Balance of payments

The balance of payments records all economic transactions between residents and foreigners in terms of value for a certain period of time and provides information about the economic interdependence of an economy with foreign countries .

General

A resident is any natural person with a place of residence and any legal person with a place of business in the reference country; in addition, every economic entity - including branches or production units that are not independent companies - provided that it carries out the majority of its economic activities in Germany.

The transactions are viewed in the balance of payments in the same way as business income and expenditure , i.e. H. the balance of payments represents a net financial asset account for an entire national economy. In Germany, the Deutsche Bundesbank publishes the balance of payments on a monthly basis. The basis is a guideline of the International Monetary Fund (IMF) on the structure of the balance of payments.

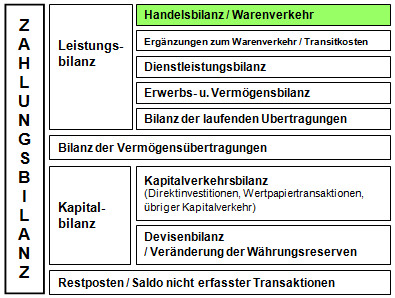

Structure of the balance of payments

The big difference to a balance sheet in the business sense is that the balance of payments records flow values and not stock values. The change in an item over a period of time and not the total balance at a point in time is thus measured. Another difference to the business account form is that the debit and credit side is combined into one column. However, the principle of double-entry bookkeeping also applies to the balance of payments: an offsetting entry must be made for each entry .

The balance of payments as a whole is always formally balanced. These two bookings mainly consist of private economic operators

- the value recording of a good ( service transactions )

- the recording of claims and property rights ( financial transactions ).

This makes it clear that the overall balance must always be balanced, since the value z. B. a delivered car and the payment must match, but both items are posted in different partial balances. Surpluses or deficits can only occur in partial balances. A balance of payments according to the guidelines of the IMF consists of the current account (LB) and the capital account (KB) as well as a "residual item":

- .

Current account

In the current account are

- the external contribution

- the movement of goods ( trade balance )

- the services ( service balance )

- labor and capital income ( balance sheet of earned and property income )

- the current transfers (transfer balance )

summarized that arise over a certain period of time between an economy and a foreign country.

Together these partial balances result in the balance of the current account. Whenever the media speaks of a “balance of payments balance”, it almost always refers to the balance of the current account. This is positive if exports exceed imports (plus the net asset transfers to foreigners).

- .

Balance of asset transfers (balance of donations)

In the Bundesbank's official balance of payments, the sub-balance sheet “asset transfers” is also taken into account. In contrast to the current transfers of the other partial balances, those unpaid services are recorded here that do not directly change the income or consumption of the countries involved (e.g. debt relief) and only take place once.

Together with the balance of the current account, the balance of capital transfers indicates the financial balance between home and abroad. With the exception of a statistical residual item, this financial balance corresponds to the change in net financial international assets .

Financial account

In the financial account any changes in receivables and liabilities are recognized to the outside world. The two possible postings here are capital export (i.e. increase in receivables or decrease in foreign liabilities) and capital import (decrease in receivables or increase in foreign liabilities). Capital imports are on the debit side and capital exports are on the credit side. The difference between capital export and capital import is called the net capital export . This can be positive (import predominates) or negative (export predominates). With the capital account as a partial balance of the balance of payments it is the opposite of the current account, it is less than zero when capital exports predominate and greater than zero when capital imports predominate.

The Bundesbank divides the capital account balance into four sub-balance sheets:

- The direct investments include all holdings of German companies in foreign companies and vice versa of more than ten percent,

- to securities include shares , investment certificates, pension value and other money market instruments ,

- Another sub-balance is the financial derivatives , such as B. futures ,

- credit transactions are divided into short-term and long-term credit transactions.

In addition, there are other capital investments and the balancing item for statistically not attributable capital movements.

- .

If there is a net capital export. A positive current account (current account surplus) goes hand in hand with a net capital export (increase in claims or decrease in liabilities to foreign countries). This changes the net external assets of a country: a net creditor country increases its net creditor position, a net debtor country reduces its net debtor position. A negative current account (current account deficit), on the other hand, goes hand in hand with a net capital import (decrease in claims or increase in liabilities to foreign countries). This changes the net external assets of a country: a net creditor country reduces its net creditor position, a net debtor country increases its net debtor position. Nothing can be said about the change in national wealth (net worth of the country), i.e. whether a country has "saved" (increased its net worth) in the sense of the national accounts, only on the basis of its current account nothing can be said, since the change in net worth of a country only results if the change in real assets is added to the current account balance. This is expressed in the basic equation of the national accounts, that for an open economy, the saving S results from the investment (in national accounts means: change in real assets) plus the current account balance (exports - imports).

Foreign exchange balance

The foreign exchange balance describes the change in the official (national) currency reserves of the central bank . The currency reserves include liquid foreign currency holdings of the central bank (for the euro area this means: claims in foreign currency against non-euro area residents - mostly in US dollars), the gold holdings , the reserve position in the International Monetary Fund and all existing special drawing rights .

The change in all other claims of the central bank is not recorded in the foreign exchange balance , but in the capital account . The central bank's liabilities are also in the financial account.

Since 1999, the central banks of the euro area can only dispose of their currency reserves within the framework of the rules of the ESCB ( European System of Central Banks ) .

Remaining stock

In the balance of payments, this position is called the “balance of statistically non-breakdown transactions” . In common parlance, however, one speaks of remaining stock .

This partial balance includes all transactions that cannot be broken down statistically. Fictitious postings for transactions are recorded in it, which due to inaccurate statistical recording do not correspond to offsetting postings. So it is a kind of balancing position so that debit and credit are actually balanced.

The remaining items include transfers abroad below the reporting limit, so-called " suitcase transactions " and items that cannot be further subdivided.

Systematics of the balance of payments

Double entry

The basic idea of double-entry bookkeeping in the balance of payments is, as already mentioned above, relatively simple: companies and individuals have to pay for the services received (goods, services) from abroad or accept liabilities to themselves and vice versa. Every service transaction results in a financial transaction and thus affects the current account and the financial account.

A second large group of processes are financial transactions, which lead to further financial transactions. A business limited only to the financial account would e.g. B. the purchase of shares and their payment. In other words, imbalances between the current account and the capital account can only be caused by service transactions.

Booking examples

In order to better understand the accounting system of the balance of payments, it is advisable to post several examples from "normal" international trade:

A German company exports $ 500 worth of goods to the United States. This process is posted as a goods export in the current account. The buyer transfers the amount in dollars from his bank to the exporter's German bank. This therefore has short-term claims against the US bank. The German bank credits the exporter with the equivalent value in euros on his bank account.

Balance of payments:

| Debit (foreign exchange income from :) | Have (foreign exchange expenses for :) |

| Current account | |

| Exports of goods | Imports of goods |

| Financial account | |

| Capital imports / borrowing abroad | Capital exports / lending abroad |

| Increase in liabilities or decrease in receivables | Decrease in liabilities or increase in receivables |

This booking system only applies to invoicing (invoicing) in the currency of the importing country, as in the example above. If invoices are made in the local currency, the offsetting entry must be posted as a negative, short-term capital import. This posting, which at first glance is opaque, can be explained by the typical interrelationships in the international banking system. The exporter and the importer will each process the payment transactions at their house bank in their own country. Each of these banks maintains foreign currency accounts in the corresponding currency with partner banks abroad. If the invoice is issued in the currency of the exporting country (euro), the currency account of the importer's bank is debited from the exporter's bank so that the claims can be settled in euros. From the point of view of the exporting country (Germany), there is a negative (short-term) capital import because its short-term foreign liabilities (currency balances with foreign banks) are decreasing. It is noticeable that a negative value is posted here. This is explained by the character of the values as composite quantities. The capital export position is made up of the granting of loans to foreign countries minus loan repayment by foreign countries and the size of the capital import from loan granting by foreign countries minus loan repayment to foreign countries. So if the rear position predominates, a negative value is posted.

Balance of payments:

| Should | Have (foreign exchange income from :) |

| Current account | |

| Imports of goods | Exports of goods |

| Financial account | |

| Capital exports / lending abroad | Capital imports / borrowing abroad |

| Increase in receivables or decrease in liabilities | Decrease in receivables or increase in liabilities |

The balance of payments as a whole always remains in balance. It should also be noted that all items in the German balance of payments are posted in euros, even if invoices were made in the currency of another country, as in the example above. This basic system applies to all service transactions. If a German tourist spends 50 euros abroad, this corresponds to an import of services. In the financial account, the liabilities increase by 50 euros.

Balance of payments:

| Debit (foreign exchange expenses for :) | To have |

| Current account | |

| Service imports | Exports of services |

| Financial account | |

| Capital exports / lending abroad | Capital imports / borrowing abroad |

| Increase in receivables or decrease in liabilities | Decrease in receivables or increase in liabilities |

The second large group of transactions posted in the balance of payments concerns only the financial account. Here, a financial transaction is followed by another financial transaction. So no goods or services are traded. Since this type of transaction has no impact on the current account, it cannot create an imbalance between the sub-accounts. Buying stocks abroad is one of these types of operations. Both transactions, purchase (transfer of ownership) and payment, are purely financial transactions, as are acquisitions of companies or parts of companies. Direct investment is also a part of the financial account. The payment of these investments, be it through shares (securities balance sheet) of the acquiring company or the transfer of the purchase price (credit balance sheet) only has an impact on the capital account. The balance of the financial account in particular has risen sharply in recent decades due to the increasing interdependence of the international financial markets.

Finally, it should be noted that in the final balance of payments, the debit items are brought to the credit side with a change of sign. The official balance of payments consists of only one column. A positive balance means that there is a surplus of the credit items compared to the debit items.

Typical misunderstandings

Current account surplus does not mean "profit", current account deficit does not mean "loss"

The balance of payments is the economic equivalent of the economic financial asset account, i.e. H. the income-expenditure account, it does not correspond to the business profit and loss account. The financial statement determines the change in net financial assets over a certain period of time, while the income statement determines the change in net worth . A current account surplus is therefore not synonymous with a profit ("profit") of the economy in question, a current account deficit does not mean a loss. The profit / loss is only obtained by adding to the current account balance the change in the total tangible assets of the economy as well as consumer purchases from third parties and material withdrawals for personal consumption.

Current account surplus does not mean "saving", current account deficit does not mean "investment"

Savings / period is the difference between profit (net wealth growth) / period and (self-consumption + consumer purchases) / period. A current account surplus (increase in financial assets) would only be equal to savings if, by chance, the increase in the value of the tangible assets of the economy were compensated for by withdrawals of the same amount for consumption. If there were no withdrawals in kind, the current account surplus would only correspond to savings if the economy's fixed assets remained unchanged. In the case of an increase in real assets, the savings would be greater than the current account surplus;

Similarly, a current account deficit would only be equal to the investment (increase in real assets) of an economy if its increase in real assets in a period exactly corresponded to its current account deficit (net financial asset decrease).

Ex post compensation

It was already mentioned above that the balance of payments as a whole is always balanced due to the double-entry bookkeeping. However, this is only partially correct: if the balance of payments is defined as an ex post- oriented listing of foreign trade transactions, it is balanced. A list of all processes for the selected period is taken into account “ex post”, i.e. retrospectively. The balance of payments can also be used to take an ex ante view of external transactions. This takes into account when a transaction leads and will lead to an effective demand for or supply of foreign currency units. An attempt is made to determine the expected foreign exchange requirements of an economy. However, both concepts post the same cash flows.

Numerical example

- Foreign trade balance :

For the year 2004 the Deutsche Bundesbank shows an export ( FOB ) of 731.5 billion euros and an import (cost, insurance, freight - CIF ) of 575.4 billion euros, so that a foreign trade balance of + 156.1 billion euros remains. - Services:

For the year 2004 the Deutsche Bundesbank shows income from the sale of services to foreign countries in the amount of 116.4 billion euros and expenditures for the purchase of services from abroad of 147.3 billion euros, so that a Service balance of EUR −31.0 billion arises. So more goods were sold from home to abroad, i.e. bought from there, and the opposite was true for services.

Income from work and property: In 2004, income from abroad flowed into Germany in the amount of 106.9 billion euros and in the opposite direction 106.8 billion euros, so that on balance +0.1 billion euros as income from abroad flowed in.- Balance of current transfers: On

balance, 28.4 billion euros flowed out of such transfers, so the balance sheet balance of current transfers is −28.4 billion euros.

Current account: This gives a current account balance of +84.6 billion euros for the current account as the sum of the balances listed so far.- Asset transfers and purchase / sale of intangible non-produced assets:

On balance, +0.4 billion euros flowed in from abroad. -

Financial account

- Balance of direct investment :

On balance (direct investment from Germany to abroad minus direct investment from abroad in Germany), direct investments abroad totaled 22.2 billion euros, so that this balance shows a minus: −22.2 billion euros. Euros, more was invested directly abroad than the other way around. - Balance of securities transactions and financial derivatives :

On balance, 16.6 billion euros more was sold to foreign countries than bought from abroad. So there was a net inflow of + 16.6 billion euros from abroad. - Balance of other capital movements:

On balance, a total of 107.0 billion euros flowed abroad, including a balance of 3.8 billion euros in the form of long-term loans from the monetary financial institutions and 85.3 billion euros in the form of short-term loans from the monetary financial institutions Billion euros. Since this money flowed abroad, for example as a loan to other countries, this balance is less than zero: −107.0 billion euros.

- For the capital account as a whole , this results in a balance of EUR −112.6 billion. At this level, capital flowed abroad on balance, the capital export amounted to 112.6 billion euros on balance.

- Balance of direct investment :

- Change in currency reserves to transaction values:

The reserves have increased by 1.5 billion euros, which is included in the balance of payments with a balance of −1.5 billion euros. A cash outflow of 1.5 billion euros was used to buy foreign currency reserves. - Balance of the statistically non-breakable transactions:

This correction figure is given by the Deutsche Bundesbank for 2004 as +26.2 billion euros.

All these balances add up to a balance of payments of EUR 0.0 billion. The partial balances of the balance of payments add up to zero; this is the case with every balance of payments.

Balancing the partial balances

Due to the principle of double-entry bookkeeping, individual transactions must be balanced. However, it can also be shown in macroeconomic terms why the partial balances have to be balanced. The following approach is not entirely correct in terms of accounting (in the logic of the balance of payments) (since every service transaction entails a financial transaction), but it shows the macroeconomic relationships of the partial balance sheets.

The current account mainly reflects imports and exports of goods and services. With a balanced current account, just as much is imported as exported. The proceeds from the export finance the imports. The same applies to the financial account. If the current account does not have a balance of zero, but z. B. a deficit, more is imported than exported. That means that more has to be paid abroad than is paid from abroad to the home country. This additional capital required to “settle the bills” can only come from abroad. The private economic subjects in Germany will have to take out loans abroad in the amount of the current account deficit, or have already taken out these in order to be able to meet their liabilities. These credits appear in the capital account in the broader sense (i.e. plus the foreign exchange account) as a mirror image of the current account and the balance of payments as a whole is balanced.

The same applies in the event of a current account surplus. As a prerequisite, foreign countries must take out domestic loans in order to be able to pay for the goods. Domestic demands on foreign countries in the capital account are thus growing. A net export of goods and services inevitably goes hand in hand with a net capital export, if one disregards transfers etc.

Of course, this presentation only refers to accounting aspects. A causal relationship between capital and trade balance sheet cannot be established in terms of balance sheet technology. Rather, the economic context must be sought.

Balance of payments settlement mechanisms

In contrast to the adjustment of the partial balances, which only brings about an accounting balance adjustment, balance of payments adjustment mechanisms can under certain circumstances lead to an actual reduction of balance of payments surpluses or deficits and thus to the restoration of the balance of payments adjustment. In the case of flexible exchange rates , this is the exchange rate mechanism . In the case of fixed exchange rates , this is the money supply price mechanism (see also money supply effect ).

Macroeconomic Implications

If investments are particularly productive (or rewarding) in a country, current account deficits over a certain period of time are the logical consequence. If, on the other hand, the consumers of a country have a low current preference , then current account surpluses are the logical consequence over a certain period of time. Neither is a cause for concern as long as current account imbalances do not become chronic.

However, a current account deficit can also be a leading indicator of a debt crisis. A balance of payments deficit means foreign debt. When current account deficits persist over a long period of time, a high level of external debt accumulates. This is only sustainable if it is based on profitable investments, but not in the case of unhealthy debt that primarily serves to satisfy consumption or is based on a bubble economy driven by speculative bubbles . Chronic current account deficits can trigger a severe economic crisis via the money supply price mechanism .

Good or bad company location

The fact that the foreign trade balance is largely offset by the capital account is the background to the question of whether Germany is a good or a bad business location. The former emphasizes the export surplus of goods and services, the latter the capital export surplus. Since both balances have to take place at the same time (apart from the other usually smaller balances), this is a kind of chicken and egg problem from a balance sheet point of view .

In the economic context, however, this causality can be seen as resolved long ago. As Böhm-Bawerk already recognized, "the capital account rules the current account": The overall economic demand is aggregated from consumer demand and investment demand , whereby the investment demand can vary greatly, while the consumer demand is relatively stable. Investment demand is based on investment decisions, which in turn depend on the attractiveness of the location. The financial account balance therefore reflects the sum of the investment decisions. Hence, both gross and net investments are a function of the financial account. With a given savings rate, a negative capital account is inevitably reflected in a low investment rate , with the corresponding implications for economic development. Finally, it becomes understandable why countries with high positive net exports may stagnate, while economies with negative current accounts may prosper. A general statement as to whether or not export surpluses are good for an economy is therefore not possible.

Partial balance imbalances

Few countries have a steady current and capital account in balance. However, it is difficult to judge whether an imbalance has positive or negative consequences for a country in the short or long term using the balance of payments. Macroeconomic factors and the overall economic situation of a country play a major role here, so that current account imbalances can only be assessed with the help of further information.

Structural view of the balance of payments

Four basic types of countries can be identified from the previous considerations on current account imbalances.

An emerging debtor country has a negative current account balance and a positive financial account balance. It imports goods and services and - to pay for them - also capital. At this point in time, debts are built up in order to be able to import - but no debt servicing has yet been performed (hence: becoming debtor country). If these capital imports are only of a short-term nature, the country finds itself in a debt servicing problem because it does not receive enough foreign currency (due to its relatively low exports) to pay interest and repay the loans. However, if the capital imports are of a long-term nature and if the imports do not consist of consumer goods but of capital goods, there is (again, ceteris paribus) the prospect of being able to service the debt through future increases in production and exports. In this case the country would be a pure / mature debtor country. The current account deficits have been reduced and the first surpluses are appearing. As soon as the country can pay not only the interest but also the repayment of the existing liabilities, it has developed into a mature debtor country, as no new debts have to be built up to finance the (previously negative) external contribution and liabilities are also reduced .

An emerging creditor country has a current account surplus. These surpluses from the current account immediately flow back abroad as capital exports. This country builds up foreign assets if long-term capital exports are involved. Only if the developing debtor country is able to invest this productively (and not just consumed) does the pure / mature creditor country have a chance of receiving capital returns through interest income (repayments). In this situation, the creditor country accepts current account deficits, as these have already been financed in the past. Here the idea of intertemporal consumption becomes clear again.

Since this classification is based purely on observations from the balance of payments of the respective countries, no statement can be made about the overall economy. Although the types described above can also be found in real terms in all countries, other factors determine whether this state of the balance of payments has positive or negative effects on the individual country. The differentiation between short-term and long-term capital imports or exports can still be read directly from the capital account, but the balance of payments alone does not provide any information on the question of whether a country imports consumer goods or capital goods. Further macroeconomic indicators must be used here.

The role of the central bank

The previous considerations have implicitly assumed the free movement of capital. There was no central bank as an intervening institution. To finance a current account deficit - if the income from exports is not sufficient to pay for imports (with foreign currency) - it was previously assumed that a loan was taken out abroad (capital import). The deficit can then be financed with these foreign currencies; this transaction appears in the capital account as an offsetting entry (see above) to the performance transaction (e.g. import of goods). The current account deficits are completely financed by (private) loans from abroad. As mentioned above, this has an impact on the exchange rate between the currencies of the countries concerned.

In the event of a current account surplus and the resulting capital account deficit, i.e. capital export, there is appreciation pressure on the domestic currency. Conversely, a current account deficit results in a capital account surplus, i.e. a capital import that leads to devaluation pressure compared to the currency of the trading partner. One of the tasks of the central banks can also be to offset these exchange rate changes - induced by world trade (current account imbalances) - or at least to keep their effects on the domestic economy as low as possible.

The central bank can also balance the capital account. As mentioned above, the foreign exchange balance, which exclusively describes the change in the currency reserves of the central bank, is sometimes even counted as part of the capital account. In this way - purely arithmetically - a current account imbalance could also be offset via the foreign exchange balance.

Every central bank holds (more or less) large amounts of foreign currency. A demand for foreign exchange can therefore also be satisfied by the central bank, as long as there are enough foreign exchange reserves. The central bank sells the foreign currency to residents so that they can meet their obligations to foreign countries - so there is no need to borrow abroad in order to receive enough foreign currency. In extreme cases, the entire current account deficit is financed by the central bank. The central bank reserves then decline in the amount of the current account deficit. This can be done analogously with a current account surplus. Here the central bank buys the existing surplus and the central bank's currency reserves increase.

These considerations are especially important in a system of fixed exchange rates. From World War II to 1973, the major industrialized countries had a system of fixed exchange rates based on the Bretton Woods Agreement . Even today, many smaller countries in particular have agreed fixed exchange rates with each other or have pegged their currencies to a key currency (such as $ or €), which ultimately means a fixed exchange rate to this currency. Often these are not exactly fixed rates, but flexible exchange rates up to an upper and lower limit ("dirty floating") at which the central bank then has to intervene in order to keep the exchange rate within these limits. As soon as the exchange rate of the home currency z. B. If current account imbalances threaten to move outside the specified range, the central bank intervenes.

However, the central bank can only intervene as long as it also has currency reserves in order to keep the market price within the defined limits through additional supply or additional demand.

If the current account of a country is in a one-sided imbalance in the long term, sooner or later the central bank has to give in to market pressure and appreciate or depreciate the domestic currency with the associated negative consequences that should be avoided. When upgrading z. For example, domestic goods are becoming more expensive on the world market and therefore more difficult to sell, while imports are also becoming cheaper. This could result in job losses. In the event of a devaluation, foreign products become more expensive and there is a risk of “imported” inflation. At the same time, however, their own exports become cheaper.

So far, only the “reaction” of the central bank to the macroeconomic situation has been described, the central bank can also actively influence the current account through the mechanisms described above. If the central bank changes the exchange rate, it can affect future imports / exports and thus avoid an imbalance in the current account. With a devaluation, there is (ceteris paribus) an improvement in the current account, since export goods are in greater demand abroad due to the “cheaper”. Conversely, the same applies to an upgrade.

Which effects are to be expected and how strong depends to a large extent on the macroeconomic picture of a country and is very difficult to predict. Whether the central bank intervenes or not was, at least officially, left to its autonomous decision in Germany - influenced by the overall economic development. The same applies to the European central bank now responsible. In a system of flexible exchange rates, a number of factors determine whether or not the central bank intervenes.

The role of the IMF

In order to enable the central bank of a country to intervene in the long term to compensate for economic fluctuations, the International Monetary Fund (IMF) was founded by Bretton Woods with the introduction of the fixed exchange rate system . The main task was and is to help countries with balance of payments problems financially. All member countries had to pay into the fund and, in the event of persistent imbalances within the balance of payments, could be granted loans in order to be able to intervene in the foreign exchange market over the longer term. However, since it was noticed after a short time that there could be not only economic but also structural problems, the IMF loans are also used for government investments to solve these structural problems (the main task of the IMF today). The IMF loans are linked to (now partially questionable) conditions on the economic policy of the receiving country. With these conditions and the loans granted, balance of payments problems of individual countries are to be resolved and thus a balanced growth of world trade can be achieved.

literature

- Fritz W. Meyer : The equalization of the balance of payments (= problems of theoretical economics , volume 5). Fischer, Jena 1938.

Web links

- Structure of the balance of payments (graphic) ( Memento from November 16, 2012 in the Internet Archive ) (PDF file; 12 kB) on R. Moser's website.

- Deutsche Bundesbank: Balance of payments of the Federal Republic of Germany (2007-2010; status: March 2011) ( Memento from March 17, 2012 in the Internet Archive ) (PDF file; 69 kB)

- Deutsche Bundesbank: Balance of payments of the Federal Republic of Germany 2013 (.pdf file).

- Oesterreichische Nationalbank: Balance of payments of Austria ( Memento from August 6, 2013 in the Internet Archive )

- Swiss National Bank: Swiss Balance of Payments ( Memento of 7 December 2012 in the Internet Archive ) see also: Swiss Balance of Payments

- Thomas Schlup: Balance of Payments. In: Historical Lexicon of Switzerland .

Individual evidence

- ↑ Wolfgang Stützel: Paradoxes of the money and competitive economy. Aalen: Scientia 1979, pp. 60-63

- ^ Deutsche Bundesbank: Publications on the balance of payments ( direct link )

- ↑ Wolfgang Stützel: Paradoxes of the money and competitive economy. Aalen: Scientia 1979, pp. 63-64

- ↑ Wolfgang Stützel: Paradoxes of the money and competitive economy. Aalen: Scientia 1979, pp. 64-65

- ^ Springer Gabler Verlag, Gabler Wirtschaftslexikon, balance of payments adjustment

- ^ Warner Max Corden, Economic Policy, Exchange Rates, and the International System , Oxford University Press, 1994, ISBN 9780198774099 , p. 97