Global oil production peak

The global oil production maximum (English peak oil ) is the temporal maximum of the global production rate of crude oil . The concept of an oil production maximum is based on the observation that the production of raw materials from certain deposits will reach a historical maximum long before the reserves are finally exhausted due to several factors and that production will then fall irreversibly. It goes back to the work of the geologist Marion King Hubbert from 1949. Hubbert forecast u. a. in 1974 the maximum of conventional production for 1995, but he deliberately excluded the unconventional reserves. The US Energy Information Administration assumes that conventional oil production has already reached the "plateau" in 2005 and that this continues to this day (2019). In contrast, it is estimated that the production maximum for unconventional oil production, such as hydraulic fracturing , will be reached between 2050 and 2100.

In the early and mid-2000s, the concept received worldwide attention through a number of publications and popular science books. The point in time and the amount of the maximum of the total oil production was delayed considerably due to the inclusion of previously unconventional deposits such as shale oil , oil sands or deep-sea deposits . The failure of the predicted production maximums led to the ironic description as an oil constant .

Development of the concept

Marion King Hubbert , at that time a senior oil expert at Shell and a well-known member of the technocratic movement , coined the term in 1956. Hubbert was familiar with the course of oil production from individual wells and smaller oil fields, which is roughly similar to a logistical distribution , and transferred this to the North American such as global promotion. With the so far correct forecast of the maximum oil production for the United States, Hubbert caused a sensation; However, according to more recent forecasts, for example from the International Energy Agency, the USA sees itself in a position to exceed its previous maximum oil production from the early 1970s through unconventional oil production. Hubbert (1974) predicted the global maximum oil production for 1995. The actual development has refuted this forecast.

In 1998 geologists, physicists, energy consultants and publicists who deal with the production maximum joined together in the Association for the Study of Peak Oil and Gas (ASPO) founded by geologist Colin J. Campbell . In the first decade since the turn of the millennium, a global oil production maximum and a subsequent exponential reduction in oil production and its consequences were discussed in public. The key oil producers around the world could hardly expand their production. The official numbers of their reserves are also most likely greatly exaggerated. For decades, the finds of cheap, conventional oil have fallen sharply and are less than the amount consumed in the same period. Some of these experts, with great public attention, forecast an impending global oil shortage and considerable price increases between 2010 and 2020 due to falling production possibilities. In other, more optimistic scenarios, a plateau is initially assumed with a tight but not abruptly falling oil supply. The predicted stagnating or falling oil supply was and is in part linked to the demand for an energy turnaround .

Since 2008, the International Energy Agency has also addressed the global oil production maximum. It saw the production maximum of conventional oil already in 2006 and regards the production maximum as a possible driver for oil price increases.

Other experts and leading representatives of petroleum companies consider the concept of the global maximum oil production and the time forecasts derived from it to be unusable. The complex development of the promotion of individual countries cannot be described by a single cumulative curve with a single peak. A plateau or more complex curves result. This means that there is enough time to build up other energy sources and introduce technical innovations. In the OPEC countries, the topic is completely ignored and claims are made that there would still be enough oil for several decades at the current production rates. Likewise, some economists, with reference to new technological developments as well as the history of the raw materials economy as a whole, question the extent to which finite resources generally represent a permanent problem. Clive Mather, CEO of Shell Canada, regards the earth's hydrocarbon reserves as "nearly infinite". Former Enron manager Robert L. Bradley Jr. refers to the Austrian School of Economics in its criticism of the oil production peak. The retired oil geologist Heinz Beckmann advocated a very similar thesis when he pointed out that stocks of unconventional reserves far exceeded the amounts that were economically recoverable at the time, and that the maximum oil production will occur due to rising production costs.

General problems determining the point in time of maximum oil production

The forecast of the point in time and the level of a global oil production maximum is fraught with great uncertainty for several reasons. Even the creation of a production curve using the Hubbert method, which only includes geological factors and is limited to the analysis of the production of crude oil, is problematic, since this requires precise knowledge of the worldwide production and reserve data. However, in a number of countries, particularly major oil-producing countries in the Middle East, these data are published by the national oil companies and cannot be independently verified.

In more recent analyzes, in addition to conventional oil (crude oil + liquefied gas ), “unconventional oil” such as extra-heavy oil (oil that does not flow naturally) and oil from tar sandstone as well as other oil-like liquids (synthetic oil from gas and coal, biofuels) are often included. Depending on which liquids are considered, different results can be obtained with regard to a conveying or production maximum.

A number of factors cannot be modeled at all. These include B. the effects of war, unrest or sanctions in major oil-producing countries. It is just as difficult to predict the effects of technological advances and rising oil prices on production.

The figures for an oil production maximum diverge accordingly. The table below gives an overview of the various forecasts.

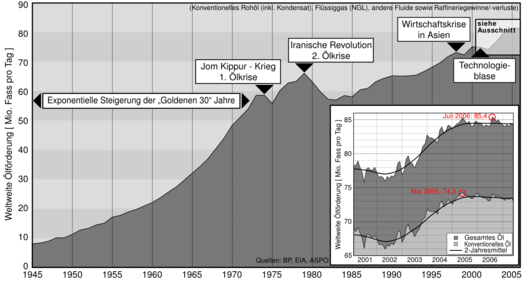

Worldwide oil production

Worldwide oil production increased (after initial crises and doubts about the unlimited continuation of production around 1920) between 1930 and 1972 approximately exponentially. Fig. 4 shows this development. With the politically justified oil crises in 1973 and 1979/83, exponential growth ceased, oil production declined somewhat and continued to rise more slowly and only linearly. There was also a significant drop in demand after the Asian crisis and the bursting of the dot-com bubble . The terrorist attacks on 11 September 2001 in the United States, however, expressed only in the short term, demand for aviation fuel.

With the recovery of the world economy after the dot-com bubble , global production rose until mid-2004, and then stagnated, especially in the People's Republic of China and India, despite sustained strong economic growth , which led to a sharp rise in prices. After 2009, production increased by about 2% annually, faster than global GDP, resulting in falling prices and full stocks.

In continuation of Figure 4, the following table gives an overview of the development of the supply of liquid fuels since 2005 (in 1000 barrels / day, rounded values), broken down according to product groups.

| year | Crude oil including condensate |

Liquefied gas |

other liquids |

total |

|---|---|---|---|---|

| 2005 | 73820 | 7599 | 1205 | 82987 |

| 2006 | 73430 | 8132 | 1354 | 82980 |

| 2007 | 73121 | 8329 | 1472 | 82977 |

| 2008 | 74012 | 8447 | 1814 | 84338 |

| 2009 | 72863 | 8474 | 1966 | 83437 |

| 2010 | 74585 | 8656 | 2221 | 85736 |

| 2011 | 74692 | 9042 | 2331 | 86128 |

| 2012 | 76117 | 9227 | 2443 | 88037 |

| 2013 | 76202 | 9611 | 2611 | 88515 |

| 2014 | 77983 | 10069 | 2751 | 90803 |

| 2015 | 80043 | 10403 | 2819 | 93265 |

Explanations to the table:

Crude oil is the term used to describe the extracted oil that has already been separated from water and gases but has not yet been processed. The synthetic oil obtained from the tar sands of Canada is also counted as crude oil here. Of the liquids listed in the table, crude oil has the highest energy density and the greatest flexibility in terms of further processing.

Condensate is light oil that is a by-product of natural gas extraction and processing. Condensate, which is separated from the natural gas at the point of production and mixed with crude oil from nearby oil wells before further transport and processing, is statistically recorded together with the crude oil.

Liquefied gases are gases that become liquid under relatively low pressure and can therefore be used for heating purposes or to drive vehicles. Liquefied gases are obtained in refineries as part of the processing of crude oil or natural gas. Liquid gases only have about 2/3 the energy content of crude oil and can only be processed into transport fuels to a limited extent.

"Other liquids" include biodiesel and ethanol as well as synthetic oil obtained from natural gas and coal (the last two product groups mentioned are currently negligible).

The “volume gains through refining” is a statistical effect that arises from the fact that the crude oil is further processed in the course of refining into distillates with a lower specific weight and thus a larger volume. The energy content remains unchanged. Nevertheless, these volume gains are often added to the “total oil supply”.

The table shows that both crude oil production and total supply stagnated up to 2009. Since 2010 the funding or production has increased again significantly. Production expansions in the Middle East (Saudi Arabia, United Emirates, Iraq) and the resurgence of US oil production since 2008 have played a major role in this increase.

Oil reserves

Reserve data do not usually indicate the absolute total amount of oil in the soil, but the amount that can also be extracted. This amount depends on the geological conditions ( porosity and permeability of the storage rock ) as well as on the extraction technology used and the oil price. The higher the oil price, the more expensive technology can be used profitably. The limit, however, is the energetic cost-benefit calculation; as soon as more energy has to be used for the search for oil, the extraction and the transport than is contained in the extracted oil, this extraction becomes unprofitable as an energy source (" ERoEI " Energy Return on Energy invested).

Even with the use of state-of-the-art technology, the proportion of recoverable oil in the soil is only around 35–45% of a deposit. The greatest impact on the production rate has, on the one hand, the geology (highly permeable deposits enable high production rates) and, on the other hand, the use of what is known as secondary production technology (usually the pumping of water under the oil field ). The maximum exploitation of an oil field - i.e. the increase in the proportion of recoverable oil - is achieved above all by high-precision drilling even into the small pockets of an oil field. Nowadays, drilling can be done horizontally, and with an accuracy of a few meters, it can also reach very narrow oil-bearing layers and thus increase the degree of oil removal.

The oil-producing countries often use leeway for interpretation to manipulate their reserves. In 1985, the OPEC producing countries decided to link the country-specific production rates to the respective reserves; those who had high reserves were allowed to promote more and vice versa. As can be clearly seen in Fig. 5, this decision provoked a general artificial increase in the reserves of the individual member states, since each state wanted higher production rates at a high price.

In order to continue to produce oil, new oil wells must be discovered. Fig. 6 shows the oil discoveries from 1930 to 2050 according to Campbell with the aid of the method of "backdating oil discoveries", whereby the white bars are estimates. The annual delivery rate is included. You can see the large oil discoveries in the Persian Gulf in the late 1940s and the large discoveries in the North Sea in the early 1980s. Most of the deposits, however, were found in the 1960s. According to Campbell, the findings - with a few exceptions - are constantly decreasing; since 2003 they have even been continuously below the forecast values. According to his study, more oil has been extracted than new found since the early 1980s.

According to industry experts, a rise in the price of oil makes it possible to explore areas that have not been intensively investigated (e.g. Siberia) and to exploit unconventional, previously economically unprofitable deposits. These include oil sands , especially the large deposits in Alberta in Canada, oil shale , deep-sea drilling , Siberia or Alaska exploration, bitumen, etc. Leonardo Maugerie, an employee of the Italian oil company Eni , saw a considerable investment backlog as early as 2004 because in many oil countries and the oil industry's experience of falling prices due to overcapacity from the 1980s still had an impact.

Oil production in individual countries

Overview

The table below shows the current delivery volume (2016) broken down by country in relation to the maximum achieved delivery. Countries that have produced more than 1 million barrels per day are recorded individually. All other countries are grouped into regions with the corresponding aggregated funding rates. The figures include crude oil including condensate and liquefied gas. Biofuels and volume gains from refining are not included. Deviations in the summation (world oil production) to the table above (sum of columns 2 and 3 for 2016) are due to the different sources.

| country | Year of maximum funding |

Peak oil barrels / day |

Production 2016 barrels / day |

Funding in 2016 as a percentage of the maximum funding |

Trend (year) | Remarks |

|---|---|---|---|---|---|---|

|

|

2015 | 12,757,000 | 12,354,000 | 97 |

|

According to BP statistics, the previous funding maximum of 1970 was exceeded in 2014 |

|

|

2016 | 12,349,000 | 12,349,000 | 100 |

|

Promotion stagnates; current production capacity according to own information 13.5 million barrels / day |

|

|

1987 | 11,297,000 | 11,227,000 | 99 |

|

Promotion z. Currently still slowly increasing |

|

|

1974 | 6,060,000 | 4,600,000 | 76 |

|

Promotion impaired by political conditions |

|

|

2016 | 4,460,000 | 4,460,000 | 100 |

|

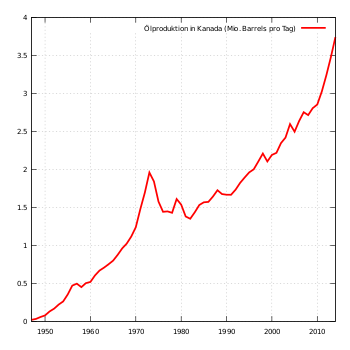

Extraction from tar sands; increasing |

|

|

2015 | 4,309,000 | 3,999,000 | 93 |

|

Funding maximum not yet reached |

|

|

2004 | 3,824,000 | 2,456,000 | 64 |

|

Production waste |

|

|

2016 | 4,073,000 | 4,073,000 | 100 |

|

Funding maximum not yet reached |

|

|

2016 | 4,465,000 | 4,465,000 | 100 |

|

Funding can be increased significantly if political conditions are stable |

|

|

1998 | 3,480,000 | 2,410,000 | 69 |

|

Promotion impaired by political conditions |

|

|

2001 | 3,418,000 | 1,995,000 | 58 |

|

Production waste |

|

|

1972 | 3,339,000 | 3,151,000 | 94 |

|

Delivery rate stagnates |

|

|

1999 | 2,909,000 | 1,013,000 | 35 |

|

Production waste |

|

|

2010 | 2,523,000 | 2,053,000 | 81 |

|

Promotion impaired by political conditions |

|

|

2016 | 2,605,000 | 2,605,000 | 100 |

|

Funding maximum not yet reached |

|

|

1979 | 2,139,000 | 426,000 | 20th |

|

Funding severely affected by political conditions |

|

|

2007 | 1,992,000 | 1,579,000 | 79 |

|

Production waste |

|

|

2008 | 1,901,000 | 1,807,000 | 95 |

|

Production waste |

|

|

2013 | 1,785,000 | 1,672,000 | 94 |

|

Delivery rate stagnates |

|

|

1977 | 1,685,000 | 881,000 | 52 |

|

Production waste |

|

|

2013 | 1,995,000 | 1,899,000 | 95 |

|

Delivery rate stagnates |

|

|

2010 | 1,023,000 | 826,000 | 81 |

|

Production waste |

|

|

2013 | 1,004,000 | 924,000 | 92 |

|

Delivery rate stagnates |

| Rest of America | 2006 | 1,806,000 | 914,000 | 51 |

|

Production waste |

| Rest of Europe | 2003 | 1,484,000 | 983,000 | 66 |

|

Production waste |

| Rest of the Middle East | 2001 | 2,044,000 | 1,250,000 | 61 |

|

Production waste |

| Rest of Africa | 2008 | 2,403,000 | 2,027,000 | 84 |

|

Production in Sudan affected by war |

| Rest of Asia / Pacific | 2010 | 3,292,000 | 3,131,000 | 95 |

|

Delivery rate stagnates |

| world | 2016 | 92,150,000 | 92,150,000 | 100 |

|

Funding maximum not yet reached |

Saudi Arabia

More than ten percent of the world's oil comes from Saudi Arabia . A large part of Saudi production comes from a few giant oil fields that were put into operation decades ago and may already be in the phase of production waste. Reliable information on this is not available as the production data is a state secret and no independent experts are approved in Saudi Arabia.

Saudi oil production over the past 10 years has fluctuated between 8.9 million barrels / day in 2002 and 11.5 million barrels / day in 2012. However, these production figures do not reflect geological limits, that is, they are not the maximum possible funding rates. Rather, as one of the few remaining swing producers, Saudi Arabia is able to adapt its production figures to current political and economic requirements.

According to the IEA, the current maximum permanent production capacity for crude oil is approx. 12 million barrels / day. This production capacity can probably be maintained until at least 2016. In addition, there are 1.55 million barrels per day of liquid natural gas (LNG) (expanded to 1.8 million barrels / day by 2016). Liquefied natural gas is a substitute for liquid fuels made from crude oil in many applications, albeit with a lower energy density.

In late 2011, Saudi Arabia announced that a $ 100 billion investment program to expand crude oil production capacity to 15 million barrels / day by 2020 had been suspended. The reasons given were the expected increase in oil production in Iraq and the increasing oil production from tar sands and shale as well as weaker oil demand. The same source states that Saudi Arabia currently needs an oil price level of at least $ 92 / barrel (up from $ 60 in 2008) to meet its soaring government spending, and will defend this price level through production restrictions.

Domestic consumption of crude oil and liquefied natural gas has risen sharply in recent years. In 2012 it was 2.935 million barrels / day compared to 1.578 million barrels / day in 2000. Oil exports (crude oil + condensate + liquid natural gas) peaked in 2005 at 8.918 million barrels / day. In 2012, 8.595 million barrels / day were exported.

Russia

Oil production in the area of today's Russia reached its maximum of 11.484 million barrels / day in 1987, that is, back in the days of the Soviet Union. After their dissolution, the disintegration of the state and economic structures initially led to a sharp drop in production to a minimum of 6.062 million barrels / day in 1996. Since then, production has increased almost every year and reached 10.643 million barrels. Barrel / day in 2012 a preliminary maximum.

The following table gives an overview of the development of oil production and consumption in the years 2002–2012 (in 1000 barrels / day).

| year | advancement | increase | Domestic consumption | Export balance * |

|---|---|---|---|---|

| 2002 | 7755 | 2559 | 5196 | |

| 2003 | 8602 | 847 | 2679 | 5923 |

| 2004 | 9335 | 733 | 2660 | 6675 |

| 2005 | 9598 | 263 | 2679 | 6919 |

| 2006 | 9818 | 220 | 2761 | 7057 |

| 2007 | 10044 | 226 | 2777 | 7267 |

| 2008 | 9950 | −94 | 2862 | 7088 |

| 2009 | 10139 | 189 | 2772 | 7367 |

| 2010 | 10365 | 226 | 2892 | 7473 |

| 2011 | 10510 | 145 | 3089 | 7421 |

| 2012 | 10643 | 133 | 3174 | 7469 |

- The export balance is the arithmetical difference between production and domestic consumption. It does not correspond to the oil actually exported. On the one hand, for domestic consumption according to Definition of BP Biofuels included. on the other hand, some of the oil is already processed domestically and only then exported, which also results in changes in volume (refinery gains). Building up or reducing stocks is also not taken into account. However, the balance provides an indication of whether rising domestic consumption overcompensates for an increase in production. In countries with a decline in production, increasing domestic consumption means that exports fall faster than production.

As can be seen from the table, funding has only increased slowly since 2005. A plateau is emerging. The export balance has stagnated since 2010.

The International Energy Agency (IEA) also sees Russian oil production at its maximum in a publication from early November 2011. The IEA predicts that production of around 10.5 million barrels / day can be sustained by the end of the decade. After that, a slow decline in production should begin. Daily production of 9.7 million barrels is expected for 2035. Other experts consider this assumption to be too optimistic and expect a greater drop in production.

Kazakhstan and other states of the former Soviet Union

The share of FSU and OPEC oil is increasing, which allows these countries to use production rates and prices as political leverage.

The deposits of the CIS countries in the vicinity of the Caspian Sea are still being developed. First geological surveys in the region in the second half of the 1990s estimate the so-called Kashagan field alone to have around two to four billion barrels of recoverable reserves. Following the completion of two exploration wells and two additional evaluation holes, the official estimates were revised upwards to between seven and nine billion barrels. In February 2004, however, after four more exploration wells, the new estimates were 13 billion. According to BP, the oil reserves found in the wider area still hold considerable reserves.

Other states

Fig. 7 shows oil production outside of the OPEC countries; the data are estimates from 2004 onwards. The OPEC's share of funding makes up around 50% of the total funding. The graphic also shows that the maximum production of oil producers outside OPEC and the Russian Federation or the CIS countries (FSU, Former Soviet Union ) was exceeded in 2000. In the OECD European countries, oil production is falling by around five percent annually. In January 2006 it was still possible to cover around 36% of the demand from our own sources. In 2015 it is expected that 92% will have to be imported into the EU .

Development of the oil price

Previous price development

Global demand for oil fluctuates with the economy . Short-term price fluctuations in oil are closely linked to security and regional policy developments and fears. Price fluctuations alone are therefore not an indication of acute shortages. However, a clear effect can be seen in the synopsis of prices and delivery volumes: While up until 2004 the often speculative price fluctuations led to significant adjustments in the delivery volume at short notice, the supply has responded much weaker since then. The sudden drop in price elasticity indicates that the major OPEC producers are now operating at their production maximum.

Forecasts

Since the price of oil depends heavily on demand and the overall economic situation and, on the other hand, a very high oil price has an impact on the latter, forecasts of the oil price development must make assumptions about economic development. A key concept used to describe the link between supply, demand and price is that of price elasticity , which indicates how much demand for a product changes when the price increases by a certain percentage.

The forecasts for the future development of the oil price therefore show a wide range.

The International Monetary Fund presented scenarios for this in the World Economic Outlook of April 2011 that include a shortage in oil production. On the one hand, the report looks at the development of oil production and comes to the conclusion that oil production has stagnated since around 2005.

Model calculations with different scenarios are considered for the forecasts. For example, for a scenario of a production maximum with an oil shortage by an average of 3.8% annually, a short-term increase in the oil price of 200% and an increase of 800% for a period of 20 years is calculated. These calculations expressly emphasize that they do not include non-linear effects and economic feedback.

As a possible countermeasure, the report discusses a preventive reduction in oil consumption, which increases the elasticity of demand:

"Regarding policies aimed at lowering the worst case risks of oil scarcity, a widely debated issue is whether to preemptively reduce oil consumption - through taxes or support for the development and deployment of new, oil-saving technologies - and to foster alternative sources of energy. ”

"With regard to policy measures to reduce the risks in the worst case of oil scarcity, consideration is often given to lowering oil consumption preventively - by controlling or promoting the development and use of new oil-saving technologies - and building alternative energy sources."

time

Due to the difficult data situation, the maximum oil production can probably only be dated with certainty a few years after its occurrence. The times predicted by Campbell, the founder of ASPO, for a global oil production peak have been postponed several times into the future and cannot currently be confirmed beyond doubt. Among other things, this is taken as an opportunity by critics to consider the transfer of the Hubbert peak to global funding to be inappropriate. On the other hand, the more optimistic International Energy Agency (IEA) also revised its forecasts. In its annual World Energy Outlook , it lowered the forecast production rates and total production volumes each time, and as a result set the time of the global oil production peak earlier and earlier.

The ASPO also assumes that the production rate of the OPEC countries is close to its maximum and can currently only be increased in Iraq and on the West African coast, so that the maximum oil production is currently in effect. This is especially true for the Arab OPEC members, who have a very high share in global oil production. According to a paper by WikiLeaks and the British newspaper The Guardian gave the Saudi oil expert Sadad al-Husseini , former chief geologist of Aramco in 2007 and 2009 compared with the Consul General of the United States that the oil reserves of Saudi Arabia by nearly 40% were overestimated, so that the country - contrary to previous expectations - will probably not be able to contribute to alleviating global funding bottlenecks and the associated price peaks.

Leonard Maugerie from the Eni Group takes a counter-position . According to him, the upheaval in the oil industry is much more important than the discussion about maximum oil production. He believes the maximum conventional oil production in the OPEC states and Russia is still far from being reached, and the possibility of using unconventional oil reserves is not even included. At the beginning of 2006 - with an oil price of around US $ 60 - he also feared a price fall, which would have negative consequences for investments in unconventional oil sources and alternatives for fuel production, which for economic reasons require an oil price of at least US $ 45.

In August 2009, the International Energy Agency overshadowed earlier warnings: Since oil production capacities are decreasing due to declining reserves and a lack of investment, the massive oil shortage could aggravate and prolong the global financial and economic crisis since 2007 due to the massive oil shortage . The production of the existing oil fields is currently falling by 6.7 percent annually. To compensate for the declining production of depleted oil reserves, it would be necessary to find the equivalent of four times the production capacity of Saudi Arabia by 2030 . In November 2010 the IEA also stated that the era of cheap oil was over.

Various methods are used to predict future oil production:

- Curve fitting: This method assumes that global oil production can be described by the Hubbert curve. The Hubbert curve is adapted to historical data in order to extrapolate to further oil production.

- Bottom-up methods: Here the oil production rates for the largest oil fields are examined individually. Planned future major projects are also included in the analysis. Global oil production is estimated from the sum of the production rates of the individual fields.

Estimated

timeDate of

publication

lichungMaximum

flow rate

(mbarrel / day)author 1989 1989 Campbell * 2020 1997 Edwards 2003 1998 Campbell 2007 1999 Duncan and Youngquist 2008 2000 Marie Plummer Minniear 2019 2000 Bartlett 2004 2000 Bartlett 2005 conv. Oil

2010 incl. Unconv. Oil ***2000 Campbell 2003-2008 2001 Deffeyes 2011-2016 2002 Smith 2004-2011 2002 Nemesis approx. 2020 for conv. Oil

not before 2030 incl. Unconv. oil2004 85 for conv. Oil

> 120 incl. Unconv. oilInternational Energy Agency 2015-2020 2005 BGR ** 2005 conv. Oil

2010 incl. Unconv. Oil ***2006 66 conv. Oil

90 incl. Unconv. oilCampbell 2006 2007 Energy Watch Group 2005 conv. Oil

2008 incl. Unconv. Oil ***2008 66 conv. Oil

83 incl. Unconv. oilCampbell not before 2030 **** 2008 > 105 International Energy Agency 2022 conv. Oil

2027 incl. Unconv. oilDec 2008 78 conv. Oil

97 incl. Unconv. oilBustard probably 2020 Aug 2009 International Energy Agency 2020 Dec 2009 International Energy Agency 2014 2010 Ibrahim Sami Nashawi and Adel Malallah (Kuwait University),

Mohammed Al-Bisharah (Kuwait Oil Company)2010 2010 Center for Transformation of the Bundeswehr 2006 for conventional crude oil 2010 70 International Energy Agency from 2035 including unconventional oil that is difficult to extract *** 2010 96 International Energy Agency 2008 for conventional crude oil 2012 70 International Energy Agency from 2035 including unconventional oil that is difficult to extract *** 2012 97 International Energy Agency 2008 for conventional oil 2013 - Energy Watch Group 2013 including unconventional oil 2013 - Energy Watch Group around 2015 combined maximum funding of all fossil

fuels (including coal)2013 - Energy Watch Group

| * | Colin J. Campbell , the chairman of ASPO , has been warning of an imminent global oil production peak since 1989 . His theses are also represented in Germany by Wolfgang Blendinger , Professor of Oil and Gas Geology at the TU Clausthal . In 1999 he published the forecast for peak oil in the North Sea and stated in an interview in 2006 that global peak oil had probably already been exceeded. |

| ** | In Peter Gerling's BGR forecasts, it should be noted that the approximation to the maximum funding is very flat over a period of ten years. Worldwide increases in demand on the scale previously known could not be met in this way. |

| *** | Heavy oil , oil sands , oil shale , "deep sea oil" (oil from boreholes in the deep shelf or the continental slope ), "polar oil" (oil from boreholes in the Arctic ) |

| **** | The IEA's World Energy Outlook 2008 (WEO), however, predicts that the production rate will flatten out by 2030. According to the IEA, massive investments must be made to meet this reference scenario. WEO 2008 warns of funding bottlenecks before 2015 due to insufficient investment. In April 2009 Nobuo Tanaka (IEA Executive Director) predicted that these funding bottlenecks could occur as early as 2013. |

The Commissioner for Energy of the European Union , Günther Oettinger , expressed in November 2010, the assessment that the amount of the world's available oil has probably reached its peak ". The amount of oil available globally, I think, has already peaked"

In the World Energy Outlook 2012, the IEA determined that the peak for conventional crude oil was exceeded in 2008.

consequences

Transport and agriculture are particularly dependent on the availability of cheap oil. Some states, such as the USA, are more dependent on oil availability than others. Globalization is based in principle on two pillars: worldwide communication and worldwide, cheap transport . In particular, data and information are sent via global data and communication networks that consume electricity. Worldwide transports are 97% based on crude oil ( petrol , diesel , kerosene ) or natural gas . 95% of global trade flows are handled by diesel and heavy oil-powered cargo and container ships on the world's oceans. Alternatives have to stay within reasonable prices and also be suitable for vehicles or the fuel infrastructure that is available worldwide. So far, however, it has not been possible to replace fossil fuels such as gasoline or marine diesel in goods transport with known alternatives, such as electricity stored in accumulators or hydrogen technology , since the achievable price-related energy densities of around 0.01 kWh / € are far below those of fossil fuels Fuels (with gasoline approx. 6 kWh / €).

Agriculture and food supply

Around 1800 75% of the German population lived from agriculture, and the proportion of fuel crops (for livestock) was relatively high. By 2006, the proportion of people employed in agriculture had fallen to two to three percent. This enormously increased productivity is characteristic of all developed industrial countries. Since the beginning of industrialization, especially since the Green Revolution in the 1960s, global grain production has increased by 150% without changing the area under cultivation (see Fig. 10). This is very much due to the use of fossil fuels in agriculture and distribution. The same applies to pesticides and biocides , without whose use agricultural yields would be significantly reduced. Crude oil plays a particularly important role in agriculture in the production of fertilizers using the Haber-Bosch process , whereby the hydrogen required for this can in principle also be obtained differently.

In addition to the aspect of dwindling amounts of energy for animal husbandry and grain production, there is also the increasing cultivation of "fuel crops". These are not included in the set-aside . A possible revival of labor-intensive agriculture could lead to a reagrarization of rural areas, in which more and more people would find their livelihood. However, global food production and the world's population will peak at about the same time (see also population trap ). In fact, staple food prices, especially rice and corn , rose sharply in 2007 and 2008.

Oil substitution options

A lack of petroleum means a lack of (1.) an energy source , (2.) an energy carrier and (3.) a raw material , with the loss of energy being more serious than the shortage of the raw material. For example, around 40% of total energy consumption in Germany is based on oil. The energy demand previously covered by oil can in principle be reduced to a certain extent by saving energy and served by alternative energy sources to a certain extent . It must also be noted that simply replacing the amount of energy does not solve all problems, because not every energy source can be used for every task. The most important area here is the transport sector, for which there is currently hardly any adequate substitute for fuels made from crude oil that can be provided in sufficient quantities.

Global one-sided technology-based scenarios are also viewed critically. There is a risk of a technocratic utopia that is undemocratic and not adapted to regional differences (such as the Atlantropa project).

Substitution of oil as an energy source

One advantage of petroleum is its high energy density; H. the amount of energy that can be stored in a certain volume. The energy density of crude oil far exceeds that of other energy sources such as accumulators. This is why crude oil offers great advantages, especially as an energy source for mobile applications such as motor vehicles.

Compared to regeneratively produced hydrogen or electrical storage media, biogenously produced liquid fuels come very close to crude oil with their energy density and the technological effort required for their use. These are u. a. Ethanol (1st and 2nd generation), biodiesel ( RME , FAME ) and vegetable oils (1st gen.), Synthetic fuels (Synfuel from BtL process , 2nd generation).

The production of such fuels, however, depends on external energy to varying degrees, in addition to the expenditure for field cultivation and fertilizers, depending on the biomass used. The external energy required for the conversion process is particularly high for synthetic fuels. With regard to the post-petroleum age, however, there are e.g. In bioethanol production, for example, there is the option of effectively generating the process energy from biomass using a combined combined heat and power unit with residual heat (example: Prokon Nord bioethanol plant in Stade).

The great expectations of a hydrogen economy have not yet been met. Liquid hydrogen is difficult to store, requires extremely heavy tanks in relation to its energy content and has only 25% of the calorific value of gasoline. The fuel efficiency of electrolyzed hydrogen is also only 25%. The energy equivalent of a barrel (equivalent to 159 l) of crude oil, produced from wind power (nine cents / kilowatt hour) as liquid hydrogen, would have a price per barrel of US $ 304 and would therefore be at a similar level to the current customer price at the gas station .

In a methane or methanol economy should methanol fossil fuels to replace as a secondary energy carrier. In 2005 Nobel Prize winner George A. Olah published his book “Beyond Oil and Gas: The Methanol Economy”, in which the opportunities and possibilities of the methanol economy are discussed. He gives arguments against the hydrogen economy and explains the possibilities of producing methanol from carbon dioxide or methane. The existing fuel infrastructure can continue to be used. However, questions remain about the extraction of the raw material carbon dioxide (extraction from the air is very complex) and the primary energy source that is used to generate the methanol (electricity from nuclear energy or solar electricity).

Despite the enormous advances in electrical storage media , these are still considered to be too expensive and of insufficient capacity for mobile applications. To what extent their price will change in the future remains unclear. Increasing technological controllability and large-scale production speak in favor of a price reduction; on the other hand, an increase in the price of the necessary raw materials such as lithium and rare earth metals cannot be ruled out.

The existing substitutes are therefore associated with higher costs and expenditures compared to crude oil and are not yet available in sufficient quantities. The retrofitting of vehicle fleets and distribution chains is also technologically, time-consuming and expensive depending on the substitute. Depending on how quickly, to what extent and with what financial means, various future strategies and their interrelationships are conceivable and feasible.

Substitution of oil as a chemical raw material

With coal liquefaction , coal could even directly replace oil. However, this would cause various problems: Firstly, some of the energy would be lost during the liquefaction. Second, the CO 2 emissions of liquefied coal would be considerably higher than those of crude oil and - with liquefaction - also higher than those of the direct use of coal. Third, these processes would be costly. Fourth, this would significantly reduce the previous large static range of coal, as it is mainly used to generate electricity, which only accounts for around 17% of primary energy consumption.

However, for many chemical uses of petroleum, the substitute need not be oily. Many products can be obtained in alternative ways, for example directly from biomass. In other cases, alternative products made directly from biomass are possible, such as packaging films made directly from starch.

Positions on risks and possible solutions

Adaptation advantages in international competition through energy-efficient technologies

A study by Deutsche Bank examines the risks and opportunities of peak oil for German mechanical and plant engineering. On the one hand, peak oil is classified as one of the greatest challenges of our time because of the risk of energy shortages. Scarcity and high energy prices are likely to have a major impact on further economic development.

The study also comes to the conclusion that due to the enormous need for investment in adapted technologies for energy generation and use, there are not only risks but also considerable opportunities for companies that are the first to develop energy-efficient technologies. These included, in particular, more efficient raw material production and adapted offers in areas such as solar thermal energy and the construction of highly efficient power plants or systems for gas liquefaction (GTL technology). New technologies, materials and processes would enable the production of lighter, significantly less fuel-consuming cars, as well as the more cost-effective mass production of photovoltaic modules. Mechanical engineering plays a key role here. Due to the technological leadership and export orientation of many German companies, the imminent profound structural change in the energy sector is therefore also a great opportunity.

The dwindling oil reserves are not a serious problem

“We don't have to worry. There are still enough reserves. [...] Saudi Arabia produces around ten million barrels a day today, and in a few years it will surely manage 12.5 million barrels. [...] It is very likely that in the medium term [oil] prices will be around US $ 40 Cut lying. In the long run, even US $ 25-30 are conceivable. "

"The world will not have to worry about the maximum oil production in the foreseeable future."

This position considers it nonsensical to transfer the oil field-specific concept of maximum oil production to global production. The oil supply is also secured on the basis of conventional oil deposits with current consumption until the year 2060. Rising demand and the resulting rising prices are a sufficient mechanism to ensure timely technical advances in oil production as well as in substitute materials and sources. The proponents of this thesis see wrong political decisions and widespread hysteria that are “completely inappropriate” as the worst side effects of the “recurring oil panic”.

Based on historical studies, the economist Julian L. Simon generally doubts to what extent short-term raw material shortages would be able to endanger industrial civilization. In the past, such growth crises had already led to new technologies and the discovery of new energy sources, the extinction scenarios feared regularly in the past never occurred, the allegedly running out raw materials are currently more available than ever before.

Leonardo Maugeri from the Italian company Eni believes that the oil age, which the US Geological Survey had already declared dead in 1919, is still far from over, and rules out the drastic, imminent consequences of an oil production peak. According to Maugeri, the thesis of an imminent occurrence has been refuted on the basis of new oil discoveries and production opportunities.

After the drop in oil prices at the end of 2008, BP's chief economist , Christoph Rühl, repeated his skeptical attitude towards the peak oil thesis

"Physical peak oil, which I have no reason to accept as a valid statement either on theoretical, scientific or ideological grounds, would be insensitive to prices. In fact the whole hypothesis of peak oil - which is that there is a certain amount of oil in the ground, consumed at a certain rate, and then it's finished - does not react to anything. Whereas we believe that whatever can be turned into oil strongly depends on technology and technology depends on prices as well. Therefore there will never be a moment when the world runs out of oil because there will always be a price at which the last drop of oil can clear the market. And you can turn anything into oil if you are willing to pay the financial and environmental price. "

Replacement by renewable energy sources possible

Many governments in industrialized countries assume that the failure of crude oil can be intercepted by a combination of three measures to be promoted by the state: Replacing crude oil with renewable energy sources would be possible on the supply side, while technological developments on the demand side enable significantly higher energy efficiency and social changes Lifestyle with significantly lower energy requirements . New technologies combined with rising prices for oil products make it possible to use energy more efficiently and to develop renewable energy sources - provided that sufficient time is available for their development and application.

Risk of serious economic crises

"There is no longer a sufficient supply of oil worldwide for full growth of our economy or the world economy."

"The inability to expand oil production in line with increasing demand will result in severe economic shock in the future."

“If Iraq's oil production doesn't grow exponentially by 2015, we have a very big problem. And this even if Saudi Arabia keeps all of its promises. The numbers are very simple, you don't have to be an expert. […] Within 5–10 years, non-OPEC production will peak and begin to decline due to insufficient reserves. There is new evidence for this fact every day. At the same time, we will see the peak of Chinese economic growth. So both events will coincide: the explosion in the growth of Chinese demand and the decline in oil production in the non-OPEC countries. Will our oil system be able to meet this challenge, that is the question. "

The physicist David L. Goodstein , Vice President of the California Institute of Technology , takes a similar alarming position.Goodstein emphasizes that the exact point in time at which a supply crisis will occur cannot be predicted with sufficient accuracy and it is not yet clear which energy sources and technologies are used in oil Can replace the future. A deep energy crisis of historic proportions and possibly catastrophic consequences can therefore be expected. Jeremy Leggett coined the term for such a situation "Energy Famine" , or "energy famine ".

The International Energy Agency repeatedly warned, for example in July 2007 and February 2009, that oil production capacities would decrease due to declining reserves and a lack of investment and that a global economic crisis could arise as early as 2013 due to massive oil shortages. In August 2009, Fatih Birol, the leading economist of the IEA, tightened this warning with the addition that an oil crisis could occur as early as 2011: “Even if demand remained the same, the world would have to find the equivalent of four Saudi Arabia's in order to to maintain production, and six of Saudi Arabia's to keep pace with the expected increase in demand between now and 2030. ”The IEA also states that production from existing oil fields is declining 6.7% annually, making its 2007 release Corrected estimate of an annual decline of only 3.7%.

Matthew Simmons , investment banker and former White House energy advisor, predicted an oil price of at least $ 200 a barrel in 2005 due to the oil peak in 2010 and then has a public bet of $ 10,000 with John Tierney , a business journalist for the New York Times completed. Tierney considers bulls in the raw materials sector - with reference to Julian L. Simon - to be fundamentally limited.

An analysis by the German Armed Forces explains that the decline in oil production can reach a point ( tipping point ) at which the economic system tips over. The black and yellow federal government did not agree with the corresponding conclusions in 2010 and referred to the energy and raw materials concept that had already been adopted .

The trigger can be that market participants realize that the global economy will shrink for an indefinite period of time. In this scenario - which the Federal Government expressly does not share - the global economic system and every market economy will collapse in the medium term. In an indefinitely shrinking economy, savings are not invested because companies are not making profits. Companies are no longer able to pay borrowing costs or distribute profits to equity providers for an indefinite period of time. The banking system, stock exchanges and financial markets as a whole are collapsing.

The publication "Tipping Point" by David Korowicz, employee of the "Risk Resilence Network" of the Irish organization Feasta, represents a politically different position, but very similar in terms of economic effects.

Jürgen Wiemann , former deputy director of the German Development Institute , takes the position that the global financial and economic crisis since 2008 due to the effects z. B. on the income of American consumers available for mortgage payments could already be caused by the rise in oil prices.

Security challenge

A study by the Department of Future Analysis of the Center for Transformation of the Bundeswehr was published in July 2010 . In various sections, it describes, among other things, a shift in the roles of states and private economic actors , the path to economic and political crises in the transition to post-fossil societies, the excessive demands on actors in the selection of interventions and a systemic risk when the “tipping” is exceeded Point " .

Resource wars

The Swiss journalist Daniele Ganser writes in Peak Oil: Oil in the field of tension between war and peace , there are many indications that the Iraq war was a "classic resource war", with which the USA had important oil sources before reaching peak oil and the global decline in production wanted to occupy them in order to build up a position of power over their rivals China, Europe and Russia. Alan Greenspan , the former director of the US Federal Reserve, found it regrettable in this context not to be allowed to admit that, as is well known, the Iraq war was about oil. ”

The Swiss journalist Roger Schawinski considers Ganser's thesis to be monocausal , conspiracy-theoretical and obviously erroneous. The American troops would not have confiscated the Iraqi oil wells, and the USA did not need them at all due to the development of its own resources and the increasing use of renewable energies.

Risk of collapse

There are also cautionary positions which - more pessimistic than those by David Goodstein, Matthew Simmons, or the authors of the study by the Center for Transformation of the German Armed Forces - portray a possible collapse of industrial society , triggered by exceeding the maximum oil production limit, as probable. This is justified by the fact that work machines and means of transport operated with fossil energy sources, such as steam engines , ships, engines and turbines, contributed so much to the industrial revolution that it seems impossible for many authors to do without such sources.

Writers such as James Howard Kunstler , Richard Heinberg or Andreas Eschbach have designed scenarios in which fuels, an important basis of industrial civilization, are no longer available in sufficient quantities and this leads to significant social upheavals. The so-called Olduvai thesis is extremely pessimistic, according to which the current industrial civilization will have to collapse by 2030 due to the maximum oil production and only about two billion people will be able to survive on a pre-industrial energy level by 2050.

Increasing risk of major oil spills

On the occasion of the oil disaster in the Gulf of Mexico in 2010 as a result of the Deepwater Horizon platform disaster, geologist Klaus Bitzer, member of the ASPO, takes the position that the exhaustion of the easily accessible oil fields increases the risks of oil production and thus also creates a greater danger Contributions from oil spills:

- “In the search for and during the exploitation of the last deposits, the technical problems are getting bigger and bigger. [...]

- (Question) 'Why take such risks?' - K. Bitzer: It is quite simply that all high-yield, conventionally exploitable oil fields have long been discovered. So the search becomes more and more difficult. It's like sinking ships: First you always meet the big tankers. It takes a lot longer until you have all the small submarines. "

Conversely, the position is taken that higher safety requirements for technically and ecologically risky oil production projects as a reaction to the accident could lead to production restrictions and failures. The IEA puts these at up to 300,000 barrels, and by Steffen Bukold, if other oil production regions are included, at up to 1,000,000 barrels per day, as a very large proportion of new oil wells to be developed in the OECD countries should come from deep-sea production. The fact that such a high proportion is based on realistic forecasts is in turn called into question by experts like Klaus Bitzer, who fear an early decline in oil production even if there is no moratorium. B. are planned off the coast of Brazil to associate enormous technological risks. In fact, deep-sea oil production roughly corresponds to the increase between 2000 and 2009.

Discussed measures and forums

The Oildrum forum on the Internet and conferences and publications by the ASPO and its regional members and societies served as a platform for discussions . The professor and ministerial candidate Claudia Kemfert also became known in Germany . The Oildrum was discontinued in 2013 and only the discussions that had already been created are documented.

Precautionary measures as risk management

Appropriate reactions to the risk of a decline in oil production require a decision under uncertainty as part of a risk management system that weighs scenarios and their probabilities of occurrence against each other, as is the case with safety measures of all kinds, such as fire protection or the assessment of the risks of nuclear energy , is required. The so-called Hirsch Report from 2005, which was commissioned by the US Department of Energy, deals with this question . The Hirsch Report had also drawn the (now falsified) conclusion that the (scarce) time available does not allow relying on the development of completely new technologies, but makes it necessary to use technologies that are already available. Simulation games by the Heritage Foundation , for example, come to similar results with regard to a terrorist interruption of the oil supply.

Proposed precautionary measures by country

Germany

The German federal government sees no danger of an energy crisis due to a reduction in oil production. Therefore, no measures are planned to counter such an event.

Sweden

The risk of a decline in oil production in Sweden contributed to the announcement that the country would be made independent of oil and fossil fuels by 2020, which was published in 2005 by the government formed at the time by the Swedish Greens and the Left Party ( Swedish oil phase-out ). The recommendations of the expert committee formed for this purpose received international attention. Implementation has not taken place.

United States

A corresponding implementation of measures has not yet taken place; since 2012, contrary to Hirsch's and Hubbert's predictions, due to new technologies (see Hydraulic Fracturing ) , the USA has been on the way again to become the world's leading oil producer.

See also

- Anthropocene

- The limits of growth

- Peak phosphorus

- Petroleum / tables and graphics , maximum production ( hubbert peak ), world energy demand

- Global uranium production maximum

- Carbon bubble , coal production maximum

- Climate protection

- Oil constant

- Rimini Protocol

- Sufficiency (ecology)

- Transition Towns

- 2 degree goal

literature

- Sabine Pamperrien , Klaus Stieglitz: The oil, the power and signs of hope. About corporations and the human right to clean water . rüffer & rub , Zurich 2016, ISBN 978-3-907625-95-8 .

- Kjell Aleklett with Michael Lardelli and Olle Qvennerstedt: Peeking at Peak Oil. Springer, New York, 2012, ISBN 978-1-4614-3423-8 . (eBook, ISBN 978-1-4614-3424-5 )

- Colin J. Campbell , Frauke Liesenborghs, Jörg Schindler , Werner Zittel: Oil change! The end of the petroleum age and the setting of the course for the future. Updated edition. Deutscher Taschenbuch-Verlag, Munich 2007, ISBN 978-3-423-34389-3 .

- Oliver Krischer, HJ Fell: Background paper: Away from oil - towards renewable energies.

- Kenneth S. Deffeyes : Hubbert's Peak. The Impending World Oil Shortage. Reissue, with a new preface. Princeton University Press, Princeton NJ 2009, ISBN 978-0-691-14119-0 .

- Daniele Ganser : Europe in the oil frenzy. The consequences of dangerous addiction. Orell Füssli, Zurich 2012, ISBN 978-3-280-05474-1 .

- Steven M. Gorelick: Oil Panic and the Global Crisis: Predictions and Myths. Wiley-Blackwell, 2009, ISBN 978-1-4051-9548-5 .

-

Richard Heinberg : Party's Over. Oil, War and the Fate of Industrial Societies . 2nd Edition. Clairview Books, 2007, ISBN 1-905570-00-7 . German: Richard Heinberg: oil end. "The Party's Over". The future of the industrialized world without oil . Adults and act. Edition. Riemann, Munich 2008, ISBN 978-3-570-50104-7 .

- Marion King Hubbert : Energy from Fossil Fuels . In: Science . tape 109 , no. 2823 , 1949, pp. 103-109 , doi : 10.1126 / science.109.2823.103 ( scan ).

- Thomas Seifert, Klaus Werner : Black Book Oil. A story of greed, war, power and money. Deuticke, Vienna 2005, ISBN 3-552-06023-5 .

Web links

- ASPO Germany website of the German Association for the Study of Peak Oil and Gas

- The Oil Drum Discussions about Energy and Our Future

- Energy Bulletin Information regarding the peak in global energy supply

- PeakOil.com News and forum updated several times a day

- Colin J. Campbell : "The Depletion of World Oil Reserves" - as video (English) as pdf (German)

- The Crash Course Chapter 17a - Peak Oil Video (German) with facts and arguments

- Leonardo Maugeri: "Oil: False Alarm - Why the Age of Oil Is Far From Over" Science, May 21, 2004 (PDF; 292 kB)

- Peak oil. The international discussion and possible effects on Vorarlberg Study by the Austrian Ecology Institute on behalf of the Vorarlberg state government, Nov. 2008 (PDF; 7.5 MB)

- The Theory behind Peak Oil The Impact of Peak Oil on Crude Oil Futures

- Graphic: Peak Oil , from: Facts and Figures: Globalization , Federal Agency for Civic Education / bpb

Movies and radio

- The Oil Crash (award-winning documentary film from 2006, which shows the history of oil production and describes an impending oil crisis, 83 min.)

- Four Corners Broadband Edition - Peak Oil? Australian documentation in six chapters and additional information

- rte.ie, 2007: Future Shock: End of the Oil Age

- Requiem for a raw material , part 1: In the beginning there was oil , part 2: Oil - a story that ends in twopartsPHOENIX documentary, 2009

Individual evidence

- ↑ aspo-deutschland.blogspot.de

- ↑ https://www.greenpeace.org/international/story/20026/will-peak-oil-save-earths-climate/

- ↑ https://iea-etsap.org/E-TechDS/PDF/P02-Uncon_oil&gas-GS-gct.pdf

- ^ Robert L. Hirsch: Mitigation of maximum world oil production: Shortage scenarios . In: Energy Policy . tape 36 , no. 2 , February 2008, p. 881–889 , doi : 10.1016 / j.enpol.2007.11.009 (English): “(1) a Best Case where maximum world oil production is followed by a multi-year plateau before the onset of a monatomic decline rate of 2- 5% per year; (2) A middling case, where world oil production reaches a maximum, after which it drops into a long-term, 2-5% monotonic annual decline; and finally (3) a Worst Case, where the sharp peak of the Middling Case is degraded by oil exporter withholding, leading to world oil shortages growing potentially more rapidly than 2-5% per year, creating the most dire world economic impacts. "

- ^ Adam R. Brandt: Testing Hubbert . In: Elsevier (Ed.): Energy Policy . tape 35 , no. 5 , May 2007, pp. 3074–3088 , doi : 10.1016 / j.enpol.2006.11.004 ( free full text [PDF; 325 kB ; accessed on January 23, 2011]).

- ↑ World Energy Outlook 2010. (PDF; 895 kB) In: worldenergyoutlook.org. IEA , pp. 6-7 , accessed August 10, 2016 .

- ^ Myth: The World Is Running Out of Oil. ABC News, May 12, 2006, accessed April 26, 2011 .

- ↑ Resourceship: An Austrian theory of mineral resources (PDF; 356 kB)

- ↑ Resourceship: Expanding "depletable" Resources

- ↑ "The earth has oil in abundance", Geo 2/80, interview.

- ↑ on Hubbert's analytical method see z. B. Brent Fisher: Review and Analysis of the Peak Oil Debate. Section III.A

- ↑ for classification see z. B. The Global Oil Depletion Report: Launched 10/08/09. (No longer available online.) In: ukerc.ac.uk. Archived from the original on March 8, 2013 ; accessed on August 10, 2016 .

- ↑ Brent Fisher; Review and Analysis of the Peak Oil Debate; Institute for Defense Analyzes; August 2008 (PDF)

- ↑ eia.gov

- ↑ on the definitions see archive link ( Memento from November 11, 2013 in the Internet Archive ) or [1]

- ↑ energycomment.de

- ↑ To the energy densities

- ↑ eia.gov

- ↑ Fear of the second half. In: The time. No. 17, 2006.

- ↑ a b Lord John Browne in an interview with Der Spiegel: “Part of the profit is undeserved”, Der Spiegel, June 2006 (24/2006), (English)

- ^ The problem of re-evaluation and back-dating.

- ↑ Reserves, resources, ranges - how long will oil and gas be around? Lecture at the BASF symposium "Talking to Journalists and Scientists - Energy Management", October 2004

- ^ A b c d Leonardo Maugeri: Oil: Never Cry Wolf - Why the Petroleum Age Is Far From Over . In: Science . tape 304 , no. 5674 , May 2004, p. 1114–1115 , doi : 10.1126 / science.1096427 .

- ↑ BP Statistical Review of World Energy 2017. (PDF) Retrieved October 3, 2017 .

- ↑ BP Statistical Review of World Energy 2013, p. 10.

- ^ IEA Oil Market Report Dec 2011, p. 22.

- ↑ energybulletin.net ( Memento from February 6, 2012 in the Internet Archive )

- ↑ BP Statistical Review of World Energy 2013, p. 11.

- ^ BP Statistical Review of World Energy June 2013 workbook

- ↑ BP Statistical Review of World Energy 2013, p. 10f.

- ↑ BP Statistical Review of World Energy 2013, p. 11, see footnote

- ↑ arabianbusiness.com

- ↑ Werner Zittel, Jan Zerhusen, Martin Zerta, Nicholas Arnold: Fossil and Nuclear Fuels - the Supply Outlook. (PDF; 5.5 MB) (No longer available online.) Energy Watch Group , March 2013, p. 38 , archived from the original on April 18, 2016 ; accessed on August 10, 2016 .

- ↑ Search for oil and gas supplies on Kaspi Shelf fails. RIA Novosti, Moscow, June 26, 2008 Online version at RIAN

- ↑ Renewable energies have economic benefits in the billions. In: Information campaign for renewable energies February 15, 2006, accessed on February 18, 2006.

- ↑ James Murray, David King: Climate policy: Oil's tipping point has passed. In: Nature. Vol. 481, 2012, pp. 433–435, doi: 10.1038 / 481433a , ( online ( memento of July 21, 2014 in the Internet Archive ); PDF; 1.1 MB).

- ↑ Graphic: Development of forecast crude oil prices (PDF; 725 kB)

- ^ World Economic Outlook, April 2011. Tensions from the Two-Speed Recovery. Unemployment, Commodities, and Capital Flows (PDF; 4.4 MB), World economic outlook: a survey by the staff of the International Monetary Fund, Washington, DC, ISBN 978-1-61635-059-8 .

- ^ World Economic Outlook, April 2011. Tensions from the Two-Speed Recovery. Unemployment, Commodities, and Capital Flows (PDF; 4.4 MB), World economic outlook: a survey by the staff of the International Monetary Fund, Washington, DC, ISBN 978-1-61635-059-8 , p. 99, Fig 3.7

- ^ World Economic Outlook, April 2011. Tensions from the Two-Speed Recovery. Unemployment, Commodities, and Capital Flows (PDF; 4.4 MB), World economic outlook: a survey by the staff of the International Monetary Fund, Washington, DC, ISBN 978-1-61635-059-8 , p. 106.

- ↑ See also as a summary and commentary IMF warns of oil scarcity and a 60% oil price increase within a year ( Memento of April 24, 2011 in the Internet Archive ), crudeoilpeak.com, May 12, 2011.

- ^ World Economic Outlook, April 2011. Tensions from the Two-Speed Recovery. Unemployment, Commodities, and Capital Flows (PDF; 4.4 MB), World economic outlook: a survey by the staff of the International Monetary Fund, Washington, DC, ISBN 978-1-61635-059-8 , p. 110.

- ↑ WikiLeaks cables: Saudi Arabia cannot pump enough oil to keep a lid on prices. US diplomat convinced by Saudi expert that reserves of world's biggest oil exporter have been overstated by nearly 40% , The Guardian , February 8, 2011.

- ↑ Two cheers for expensive oil, Leonardo Maugeri, in Foreign Affairs - March / April, 2006, German translation of the article on the BP website (PDF; 112 kB)

- ↑ Michael Kläsgen: Head of the International Energy Agency warns of bottlenecks: The next oil crisis is certain to come. In: Süddeutsche Zeitung of February 28, 2008, p. 25. See also: Spiegel Online: Scarce Oil: Energy Agency warns of mega economic crisis 2013 of February 28, 2008,

- ↑ a b c Steve Connor: Warning: Oil supplies are running out fast Catastrophic shortfalls threaten economic recovery, says world's top energy economist. In: The Independent of August 3, 2009.

- ↑ a b F. Vorholz: Energy: The next oil price shock. In: The time . Issued May 20, 2009.

- ↑ World Energy Outlook 2010. (PDF; 1.2 MB) (No longer available online.) IEA , archived from the original on November 21, 2010 ; accessed on August 10, 2016 (English): "The age of cheap oil is over, though policy action could bring lower international prices than would otherwise be the case"

- ↑ Sam Foucher: Peak Oil Update - August 2008: Production Forecasts and EIA Oil Production Numbers. In: theoildrum.com. September 13, 2008, accessed August 10, 2016 .

- ↑ Sam Foucher: Oil Megaproject Update. In: theoildrum.com. July 5, 2008, accessed August 10, 2016 .

- ↑ Marie Plummer Minniear: Forecasting the Permanent Decline in Global Petroleum Production , Journal of Geoscience Education, v. 48, 2000, p. 130. (PDF; 213 kB).

- ↑ CJ Campbell: The Depletion of World Petroleum Reserves. In: hubbertpeak.com. December 2000, accessed August 10, 2016 .

- ^ KS Deffeyes: Hubbert's Peak , Princeton University Press, 2001, ISBN 0-691-09086-6 . Uses a range of statistical techniques, based, essentially, on the discovery trend curve indicating the likely 'ultimate'. This study has no direct access, we believe, to the industry database. Quoted on: Archive link ( Memento from April 25, 2016 in the Internet Archive )

- ↑ MR Smith: Analysis of Global Oil Supply to 2050. Consultancy report from The Energy Network , March 2002. Production estimates are based on detailed country by country exploration analyzes, and use individual depletion curves to meet calculated 'ultimates', rather than simple' mid-point peaking '. Includes data on the non-conventionals, and expected oil price forecasts. Global ultimate is 2180 Gb, making the global peak in 2011 if global demand is assumed to rise by 2% / yr .; or 2016 at 1% / yr. growth. Quoted on: Archive link ( Memento from April 25, 2016 in the Internet Archive )

- ↑ 'Nemesis', in a contribution in ASPO / ODAC Newsletter, Issue 15, March 2002. This study generates a range for the dates of peak production, based on cumulative production to-date; plus reserves and 'net discovery' data from Campbell and BP's Schollnberger. This approach avoids the need to use specific estimates of 'ultimate', but yields the approximate 'equivalent ultimates' listed in the table. Quoted on: Archive link ( Memento from April 25, 2016 in the Internet Archive )

- ^ World Energy Outlook 2004 - German Summary ( Memento from October 7, 2006 in the Internet Archive ) IEA

- ^ Crude Oil - The supply outlook. Energy Watch Group , 2007, accessed on August 10, 2016 (PDF; 2.1 MB, English)

- ↑ a b World Energy Outlook 2008 - Executive Summary. IEA , accessed on August 10, 2016 (PDF; 176 kB, English).

- ↑ Raffael Trappe: The development of supply, demand and prices of crude oil. (PDF; 1.2 MB) 2008, p. 73f. and 115f.

- ↑ 2020 vision: The IEA puts a date on peak oil production In: The Economist Interview with Fatih Birol , December 10, 2009. “Fatih Birol, the chief economist of the International Energy Agency (IEA), believes that if no big new discoveries are made, "the output of conventional oil will peak in 2020 if oil demand grows on a business-as-usual basis." Coming from the band of geologists and former oil-industry hands who believe that the world is facing an imminent shortage of oil, this would be unremarkable. But coming from the IEA, the source of closely watched annual predictions about world energy markets, it is a new and striking claim. "

- ↑ Ibrahim Sami Nashawi, Adel Malallah, Mohammed Al-Bisharah: Forecasting World Crude Oil Production Using Multicyclic Hubbert Model. In: Energy & Fuels. 24, 2010, pp. 1788-1800, doi: 10.1021 / ef901240p .

- ↑ Peak Oil - Security Policy Implications of Scarce Resources, (PDF; 2 MB) .

- ↑ World Energy Outlook 2010. (PDF; 895 kB) In: worldenergyoutlook.org. IEA , accessed August 10, 2016 .

- ↑ World Energy Outlook 2010. (PDF; 895 kB) In: worldenergyoutlook.org. IEA , accessed on August 10, 2016 : "In the scenario of the new energy policy framework conditions, overall funding will not peak before 2035, albeit almost."

- ↑ a b c World Energy Outlook 2012 . Organization for Economic Co-operation and Development, Paris 2012, ISBN 978-92-64-18084-0 , p. 81 .

- ↑ a b c Werner Zittel, Jan Zerhusen, Martin Zerta, Nikolaus Arnold: Fossil and nuclear fuels - the future supply situation. (PDF; 1.4 MB) (No longer available online.) Energy Watch Group , March 2013, p. 47 , archived from the original on July 24, 2014 ; accessed on August 10, 2016 .

- ↑ nano broadcast from September 15, 2006, 3sat TV

- ↑ Shigeru Sato, Yuji Okada: IEA Sees Oil-Supply Crunch by 2013 on Slow Investment (Update 1). In: Bloomberg. April 25, 2009.

- ↑ Global oil availability has peaked - EU energy chief , Reuters , Brussels, November 10, 2010.

- ↑ For gasoline with a calorific value of 8.9 kWh / l and a current price of 1.5 € / l (May 2008), as well as for accumulators with a reciprocal energy density of around 100 € / kWh, see accumulator #energy density and efficiency and Gasoline . For the costs of hydrogen storage, see hydrogen technology .

- ↑ ( page no longer available , search in web archives: Spiegel online yearbook )

- ^ DA Pfeiffer: Eating Fossil Fuels. ( Memento of May 31, 2004 on the Internet Archive ) Wilderness Publications

- ↑ Bioethanol plant in Stade ( Memento from February 11, 2013 in the web archive archive.today )

- ↑ German mechanical engineering steeling economy for the post-oil era (PDF; 208 kB), Josef Auer, German Bank Research, December 16 of 2008.

- ↑ Uchenna Izundu: WEC: Saudi Aramco chief dismisses peak oil fears. In: Oil and Gas Journal . November 14, 2007, archived from the original on December 23, 2015 ; accessed on August 10, 2016 .

- ↑ Abdallah S. Jum'ah: Rising to the Challenge: Securing the Energy Future. ( Memento of April 4, 2013 in the Internet Archive ) In: World Energy Source

- ↑ energytribune.com ( Memento from February 15, 2012 in the Internet Archive ), Aramco Chief Debunks Peak Oil Energy Tribune, by Peter Glover, January 17, 2008, quotation “We have grossly underestimated mankind's ability to find new reserves of petroleum, as well as our capacity to raise recovery rates and tap fields once thought inaccessible or impossible to produce. " Jum'ah believes that in-place conventional and non-conventional liquid resources may ultimately total between 13 trillion and 16 trillion barrels and that only a small fraction (1.1 trillion) has been extracted to date "

- ↑ BP Topic Special: When will we run out of oil?

- ↑ The historical models he named include worries about the tin supply around 1200 BC; Timber shortage in Greece around 550 BC And in modern England between the 16th and 18th centuries; Food in Pre-Revolutionary Europe 1798; Coal in 19th Century Britain; Oil since the emergence of modern oil production in the years after 1850 and again oil like several metals after 1970.

- ↑ Oil: The Next Revolution THE UNPRECEDENTED UPSURGE OF OIL PRODUCTION CAPACITY AND WHAT IT MEANS FOR THE WORLD (PDF; 1.5 MB) Leonardo Maugeri The Geopolitics of Energy Project

- ↑ We were wrong on peak oil. There's enough to fry us all A boom in oil production has made a mockery of our predictions. Good news for capitalists - but a disaster for humanity George Monbiot guardian.co.uk, Monday 2nd July 2012.

- ↑ BP: We should see increasing price fluctuations . Interview with Dr. Christoph Rühl, October 1st, 2008, Euractiv website.

- ↑ Wolfgang Gründinger: The energy trap, review of the petroleum age. beck'sche Reihe, 2006, ISBN 3-406-54098-8 .

- ^ Charles Reich: "The world is getting young: the nonviolent uprising of the new generation", 1971, ISBN 3-217-00404-3 .

- ↑ Hardball with Chris Matthews' for Feb. 2nd - Transscript , in MSNBC.com February 3, 2006 "There is not enough supply of oil in the world to grow our economy or the global economy at its full potential ..."

- ↑ in winter 2005/2006 in the US magazine The National Interest, which he edited . Quoted from: - ( Memento from September 29, 2007 in the Internet Archive ) The inability readily to expand the supply of oil, given rising demand, will in the future impose a severe economic shock.

- ^ “Le Monde” on June 27, 2007 ( source of the quotation and translation ).

- ^ "Professor Goodstein discusses lowering oil reserves" ( Memento of May 9, 2013 in the Internet Archive ), Tony Jones (transcript of a television broadcast of November 22, 2004).

- ^ David Goodstein: Out of Gas: The End of the Age of Oil. Norton, WW & Company, 2004, ISBN 0-393-05857-3 .

- ^ The Guardian < Dawn of an energy famine Just as the need for renewables becomes critical, the oil giants signal an alarming retreat , May 2, 2008.

- ↑ Michael Kläsgen, "Head of the International Energy Agency warns of bottlenecks:" The next oil crisis is certain to come ", Süddeutsche Zeitung of February 28, 2008, p. 25.

- ↑ See also: Spiegel Online from February 28, 2008, Knappes Öl: Energy Agency warns of mega economic crisis in 2013

- ↑ John Tierney. The New York Times . August 23, 2005 "The $ 10,000 Question." , Bet on falling oil prices again

- ↑ a b Armed Forces, Capabilities and Technologies in the 21st Century - Environmental Dimensions of Security, Partial Study 1 Peak Oil, Security Policy Implications of Scarce Resources, Center for Transformation of the Bundeswehr. 2010. [2] (PDF; 2 MB)

- ↑ a b According to an answer to a “small question” from the Green MP Oliver Krischer from November 26, 2010, cf. Paul Nellen: “The federal government is optimistic about oil - the federal government contradicts a peak oil study by the Bundeswehr " , TELEPOLIS, Dec. 8, 2010.

- ↑ Tipping point: Short-term systemic consequences of the decline in global oil production (PDF; 810 kB), David Korowicz Feasta & The Risk / Resilience Network, publisher: The Foundation for the Economics of Sustainability (Feasta), 14 St Stephens Green, Dublin 2 , Ireland. Tel: 00353 (0) 6619572, www.feasta.org , (October 3rd 2010)

-

↑ Interview with Jürgen Wiemann , published on the website of Deutsche Welle : Oil is finally

Quote:

- The global financial crisis also points to the approach of peak oil. While economists are still trying to understand why the world financial system, which from their point of view was completely rational, could come to the brink of collapse, and thereby question some of the axiomatic foundations of their discipline, only a few go so far as to be responsible for the drastic rise in oil prices in the previous year close. [...] The connection is obvious. After all, in the years before the oil price had climbed to 150 US dollars a barrel and, with the rise in fuel prices, had also driven up food prices. The more expensive it was to drive to work, the faster the lower middle classes in the United States, tempted to buy suburban homes with risky mortgage financing, defaulted, and the mortgage crisis took its course.

- ↑ See also Jürgen Wiemann, The inconvenient truth of finite oil , Zeit Online from July 21, 2010.

- ↑ zentrum-transformation.bundeswehr.de ( Memento from April 26, 2017 in the Internet Archive )

- ↑ Peak Oil: Oil in the field of tension between war and peace. (PDF; 2.3 MB) In: Phillip Rudolf von Rohr, Peter Walde, Bertram Battlog (eds.): Energy. vdf Hochschulverlag at the ETH Zurich, Zurich 2009, series Zürcher Hochschulforen, Volume 45, ISBN 978-3-7281-3219-2 , p. 56. (online) ( Memento from April 15, 2016 in the Internet Archive ), accessed on 10 November 2010.

- ↑ Alan Greenspan quoted from Danielle Ganser in the Irish Times. dated September 17, 2007.