Economic crisis

In economics , the economic crisis is the phase of a clearly negative development in economic growth . In addition, negative developments in other macroeconomic variables (e.g. price level, employment, capital flows, etc.) are also referred to as economic crises. An economic crisis can affect one or more national economies or even the entire world economy .

In relation to the economic cycle, a distinction is made between the three forms of stagnation , recession and depression . As stagnation refers to a phase in which an economy is not growing and thus the economic output between two points is stagnating. However, it is debatable whether a phase of stagnation can already be described as an economic crisis. In an economic downturn following the boom, however, according to the American definition, economic output shrinks over at least two consecutive quarters . As depression is defined as a prolonged recession.

Explanatory approaches for economic crises

Crisis theories

Theories about the development of economic upswings and downturns can basically be divided into endogenous and exogenous theories. Endogenous theories see the cause of crises in the economy itself, exogenous theories attribute crises to external causes.

Currency crises

A currency crisis can e.g. B. be triggered by extremely high inflation ( hyperinflation ). Chronically strong capital inflows from abroad, e.g. B. due to an artificially excessive exchange rate, lead to a balance of payments crisis , which often leads to a currency crisis. If the banking and currency crises occur together, one speaks of a twin crisis .

The typical consequence of a currency crisis is a flight of capital , a restrictive monetary policy and a credit crunch , so that a currency crisis often leads to a financial and economic crisis.

Deflationary crises

The reverse fall of inflation, i.e. a longer-term fall in prices, is known as deflation and can lead to economic crises. The monetarism considers reducing the money supply in the US by 30% between the years 1929 and 1933 as the main cause of the Great Depression .

Financial market crises

- Main article: Financial crisis

Financial crises are major upheavals in the financial system, which are characterized by a decline in assets and the insolvency of numerous companies in the financial sector and other sectors and which affect economic activity in one or more countries. If this is triggered or accompanied by a collapse of the banking system, one also speaks of a banking crisis .

In general, all financial crises are triggered by uncertainty on the part of investors about the advantages of investing in a country. The same applies to banking crises in relation to the individual bank or the banking sector. The reason for the crisis can therefore be described as the factor that is responsible for the increasing uncertainty. In the case of banking crises, these are usually a poorly functioning banking system , inadequate banking supervision or the poor overall economic situation, which means that banks have to write off a large number of claims and thus get into financial difficulties.

General financial crises can u. a. attributed to inefficiencies in the financial markets , e.g. B. in the form of blistering . The ability to quickly withdraw financial capital is due to low transaction costs . The shorter the average period of capital invested in a country, the greater the risk of a financial crisis. Financial crises are favored by uncertain economic prospects and political uncertainties (danger of a coup, lack of legal certainty , danger of expropriations, etc.). Strong disinvestments on stock exchanges occur particularly frequently, e . B. in the form of a stock market crash .

Crises known from economic history

German money crisis / Schinderling crisis

In the course of inheritance disputes between the Habsburgs Archduke was Albrecht VI in the newly established mints Enns, Linz and Freistadt inferior silver pennies (later Schinderlinge called) shape, resulting from catastrophic 1459 to a cash crisis proportions in the German language.

Saxon money crisis

The inferior red sighs , also known as sighs and Leipzig sighs, which the Saxon elector and Polish king August the Strong (1694–1733) had in huge quantities minted in 1701 and 1702, triggered a financial crisis in Electoral Saxony. The name of these sixes can be traced back to the loss suffered by the population due to the high copper content of the coins.

Tulip mania

The so-called tulip mania was an economic crisis in the Netherlands between 1634 and 1637. The speculation was connected with the Haarlem tulip bulbs , which were given an inflated and often purely fictitious value.

English money crisis

The English money crisis of 1696 was due to changes in the composition of coins and a general lack of means of payment.

Further crises of the 18th century

- 1716–1720: Law's stock and banknote fraud

- 1711–1720: the English South Sea swindle

- 1790–1797: the French assignat economy

Hamburg trade crisis

In 1799, the so-called Hamburg trade crisis was triggered in Hamburg by the overcrowding of the Hamburg market with goods that could not be sold.

Crises of the early 19th century

- 1815: British economic crisis (triggered by overestimation of consumer behavior on the continent)

- 1825: British economic crisis after a large-scale start-up and stock fraud (of the projected £ 372 million, only £ 17.6 million was actually paid up).

USA / Great Britain 1837

Economic crisis of 1837 : The economic crisis that lasted from 1837 to 1843 was marked by a sharp economic slowdown in the US economy, caused by bad investments by banks and a lack of confidence in the paper currency. The effects carried over to the British economy in particular.

British railway crisis

In 1847 Great Britain was hit again by a severe economic crisis, this time triggered by speculation with railways and supply companies. The only three-year-old Peelsche bank file had to be temporarily suspended. The First Opium War , which forced the import of opium from British India into China, led to such a silver outflow that England's exports of other goods to China collapsed.

Economic crisis of 1857

The economic crisis of 1857 was the first world economic crisis. It began in New York City in August 1857 when a bank had to stop making payments. From there, the crisis quickly spread across the world. The financial centers of Europe and America were particularly hard hit.

Founding crisis of 1873

Following the boom years of the founding period , the so-called founders' crash occurred in 1873, as a result of which over 60 banks in Germany and Austria alone became insolvent . This crisis tended to be caused by overheating of the economy and was therefore only a correction of the previous high growth rates. Firms and factories had been taken over and formed at inflated prices.

The crisis coincided with a US economic crisis and led to long stagnation in all highly developed countries. The economic decline reached its lowest point in 1878, and it was not until the second half of 1879 that the economic situation began to improve, emanating from the USA and Great Britain. Nicholas Gregory Mankiw claims in his standard work Grundzüge der Volkswirtschaftslehre that the economic crisis of that time was only ended by the gold discoveries on the Klondike . Because back then there was the gold standard . The international economic growth disturbances of 1873–1896 are known under the term Great and Long Depression .

Stock market crash in France in 1882

In France, soon after the founding crisis, a stock market fraud developed under the influence of the Union générale , which ended on January 19, 1882 with a major stock market crash that mainly affected the stock exchanges in Paris and Lyon .

Great Depression 1929

Great Depression ( Great Depression ) in 1929 until the late 1930s: As the global economic crisis referred to a 1929 onset of severe economic downturn, the massive in all major industrial nations negative consequences had since the gold standard and stability policy (u a business failures, mass unemployment and deflation..) Austerity demanded.

First oil crisis (1973)

First oil crisis 1973: The oil embargo of the OPEC combined with the high public debt of the United States because of the Vietnam War led to stagflation in the US. All major industrial nations were affected by the first oil crisis. In Germany it marked the end of the economic miracle . As a result, hitherto largely unknown phenomena occurred, such as short-time work , unemployment and rising social spending .

Second oil crisis (1979/1980)

Second oil crisis 1979 to 1980: Another drastic price increase took place in 1979/1980. It was mainly triggered by funding failures and uncertainty during the first Gulf War between Iran and Iraq . The second oil crisis was one of the main reasons for the worst recession to date since the Federal Republic of Germany was founded in 1981/82. The second oil crisis can also be seen as the final trigger for the debt crisis in a number of developing countries . These had to negotiate in several rescheduling agreements on a political level, some of them until the mid-1990s, in order to regain their economic sovereignty.

US savings bank crisis (1981)

Latin American Debt Crisis (1982)

Nordic banking crisis (1990s)

Central measures to overcome the banking crises of the 1990s in Sweden and Finland were the buying up of “bad papers” by asset management companies (bad banks) and the nationalization of important banks in both countries. From the Finnish and Swedish point of view, priority should be given to crisis management and, in particular, to the recovery of non-performing assets on bank balance sheets. Thanks to strict purchase conditions and successful exploitation strategies, the Swedish “bad banks” succeeded in relieving taxpayers of the costs of the crisis.

Japan crisis (from 1991)

The Japanese crisis is a severe economic crisis that occurred after a property price bubble burst in the early 1990s and shaped the country's economic situation for almost 15 years. The sharp decline in asset prices led to a perceived impoverishment of the population, which contributed to a strong reluctance to consume and invest . Entrepreneurial mistakes, overcapacity and inefficiencies increased the effect. The result was an increase in unemployment, the world's highest national debt for the Japanese state and still ongoing deflation .

Crisis of the European Monetary System (1992)

Tequila crisis (1994/1995)

Asian crisis (1997/1998)

Asian crisis 1997 to 1998: The financial and economic crisis in East Asia of 1997 and 1998 is referred to as the Asian crisis . It began in Thailand in July 1997 and spread to several Asian states, especially many of the so-called tiger states . The hardest hit countries were Indonesia , South Korea and Thailand. The cause of the crisis was the excessive promise of returns to foreign investors that could no longer be refinanced by investing in the countries. Because of this and due to the lack of exchange rate risk (fixed exchange rate peg to the US dollar ), a lot of short-term capital flowed into the countries in the run-up to the crisis. As a result of herd behavior , the first symptoms of the crisis led to a massive withdrawal of capital from the countries, which triggered an economic and financial crisis there for several years.

Russian crisis (1998/99)

Argentina crisis (1998–2002)

Dotcom Bubble (2000)

Collapse of the dot-com bubble from 2000: In March 2000, a speculative bubble burst in many industrialized countries, which particularly affected the so-called dot - com companies. Similar to the Japanese crisis, there was a perceived decline in wealth and, as a result, a reluctance to buy, which led to recessive tendencies in the countries.

Financial and economic crisis from 2007

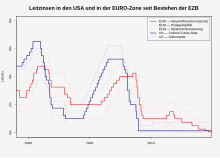

The financial crisis from 2007 is a banking and financial crisis that began in the early summer of 2007 with the US real estate crisis (also known as the sub-prime crisis). This crisis manifested itself worldwide in losses and insolvencies among companies in the financial sector, but since the end of 2008 also in the real economy. The crisis was mainly triggered by falling real estate prices in the USA, which after a long period of price increases had developed into a real estate bubble. At the same time, more and more borrowers were no longer able to service their loan installments, partly due to the base rate rising again (from mid-2004) and continuously rising lending rates, partly as a result of falling incomes. Since the loans were resold (securitization) and these were scattered around the world, the crisis spread internationally.

Large parts of the global economy have been affected by the crisis since the end of 2008. The economy shrank in Germany, France and the USA, among others. The United States is reporting the sharpest sustained economic decline since the end of World War II. The effects in Japan, South Korea and Italy are also serious. Many emerging economies such as China, Russia, India and Brazil saw their growth rates slow.

Euro crisis from 2010

Iceland's financial crisis 2008-2011

Economic crisis in Venezuela from 2013

Economic crisis 2020 to Covid-19 pandemic

The spread of the COVID-19 pandemic has resulted in stock market crashes in several countries. In addition to the drop in the oil price due to the failure of oil price negotiations between Saudi Arabia and Russia, the main reasons for the beginning economic crisis were the slump in sales due to contact bans, exit and travel restrictions as well as falling purchasing power due to rising unemployment in sectors particularly affected by this.

Effects of economic crises

Business demographics are changing significantly, especially in the so-called " medium- sized companies", due to unusually high balance sheet losses and the increase in bankruptcies . But from the point of view of some capital owners or with regard to a more competitive corporate landscape , economic crises are not always rated negatively. In politics, an economic crisis can, under favorable circumstances, generate the necessary pressure to reform in order to solve the structural problems that cause or aggravate the crisis.

In particular, the poorer sections of the population are mostly the losers and suffer the hardest from the economic consequences of the crisis. For many, the dramatic and persistent rise in unemployment means permanent unemployment and social decline. For many, it leads to health problems such as depression or other diseases resulting from stress, and it reduces life expectancy. At the same time, the chances of receiving medical care are reduced.

The crisis also increases economic and social insecurity. An OECD report from April 2009 sees the share of informal work currently at a record level of over half of the world's workforce and estimates that it will increase to 2/3 by 2020.

Which political solution the government of a given state decides on depends on the interaction of these five points:

- the economic position of the main social forces and the political weight of their representative bodies (trade unions, employers' associations);

- the ability of political actors to form coalitions between parties, groups and associations;

- the willingness and ability of the state to intervene in the activities of companies ;

- the (more or less liberal) traditions of the state; and

- the position of the respective state within the geopolitical power structure.

The negative consequence of an economic crisis is often an increase in social tensions (e.g. the cacerolazo as a result of the Argentina crisis ). Some economic crises have led to civil wars and other armed conflicts by increasing the potential for conflict or exacerbating existing conflicts.

See also

Web links

- Bill Bradley, Niall Ferguson, Paul Krugman, Nouriel Roubini, George Soros, Robin Wells et al .: The Crisis and How to Deal with It . The New York Review of Books. Volume 56, Number 10. June 11, 2009 (English)

literature

- Nicolle Matern et al. Timo Ruget (Ed.): The great crash. Economic crises in literature and film. Würzburg: Königshausen & Neumann 2016. ISBN 978-3-8260-5772-4 .

- Nouriel Roubini , Brad Setser: Bailouts or Bail-ins? Responding to Financial Crises in Emerging Economies. Institute for International Economics, Washington DC 2004. ISBN 978-0-88132-371-9 .

- Werner Plumpe (with the assistance of Eva J. Dubisch): Economic crises - past and present. 5th, revised and updated edition. Beck, Munich 2017, ISBN 978-3-406-60681-6 . ( Review of the first edition )

- Werner Seppmann : Crisis without Resistance? Culture machines , Berlin 2010. ISBN 978-3-940274-22-9 .

- David Römer: Economic crises. A history of linguistic discourse. De Gruyter, Berlin 2017. ISBN 978-3-11-051750-7 .

- Kristoffer Klammer: 'Economic Crises'. Effect and factor of political communication. Germany 1929 - 1976 (= historical semantics, vol. 28). Vandenhoeck & Ruprecht, Göttingen 2019, ISBN 978-3-525-31059-5 .

Individual evidence

- ↑ Kaminsky, G. / Reinhart, C. (1999): The Twin Crises: The Causes of Banking and Balance of Payments' Problems , in: The American Economic Review, 89th year, pp. 473-500.

- ^ Rolf Caspers, Balance of Payments and Exchange Rates , Oldenbourg Wissenschaftsverlag, 2002, ISBN 978-3-486-25924-7 , pages 113, 114

- ↑ Michael Heine, Hansjörg Herr, Economics: Paradigm-Oriented Introduction to Micro- and Macroeconomics , Walter de Gruyter, 2013, ISBN 978-3-486-71750-1 , p. 726

- ↑ Milton Friedman: A Monetary History of the United States .

- ↑ Richard Gaettens, Inflations - The drama of monetary devaluations from antiquity to the present (The time of the Schinderlinge). Pflaum Verlag Munich, 1955

- ^ Nicholas Gregory Mankiw: Grundzüge der Volkswirtschaftslehre 4th edition. Schäffer-Poeschel Verlag Stuttgart 2008, ISBN 3-7910-1853-1

- ^ Paul Krugman: About Austerity: Germans and Aliens , January 9, 2012, accessed November 15, 2012

- ↑ Measures to overcome the Nordic banking crisis (1990s)

- ↑ Monetary Policy and the Housing Bubble Chart: 2000–2009

- ↑ Josh Bivens: Worst economic crisis since the Great Depression? By a long shot. Economic Policy Institute . Read on February 9, 2010.

- ^ Federal Statistical Office ( Memento of April 6, 2009 in the Internet Archive )

- ↑ How did the stock market crash as a result of the coronavirus? And what are the possible consequences? Frankfurter Rundschau online, March 17, 2020

- ↑ Bankruptcy wave due to the economic crisis. Tagesschau, as of February 3, 2010 at 4:08 p.m.

- ↑ ILO : Global Wage Report: 2009 Update. ( Memento of December 10, 2009 in the Internet Archive ) (2nd quarter 2009 wage trends in a number of countries; English) Retrieved September 23, 2015.

- ↑ Michael Luo: At Closing Plant, Ordeal Included Heart Attacks. The New York Times, February 24, 2010.

- ↑ Michael Luo, Megan Thee-Brenan: Poll Reveals Depth and Trauma of Joblessness in US. The New York Times December 14, 2009.

- ↑ Rising informal employment will increase poverty OECD Development Center April 8, 2009

- ^ Serge Halimi: Free Traders and Junkers , March 13, 2009