Self-financing

In business administration, self-financing refers to financing measures within the framework of corporate financing , in which a company is provided with additional equity . The opposite is external financing .

General

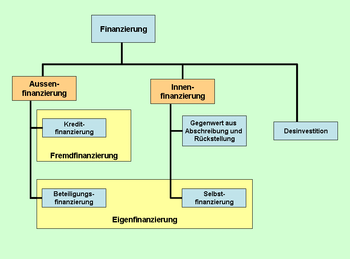

Internal and external financing represent the total financing of companies and other legal entities (such as local authorities ). They provide information about the origin of the financing resources that come from the shareholders or from their own company in the case of internal financing ( retained earnings and depreciation ). If the source of financing lies in your own company, it is called internal financing , otherwise it is external financing . Despite the legal and financial proximity of the shareholders to their company, financing by shareholders is part of external financing. By way of external financing, they can provide their company with both equity and debt capital (through shareholder loans ); only equity is part of the self-financing. Internal financing are only those sources of finance that come from within the company itself. The self-financing is booked in the balance sheet under equity.

species

In the context of internal financing, self-financing can come from retention of profits ( self-financing ) and depreciation; both are formed from profits . Company profits are not distributed in whole or in part, but added to the revenue reserves , while depreciation in turn increases the hidden reserves in some cases . The main source of self-financing, however, is external financing, where the sources of financing are outside the company - namely with the shareholders. The financing instruments include equity securities such as shares ( ordinary shares , preference shares ), participation certificates , convertible bonds , GmbH shares, or limited or cooperative shares .

Distinction is made between emissive ( Aktiengesellschaft , KGaA ) and non-emissive companies ( general partnership , limited liability company , partnership , cooperative distinction). The latter do not have the opportunity to issue their securities (shares) on the stock exchange and thus raise large amounts of equity. For the investor in particular, the disadvantage here is the low fungibility of the units, so that they have to be committed for a longer period of time.

Demarcation

The distinction between external and internal financing is not always easy - as is the case with profit participation certificates or convertible bonds. For self-financing it is necessary that the capital has to be available to the company indefinitely and non-repayable and has an interest-independent interest rate. Hybrid forms of equity are a hybrid between equity and debt and are therefore also called mezzanine capital . Equity instruments (IAS 32.15 ff.) Only exist if the instrument is not linked to a contractual obligation to deliver cash or other financial assets, as the instrument would otherwise meet the definition of a liability. Dirk Kaiser focuses on insolvency if he only assigns financing contracts to self-financing that do not belong to the claim group of creditors in the insolvency and which - if at all - are only served after the creditors have been satisfied.

Accounting

In accounting , the type of origin of the self-financing is required under accounting law. According to Section 266 (3) HGB , self-financing is to be booked on the liabilities side of the balance sheet, namely within the balance sheet item "Equity", separated by subscribed capital (Section 266 (3) No. AI HGB), capital reserves (Section A II) , Retained earnings (Section A III), profit carried forward / loss carried forward (Section A IV) and annual surplus / net loss (Section AV).

Key figures

In the context of the balance sheet analysis, self-financing is the subject of a large number of economic key figures . These include vertical indicators such as the equity ratio and horizontal indicators such as asset coverage . The most important is the equity ratio, which shows the share of equity in total financing (= total assets ):

The higher the equity ratio, the better the creditworthiness of a company and vice versa. A high proportion of self-financing leads to a favorable cost leverage , because fewer profits are used for interest expenses for the relatively low external capital and the break-even point is reached more quickly.