August 2015, the Brazilian real around 25% from July to September 2015, the ruble around 50% from the end of 2012 to August 2015 and the Indonesian rupiah around 25 % % against the euro. The Malaysian ringgit fell to its lowest level since 1998. The value of the Kazakh tenge fell by around 40% from April to December 2015 and that of the Azerbaijani manat by almost 50%. The South African rand lost 42% of its value against the US dollar from early 2015 to early 2016. The currencies of Colombia, Mexico and Chile also lost value in relation to the dollar and the euro. The inflation increased in all these countries without could be increased significantly by the price decline exports.

The key role of China

In 2015, China still showed considerable growth compared to Europe, but in 2014 it fell to its lowest level in 25 years. This development played a catalytic role in the growth crisis in other emerging markets.

While China tried to compensate for the consequences of the financial crisis in 2009 with a gigantic investment boom, years later it became clear that the uncoordinated expansion of industries in the provinces, supported by bank loans, had led to overcapacities in numerous branches of the economy, for whose products there were hardly any sales opportunities. The capacities of steel and paper and cardboard production were only used to 67 percent in 2015; Utilization of refineries, coal mines, shipyards, cement factories, industrial glass factories and some agricultural sectors (including corn) was also weak. Hundreds of thousands of employees are underemployed in so-called “zombie factories”.

This showed the failure of state control: the planned restructuring of the Chinese economy from mass production to high-tech and domestic-market-oriented service economy did not proceed without serious upheavals. Despite the devaluation of the local currency to increase exports, numerous - mainly state-owned - companies were closed, especially in the heavily industrialized north-east of the country, especially in the Liáoníng province . As a result, China's demand for raw materials, which, in its role as the “workbench” of the USA and Europe, is one of the most important raw material importing countries and invested in the development and extraction of raw materials worldwide, fell sharply. At the end of 2015, there were around 11,000 coal mines in operation in China with a total of around six million employees. By 2018, 4,300 of these mines with one million jobs are to be closed. The decline in China's demand for raw materials and the falling world market prices for oil, iron ore, copper, nickel and coal were particularly affected by Brazil, which had only recently become a net crude oil exporter through major investments, and other Latin American countries, whose most important raw material market had become China .

For the time being, the Chinese government's plan to move industry away from the “workbench of the world” and the necessary gradual reform of the private banking system by stimulating the stock market has proven to be a failure, while the state banks, above all the China Development Bank , should continue to finance the large state or state-affiliated corporations such as Huawei and an extremely ambitious expansion of the infrastructure. In 2013, the investment quota in China was almost 50 percent of the gross domestic product . Many of these investments seeped away without lasting effects in poorly developed regions (policy of the “new silk road ” with the city of Xi'an as the starting point). Countless airports (97 alone were planned for the years from 2008 to 2020), ports, roads and high-rise areas were built, although they were not always needed where they were built. Investments in state-affiliated companies allowed them to export at dumping prices. The migration from the countryside to the cities, and especially to the cities of the coastal zone, accelerated as investment and prosperity increased. In 2013, land sales rose to a record 50% above 2012. Whereas the degree of urbanization in China was 26 percent in 1990, today around 55 percent of the Chinese live in cities. However, this also increased the vulnerability of the labor market to fluctuations in the order situation of large export-intensive companies, around which numerous dormitory cities were built up out of the ground. which should only be populated afterwards and are now empty as ghost towns . In the hinterland, however, there were massive vacancies in cities beyond the front row. Housing construction then collapsed significantly in 2014.

As a result of the investment boom, China's total debt had risen from 158 percent of gross domestic product in 2007 to 282 percent in 2014 and thus relatively exceeded the debt of the USA. It is less the central government than the local governments that play the driving role; they financed themselves through the sale of land use rights, thereby promoting the real estate bubble . China's companies are in debt to the tune of around $ 700 billion, or around 170 percent of GDP. For the most part, these are loans from shadow banks at high interest rates. Because of falling producer prices, many companies are unable to repay their loans. Millions of small savers - one speaks of 5 percent of the population - invested a large part of their savings on the stock market under the influence of propaganda. The Composite Index of the Shanghai Stock Exchange rose more than 150 percent within a year; from the peak of this bubble formation on June 12, 2015 to August 25, 2015, it then fell by around 42 percent. Since the summer of 2015, this development has triggered panic returns of capital from other emerging markets to North America and Europe. In China, the foreign exchange reserves melted, which had reached a record value of over 3.8 trillion US dollars at the beginning of 2014 due to the high export surpluses; The multiple devaluation of the Chinese currency should above all stabilize the foreign exchange reserves, which at the beginning of 2016 amounted to only 3.3 trillion dollars.

Economic impact

Private debt

In many emerging countries, private debt is still low compared to Australia, Great Britain, Sweden, Denmark or the USA; but the increase, mostly due to the purchase of real estate and cars, is considerable in many countries. Overall, private debt in the emerging markets rose to around 120 percent of their annual economic output in 2016; that is more than at the beginning of the emerging market crisis in 1998. The private dollar and euro debts can no longer be serviced because of the currency depreciation in many emerging countries. The middle classes are particularly affected.

In Brazil, for example, household indebtedness reached around 65 percent of GDP in 2016. That is the highest level in 25 years. Monthly debt servicing alone devours more than 25 percent of net income and thereby significantly reduces consumption.

The further course and the effects of the development are currently (January 2017) not yet exactly foreseeable, least of all in the case of China. Further negative effects on consumption and private investment are to be expected there.

National debt

In the years before the financial crisis, the national debt of most of the emerging economies had declined due to growing revenues from oil exports. In terms of gross domestic product, it was actually quite low in 2014 compared to the industrialized countries (Russia 18, China 41, Brazil 65 percent, compared to Germany 75 and Japan 246 percent). In 2016, however, it was already considerably higher than at the time of the financial crisis. Especially since the loans were taken out in hard currencies and export earnings fall, this leads to budget crises and inflationary developments due to the currency collapse. About a quarter of all dollar debt (around $ 2.6 trillion) was borrowed from emerging economies. The declining gross domestic product in 2015 in Algeria, Argentina, Australia, Brazil, Mexico, Russia and Turkey - in Venezuela here the economy contracted for the third year in a row - contributed to the increase in the relative debt burden of these countries. Overly optimistic growth forecasts by the donor countries, a lack of credit checks, poor debt management, mismanagement and corruption further exacerbated the situation. With the rise in interest rates in the USA, the repayment of dollar loans in 2017 is at risk, especially in Venezuela.

World trade

In 2015, the imports of the industrialized countries rose faster than those of the emerging countries, which thus lost their function as drivers of world trade, which they had exercised since the 1990s. The imports of the emerging countries not only declined in machinery and equipment, but also in high-quality consumer goods (especially cars). The decline in imports from China and other large emerging countries dampened GDP growth in the OECD countries by around half a percentage point in 2015, according to OECD estimates.

Africa's raw material and agricultural goods exports were particularly hard hit by falling demand from China and the interruption in the development of infrastructures for raw material extraction; But production in Chile, Peru, Bolivia, Australia and Kazakhstan also declined. India alone, the third largest importer of fossil fuels, benefited from the price reduction of raw material imports and spent almost 30 billion euros less on crude oil imports from April 2015 to March 2016.

The often predicted stronger interdependence of the emerging economies with one another in order to reduce their dependence on the industrialized countries is - with the exception of the active role played by China e.g. B. has taken over the infrastructure expansion in some emerging countries - has not progressed to the expected extent.

In Germany, the automotive, automotive supply and electrical industries, mechanical engineering, whose main customer is China, and the automotive chemical industry were affected. Maritime shipping and container handling in the Port of Hamburg also suffered, which with 9.7 million 20-foot standard containers (TEU) in 2014 had not yet reached the level of 2007, as Hamburg handling with China alone made 2.97 billion Euros from. Maritime trade with Russia, whose economy shrank by 3.7% in 2015, also fell in 2014/15.

Investments in oil production and raw material development

Investments in the development of new oil wells and in fracking continued to decline worldwide. Shell stopped deep-sea drilling in the Arctic in September 2015 after 10 years. The fracking industry in the United States dismantled production facilities on a large scale, as did the oil sands industry in Canada. Several Russian oil companies withdrew from the London Stock Exchange in 2015 because they could no longer raise capital there. Petrobras , the fifth largest company in the world by market capitalization in 2008, was barely able to service its bonds and got into trouble in 2015. In January 2016 , the Chinese CNOOC was the first major oil production company to partially cease production . In the spring of 2016, Wells Fargo and JPMorgan Chase viewed more than $ 50 billion in loans to the oil and gas industry as threatened. In April 2016, US oil production fell to its lowest level since fall 2014.

Other mining businesses also had to write off their investments or sell some of their mines. The heavily indebted Glencore group lost almost 90% of its market value from 2011 to September 2015. He stopped all zinc production in Peru. BHP Billiton lost a large part of its market value due to the collapse in the price of coal and the breach of the Bento Rodrigues dam . Other mining companies like Anglo American could no longer even generate their loan interest with their income from the operating business; around half of the 135,000 jobs worldwide are at risk. The subsidiary, the South African Anglo Platinum , recorded high losses for the first time in 2015 due to the slump in the platinum price. The state-owned Chilean copper company Codelco , which contributes around 25 percent to state revenues, also suffered from falling revenues and sharply rising mining costs. Export revenues from iron ore mines also fell in Brazil.

Rio Tinto stopped the further expansion of the Ojuu Tolgoi copper and gold deposit in Mongolia shortly after the start of production in the summer of 2013 , the proceeds of which should account for a third of Mongolian gross domestic product. The country had borrowed heavily in anticipation of the boom and was on the verge of national bankruptcy in 2017.

Almost all mining and other raw materials companies scaled back their planned investment projects in 2015/16. According to Standard & Poor's , investments by raw materials companies fell by ten percent in 2015 alone. However, they ran into difficulties servicing the hard currency loans they had taken out. Since the beginning of 2016, their debts in the three-digit billions have also led to a fall in the price of the shares of some of the major international banks that are heavily involved in the raw materials sector.

In the long term, it is to be expected that the multinational oil corporations will find it increasingly difficult to develop oil reserves compared to the state oil corporations. While the multinational oil companies quadrupled their exploration expenditures from 25 to almost 100 billion US dollars and tripled their debts from 2001 to 2014 according to calculations by the Boston Consulting Group , the volume of newly developed reserves remained unchanged at 20 billion barrels of oil equivalent during this period.

Capital outflow from emerging markets

It was expected that in future less European capital would flow into the Asian emerging markets, which are about to consolidate their banking landscape. Some European banks withdrew from Asian banking centers like Singapore . In addition, capital outflows from emerging markets, especially China, increased. The country was forced to restrict large foreign investments by Chinese companies and the repatriation of profits to foreign investors due to the falling rate of its own currency. In view of the strong dollar and higher interest rates in the USA, the IMF warned in January 2016 that the dollar-borrowing countries could become insolvent.

The establishment of the New Development Bank of the BRICS countries, which is due to become active in 2016, came too late for the emerging countries to play a significant role in combating the crisis. With the strengthening of the US dollar in 2018, there was again a flight of capital from emerging countries, such as Argentina, Brazil, South Africa and Turkey.

Social and Political Impact

The middle classes of these countries, which have grown strongly in the last ten to twenty years, have difficulty maintaining their prosperity due to inflation, burst real estate and stock market bubbles and the impact of the crisis on the labor market, unless raw material prices rise rapidly. In Brazil, unemployment rose from around 5 to 8 percent from the end of 2014 to the end of 2015, and from 8 to 14 percent in Venezuela.

In many countries the transition to an open economy and growth optimism are being questioned. The crisis has undermined the credibility of Western economic concepts. This applies in particular to the Arab world and Africa, where the raw materials boom was not used sustainably. Since 2014 there has been an emigration of members of the middle classes from the Arab region, also due to the chaos of war. There are also slumps in the tourism industry, which hit Egypt and Tunisia in particular.

For a long time, OPEC proved to be incapable of stopping the fall in the oil price. The escalation of the conflict between Saudi Arabia and Iran, which are already waging two proxy wars in Syria and Yemen , did not prevent the oil price from falling further. All attempts to reach a political agreement failed.

With the intensification of the public finance crisis, the political instability in the Gulf region increased. Due to the low oil price, the number of guest workers from India, Nepal and Bangladesh fell sharply in the region. This reduced remittances to their home countries - for India alone it is an amount of around 35 billion US dollars per year. Political upheavals can be the result or have already occurred.

The highly regulated labor market in Saudi Arabia, which is characterized by quota systems, is particularly hard hit by the crisis. There, because of the discontinuation of subsidies for many jobs and the loss of income of the executive elite and the middle classes, a further rise in unemployment is predicted, especially among the approximately 9 million foreign workers; However, important positions in the private sector cannot be filled by the inadequately qualified German. Despite the intensive search for export opportunities for alternative raw materials and products from non-oil-dependent industries (e.g. as part of the raw material processing and industrial projects in Ras al-Khair near al-Jubail ), there is a risk of a further rise in youth unemployment. At the end of 2016, national debt had reached such a level that value added tax as well as sugar and tobacco taxes were introduced for the first time.

Heavily indebted as a result of the Suez Canal expansion, Egypt lost a large part of its currency reserves after Saudi Arabia cut support for the government and had to submit to IMF conditions in November 2016 and devalue its currency by half in order to obtain an IMF loan to get.

In South America, governments that proved incapable of adequately responding to the end of the commodity boom failed in Venezuela, Brazil and Argentina; or in elections, business-friendly candidates like the former Wall Street banker Pedro Pablo Kuczynski in Peru in 2016. Large South American state corporations are faced with the need to carry out far-reaching reforms. Investors therefore returned to the Latin American stock exchanges in spring 2016, although the economies of the seven largest countries in Latin America are expected to contract by 1% in 2016 as well. A new setback hit the Latin American markets, however, as a result of the corruption scandal involving the Brazilian private company Odebrecht , which is shaking the political class in at least 12 emerging and developing countries.

The establishment of free trade zones between the large economic blocs through agreements such as TTIP , which, after the failure of the negotiations between the WTO member countries for multilateral solutions, is intended to defend against competition from the emerging countries and as a means of exerting pressure on the industrialized countries against them, is not only encountered in the emerging countries, which perceive the creation of such a threatening backdrop as discrimination, in response to increasing criticism: In the industrialized countries too, job losses are feared if foreign investments by the USA or EU countries are facilitated by the devaluation pressure on the currencies of the emerging countries. In its World Economic Outlook of April 2016, the IMF fears a further increase in nationalist and protectionist tendencies.

In China, Russia and Turkey, but z. In India, for example, such nationalistic tendencies have been strengthening since 2014 and reached the western industrialized countries in 2016. The tendency towards cooperation in the world economy has suffered a setback as a result of the crisis and the political resistance to the consequences of globalization in many countries - especially after the election of Donald Trump in the USA.

Trend reversal in 2016

The decline in investments in oil production, the throttling of fracking activities as well as failures in oil production in Venezuela, Nigeria and - due to forest fires - in Canada meant that oil stocks fell worldwide since the spring of 2016 and the price per barrel until June 2016 again to over 50 US dollars, in October 2017 increased to over 60 dollars. However, US exports of shale oil in particular continued to rise in 2017 and put the OPEC countries, which were trying to stabilize crude oil prices, under pressure.

The closure of copper and zinc mines, the increased demand for gold and crop failures in agricultural products (e.g. coffee and cocoa, the price of which even reached its second highest level since 1977 in 2017) led to rising prices for other raw materials in the early summer of 2016 and agricultural products other than wheat, some of which reached their pre-2015 levels. The zinc price rose by around 50 percent from its five-year low in January 2016 to July 2016; The copper price, which in July 2016 returned to its 2009 level for the first time, rose by a further 20 percent in 2017. The prices for aluminum and tungsten also rose again.

In relation to the almost stagnating European economy, the emerging markets have therefore appeared again to many investors as interesting investment fields since spring 2016 - especially after the Brexit referendum. The IMF calculated economic growth of 4.1 percent for the emerging countries (for comparison: industrialized countries 1.6 percent) and forecast growth of 4.5 for 2017 (for comparison 1.9 percent).

The glut of money as a result of the policies of the major central banks supported the willingness to invest, even in emerging economies such as Kazakhstan, which had previously been neglected. The increased willingness to invest, however, was curbed by Donald Trump's announcements that he would impose high import duties on imports from Mexico and other countries, as well as political uncertainty in Turkey and Brazil. Mexico and some other Latin American countries and other heavily export-oriented countries such as Thailand and South Korea are likely to suffer from a possible foreclosure of the US market. The raw material countries, on the other hand, could presumably compensate for the effects of protectionist measures by increasing US demand for raw materials.

Latent Risks

In China, the credit bubble in connection with the lack of private investments despite low key interest rates remains a risk factor.A capital outflow is expected here due to increasing Chinese direct investments in Europe, which the government will face with the expansion of infrastructure in western China and the neighboring countries and the opening of new trade corridors to Europe wants to meet ( New Silk Road project ). Despite the economic recovery, the political and social consequences of the growth cut in 2014/15 are likely to be felt for a long time to come.

A credit bubble also grew in India. The Indian financial industry is repeatedly shaken by fraud and corruption scandals.

The Institute of International Finance (IIF), a lobby group of 38 leading banks, worried at the beginning of the year 2018 again to the financial stability of emerging markets. In 2018, their debt rescheduling risk is particularly high: this year, debt securities worth 1,500 billion US dollars will reach the end of their term and will have to be replaced by new loans.

The return of the crisis 2018/19

In 2018 there were increasing signs of a slowdown in the growth of world trade. In particular, the trade conflict between China and the USA in summer 2018 once again led to falling raw material prices for copper (from June to August 2018 approx. −12%), silver and zinc, while oil prices rose at the same time. The palm oil price fell to its lowest level in two years in the summer of 2018. Of these tendencies were u. a. the economies of Chile, Peru, Bolivia, Indonesia and Malaysia were particularly hard hit. The drop in coffee prices (September 2017 - September 2018 approx. −23%) a. Mexico, Guatemala, Brazil and Colombia.

In addition, private and corporate debt in foreign currencies rose in many countries. The rise in the dollar exchange rate in spring 2018 made repaying dollar loans more difficult than expected in many countries. In Turkey, with its rising current account deficit, short-term liabilities were higher than foreign exchange reserves in summer 2018. The crisis in the Turkish currency fueled fears of stretching tendencies. Turkey (September 2018: 24%), Argentina (August 2018: 60%), but also Ecuador, Mexico, Pakistan and India had to raise their key interest rates in 2017/18 in order to stabilize their currencies, which was hardly successful. In Brazil and Russia, key interest rates were over 6 percent in summer 2018; these two countries only recovered slowly from the 2014–2016 recession. Argentina had to postpone all infrastructure projects due to IMF austerity measures, including a $ 2.2 billion dam project. South Africa experienced an unexpected recession in 2018; agricultural production fell and unemployment rose. The symptoms of these crises clearly resembled the tequila crisis of 1994/95; many central banks now had higher dollar reserves and other financial resources. Brazil used dollar swaps in cooperation with the Fed to overcome short-term liquidity bottlenecks. Countries like Mexico, Colombia, Peru and Chile were less affected by the currency crisis.

The infrastructure investments in the New Silk Road also led to the increased indebtedness of some Asian countries such as Pakistan and Kyrgyzstan . At the end of August 2018, the Indonesian rupiah fell to its lowest level against the US dollar since the Asian crisis in 1998, the Indian rupee to an all-time low, the South African rand near it and the yuan to a record low in October 2018.

After a brief recovery in winter 2018/19, commodity prices and the currencies of some emerging countries fell again in July / August 2019, as the global economy cooled and investors withdrew capital, mainly due to the trade dispute between the USA and China.

Since autumn 2019, the global economic slowdown has threatened the emerging markets again. As a result of the COVID-19 pandemic , US capital in particular was again withdrawn from these countries in 2020; the currencies of South Africa, Brazil and Turkey lost significantly against the dollar and the euro. In April 2020, Argentina's insolvency was announced. In March 2020, oil prices also came under heavy pressure after Russia rejected a production restriction, while Saudi Arabia announced a significant expansion in production. The resulting oversupply met with a massive drop in demand due to the Corona crisis. On March 9, 2020, the oil price plummeted and fell to around a third within two months, which put Russia, Azerbaijan, Iraq, Nigeria and Angola, but also the US fracking industry, in distress.

See also

literature

- Hermann Sebastian Dehnen: Market entry in emerging market economies: Development of an internationalization process model. Wiesbaden 2012, ISBN 978-3-8349-4217-3 .

- Martin Leschke: Economics of Development: An introduction from an institutional economics perspective. Bayreuth, 2nd edition 2015.

- Franz Nuscheler: Learning and work book development policy. (A basic introduction to the central development issues of globalization, state failure, hunger, population, economy and the environment). 5th, completely revised edition. Dietz, Bonn 2004, ISBN 3-8012-0350-6 .

- Attila Yaprak, Bahattin Karademir: The internationalization of emerging market business groups: an integrated literature review. In: International Marketing Review , Issue 2 (27) 2010, pp. 245–262. doi : 10.1108 / 02651331011037548 (literature review).

Web links

- Phuong Thao Le, Matthias Nöckel: Development stages and country types University of Trier , 2011

Individual evidence

- ↑ See e.g. B. Paweł Bożyk: Newly Industrialized Countries: Globalization and the Transformation of Foreign Economic Policy. Ashgate Publishing: Farnham 2006.

- ↑ Life expectancy in China or Brazil is slightly higher than in EU countries such as Romania, Bulgaria or Latvia. CIA World Factbook

- ↑ Federal Ministry for Economic Cooperation (BMZ) , accessed on October 31, 2016. The Federal Ministry for Economic Cooperation (BMZ) names Brazil, China, India, Indonesia, Mexico and South Africa as examples of large emerging countries, but not Russia.

- ↑ FAZ (Christoph Hein, FAZ economic correspondent for South Asia / Pacific based in Singapore): Asia gets to feel the reality - especially in Southeast Asia, where uncertainty is growing and share and exchange rates are falling increasingly.

- ^ The World Bank - Country Groups

- ^ International Monetary Fund - Country Groups Information

- ↑ In connection with an investment recommendation for financial products, most of which are managed by Goldman Sachs, see Handelsblatt August 21, 2012: The investment strategy is MIST , online: handelsblatt.com

- ↑ DWS (Deutsche Bank), August 19, 2015 ( page no longer available , search in web archives )

- ^ Joe Studwell, How Asia Works: Success and Failure in the World's Most Dynamic Region. 2013.

- ↑ See the review of the book in the Financial Times , April 5, 2013

- ↑ Matthias Fronius: The causes of the Taiwanese economic miracle. Berlin 2001, p. 93 ff.

- ↑ Ingo Bultmann: Mexico: On the way to the debt service economy, in: Michael Ehrke, Dietmar Dirmoser, Tilam Evers (eds.): Latin America. Analyzes and reports 11. Junius, Hamburg, pp. 247-259.

- ↑ Patrick Bernau: The late victory of terror. ( Page no longer available , search in web archives ) In: www.faz.net, August 18, 2011.

- ↑ According to the Institute of International Finance (IIF); see. Frank Wiebe: Studies shed light on the crisis in emerging markets. Handelsblatt, September 4, 2015, online: handelsblatt.com

- ↑ D. Eckert: The real debt bomb is ticking in Asia. In: Die Welt, February 10, 2015, online: welt.de and Chr. Geinitz: Asia's debts are getting out of hand. FAZ-net, online: faz.net

- ↑ Where the BRIC countries are weak. Handelsblatt, March 16, 2012.

- ↑ AP / Reuters according to Handelsblatt, January 3, 2014

- ↑ Christoph Hein: Thailand and Malaysia: Crisis, but not a second Asian crisis. FAZ-net, August 28, 2013 faz.net

- ↑ Stefanie Schmitt: State enterprise in reform backlog. Asia Courier 11/2010, November 1, 2010 ( Memento from December 22, 2015 in the Internet Archive )

- ↑ Federal Agency for Civic Education: Agriculture in Crisis , May 3, 2014

- ^ John Le Fevre: Thai Economy Loses §12 billion in 2014 - What's Ahead for 2015? Establishment Post, January 15, 2015 ( Memento of November 23, 2015 in the Internet Archive )

- ↑ www.boerse.de

- ↑ Country information from the BMZ

- ↑ Federal Foreign Office: Country Info Russian Federation: Economy , April 2015

- ^ World Bank: Gini Index, April 5, 2015

- ↑ Deutsche Wirtschafts-Nachrichten June 12, 2015

- ↑ n-tv , August 11, 2015

- ↑ Benjamin Triebe: When the ruble is a blessing. In: NZZ , International Edition, September 2, 2015, p. 10.

- ^ German Trade and Invest , May 20, 2015.

- ↑ dpa report from August 24, 2015

- ↑ Handelsblatt dated December 8, 2015

- ↑ finanzen.net, February 3, 2015

- ↑ a b Finanz.net, August 25, 2015

- ↑ Turks are fleeing from the lira. Handelsblatt, 21./22./23. August 2015, p. 32 f.

- ↑ Real is losing ground dramatically. In: Handelsblatt, September 24, 2015

- ↑ Benjamin Triebe: Oil pulls currencies with it. In: NZZ, International Edition, December 30, 2015, p. 12.

- ↑ China's overcapacities threaten Europe's industry. In: Die Welt online February 22, 2016

- ↑ Smog in China: Off for coal mines threatens one million jobs. In: Spiegel Online. Spiegel online, January 21, 2016, accessed April 12, 2016 .

- ^ German Trade & Invest, October 21, 2014

- ↑ finanzen100.de, June 25, 2015

- ↑ End of a dream? In: Handelsblatt 21./22./23. August 2015, p. 42 ff.

- ↑ Shanghai Composite , August 25, 2014

- ↑ Trade surplus: China's reserves grow by $ 500 billion. In: Spiegel Online. Spiegel Online, January 15, 2015, accessed April 12, 2016 .

- ↑ finanzen.net , January 7, 2016.

- ↑ de.statista.com , accessed January 27, 2016.

- ↑ Stefan Bielmeier: A turning point in German exports , in: Wirtschaftswoche, March 2, 2016 [1]

- ↑ See e.g. B. Yaprak / Karademir 2010 and stretching 2012.

- ↑ Hamburg port statistics 2014

- ↑ Shell puts Arctic project on hold. In: NZZ, International Edition, September 30, 2015, p. 7.

- ↑ London's stock exchange like a sinking ship. Handelsblatt, October 12, 2015

- ↑ More and more loans threatened by default , in: Handelsblatt, May 5, 2016 [2]

- ↑ Glencore becomes windfall. In: NZZ, International Edition, September 30, 2015, pp. 1, 15.

- ^ Martin Hock: Payment crisis in Mongolia. In: www.faz.net, February 20, 2017.

- ↑ Matthias Streit: The end of the cheap bean. In: Handelsblatt, June 7, 2016 [3]

- ↑ Franz Hubík, Regine Palm: shrinking, dying, reinvent . In: Handelsblatt , November 5, 2016.

- ↑ M. Rist: Digitization is good, customer contact is better. In: NZZ, international edition, September 16, 2015, supplement p. 21.

- ↑ Arne Gottschalck: This development makes Goldman Sachs nervous , in: manager magazin, November 10, 2016.

- ↑ Warnings from the IMF and WEF: Risks for the global economy are greater than they have been in a long time , t-online.de, January 14, 2016.

- ↑ Nina Trentmann: Nina Trentmann: We want to show that we are different , in: Die Welt August 23, 2015

- ↑ Emerging economies under pressure. www.dw.com (Deutsche Welle) , May 21, 2018

- ↑ Die Zeit , January 3, 2016.

- ↑ CNBC , January 5, 2016.

- ↑ Volker Pabst: The gift of cheap petroleum. NZZ, international edition, January 27, 2016, p. 10.

- ^ Mathias Brüggmann: A jewel of the Saudi industry , in: Handelsblatt , November 30, 2016

- ↑ Germany Trad & Invest, January 31, 2014

- ↑ Alexander Busch: Inverted World in Latin America , in: NZZ, International Edition, May 4, 2016, p. 15.

- ↑ Tjerk Brühwiller: Latin America's Pandora's Box , in: NZZ, February 6, 2017.

- ↑ Barbara Unmüßig, Rainer Falk: The Revenge of the North. In: Die Zeit, February 15, 2014

- ↑ IMF lowers outlook - and warns of nationalist tendencies. In: Die Presse , April 12, 2016.

- ↑ zinc price in: www.finanzen.net , call on Aug. 19, 2016.

- ↑ IMF: Growth in emerging markets is picking up , in: Handelsblatt, April 6, 2017.

- ↑ Markus Frühauf: Central Bank BIS fears credit bubble in China.

- ↑ FAZ.net , September 19, 2016.

- ↑ Bernhard Zand: How China wants to conquer the world with 900 billion dollars. In: Spiegel.de, May 15, 2017.

- ↑ Franz Stocker: A huge credit bubble is growing in the wonder nation. www.welt.de , April 9, 2018.

- ↑ Concern about the financial crisis in the emerging markets. In: kurier.at, January 8, 2018.

- ↑ Frank Stocker: The world is returning to the path of the debt crisis. In: welt.de, October 1, 2017.

- ↑ Mischa Ehrhardt: Emerging countries in the wake of the Turkey crisis , on Deutsche Welle , September 1, 2018

- ↑ Alexander Busch: /25719140.html Argentina is insolvent. In: handelsblatt.com, April 6, 2020.