Economic miracle

The economic miracle is a catchphrase describing the unexpectedly rapid and sustainable economic growth in the Federal Republic of Germany after the Second World War . In Austria, too, the rapid economic upturn from the 1950s on is known as the economic miracle. The economic miracle gave the Germans and Austrians a new self-confidence after the horrors of World War II and the misery of the immediate post-war period . In fact, the strong economic growth of the 1950s and 1960s was a pan-European phenomenon ( post-war boom ). Economics gives several reasons, some of which are controversial. For example, the economic miracle after the Second World War in Germany would not be a miracle in the strict sense, but a natural adjustment process that is predicted by the Solow model .

However, the term “German economic miracle” already existed before the 1950s, also outside of Germany. It was used in connection with the reduction in unemployment in the 1930s, which was achieved at the time due to a massive increase in national debt (see Social Policy under National Socialism # Unemployment ).

German economic miracle

initial situation

Despite the difficult initial situation after the unconditional surrender in 1945, unlike in the case of urban living space, around 80 to 85 percent of production capacities remained undamaged. The total capacities after the war even exceeded those of the last year of peace in 1938. The road and rail network was only severely damaged in certain places: the numerous interruptions caused by destroyed bridges (many of which were blown up by Wehrmacht soldiers shortly before the end of the war) and junctions could be repaired relatively quickly. The same applied to the shipping lanes; these were by destroyed bridges and shortly before the war ended scuttled (some of which ships fairways and quays blocked) initially often impassable. Reconstruction made good progress here even before the currency reform of 1948 , and the clean-up work in the cities made rapid progress by 1948.

The occupation policy of the Western Powers after the war was by no means aimed at the rapid economic recovery of Germany. Passenger traffic between the three western zones was subject to restrictions until 1948. The currency reform called for by economic experts like Ludwig Erhard was initially refused. After various plans , already discussed during the war but later rejected , on how to deal with the Germany responsible for the world war, the western allies finally decided in favor of reconstruction . Compared to the Soviet occupation zone , the dismantling in the western occupation zones was limited. As the differences between the world powers then grew and grew relatively quickly into the Cold War , economic aid for both German states was expanded.

The Reichsmark was largely devalued after the war . It was replaced by the new Deutsche Mark on June 21, 1948 in the three western occupation zones . This currency reform created the prerequisites for economic consolidation and simplified the organizational aid provided by the Marshall Plan . A few days later the Frankfurt documents were handed over :

- The first document contained the authorization of the heads of government to convene a meeting of the eleven state parliaments so that adequate central authority and fundamental rights could be worked out for the newly created state.

- The second document contained the request to adjust the national borders within the western zones.

- The third document called for the basic features of a future occupation statute to be laid down.

The Frankfurt documents can be seen as the birth certificate of the Federal Republic of Germany, which was then founded in 1949.

course

At the end of the 1940s, a dynamic economic upswing began in western Germany, which, interrupted only by an economic dip in 1966 and 1967, lasted until the oil price crisis in 1973.

The currency reform of 1948 put an end to the previously widespread barter and the black market economy practically overnight. The shelves filled up just as quickly with goods, initially primarily goods to meet basic needs . The companies initially lacked sufficient capital for broad investment activities . This changed in the following years, initially hesitantly, then radically. The basis was the good profit development , the subsequent willingness to invest was largely self-financed (= self- financed and internally financed ). This also improved the extremely precarious financial situation of very many companies until the early 1950s.

As early as the end of 1947, the Marshall Plan made funds available, most of which were granted as loans and only a small part as grants. An important factor was the increase in exports , caused by very low production costs in Germany and temporarily increased by the Korean boom in the USA (1950/1951). The fixed exchange rate to the US dollar of 4.20 DM to 1 US dollar acted as an indirect export subsidy. A dynamic and steady export growth developed. In 1960 German exports were already 4.5 times as high as in 1950, and the gross national product had tripled. The company's capital increased and investments grew. The German share of world exports had risen from six to ten percent. Even after the Korean boom, German industry retained a cost and thus price advantage over other countries. Germany took advantage of a European "dollar gap" and the advantages of the European payments union . In addition, German industry was able to quickly deliver modern capital and consumer goods from the mechanical engineering and vehicle construction as well as the electrical industry.

The enormous speed of development can be seen, among other things, from the fact that the real income of the average working class family had already exceeded the pre-war level in 1950. In 1949, the year it was founded, the Federal Republic of Germany had “reached the same level of prosperity and modernity” as it had before the war. The number of unemployed was still over two million in the early 1950s, but became increasingly smaller from 1952 onwards. The demand for labor in the emerging economy was enormous, and so-called guest workers were officially recruited for the first time as early as 1955 . Despite immigration from the former German eastern territories and the flight from the Soviet occupation zone and the GDR , the need for labor could no longer be met, growth seemed to be in danger. Especially the so-called emigrants from the GDR were of particular importance for the economic miracle because of their above-average qualifications: hundreds of thousands of academics, self-employed and craftsmen came to the West until the Wall was built in 1961.

Another not insignificant point was the migration of factories from the Soviet-occupied areas and the later GDR to the western zones and the later Federal Republic. In some western German regions this led to strong industrial growth from 1945 onwards, especially in Bavaria, which was hardly industrialized before the Second World War . For example, Ingolstadt was not an industrial city until 1945, but only became this when Auto Union AG (now Audi AG) emigrated from Chemnitz in the first post-war years. From Chemnitz alone, a large number of other companies migrated to the west, including, in addition to Auto Union, Schubert & Salzer AG, Wanderer-Werke AG and Hermann Pfauter AG. Siemens' corporate headquarters were relocated from Berlin to Munich and Erlangen . A multitude of other examples could be given.

The investments in the Federal Republic rose from 1952 to 1960 by 120 percent, the gross national product increased by 80 percent. The German reparation policy not only paved the way for Germany's return to the international community, but ultimately also made possible the London Debt Agreement of 1953 negotiated by the banker Hermann Josef Abs . With its relatively generous regulation of old debts, which was almost halved, it became an important basis for further ascent. As early as 1954, the housing stock in the Federal Republic was back to the level of the last year of peace in 1938 in the same area. This pace of reconstruction exceeded expectations; after the end of the war, experts had estimated the time needed to rebuild the cities at 40 to 50 years.

From 1953, capacity expansion was the focus of investments. Previously, war damage had to be repaired and then investment arrears from the war years had to be made up. The switch to civilian productions also initially tied up considerable parts of the scarce investment funds. Despite these deficits in the capital stock of the German national economy, the most modern technologies and the establishment of internationally competitive industrial research and development were soon achieved . 1955 was the fastest growing year in German history. The economy grew by 10.5 percent in real terms, real wages also rose by 10 percent, and the number of vehicles increased by 19 percent this year. In 1948, automobiles with wood gasifiers were still driving on empty highways , but now the first traffic jams formed during the holiday season. The term "economic miracle", which had only been used sporadically until then, became a popular word in 1955. It was also the year in which the Federal Republic largely regained its sovereignty - on May 5, 1955, deliberately 10 years to the day after the partial surrender of the German Wehrmacht to the Western Allies.

The west of Germany approached the US standard in the course of the 1950s. The German vehicle industry was able to increase its production fivefold between 1950 and 1960. Industry and service providers were able to absorb two million unemployed within a few years. The 8 million displaced persons and 2.7 million people who immigrated from the GDR also found work. Full employment had prevailed since the late 1950s and the unemployment rate was below two percent. According to today's understanding, with a rate of around 4 to 5 percent, full employment was achieved as early as 1955/1956. From 1950 to 1970 real wages rose two and a half times. In the second half of the 1950s, the Federal Republic was already able to shoulder the economic burden of rearmament . During this time the Deutsche Bundesbank began to accumulate high foreign exchange reserves due to persistent export surpluses and to build up the gold stocks that it still has today. Foreign liabilities were repaid ahead of schedule, and the D-Mark revalued several times. The federal budget was almost completely balanced between 1949 and 1968, and the national debt - measured in terms of national product - fell rapidly. At the same time, a rapid structural change took place : in 1949, large parts of Germany were still characterized by rural and agricultural activities and 21% of employees were active in agriculture; by 1970 this proportion fell to below 10%, in favor of industry and later mainly the service sector , production of the remaining farmers was increased through the mechanization of agriculture and their economic survival secured through state subsidies .

From the beginning of the 1960s, the investment boom slowly declined. The capacities were able to satisfy the demand , the technical backlog had been made up. The economy continued to grow very dynamically up to and including 1973, the year of the first oil crisis , only interrupted by the slight recession of 1967: “The post-war boom only ended in 1973.” This economic development is one of the reasons that the second German democracy, unlike the Weimar Republic , was accepted by the population, although it was a product of the Allied occupation, as it promised prosperity, stability and social equilibrium.

Austrian economic miracle

initial situation

The development in Austria was similar to that in Germany. After the Reichsmark had become almost worthless, the Austrian Schilling was reintroduced in 1945 . Austria qualified for the Marshall Plan in 1947 and was able to rebuild and modernize ailing industries more quickly with US help. 1952 Reinhard Kamitz became Minister of Finance. Together with Chancellor Julius Raab, he pursued a policy of social market economy ("Raab-Kamitz course"). As in West Germany, Austria also decided in favor of the social market economy as an economic and political system, which, like in West Germany, was initially highly controversial across the political landscape.

course

In Austria, industry and infrastructure were far less affected than in Germany during the Second World War. From 1945 to 1950 the leading companies ( Austria Metall AG , VÖEST , Steyr-Puch ) were nationalized and also rebuilt with the help of taxpayers' money and US investments.

A high degree of social peace promoted further investments in Austrian companies; German companies set up a large number of subsidiaries in Austria, which, as in Germany, pushed the unemployment rate to below 3 percent. Billions in projects, such as the construction of the Kaprun storage power station or the expansion of the western motorway (Salzburg-Vienna) were tackled and in turn created jobs.

In 1949, VÖEST engineers invented the so-called Linz-Donawitz process , which revolutionized steel production worldwide. In 1959 and 1965, new off-road vehicles were built in Steyr-Puch, the so-called Haflinger and the Pinzgauer , which became an export hit. It was not until the mid-1960s that the high level of dynamism slowly came to a standstill, the first crises in the nationalized companies and a decline in the increase in purchasing power set in.

Causes of the economic miracle

After the horrors of the war and the misery of the post-war years, the prosperity phase of the 1950s and 1960s came unexpectedly, especially for the Germans and Austrians, so that the first talk was of an economic miracle. (But even under Bismarck there was the word of the German economic miracle.) A little later, the French also spoke of the Trente Glorieuses , the "thirty glorious (years)", the Spanish of the Milagro español , the Italians of the Miracolo economico italiano . In fact, a European economic miracle took place during this period. The interpretation of the post-war boom is not yet entirely uniform among economic historians and economists. However, the view has largely gained acceptance that the reconstruction effect played a major role until the end of the 1950s and the catch-up effect until the beginning of the 1970s.

Marshall plan help

The US economic aid through the Marshall Plan has facilitated the reconstruction of Western Europe and thus also the economic miracle in Germany and possibly accelerated it in phases, but by no means caused it on its own. West Germany received a total of 1.4 billion US dollars in development aid , among other things for the reconstruction of the infrastructure, which was often severely damaged in certain places. The starting position of West Germany after the war was more favorable than a superficial examination would suggest:

“Germany was in ruins, but this applied primarily to the buildings in the inner cities and the large industrial plants. A large part of the factory machinery, which was expanded during the war, had been outsourced and survived the war unscathed. Despite all the destruction, at the end of the war industrial capacities exceeded those at the beginning of the war. "

Beyond the Marshall Plan aid, countries such as the Federal Republic or Japan were promoted through their integration into the western economic system, which was dominated by the USA, especially since the USA regarded the countries as model countries in the region in the sense of anti-communism. The US political scientist Chalmers Johnson explained that in the years leading up to the Vietnam War, countries such as For example, Japan was given massive support as an export nation - by lowering import restrictions into the US despite damage to the US economy.

Keynesian explanation

According to Keynesian analysis, the problems of the interwar period hindered economic growth in Western Europe even more than did the US. In contrast to the USA, a restrictive monetary policy was predominantly pursued in Europe , which had a very negative effect in the post-war recession 1920-21, the stabilization crises after the war-related hyperinflation and the deflationary policy of Great Britain with a return to the gold standard and the German Reich in 1932. Together with the collapse of the international financial system, this is also blamed for the global economic crisis .

In contrast, the “Keynesian era” of the post-war boom was characterized by an expansive economic policy to control the business cycle of the FRG, to avoid mass unemployment and to achieve maximum capacity utilization. The Bretton Woods system had contributed to the liberalization of foreign trade and the stabilization of the international financial system.

According to this view, the fact that Germany already experienced strong economic growth in the 1950s, although it only switched to a Keynesian economic policy in the 1960s, does not speak against the thesis that German growth in the 1950s was not solely determined by the supply side. On the one hand, the export-driven growth strategy of the 1950s was dependent on free trade policy and the general Western European post-war boom. On the other hand, the Deutsche Bundesbank was forced to adopt an expansive monetary policy because of the Bretton Woods system. According to Ludger Lindlar, the Keynesian explanation is coherent in the long run, but in its pure form, i.e. if the additional reconstruction and catch-up effect is not taken into account, the quite different growth rates e.g. B. between the USA and Great Britain on the one hand and Germany or France on the other.

Offer theory approach

The supply theory perspective was developed as an alternative explanation to the Keynesian perspective. According to Charles P. Kindleberger and others, it was not decisive whether supply or demand forces had triggered growth, but only that the supply side did not limit growth. Above all, the "flexible labor supply" was decisive due to the shrinking number of jobs in the agricultural sector, high immigration rates and high population growth. This has kept wages low and thus enabled an investment boom driven by high profits. Barry Eichengreen focuses more on institutional wage restraint through social alliances of employers and trade unions or state wage and price controls.

According to Ludger Lindlar, the supply theory approach is coherent in itself, but cannot explain the extraordinarily strong productivity growth. Nevertheless, the supply theory approach is criticized by some economists. If wages that were too high were the reason for the end of the post-war boom, falling wages should have caused the boom to return. Indeed, since 1982 real wage increases in most Western European countries have lagged well behind productivity growth, so that in many countries the wage share has fallen back to or below the 1970 level. Some economists conclude from this that the existing mass unemployment can no longer be attributed to excessively high wages.

Demand-theoretical approach

In rejection of the supply theory approach, the demand theory approach arose. Following Say's theorem , supply theorists assume that the companies that are inferior to the competition look for and find other profitable investment opportunities. Demand theorists assume that this is not always the case. If the losing companies do not give up the market, they will also accept a falling rate of profit in the price competition. This in turn leads to falling investment, falling demand and falling employment across the industry. Accordingly, the catching up economies, especially Germany and Japan, had realized larger export surpluses at the expense of the advanced economies of the USA and Great Britain in the 1950s and 60s. This was tolerated as long as the advantages of growing foreign trade outweighed the disadvantages in the USA and Great Britain as well. In the 1960s, world trade rose so rapidly that the foreign trade deficits or surpluses brought about the end of the Bretton Woods system. As a result, the dollar depreciated sharply against other currencies, increasing the international competitiveness of the USA at the expense of other countries, especially Germany and Japan. In addition, the US economy took measures to reduce costs. For their part, the Japanese and German economies reacted with cost reductions and wage restraint. The situation was exacerbated by the rise of East Asian economies, which in turn expanded world market shares. According to this approach, there is an increasing overproduction crisis or secular stagnation , which led to a long downturn following the post-war boom.

Specifically German development

Herbert Giersch , Karl-Heinz Paqué and Holger Schmieding explain the German post-war boom with the ordoliberal regulatory policy. The upswing was initiated by a market economy shock therapy as part of the currency reform. A cautious monetary and fiscal policy led to persistent current account surpluses. The growth of the 1950s was driven by the spontaneous market forces of a deregulated economy and ample corporate profits. Increasing regulation, higher taxes and rising costs would then have slowed growth from the 1960s onwards.

Werner Abelshauser or Mark Spoerer , for example, object to this point of view, claiming that a West German special development is postulated that does not correspond to the facts. There is not only a German economic miracle, but also z. B. a French. French economic growth in the 1950s to 1970s ran almost parallel to that in Germany, although the social market economy in Germany and the more interventionist planification in France represented the strongest economic and political contradictions in Western Europe. This suggests that the various economic policy concepts have little practical importance as long as property rights and a minimum of competition are guaranteed.

Reconstruction thesis

The reconstruction thesis was developed in rejection of a specifically German interpretation. According to the explanatory approach developed in the 1970s by Franz Jánossy , Werner Abelshauser and Knut Borchardt in particular , productivity growth remained far below the potential production potential of the German and European economies due to the effects of the First and Second World Wars and the intervening global economic crisis. Abelshauser was able to show, following contemporary work, that the extent to which German industry was destroyed in the war had been greatly overestimated in literature. While the Allies had succeeded in destroying entire cities, the deliberate destruction of industrial facilities had hardly succeeded. In spite of all the destruction, there was therefore a significant amount of intact capital stock, highly qualified human capital, and tried and tested corporate organization methods. Therefore, after the end of the war, there was particularly high potential for growth. Due to the falling marginal return on capital, the growth effect of investments was particularly high at the beginning of the reconstruction and then declined as the economy approached the long-term growth trend. The Marshall Plan is not considered to be of great importance for the West German reconstruction, since the aid started too late and had only a small volume compared to the total investment. A “mythical exaggeration” of the currency reform is also rejected. The reconstruction process began a year before the currency reform with a strong expansion of production, which was the decisive prerequisite for the success of the currency reform.

Abelshauser sees the reconstruction thesis confirmed by the economic failure of the monetary, economic and social union . On the basis of the specifically German interpretation of the post-war boom, Federal Chancellor Helmut Kohl, as well as most German politicians and most West German economists, believed that a second economic miracle in the five new federal states could be sparked by a regulatory-induced unleashing of market forces. The government essentially followed a bulletin by Ludwig Erhard in 1953, in which he had planned the economic completion of reunification. However, the introduction of the DM at an excessive exchange rate only led to the elimination of the international competitiveness of East Germany; with the expiry of the transfer ruble offsetting on December 31, 1990, East German exports suddenly collapsed. In the end, the economic miracle turned out to be unrepeatable.

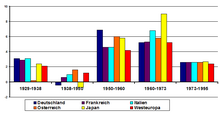

A comparison of economic growth rates reveals that countries that had suffered considerable war damage and a tough occupation regime recorded particularly high growth rates after the Second World War. In addition to Germany, Austria, Italy, Japan, the Netherlands and France experienced rapid catch-up growth of (on average) 7–9% annually between 1945 and 1960. Countries less severely affected by the war or neutral countries experienced economic growth of “only” 3–4%. According to Ludger Lindlar, the reconstruction thesis therefore offers an explanation for the above-average growth rates of the 1950s. But only the catch-up thesis can explain the high growth in the 1960s.

Catch-up thesis

The catch- up thesis put forward by economic historians Angus Maddison and Moses Abramovitz in 1979 is represented today by numerous economists (including William J. Baumol , Alexander Gerschenkron , Robert J. Barro and Gottfried Bombach ). The catch-up thesis indicates that by 1950 the USA had achieved a clear productivity lead over the European economies. After the war, the European economy started a catch- up process and benefited from the catch-up effect . European companies were able to follow the example of American companies. Figuratively speaking, the catching-up process took place in the slipstream of the leading USA and thus allowed a higher pace. After the productivity level of the American economy had been reached and the catching-up process had come to an end, the Western European economy stepped out of the slipstream at the beginning of the 1970s, so that growth rates as high as in the 1950s and 60s were no longer possible.

The catch-up thesis can be the different high growth rates z. B. between the USA and Great Britain on the one hand and Germany or France on the other. According to an analysis by Steven Broadberry , z. For example, Germany has a strong potential for productivity growth through a reduction in low-productive sectors such as agriculture in favor of high-productive sectors such as industrial production. There was no such potential for the more industrialized Great Britain. While only 5% of the working population in Great Britain worked in the agricultural sector in 1950, it was 24% in Germany. According to an econometric analysis by Ludger Lindlar, the catch-up thesis for the period from 1950 to 1973 offers a conclusive and empirically well-supported explanation for the rapid productivity growth in Western Europe and Japan.

See also

literature

- Werner Abelshauser : Economic history of the Federal Republic of Germany (1945–1980) (= Edition Suhrkamp 1241 = NF 241 New Historical Library ). Suhrkamp, Frankfurt am Main 1983, ISBN 3-518-11241-4 .

- Gérard Bökenkamp: The end of the economic miracle. History of social, economic and financial policy in the Federal Republic of 1969–1988. Lucius & Lucius, Stuttgart 2010, ISBN 978-3-8282-0516-1 .

- Fritz Diwok, Hildegard Koller: Reinhard Kamitz . Pioneer of Prosperity. With prefaces by Heinrich Treichl and Alois Brusatti . Molden, Vienna et al. 1977, ISBN 3-217-00840-5 .

- Anselm Doering-Manteuffel , Lutz Raphael : After the boom. Perspectives on contemporary history since 1970. Vandenhoeck & Ruprecht, Göttingen 2008, ISBN 978-3-525-30013-8 .

- Rudolf Großkopff: Our 50s. How we became what we are. Eichborn, Frankfurt am Main 2005, ISBN 3-8218-5620-3 .

- Frank Grube, Gerhard Richter : The economic miracle. Our way to prosperity. Hoffmann and Campe, Hamburg 1983, ISBN 3-455-08723-X .

- Nina Grunenberg : The miracle worker. Networks of the German Economy 1942 to 1966. Pantheon, Munich 2007, ISBN 978-3-570-55051-9 .

- Ulrike Herrmann : Germany, an economic tale: why it is no wonder that we got rich. Westend Verlag Frankfurt / Main 2019. ISBN 978-3-8648-9263-9 .

- Konrad H. Jarausch (Ed.): The End of Confidence? The seventies as history. Vandenhoeck & Ruprecht, Göttingen 2008, ISBN 978-3-525-36153-5 .

- Alexander Jung: Suddenly the shelves were full . In: Der Spiegel . No. 52 , 2005, pp. 48-53 ( Online - Dec. 23, 2005 ).

- Rainer Klump : Economic history of the Federal Republic of Germany. On the criticism of more recent economic-historical interpretations from a regulatory perspective (= contributions to economic and social history. Vol. 29). Steiner-Verlag-Wiesbaden, Stuttgart 1985, ISBN 3-515-04475-2 .

- Ludger Lindlar: The misunderstood economic miracle. West Germany and the West European post-war prosperity (= writings on applied economic research. Vol. 77). Mohr-Siebeck, Tübingen 1985, ISBN 3-16-146693-4 (also: Berlin, Freie Univ., Diss., 1996).

- Axel Schildt , Detlef Siegfried , Karl Christian Lammers (eds.): Dynamic times. The sixties in the two German societies (= Hamburg contributions to social and contemporary history. Vol. 37). Christians, Hamburg 2000, ISBN 3-7672-1356-7 .

- Axel Schildt, Arnold Sywottek (ed.): Modernization in reconstruction. West German society in the 1950s. Unabridged, reviewed and updated study edition. Dietz, Bonn 1998, ISBN 3-8012-4091-6 .

- Irmgard Zündorf: The price of the market economy. State price policy and standard of living in West Germany 1949 to 1963 (= quarterly journal for social and economic history. Supplements 186). Steiner, Stuttgart 2006, ISBN 3-515-08861-X (also: Potsdam, Univ., Diss., 2004).

Web links

- Texts and pictures on the everyday culture of the "long fifties" in the "economic miracle museum"

- Our economic miracle - The true story (documentary on Phoenix) with new knowledge about the time of the economic miracle and its background

Individual evidence

- ↑ Economic miracle. In: The Brockhaus contemporary history: from the eve of the First World War to the present. 2003, ISBN 3-7653-0161-2 ; Economic miracle. In: Brockhaus, the encyclopedia: in twenty-four volumes. Volume 24, 1999, ISBN 3-7653-3100-7 .

- ↑ Material and spiritual reconstruction of Austria. on: sciencev1.orf.at

- ^ Felix Butschek: Austrian economic history: from antiquity to the present. Böhlau, Vienna 2011, ISBN 978-3-205-78643-6 .

- ^ Hans-Ulrich Wehler , German history of society. Complete works: German history of society 1949–1990 , Volume 5, CH Beck, ISBN 978-3-406-52171-3 , page 48 ff.

- ^ Background to an economic miracle . In: The time . April 3, 1947, ISSN 0044-2070 ( zeit.de [accessed September 30, 2017]).

- ↑ a b Wolfgang König : The seventies as a turning point in the history of consumption in the Federal Republic. In: Konrad H. Jarausch: The End of Confidence? The seventies as history. Göttingen 2008, pp. 84-99.

- ↑ see also the history of the railways in Germany

- ↑ Andreas Dilger, Ute Frevert , Hilke Günther-Arndt, Hans-Georg Hofacker, Dirk Hoffmann, Ulrich Maneval, Norbert Zwölfer and others. a .: Course book on history - from the end of the 18th century to the present. 2003, p. 382.

- ↑ a b Andreas Dilger, Ute Frevert, Hilke Günther-Arndt, Hans-Georg Hofacker, Dirk Hoffmann, Ulrich Maneval, Norbert Zwölfer and others: Course book history - From the end of the 18th century to the present. 2003, p. 381.

- ↑ Irmgard Zündorf: The price of the market economy. State pricing policy and standard of living in West Germany 1949 to 1963. Stuttgart 2006, p. 153.

- ^ Axel Schildt: The social history of the Federal Republic of Germany until 1989/90. Oldenburg 2007.

- ↑ Axel Schildt, Detlef Siegfried: German cultural history. The Federal Republic - 1945 to the present. Munich 2009, p. 181.

- ↑ Gabriele Tergit , Something Rare Ever. Memories. Ullstein 1983, p. 81.

- ^ Peter Temin: The Golden Age of European growth: A review essay . In: European Review of Economic History . 1, No. 1, April 1997, pp. 127-149. Retrieved September 27, 2014.

- ↑ Chalmers Johnson: An Empire Decays New York 2000, p. 231.

- ↑ a b c d Ludger Lindlar: The misunderstood economic miracle. 1st edition, Mohr Siebeck, 1997, ISBN 3-16-146693-4 , pp. 70-77.

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition, Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 54.

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition, Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 60.

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition, Mohr Siebeck, 1997, ISBN 3-16-146693-4 , pp. 22-23.

- ^ Robert Paul Brenner : The Economics of Global Turbulence: The Advanced Capitalist Economies from Long Boom to Long Downturn, 1945-2005 , Verso, 2006, ISBN 978-1-85984-730-5 , pp. 27-40.

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition, Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 55.

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition. Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 32.

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition. Mohr Siebeck, 1997, ISBN 3-16-146693-4 , pp. 32-33.

- ↑ Mark Spoerer: Prosperity for Everyone? Social market economy. In: Thomas Hertfelder, Andreas Rödder: Model Germany. Vandenhoeck & Ruprecht, 2007, ISBN 978-3-525-36023-1 , p. 35.

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition, Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 36.

- ↑ a b Ludger Lindlar: The misunderstood economic miracle. 1st edition. Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 63

- ^ Hans-Ulrich Wehler: German history of society. Complete works: German history of society 1949–1990 , Volume 5, CH Beck, ISBN 978-3-406-52171-3 , page 51

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition. Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 62

- ^ Werner Abelshauser: German economic history. From 1945 to the present , 2011, ISBN 978-3-406-51094-6 , pp. 445–449

- ↑ Mark Spoerer: Prosperity for Everyone? Social market economy. In: Thomas Hertfelder, Andreas Rödder: Model Germany. Vandenhoeck & Ruprecht, 2007, ISBN 978-3-525-36023-1 , pp. 34-35.

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition. Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 69

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition. Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 85.

- ^ Karl Gunnar Persson: An Economic History of Europe , Cambridge University Press, 2010, ISBN 978-0-521-54940-0 , pp. 110 ff.

- ↑ Hans-Jürgen Wagener : The 101 most important questions - business cycle and economic growth. CH Beck, 2010, ISBN 978-3-406-59987-3 , p. 33.

- ^ Peter Temin: The Golden Age of European growth reconsidered . In: European Review of Economic History . 6, No. 1, April 2002, pp. 3-22. Retrieved September 15, 2014.

- ↑ Ludger Lindlar: The misunderstood economic miracle. 1st edition. Mohr Siebeck, 1997, ISBN 3-16-146693-4 , p. 95