Balance sheet

Balance sheet ( Latin bilancia '(bar) balance' ; from Latin bi 'double' and lanx 'shell' ) is a term that occurs in many specialist areas , which is generally understood to mean a summary and balancing comparison of value categories according to certain criteria .

General

Often the term balance sheet is simply associated with the traditional business accounting of a company. In this sense, the term balance sheet is used synonymously with the terms final balance sheet , balance sheet , balance sheet , commercial balance sheet , consolidated financial statement , HGB balance sheet, annual balance sheet, or company balance sheet.

Depending on the current regulations, there are different accounts such as the tax balance sheet and the balance sheet . In addition to the prescribed balance sheets, micro- and macroeconomic balance sheets with different content and purpose such as balance of payments , economic trade balance , foreign exchange balance , capital account are created; these are used either for internal information within a company (see Controlling ) or in public for presentation in connection with economic policy discussions.

In addition, there are balances that look at economic aspects in a different context, such as social balance , public welfare balance , environmental balance and energy balance , whereby in some cases attempts are made to make appropriate conversions of factors in order to measure their monetary value or to determine a uniform standard.

Furthermore, the term is used to transfer the economic calculation and comparison thinking to other areas such as the intellectual capital statement .

Business management balance sheet

The treated here company's balance sheet is in legal terms a systematic inventory of valuable rights ( asset ) obligation ( debt ) and the net assets , which are the balance is the sum of the monetary rights (gross assets) less liabilities. The rights include property rights (material and intellectual property such as copyrights and trademarks, patents, etc.) and claims. Property rights are booked on the assets side, obligations (debts) and net assets on the liabilities side (only negative net assets indicating insolvency are booked on the assets side for reasons of balance sheet identity). The net financial assets result from the means of payment plus the other receivables less the liabilities. Net financial assets and property rights add up to the net assets or equity. If this is positive, it is recorded on the liabilities side (as excess of gross assets over debts), if it is negative, it is recorded as excess of debts over gross assets on the assets side in order to obtain the same balance sheet total on both sides .

From a commercial point of view, a balance sheet is a summary comparison of the use ( assets , broken down into fixed and current assets ) and the origin of a company's funds ( liabilities ). A company's assets (assets) can come from equity or debt (liabilities) ( economic concept of capital ). The balance sheet is part of the annual financial statements of a company and is used by creditors , rating agencies , shareholders , employees , the accounting company and the state to orientate themselves about the asset, financial and earnings position of the company concerned.

A balance sheet is prepared for a balance sheet date , while the profit and loss account ( which is linked to the balance sheet ) is drawn up for a period of time. By comparing the closing balances of the various asset and liability accounts at different points in time, the economic development of a company can be shown over time and understood by looking at the bookkeeping . The balance sheet is therefore also the basis for business profit determination (see comparison of business assets ).

history

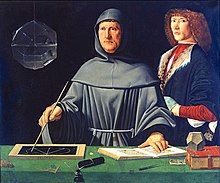

A balance sheet derived systematically from bookkeeping according to today's ideas was first described in 1494 by the Franciscan and mathematician Luca Pacioli in his book Summa de arithmetica, geometria, proportioni et proportionalità , but it has been proven that it was used much earlier in Genoa and other Italian cities. It was the first closed representation of the “Venetian method” ( double-entry bookkeeping ), as it was probably practiced in the long-distance trade in Italian city-states . Pacioli understood the balance sheet as “a sheet of paper folded lengthways on which the creditors are written on the right and the debtors on the left. If you see that the debit amount is as much as that of having, the ledger is in order ”. His "Venetian method" with the principle of the double is still internationally valid today in its basic features.

In 1511, on the occasion of an inheritance division (death of the brothers Georg and Ulrich Fugger), the Fugger's chief accountant , Matthäus Schwarz , prepared the first company balance sheet in Germany. In 1518 he wrote the German-language book "Musterbuchhaltung".

The Prussian General Land Law of June 1794 introduced the accounting obligation, because "a businessman who either does not keep proper books or who fails to balance his assets at least once a year, and thus remains uncertain about the situation of his circumstances," will be punished as a negligent banker if the bankruptcy breaks out . ”In May 1861 there were the first uniform legal regulations in the General German Commercial Code , which in Art. 31 ADHGB required the merchant to draw up an inventory and balance sheet. The HGB of May 1897 adopted this provision almost literally in Section 39 of the HGB.

In October 1937 the Stock Corporation Act tightened the accounting requirements for stock corporations . The Disclosure Act made from August, 1969 to the disclosure of previously legally required corporate balance sheets of partnerships and sole proprietorships from a certain company size . In December 1985 there was the first uniform EU regulation in the form of the Accounting Directives Act; in May 2009 the Accounting Law Modernization Act brought in particular deregulation and a reduction in expenses in favor of small and medium-sized companies . The Accounting Directive Implementation Act of July 2015 is the transformation law of the EU Balance Sheet Directive . Apart from the changes in the size classes, it has no material impact on the balance sheet.

The economic research has dealt extensively with the balance sheet for the first time after a judgment of the realm upper commercial court in December 1873 broad scientific discussion of accounting theory had triggered. Among other things, it demanded that balance sheets “should come as close as possible to the objective truth”. The accounting lawyer Hermann Veit Simon therefore first described the accounting principles of balance sheet truth and balance sheet clarity in 1899 . As early as 1919, Eugen Schmalenbach emphasized in his dynamic balance sheet theory the balance sheet as a “formally balanced list of the assets and capital parts of a company, in which the profit-calculating aspect is in the foreground”. In 1921, the Swiss Johann Friedrich Schär published the fundamental work “Accounting and balance sheet on an economic, legal and mathematical basis”, in which he interpreted the profit and loss account as part of the balance sheet. In 1940 Erich Kosiol saw the balance sheet as a systematic conclusion of bookkeeping, Erich Gutenberg described the balance sheet as a control instrument with specific control purposes. In the meantime, the balance sheet theory has become an important part of the principal-agent theory and thus of the organizational theory .

species

There are the following types of company balance sheets:

- Ongoing balance sheets

- Balance sheets are usually drawn up at the end of each financial year for a period not exceeding twelve months (exception: short financial year ), for example on December 31 ( balance sheet date ) of a year. Listed companies are obliged to publish interim reports (weekly, monthly, quarterly, semi-annual reports, more detailed interim reports ).

- Special balance sheets

- In addition to the regular balance sheets, there are also extraordinary balance sheets that are drawn up on certain occasions (foundation, merger, dispute, restructuring and liquidation balance sheet).

- Trade balance - tax balance

- It is a statutory requirement for all companies that are required to prepare a balance sheet to draw up both a commercial balance sheet and a tax balance sheet . The terms already indicate that there may be differences between the two balances in terms of approach and evaluation . The trade balance is based on commercial law ; The purpose of the tax balance sheet is an accurate determination of income for income taxation within the framework of income tax , corporation tax and trade tax , but also the mapping of company assets for the purposes of inheritance tax , formerly also wealth tax .

- Individual balance sheet - consolidated balance sheet

- An individual balance sheet is used when there is a group balance sheet. Depending on the number of companies reporting in a group, there is an individual balance sheet that reflects the economic circumstances of an individual group company. There is also the consolidated balance sheet, which is part of the consolidated financial statements and in which certain intra-group transactions are eliminated through the consolidation of assets, liabilities and sales .

- Opening balance - closing balance

- At the beginning of his trade ( opening balance sheet ) and for the end ( closing balance sheet ) of each financial year, the businessman has to draw up a statement of accounts showing the relationship between his assets and his debts ( Section 242 (1) HGB ).

Functions

The balance fulfills the following functions:

- Documentation function : The balance sheet provides binding information on the company's existing assets and capital (with the exception of hidden reserves ). By seizing the assets in the balance sheet, this is a significant commercial and tax calculator on the investments made by the company conducts business. The balance sheet thus represents the formal conclusion of the bookkeeping .

- Profit determination function : The comparison of the equity at the beginning of the financial year with that at the end of the financial year, taking into account the contributions and withdrawals, results in the profit or loss of a period. The occurrence of the profit or loss is proven in detail via the income statement in front of the equity account.

- Information function: This can be divided into self-information and third-party information. The aim of self-information is to give the businessman an instrument to control the company in this way. For interested third parties ( suppliers , other lenders , competitors , public authorities - e.g. tax office , IHK , social security agencies -, employees ) the balance sheet is an information tool regarding their future behavior towards the company. From this point of view, the balance sheet serves in a broader sense the protection of creditors .

Colloquially, the balance sheet refers to the entire annual financial statements of a company. The assessment of a company on the basis of its annual financial statements is called a balance sheet analysis in this sense . It is an essential part of fundamental analysis .

The information function is in the foreground in financial statements in accordance with IFRS (International Financial Reporting Standards). The activities of internationalized capital markets require uniform regulations according to which the success of the company is measured. Consolidated financial statements according to HGB or IFRS do not show distributable profit. For companies based in Germany, this is still determined exclusively according to the HGB.

Structure of the balance sheet

The balance sheet is divided into two areas.

- The assets side shows the use of funds . Assets show which claims the company has acquired with the economic resources available to it. These claims can be funds (e.g. cash register, bank accounts), means of production (e.g. real estate, machines), raw materials, intermediate products and similar material goods. A number of intangible goods must also be listed - these cannot always be directly measured financially. This sometimes leads to current problems with the accounting , but there are often good clues for an estimate. The assets side roughly depicts the company's asset structure.

- The liabilities side, the source of funds is. Liabilities show how the funds are financed with which the company generated (Figure financing structure). A distinction is made in particular between debt capital and equity . Equity includes the means that no claim for repayment of third parties are subject, thus, in particular the introduced stem and capital as well as from the company itself generated reserves and undistributed profits . Borrowed capital includes funds made available by third parties (for a limited period of time), such as mortgages , bonds , loans and supplier credits . The assets are usually shown on the left side of the balance sheet and the liabilities on the right side. Both sides must have the same sum of all positions, the balance sheet total .

In most countries there is a legally prescribed structure that is intended to standardize company balance sheets and, within the framework of balance sheet clarity, to convey individual items with the same content to the balance sheet reader. The balance sheet item is an item in this classification scheme of the balance sheet that contains a specific asset , equity component or debt item .

Balance sheet structure according to § 266 HGB in Germany

The breakdown takes place as separate disclosure of fixed and current assets, equity, debts and prepaid expenses ( § 247 ). According to Section 266 of the German Commercial Code (HGB), a d. F. v. December 20, 2012 (Federal Law Gazette I p. 2751) established balance sheet of a corporation.

| Assets side (use of funds) | Liabilities side (source of funds) |

|---|---|

|

|

If the company suffers such a high loss that the equity becomes mathematically negative, the "negative amount" (mathematically correct as the absolute value of the negative equity) at the end of the balance sheet on the assets side is shown separately as "deficit not covered by equity", Section 268 (3) HGB. In the case of commercial partnerships, this corresponds to the “share of the loss not covered by capital contributions” of the personally liable partner or limited partners in accordance with Section 264c of the German Commercial Code.

Deviations from this accounting scheme arise due to the legal form (according to § 264c HGB), company size (according to § 274a HGB) or industry (such as credit institutions and insurance companies ). Individual significant business transactions or items according to Section 265 of the German Commercial Code may require adjustments. For credit and financial services institutions, insurance companies and pension funds, there are separate balance sheet breakdown schemes in accordance with separate regulations ( credit institution accounting ordinance and insurance company accounting ordinance ).

Balance sheet structure according to the Swiss Code of Obligations

In Swiss law, the commercial accounting regulations are regulated in the Code of Obligations (OR). Art. 959a OR requires the following minimum structure for the balance sheet .

| Assets (assets, investments) | Liabilities (debts, financing) |

|---|---|

|

|

* The amount to directly or indirectly involved parties and bodies as well as to companies in which there is a direct or indirect participation must be stated separately in the balance sheet or in the notes.

In practice, the assets are classified according to their liquidity , the liabilities according to the maturity principle . That is, the faster an asset can be liquidated or a liability matures, the higher up it will be placed. The comparison of assets and liabilities arranged in this way gives an indication of the company's liquidity .

Bank balance sheet

The bank balance sheet provides information about the liquidity situation and the risk situation of a credit institution. The breakdown takes place according to § 340 HGB in connection with form 1 of the RechKredV on the assets side according to decreasing liquidity, it starts with the cash balance . A distinction is made between static and dynamic liquidity. On the liabilities side, outside capital comes before equity; it is structured according to increasing maturity.

The assets side differentiates between receivables and securities; on the other hand, no distinction is made between fixed and current assets . The property, plant and equipment can be found under other assets. The liabilities side differentiates between liabilities and securitized liabilities .

Active side Passive side - Cash reserve

- Claims on credit institutions

- Loans and advances to customers

- Bonds

- Shares and holdings

-

Other assets

____________________________________

Balance sheet total

- Liabilities to Credit institutions

- Liabilities to Customers

- Securitized Liabilities

- Other liabilities

-

Equity

____________________________________

Balance sheet total

The informative value of the bank balance sheet with regard to the liquidity situation is limited. It is an invoice related to the key date. In addition, the objectification, for example with regard to the term or the approach and valuation regulations, requires a differentiation according to different liquidity.

The bank balance sheet takes credit risks into account, but not interest rate and exchange rate risks. Subordinated receivables are removed from the balance sheet or listed in the notes.

Balance sheet structure according to IFRS

A balance sheet prepared according to International Financial Reporting Standards (IFRS) differs in its structure from a balance sheet according to German HGB or other national rules. The structure of an IFRS balance sheet is shown in IAS 1 , Paragraphs 51-77 (“Balance Sheet”), whereby IAS 1.51 grants companies two basic options for the balance sheet structure.

- A breakdown according to maturity (on the assets side: current assets and non-current assets and correspondingly on the liabilities side: current liabilities and non-current liabilities) as a rule and

- a breakdown of assets and liabilities according to their closeness to liquidity as an exception.

There is no clear specification as to whether this structure should be in ascending or descending order.

However, the Accounting Interpretations Committee (RIC) of the German Accounting Standards Committee e. V. (DRSC) in RIC 1 (Accounting Interpretation No. 1 "Balance sheet structure according to maturity in accordance with IAS 1 Presentation of Financial Statements ") as a guideline for accounting for German companies under IFRS, apparently the sequence long-term - short-term (see Appendix to RIC 1: Example for a balance sheet structure).

Principles of proper bookkeeping and accounting

The basis for the preparation of a balance sheet is proper bookkeeping . The balance sheet should paint a fair, accurate and comprehensible picture of the company as of the reporting date. This is known as the principle of balance sheet truth and the principle of balance sheet clarity . In addition, the principle of caution applies , stocks that cannot be precisely quantified should be assessed more pessimistically and possible risks taken into account if necessary. These norms are regulated in the principles of proper accounting ( GoB ).

Who has to draw up a balance sheet is regulated in the Commercial Code. The legally prescribed structure can be found there.

The balance sheet must include all facts that are known at the time of the balance sheet and that are relevant for the period between two balance sheet dates. It is therefore not sufficient to include an account balance available on the respective reporting date in the balance sheet. In addition, services received but not yet paid in the period prior to the balance sheet date must be assessed. It must also be ascertained which payments have already been made for services that will not be received until the following year - for example, an advance payment for raw material deliveries.

One difficulty in preparing balance sheets is therefore that all of the facts to be taken into account can rarely be quantified at any one time. For example, it is known that a company will receive a phone bill for December. Since this service was also used in December, the provider's legitimate claim must be included in the balance sheet. However, the corresponding invoice may not be available until the end of January of the following year. Thus it is practically impossible to draw up a balance sheet both precisely and promptly. Correspondingly, it usually takes two to four months for large companies to announce the proper balance sheet. On the other hand, a prompt balance sheet is expected, especially for listed companies, so that - and this tendency is becoming increasingly acute - the fastest possible balance is drawn up, at the expense of accuracy, in which many values could only be estimated.

Furthermore, the comprehensive presentation of the financial picture requires an actual inventory at the time the balance sheet is drawn up. For existing goods, this is usually done in the form of an inventory , in which possible differences between the recorded changes in stock and the stocks actually available can be recorded.

Finally, a company's assets are valued. Here, realistic values must be determined for the means used in production (e.g. machines) and for long-term financial assets (e.g. real estate and company investments). This can be done through depreciation , so that the value of a company vehicle is reduced by one eighth of the purchase price every year over the planned use of (for example) eight years (linear depreciation). Another approach is the determination of the theoretical selling price, which is particularly appropriate for investments in publicly traded values (shares of other companies). Here, for example, the shares owned by the company can be valued at the price on the last trading day before the balance sheet date.

The accounting policy describes the basic orientation of the accounting party in the use of disclosure, classification and explanation options (formal accounting policy) as well as in the use of accounting and valuation options , discretion and circumstances (substantive accounting policy).

The alignment of a company's accounting policy should also not be neglected. For example, it can change the balance sheet through different valuation approaches and various ways of presenting facts.

In order to protect the creditors of a company, the so-called principle of prudence applies when valuing assets , which is specifically applied in the following valuation principles:

Balance theories

- Classic balance sheet theories

- The static balance theories

- Breakdown statics

- Continuation statics

- The dynamic balance sheet theory

- The organic balance sheet theory

- The static balance theories

- Newer approaches

- Preservation of capital and assets

- Economic gain

- Future balance

- Synthetic balance sheet

- Functional analysis balance

- Forecast balance

- Common good balance

- Life cycle assessment or environmental balance ( life cycle analysis )

Current problems with accounting

At least since the beginning of the information age it has been shown that the value of intangible assets can become increasingly important for the valuation of a company. Extraordinary knowledge ( company knowledge from knowledge management or intellectual capital statement ) can only generate a market advantage that can only be converted into financial success in the future. Likewise, successfully established brands are considered valuable property , they help to create customer trust and loyalty.

The difficulty in presenting a realistic economic representation, however, lies in assigning an appropriate value to these thoroughly relevant intangible goods, i.e. in determining the brand value . Since the future income from these goods cannot be realistically foreseen, a cross-company structure for this representation should still have to be researched for a few years.

In the case of service companies in particular, the business success - and thus the value of the company - can possibly depend on assets that have not yet been recorded in the balance sheet, in particular the employees with their skills and knowledge. The employees carry out their work for the benefit of the company on the basis of the employment contracts concluded with them. They - and not machines - generate services and thus sales with customers. They decide on the success or failure of a company based on the quality of their service. One example are the “ investment banks ”, whose business success depends to a large extent on customer contacts and the knowledge of employees. Based on an existing basis of trust between customers and an individual employee, the company receives orders - or not.

Internally generated intangible assets (see Section 268 (8) HGB), such as software or patents , can only be recognized in the balance sheet under strict conditions according to the German and Austrian Commercial Code (similar to the criteria listed in IAS 38). A separate reserve is to be recognized in equity in the corresponding amount, so that a distribution block in the amount of the intangible assets less the deferred taxes on them applies. Intangible assets created for sale are recognized as current assets and are valued at production costs.

When acquiring companies (all assets and liabilities as well as pending contracts) without taking over the legal cover (otherwise it is simply an acquisition of an investment that is accounted for at cost), there is usually a difference ( goodwill ) that is considered to be an asset that can be used for a limited time. Scheduled depreciation follows from this. In the IFRS, a devaluation is only made in the event of a loss of value on the reporting date.

In times of the exaggerations of the New Economy , acquisitions of companies sometimes led to unjustifiably high purchase prices , which were expressed in high goodwill . In the case of company acquisitions , the future success of the purchase price determination is taken as the basis, not the substance, i.e. values expressed in the balance sheet. Income that is below expectations at the time of acquisition means that the goodwill has to be written off. There were the biggest losses companies have ever reported. This was most noticeable at AOL , which had to write off the goodwill that was created in the acquisition of Time Warner . In an international comparison, European corporations have significantly higher intangible values than American corporations. In part, this can be attributed to the strict SEC supervision.

Annual financial statements (consisting of balance sheet, profit and loss account and appendix) of corporations must be electronically filed with the operator of the Federal Gazette . If certain value limits are exceeded, they are published in the Federal Gazette, possibly supplemented by a management report ( Section 289 ) and after review by an auditor . With regard to the functionality of the capital markets, the professional law of auditors is and has been modified several times. Member states of the European Union and the European Parliament have provisionally agreed on the text of the amended directive and the new ordinance on statutory audits. AstV (Permanent Representatives Committee) approved the compromise versions on December 18, 2013.

National accounts

The European System of National Accounts (ESA) provides for balance sheets in the national accounts in which the assets (assets and receivables ) are netted with the liabilities ( liabilities ) to form net worth .

Financial balance sheets offset gross financial assets, receivables, with liabilities to form net financial assets.

Stock-Flow Consistent Models are an economic modeling concept based on balance sheets and the national accounts.

literature

- Jörg Baetge , Hans-Jürgen Kirsch, Stefan Thiele: Balance sheets. 10th edition. IDW Verlag, Düsseldorf 2009, ISBN 978-3-8021-1413-7 .

- Jörg Baetge, Hans-Jürgen Kirsch, Stefan Thiele: Consolidated balance sheets. 8th edition. IDW Verlag, Düsseldorf 2009, ISBN 978-3-8021-1414-4 .

- Adolf G. Coenenberg et al. a .: Annual financial statements and annual financial statements analysis. 21st edition. Schäffer-Poeschel Verlag, Stuttgart 2009, ISBN 978-3-7910-2770-8 .

- Andreas Eiselt: A quick introduction to balances: basics, rules, practical examples. Haufe Verlag, Freiburg im Breisgau, 2013, ISBN 978-3-648-03198-8 .

- Michael Griga, Bookkeeping and Accounting for Dummies, 8th Edition 2020, Wiley-VCH-Verlag, ISBN 978-3527716395

- Jörg Wöltje, reading, understanding and designing balance sheets. Haufe Verlag, Freiburg 2016, ISBN 978-3-648-07191-5

Web links

Individual evidence

- ^ RD Grass, W. Stützel: Economics . Munich 1988, p. 53.

- ↑ Luca Pacioli: Treatise on bookkeeping , 1494; German translation by Balduin Penndorf, 1933

- ↑ Hans-Herbert Schulze: On the problem of measuring economic activity using the balance sheet . 1966, p. 113

- ↑ Klaus Brockhoff: Business Administration in Science and History , 2014, p. 82

- ↑ ROHG, judgment of December 3, 1873, ROHG 12, 15, 19

- ↑ Eugen Schmalenbach: Fundamentals of dynamic balance theory , in ZfhF 1919, p. 79 ff.

- ↑ Erich Kosiol: Formal structure and content of the balance sheet , 1940, p. 14

- ↑ Erich Gutenberg: Business Administration and Accounting Law . In: Ludwig Raiser, Heinz Sauermann, Erich Schneider: The relationship between economics and law, sociology and statistics . 1964, p. 140

- ^ Alfred Wagenhofer: Information Policy in the Annual Financial Statements - Voluntary Information and Strategic Balance Sheet Analysis . 1990, p. 14 ff.

- ↑ Disclosure requirements. In: Federal Office of Justice. Retrieved June 9, 2019 .