Stock-flow consistent model

Stock Flow Consistent Models (SFC), even accounting models , in German about continued existence and river size consistent modeling , is used as a collective term for different dynamic economic models that the dynamics of the inventory and flow variables in the balance sheets of the economic sectors of a national economy describe. They are assigned to the accounting or balance sheet approach .

history

The initial ideas for the accounting approach go back to Knut Wicksell (1898) and John Maynard Keynes (1936). and Michał Kalecki (1899–1970). The theoretical framework is based on the work of Morris Copeland from 1949. He developed tables for the US economy, which map the cash flows of income, saving, lending and investing together with the changes in stocks of debt, credit and financial assets. To date, these flows of funds are published by the Federal Reserve System . The Social Accounting Matrix (SAM) contains as a table the economic transactions between the economic sectors and the national accounts .

From the 1960s onwards, James Tobin and his colleagues used concepts such as the Social Accounting Matrix to build time-discrete models that included the portfolio management of various investments with different interest rates as well as real economic variables. Tobin's Nobel Prize lecture is considered a “manifest” for SFC modelers. Even Robert Clower explained his Keynesian -inspired price and cyclical theories on stock-flow considerations.

SFC models were further developed by authors from the post-Keynesian tradition. In addition to Tobin's approaches, different monetary theories such as loanable funds , modern monetary theory or endogenous money creation can be mapped. Some of these theories stand in contrast to the classic dichotomy of the division of an economy into the real and the monetary sector, the neutrality of money and the general equilibrium theory and the models based on it. Instead, they want to model the dynamics of cash flows and sectoral financial balances. In Germany, Wolfgang Stützel presented a similar approach in 1958 as “ balance mechanics ”. Far- reaching consequences were derived from some models of the monetary circuit theory , such as the thesis of monetary growth pressure , which could, however, be explained by an inconsistent accounting. By considering the constraints of the accounting identities such "black holes" are ( english holes black to avoid it), where money disappears or arises without offsetting entry from scratch.

The models achieved increasing popularity at the beginning of the 21st century and especially after the beginning of the global financial crisis , as some authors had foreseen the critical developments with accounting models. Wynne Godley , one of the pioneers of the SFC approach since the 1970s, had warned in publications since 2000 that the US home market would weaken and cause a recession . In the DSGE models , which dominate macroeconomics , no crises can arise because of behavioral assumptions such as rational expectations and intertemporal optimization. They treat inventory and flow variables in a consistent manner, but mostly only model individual inventory variables such as real capital while monetary variables such as credit relationships and debts are neglected. Therefore, attempts are made to analyze financial crises with stock flow consistent models based on the accounting approach.

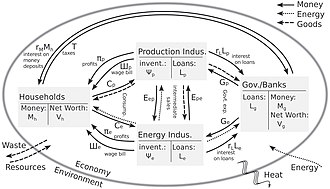

SFC models are also used in ecological macroeconomics , in which, in addition to money flows, resource or energy flows and stocks or an ecosystem with renewable raw materials are mapped. While the ecological aspects were not considered by the post-Keynesian authors like Lavoie, SFC models are now common within ecological macroeconomics. References are made in particular to the Flow Fund models by Nicholas Georgescu-Roegen . There are also approaches to integrate the properties of SFC models in agent-based modeling (ABM) or to combine them with input-output analyzes .

concept

The basis of an SFC model is the preparation of balance sheets for various economic sectors such as banks, companies, private households and the state . The various stock sizes in the balance sheets are linked via accounting identities because, for example, the balance of households with the bank is always a liability of the bank. The flow quantities are also linked to one another via identities, because the income of one is always the expenditure of the other. This results in the Social Accounting Matrix or Transaction Matrix . The monetary cycle in an economy can only be described consistently (stock-flow consistency) if the stock and flow variables meet the identities.

There are basically three important types of equations for economic models that also occur in SFC models. Definition equations such as the national accounts equations , certain model-dependent identity equations and behavioral equations . In a stock flow consistent model there are always (1) equations that establish a relationship between stock and flow variables, (2) equations that establish relationships between flow variables, and (3) behavioral equations. For example, consumption functions or certain price adjustment processes are used as behavioral functions . Rational expectations are not assumed here, but rather limited rationality is assumed. Thanks to the definitions and identities, a behavioral equation cannot be given for every variable, because otherwise the system would be overdetermined . Alternatively, additional adaptation variables have to be introduced to make the system solvable. Unlike many other economic models, no general equilibrium is usually assumed; instead, the models describe transient adaptation processes.

Most SFC models are formulated in discrete time, but can also be formulated in continuous time as differential equations or differential-algebraic equations .

Example of a simple model

Wynne Godley and Marc Lavoie describe a simple SFC model in their textbook. It consists of three sectors: households , government and corporations . In the balance sheet ( T account ) the budget is as stock size and asset , financial assets ( for English High Powered Money , central bank money ). On the liabilities side is the equity , which offsets the balance sheet. In this very simple model, the companies have neither real capital nor other assets - the sector thus serves as a pure flow item for flow variables : The income of the companies from consumption by households ( English consumption ) and state consumption ( English government expenditures ) corresponds precisely to the turnover that is distributed in full as wages ( English wages , including company wages ). From wages a proportion than is controlling ( English taxes paid). In the state's balance sheet, the amount of money emitted is found as debt on the liabilities side - equity is negative and has therefore slipped onto the assets side so that the balance sheet is balanced.

The first two equations establish the relationships between stock and flow quantities. The population size of the budget changes by two flow sizes, they increased by disposable income ( english disposable income ) and decreases by consumer spending . The amount of money emitted changes due to the flow variables of tax revenue and government consumption . This ensures two identities, whereby the time describes, and accordingly the previous period, the difference of which must be the sum of the incoming and outgoing flows:

Since, by definition, the companies do not have any inventory variables, the incoming and outgoing payments have to balance each other out, which results in a third identity that only contains flow variables:

The fourth identity is that the household's disposable income is just equal to wages minus taxes :

The behavioral equation of the state in the model is that it imposes a fixed tax rate on wages:

The household's equation of behavior is that it spends a share of disposable income and another share of previous period's financial assets :

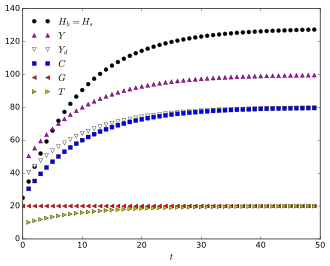

In order for it to make economic sense, the household's financial assets should correspond precisely to the amount of money emitted in the model . Since (or if) the stock and flow variables were modeled consistently, the following applies: As long as this is fulfilled as an initial condition, this identity is always fulfilled. In this way, the consistency of modeling and programming can be checked. The equations fully describe the development of the model over time, which can now be simulated numerically (see graphic on the right).

More complex models

The example model contains only a very small number of variables. Stock-flow-consistent models used in research are much more complicated, include a larger number of inventory levels in balance sheets, cash flows, capital and investments, and have dynamically changing prices. Nevertheless, the structure of these models always consists of various identities and behavioral equations that together describe the time development of the model.

Simple models can be solved analytically and examined using concepts from the theory of dynamic systems such as bifurcation analysis. More complex models have to be simulated numerically .

literature

- Wynne Godley , Marc Lavoie : Monetary Economics. An Integrated Approach to Credit, Money, Income, Production and Wealth. Palgrave Macmillan, New York 2012, ISBN 978-0-230-30184-9 (main textbook, first edition 2007).

- Dimitri B. Papadimitriou, Gennaro Zezza: Contributions in Stock-flow Modeling: Essays in Honor of Wynne Godley. Palgrave Macmillan, London 2012, ISBN 978-1-349-33340-0 , doi : 10.1057 / 9780230367357 .

- Eugenio Caverzasi, Antoine Godin: Post-Keynesian stock-flow-consistent modeling: a survey . In: Cambridge Journal of Economics . tape 39 , no. 1 , January 2015, p. 157-187 , doi : 10.1093 / cje / beu021 . Pre-printed as Working Paper 745 of the Levy Economics Institute of Bard College, 2013.

- Michalis Nikiforos, Gennaro Zezza: Stock-Flow Consistent Macroeconomics Models: A Survey . In: Journal of Economic Surveys , Volume 31, Number 5, December 2017, pp. 1204–1239, doi : 10.1111 / joes.12221 . Pre-printed as Working Paper 891 of the Levy Economics Institute of Bard College, May 2017.

- Emilio Carnevali, Matteo Deleidi, Riccardo Pariboni, Marco Veronese Passarella: Stock-Flow Consistent Dynamic Models: Features, Limitations and Developments . In: Philip Arestis, Malcolm Sawyer (Ed.): Frontiers of Heterodox Macroeconomics , Palgrave Macmillan, Cham 2019, pp. 223-276. doi : 10.1007 / 978-3-030-23929-9_6 .

- Oliver Richters, Erhard Glötzl: Modeling economic forces, power relations, and stock-flow consistency: a general constrained dynamics approach . In: Journal of Post Keynesian Economics . 2020, doi : 10.1080 / 01603477.2020.1713008 . Pre-printed as Uni Oldenburg Discussion Paper, 2018, hdl : 10419/178651 .

Web links

- Publications on Stock-flow consistent (SFC) modeling , Levy Economics Institute of Bard College

- sfc-models.net by Gennaro Zezza

Individual evidence

- ↑ a b c d Michalis Nikiforos, Gennaro Zezza: Stock-Flow Consistent Macroeconomics Models: A Survey . In: Journal of Economic Surveys , Volume 31, Number 5, December 2017, pp. 1204–1239, doi : 10.1111 / joes.12221 .

- ↑ a b c d Dirk J. Bezemer: Understanding financial crisis through accounting models . In: Accounting, Organizations and Society . tape 35 , no. 7 , 2010, p. 676-688 , doi : 10.1016 / j.aos.2010.07.002 .

- ↑ Ferdinand Wenzlaff, Christian Kimmich, Oliver Richters: Theoretical approaches to a forced growth in the money economy . In: ZÖSS Discussion Papers . No. 45 . Center for Economic and Sociological Studies, Hamburg 2014, p. 27 ( hdl : 10419/103454 ).

- ↑ a b c Dirk Ehnts : The balance sheet approach to macroeconomics . In: Samuel Decker, Wolfram Elsner, Svenja Flechtner (Eds.): Principles and Pluralist Appraoches in Teaching Economics . Routledge, London / New York 2019, pp. 243-255, doi: 10.4324 / 9781315177731-16 .

- ^ Neil T. Skaggs: HD Macleod and the origins of the theory of finance in economic development. In: History of Political Economy , Volume 35, Number 3, 2003, pp. 361-384, especially p. 377, doi : 10.1215 / 00182702-35-3-361 .

- ↑ Stephen Kinsella: Words to the wise: Stock flow consistent modeling of financial instability , UCD Geary Institute Discussion Paper Series, WP2011 / 30, November 2011. doi : 10.2139 / ssrn.1955613 .

- ↑ Knut Wicksell : Interest and Prices . Augustus M. Kelley Publishers, New York 1936/1898.

- ^ John Maynard Keynes : The General Theory of Employment, Interest and Money . Palgrave Macmillan, London 1936.

- ↑ a b c d Emilio Carnevali, Matteo Deleidi, Riccardo Pariboni, Marco Veronese Passarella: Stock-Flow Consistent Dynamic Models: Features, Limitations and Developments . In: Philip Arestis, Malcolm Sawyer (Ed.): Frontiers of Heterodox Macroeconomics , Palgrave Macmillan, Cham 2019, pp. 223-276. doi : 10.1007 / 978-3-030-23929-9_6 .

- ^ Morris A. Copeland: Social accounting for moneyflows . In: The Accounting Review . tape 24 , no. 3 , 1949, pp. 254-264 , JSTOR : 240684 .

- ↑ a b c d e f g h i j k Eugenio Caverzasi, Antoine Godin: Post-Keynesian stock-flow-consistent modeling: a survey . In: Cambridge Journal of Economics . tape 39 , no. 1 , January 2015, p. 157-187 , doi : 10.1093 / cje / beu021 . Pre-printed as Working Paper 745, Levy Institute , 2013.

- ^ Jacob Cohen: Copeland's money flows after twenty-five years: a survey. In: Journal of Economic Literature , Volume 10, Number 1, 1972, pp. 1-25, JSTOR 2720888 .

- ^ Financial Accounts of the United States - Z.1 , and Financial Accounts Guide , Federal Reserve System, accessed January 8, 2019.

- ^ William C. Brainard, James Tobin: Pitfalls in financial model building . In: The American Economic Review . tape 58 , no. 2 , 1968, p. 99-122 .

- ↑ David Backus, William C. Brainard, Gary Smith, James Tobin: A model of US financial and non-financial economic behavior . In: Journal of Money, Credit and Banking , Volume 12, Number 2, 1980, pp. 259-293, doi : 10.2307 / 1992063 .

- ↑ James Tobin : Money and finance in the macro-economic process . In: Nobel Memorial Lecture . December 8, 1981 ( nobelprize.org [PDF]).

- ^ Robert W. Clower : Stock-flow analysis . In: David L. Sills, Robert K. Merton: International Encyclopedia of the Social Sciences , Volume 15, pp. 273-277, Macmillan and Free Press, New York 1968, OCLC 491474972 .

- ^ Robert W. Clower, DW Bushaw: Price Determination in a Stock-Flow Economy . In: Econometrica 22 (3), pp. 328-343, JSTOR 1907357 .

- ↑ Romain Plassard: The origins, development, and fate of Clower's "stock-flow" general-equilibrium programs . In: European Journal of the History of Economic Thought 25 (1), May 2018, pp. 1–32, doi : 10.1080 / 09672567.2018.1425468 .

- ↑ a b c Claudio H. Dos Santos, Gennaro Zezza: A simplified, 'benchmark', Stock-Flow Consistent Post-Keynesian growth model . In: Metroeconomica . tape 59 , no. 3 , 2008, p. 441-478 , doi : 10.1111 / j.1467-999X.2008.00316.x .

- ^ A b Wynne Godley , Francis Cripps : Macroeconomics . Oxford University Press, 1983.

- ^ A b c d Wynne Godley , Marc Lavoie : Monetary Economics . Palgrave Macmillan, New York 2012, ISBN 978-0-230-30184-9 .

- ↑ Wolfgang Stützel : Economic balance mechanics. Mohr, Tübingen 1958 (reprint of the 2nd edition, 2011, Mohr Siebeck), ISBN 978-3161509551 .

- ↑ a b Oliver Richters, Andreas Siemoneit: Consistency and Stability Analysis of Models of a Monetary Growth Imperative . In: Ecological Economics . tape 136 , June 2017, p. 114–125 , doi : 10.1016 / j.ecolecon.2017.01.017 . Preprint: VÖÖ Discussion Paper 1, February 2016, hdl : 10419/144750 .

- ↑ Gennaro Zezza: Godley and Graziani: stock-flow Consistent Monetary Circuits . In: Dimitri B. Papadimitriou, Gennaro Zezza (Ed.): Contributions in Stock-flow Modeling . Palgrave Macmillan, Basingstoke, S. 154-172 , doi : 10.1057 / 9780230367357_8 .

- ↑ a b c d Oliver Richters, Erhard Glötzl: Modeling economic forces, power relations, and stock-flow consistency: a general constrained dynamics approach . In: Journal of Post Keynesian Economics . 2020, doi : 10.1080 / 01603477.2020.1713008 . Pre-printed as Uni Oldenburg Discussion Paper, 2018, hdl : 10419/178651 .

- ^ Wynne Godley : Money, finance and national income determination: an integrated approach . In: Working Paper . No. 167 . The Levy Economics Institute of Bard College, June 1996, pp. 7 ( repec.org [PDF]).

- ↑ a b Michalis Nikiforos, Gennaro Zezza: Stock-flow Consistent Macroeconomic Models: A Survey . In: Working Paper . No. 891 . Levy Economics Institute of Bard College, May 2017 ( levyinstitute.org [PDF]).

- ↑ Dimitri B. Papadimitriou, Gennaro Zezza: Contributions in Stock-flow Modeling: Essays in Honor of Wynne Godley. Palgrave Macmillan, London 2012, ISBN 978-1-349-33340-0 , doi : 10.1057 / 9780230367357 .

- ↑ Wynne Godley , Randall Wray : Is goldilocks doomed? In: Journal of Economic Issues , Volume 34, Number 1, 2000, pp. 201-206, doi : 10.1080 / 00213624.2000.11506253 .

- ↑ Wynne Godley, Gennaro Zezza: Debt and lending: A Cri de Coeur. Levy Institute at Bard College Policy Notes 4, 2006.

- ↑ David Colander, Peter Howitt, Alan Kirman, Axel Leijonhufvud, Perry Mehrling: Beyond DSGE Models: Toward an Empirically Based Macroeconomics . In: The American Economic Review . tape 98 , no. 2 , 2008, p. 236-240 , doi : 10.2307 / 29730026 .

- ^ Edwin Le Heron: Confidence and financial crisis in a post-Keynesian stock flow consistent model. In: European Journal of Economics and Economic Policies: Intervention , Volume 8, Number 2, November 2011, pp. 361–387, doi : 10.4337 / ejeep . 02.09.2011 .

- ↑ Marco Passarella: A simplified stock-flow consistent dynamic model of the systemic financial fragility in the 'New Capitalism'. In: Journal of Economic Behavior & Organization , Volume 83, Number 3, August 2012, pp. 570-582, doi : 10.1016 / j.jebo.2012.05.011 .

- ↑ Eugenio Caverzasi, Antoine Godin: Financialisation and the sub-prime crisis: a stock-flow consistent model . In: European Journal of Economics and Economic Policies: Intervention , Volume 12, Number 1, 2015, pp. 73–92, doi : 10.4337 / ejeep.2015.01.07 .

- ↑ a b c d e Matthew Berg, Brian Hartley, Oliver Richters: A Stock-Flow Consistent Input-Output Model with Applications to Energy Price Shocks, Interest Rates, and Heat Emissions . In: New Journal of Physics . tape 17 , no. January 1 , 2015, 015011, doi : 10.1088 / 1367-2630 / 17/1/015011 .

- ^ A b Yannis Dafermos, Maria Nikolaidi, Giorgos Galanis: A stock-flow-fund ecological macroeconomic model . In: Ecological Economics . tape 131 , 2017, p. 191-207 , doi : 10.1016 / j.ecolecon.2016.08.013 .

- ^ Yannis Dafermos, Maria Nikolaidi, Giorgos Galanis: Climate change, financial stability and monetary policy . In: Ecological Economics . tape 152 , 2018, p. 219–234 , doi : 10.1016 / j.ecolecon.2018.05.011 .

- ↑ a b Jonathan Barth, Oliver Richters: Demand-driven ecological collapse: a stock-flow fund-service model of money, energy, and ecological scale . In: Samuel Decker, Wolfram Elsner, Svenja Flechtner (Eds.): Principles and Pluralist Appraoches in Teaching Economics . Routledge, London / New York 2019, pp. 169–190, doi: 10.4324 / 9781315177731-12 .

- ↑ Alessandro Caiani, Antoine Godin, Eugenio Caverzasi, Mauro Gallegati, Stephen Kinsella, Joseph E. Stiglitz : Agent Based-Stock Flow Consistent Macroeconomics: Towards a Benchmark Model . In: Journal of Economic Dynamics and Control . tape 69 , August 2016, p. 375-408 , doi : 10.1016 / j.jedc.2016.06.001 .

- ↑ Stephen Kinsella, Matthias Greiff, Edward J. Nell: Income distribution in a stock-flow consistent model with education and technological change. In: Eastern Economic Journal , Volume 37, Number 1, 2011, pp. 134–149, doi : 10.1057 / eej.2010.31 .

- ^ Jung Hoon Kim, Marc Lavoie : A two-sector model with target-return pricing in a stock-flow consistent framework . In: Economic Systems Research . tape 28 , no. 3 , 2016, p. 403-427 , doi : 10.1080 / 09535314.2016.1196166 .

- ^ Soon Ryoo: Long waves and short cycles in a model of endogenous financial fragility. In: Journal of Economic Behavior & Organization , Volume 74, Number 3, 2010, pp. 163-186, doi : 10.1016 / j.jebo.2010.03.015 .

- ^ A b Wynne Godley , Marc Lavoie : Monetary Economics . Palgrave Macmillan, New York 2012, ISBN 978-0-230-30184-9 . Chapter 3. The textbook does not contain this graphic representation of the balances and flow quantities.

- ^ Wynne Godley: Money and credit in a Keynesian model of income determination. In: Cambridge Journal of Economics , Volume 23, Number 4, 1999, doi : 10.1093 / cje / 23.4.393 pp. 393-411, quoted from p. 395: The “watertight accounting of the model implies that there will always be one equation which is logically implied by the others. "