Oil price crisis

The oil price crisis (also known as “ oil price shock ”, often misunderstood as an oil crisis ) is a phase of strong oil price increases that have serious macroeconomic effects. In a narrower sense, only the increases in crude oil prices in 1973 and 1979/1980 are referred to as oil crises, as both triggered severe recessions in industrialized countries . Even the (real) price increases and leaps in demand at the beginning of modern oil production up to 1900 were comparable to the modern oil crises. At the beginning of the 1950s, crises like the putsch in Iran and the Suez crisis did not lead to an oil price shock in West Germany, which at that time still covered 35 percent of its oil needs from domestic sources, but led to intensive oil prospecting in the GDR.

The possibility of a global oil crisis is discussed, which could be caused by the increasing demand for oil and an absolute and unavoidable decline in supply due to a possibly imminent global oil production maximum . However, the historical oil crises of the 1970s did not arise because the global oil reserves were exhausted, but had political or economic backgrounds.

The first oil price crisis in 1973

description

The first and most momentous oil price crisis was triggered in autumn 1973 on the occasion of the Yom Kippur War (October 6th to 26th, 1973). The Organization of Arab Oil Exporting States (OAPEC) deliberately cut production volumes by around five percent in order to put pressure on the Western countries to support Israel , against which the Arab League had declared a comprehensive economic boycott since 1948 with little success . On October 17, 1973, the price of oil rose from around three US dollars per barrel (159 liters ) to over five dollars. This corresponds to an increase of around 70 percent. Over the course of the next year, the price of oil rose worldwide to over twelve US dollars per barrel.

This event also went down in history under the name of the “oil embargo”. The reduction in production volumes was a calculation and political leverage of the OPEC countries, which did not agree with the policy of some oil-importing countries regarding the Yom Kippur War. At the embargo took Algeria , Iraq , Qatar , Kuwait , Libya , Saudi Arabia and the United Arab Emirates in part.

Country-specific effects

The oil price crisis of 1973 demonstrated the dependence of industrialized countries on fossil fuels , especially fossil fuels.

In the Federal Republic of Germany, as a direct reaction to the crisis, an energy security law was passed, on the basis of which a general driving ban was imposed on four car-free Sundays , starting on November 25, 1973, as well as general speed limits for six months (100 km / h on motorways , otherwise 80 km / h) were introduced. The aim of these measures was not only to save oil, but also to make the population aware of the seriousness of the situation. The saving effect of the car-free Sundays was actually only slight. In 1974 the Federal Republic had to pay around 17 billion DM more for its oil imports than in the previous year. This intensified the economic crisis and led to a significant increase in short-time work , unemployment , social spending and company bankruptcies . Keynesian economic control measures and monetary measures had stagflation result. For years, the Federal Ministry of Economics ran a campaign entitled “Saving energy - our best energy source”.

In Switzerland there was a general driving ban for three consecutive Sundays from November 25, 1973.

The Austrian Kleinwalsertal , which can only be reached by car from Germany, joined the four car-free Sundays in Germany. Otherwise, an unlimited speed limit of 100 km / h was introduced on asphalt roads in Austria from November 24 or 25, 1973 (“weekend”), with which it was hoped to reduce fuel consumption by 10%. The Council of Ministers also decided that the temperature in all offices should be reduced to 20 ° C. At the turn of the year the first reports of possible restrictions on car traffic came up, then Minister of Commerce Josef Staribacher (“Pickerl-Peppi”) announced a car-free day per week, which came into force on January 14, 1974 and was valid for about five weeks. For this purpose, the vehicles were marked with a sticker for the desired weekday on the windshield. In addition, the day had to be entered on the edge of the registration certificate. Failure to comply was punished with between 500 and 30,000 schillings (36–2,180 €); in emergencies, goodwill was announced. In circumstances worth considering, a change of the weekday concerned could be requested from the district administration. There were also additional “S badges”, special permits with which only the registered owner was allowed to drive for a certain period of time and a certain distance (e.g. to and from the workplace) even on car-free days. The sticker obligation was retained for a long time in order to be able to act quickly in the event of a new crisis situation. A week's special vacation was introduced in the schools in the first half of February to save heating oil, which was then continued as a semester break . They still use the colloquial name of energy holidays among older people today.

Concerned about a drastic decline in the number of holidaymakers, Italy introduced petrol vouchers with which subsidized petrol could be obtained.

The introduction of summer time is seen as a long-term consequence of the oil price crisis .

Because of the different transfer prices (a five-year average of the world market price) in the Comecon (Eastern Bloc countries), this oil crisis in the GDR came much later (at the beginning of the 1980s) than in the Federal Republic. In particular, the chemical industry of the GDR profited in the 1970s from the intermediate trade in crude oil and chemical raw materials and fuel derived from it. At the beginning of the 1980s, however, the oil prices in Comecon were rather higher than on the world market and the GDR no longer received the quantities it needed. In the absence of foreign exchange, new technologies and its own oil reserves, it was therefore forced to increasingly rely on domestic lignite or coal liquefaction plants in order to apply for billions in loans in the West and to increasingly use "unconventional" foreign exchange procurement measures. The Deutsche Reichsbahn also reactivated steam locomotives on a large scale and dismantled them from oil to coal firing.

Technological changes

The offshore production of oil and the subsequent exploitation of older deposits became profitable again due to the increased prices. In the offshore sector, this resulted in rapid development of the associated technologies; from the construction of drilling rigs to the laying of pipelines and the use of diving robots ( remotely operated vehicles ) for prospecting, plant construction and maintenance in greater water depths.

As a result of the oil crisis, initiatives arose to reduce dependence on oil. Alternative fuels such as vegetable oil , biodiesel and waste incineration became a matter of public interest. There was increased investment in nuclear energy , renewable energy sources , the thermal insulation of buildings and in increasing the efficiency of engines and heating devices. Even as the oil crisis subsided, there was an increased awareness of energy-saving behavior among the population. In addition, the proportion was from the OPEC related -Staaten oil by tapping undersea oil fields in the North Sea as well as a diversification of the trading partner lowered. This development has meanwhile declined in favor of OPEC, since the North Sea oil has now reached its maximum production point and the production rates are falling again continuously.

In some western states, military options were considered in the wake of the 1973 crisis. According to a joint plan between the British and American governments that had been kept secret for over 30 years , an invasion of Saudi Arabia and Kuwait was the subject of planning. It was thought that US airborne troops would seize the oil installations in Saudi Arabia and Kuwait and might even ask the British to do the same in Abu Dhabi.

To reduce political blackmail, strategic oil reserves were set up or massively increased in all countries .

The second oil price crisis in 1979

After a drop in oil prices, there were again brief price increases during the second oil crisis in 1979/1980. It was triggered mainly by funding failures and uncertainty after the Islamic Revolution in Iran and the subsequent attack by Iraq on Iran ( First Gulf War ). The price increase at that time found its maximum at around 38 US dollars for a barrel (159 liters ). In the late 1980s the price of oil fell back below $ 20 a barrel.

Further short-term price increases

Second Gulf War 1990

When Iraqi troops occupied Kuwait on August 2, 1990 , an oil price crisis was feared because both countries were large oil producers. However, the price only skyrocketed for a short time. In early 1991, an international coalition led by the USA restored the state of affairs before the war by defeating Iraq militarily ( Second Gulf War ).

Global economic recovery after the Asian crisis in 2000

After overcoming the Asian crisis , the world economy grew again and with it the demand for oil. The weather conditions in the severe winter of 2001/2002 also led to an increased demand for oil. The impact was far less than in the 1970s. Increases in oil production prevented an oil price crisis, and logistical problems (such as a lack of oil tankers) outweighed an actual shortage of oil. Adjusted for purchasing power , the oil price in 1900 was higher than in 2000.

Oil price spikes in the recent past

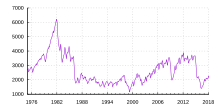

After a prolonged period of lower prices, the price of oil temporarily reached a level of 53 dollars during 2004 in an environment of political, economic and speculative stress. After the devastating Hurricane Katrina , which affected oil production in the Gulf of Mexico and refining in the United States, the price of crude oil rose to $ 70 a barrel (159 liters ). The oil price for US light oil (WTI) reached its previous record high on NYMEX on July 11, 2008, when it rose to 147.27 US dollars; Brent was trading at its high of $ 147.50. At the beginning of 2009, however, due to an economic crisis from 2007 , oil prices were back at a level of $ 30 to $ 40.

On January 31, 2011, the oil price for the North Sea variety Brent rose for the first time since October 1, 2008 in the course of trading above the 100 dollar mark and on March 1, 2011 the price for the US variety WTI also exceeded for the first time since March 1, 2011 October 2008 the limit of 100 US dollars.

On April 4, 2011, the price of North Sea Brent oil rose to over 120 US dollars for the first time since August 2008. One factor behind the increase was the protests in the Arab world from 2010 to 2011. Investors feared a long-term loss of oil production in the country due to the civil war in Libya in 2011 and the unrest would spread to Saudi Arabia, one of the world's largest oil exporters.

The mostly large gap between Brent and other types of oil is noticeable: For a barrel of the US reference type WTI, for example, B. on the above date (April 4, 2011) around 108 US dollars will be paid.

Effects and probability of a final oil price crisis

The oil price crises of the 20th century were mainly caused by political and economic events and were temporary. Supporters of the thesis of the global production maximum ( ASPO , e.g. Wolfgang Blendinger , Colin Campbell and Kenneth Deffeyes ) fear an oil crisis that is not solely political and is not temporary.

The International Energy Agency and its chief economist Fatih Birol also warned of a slump in world oil production and price escalation. At the end of February 2009, the IEA warned of a renewed oil and thus economic crisis until 2013 and oil prices of up to 200 dollars due to a lack of oil when demand picked up again. According to the IEA, global oil production capacities (in 580 of the 800 largest oil fields in the world) are already falling and oil reserves are expected to decrease significantly by 2013. The problem with an oil price of $ 40 is that the oil companies hold back their investments because they are not worthwhile.

Others, on the other hand, dispute the relevance of the forecasting method originally developed by Marion King Hubbert , the applicability of such forecasts to global oil production or even the fundamental finiteness of oil reserves.

They see the investment backlog that resulted from the collapse in prices in the 1990s and upheavals in the global oil industry as a greater challenge . Private western oil companies with a high level of technical know-how still controlled almost 50% in 1970, and in 2008 only 15% of global oil production. Due to a lack of investment security, there is a conflict between access to deposits and technology. They also point to the large deposits of unconventional oil, such as oil sands , which secured oil production for many decades.

See also

literature

- The little oil crisis . In: Die Zeit , No. 43/2004

Web links

- Cheap oil (PDF; 67 kB)

- The Association for the Study of Peak Oil and Gas

- Comparison of nominal and inflation-adjusted oil prices, 1947–2004

- Car-free day in Austria , film report from January 25, 1974 with pictures from Europe

Individual evidence

- ^ A b Rainer Karlsch, Raymond G. Stokes: Factor oil. The mineral oil industry in Germany 1859–1974 . CH Beck, Munich 2003.

- ^ David S. Painter: Oil and Geopolitics: The Oil Crises of the 1970s and the Cold War . In: Historical Social Research . tape 39 , no. 4 . GESIS - Leibniz Institute for the Social Sciences, Cologne 2014, p. 190 , JSTOR : 24145533 (English).

- ^ Ordinance on driving bans and speed limits for motor vehicles of November 19, 1973 , Federal Law Gazette I, page 1676

- ↑ Federal Chancellor Helmut Schmidt commented on the Sunday driving bans during the oil crisis as follows: So that the German people should understand what had happened, we decreed these car-free Sundays on the autobahn. Not to save oil, that was a side effect. The real purpose of this exercise was to make people realize that this is a serious situation. In: Bonner Republik 1949-1998 (TV broadcast). Part 3/6: 1969-1974 - Social-Liberal Coalition Brandt / Scheel | PHOENIX

- ↑ Three car-free Sundays in 1973 (Shipment Sinerzyt of Swiss Radio DRS with an archive recording of 21 November 1973 Federal Ernst Brugger )

- ↑ a b c d Michael Gasser: From history. The oil crisis 40 years ago changed the country. School and car were suddenly free. In: Vorarlberger Nachrichten. October 25, 2013, accessed on January 22, 2015 (With facsimiles of the UN article of November 21, 1973 "Austria's first consequences of the oil price crisis. Unlimited speed limit 100. Office room temperature 20 degrees", January 14, 1974 "Once a week without Auto. Badge is only valid together with the registration certificate ").

- ↑ a b Erich Kocina, Eva Winroither: What remained of the "energy vacation ". In: DiePresse.com. January 31, 2013, accessed on January 22, 2015 (print edition: February 1, 2013).

- ↑ Knowledge. Everything about traffic, technology and the environment - “Car-free day”. In: oeamtc.at. ÖAMTC, archived from the original on September 24, 2015 ; accessed on January 22, 2015 .

- ↑ Pickerl time ends on July 1st . In: Arbeiter-Zeitung . Vienna June 29, 1974, p. 05 ( berufer-zeitung.at - the open online archive - digitized). (But with the note that an extension has already been decided in the National Council, but not yet in the Federal Council.)

- ↑ Time: Reisenachrichten- car care with Italy , issue of July 19, 1974; Accessed July 12, 2012

- ^ APA: 1973 Oil Crisis: Motorways without Cars. In: derStandard.at. October 16, 2013, accessed January 22, 2015 .

- ^ US ready to seize Gulf oil in 1973. BBC News. January 2, 2004.

- ↑ Oil price in USD - historical prices , finanzen.net , accessed October 4, 2018

- ↑ Fatih Birol in an interview with Internationale Politik (magazine) . April 2008; see. also: World Energy Outlook 2007 . ( Memento of December 17, 2007 in the Internet Archive ) (PDF) [Summary]

- ↑ Michael Kläsgen: Energy agency warns of bottlenecks - "The next oil crisis is coming" . sueddeutsche.de. February 27, 2009. Retrieved May 8, 2011.

- ↑ Maugeri, Leonardo (2004) Oil - False Alarm (PDF; 299 kB), in: Science

- ^ As Oil Giants Lose Influence, Supply Drops , Jad Mouawad, The New York Times . August 18, 2008.