Debt financing

In business administration, external financing refers to financing measures within the framework of corporate financing , in which a company is provided with additional external capital . The opposite is self-financing .

General

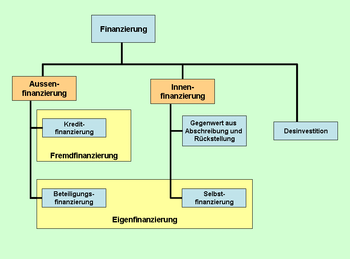

Internal and external financing represent the total financing of companies and other legal entities (such as local authorities ). They provide information about the origin of the funds that come from the shareholders or from their own company in the case of internal financing ( retained earnings and depreciation ) and, in the case of external financing, from creditors or from your own company (formation of provisions ). If the source of financing lies in your own company, it is called internal financing , otherwise it is external financing . The limit of external financing lies in the maintenance of liquidity , because debt servicing ( loan interest and repayment ) for the existing external financing as expenditure puts a strain on liquidity. The outside financing is booked in the balance sheet under outside capital.

species

In the context of internal financing, external financing can only be undertaken by setting up provisions. They are formed from profits that - in whole or in part - are allocated to provisions. Since provisions are part of debt, increasing them is a form of debt financing. The main source of external financing, however, is external financing, where the sources of financing are outside the company. Among the financing instruments here are all coming from creditors agents, especially include trade credit ( suppliers ), customer loans ( customers ), bank loans ( banks ) or public debt as tax liabilities ( Treasury ). According to the (remaining) term, a distinction is made between short-term (term <1 year), medium-term (1 to 5 years) and long-term (> 5 years) debt financing.

Demarcation

The distinction between external and internal financing is not always easy. If there is even the slightest possibility of repayment, then the corresponding balance sheet item belongs to external financing. Therefore, all types of provisions (including pension provisions ) form part of the debt, since there is at least a 50% repayment probability. A non-performance-related interest rate also speaks in favor of outside capital. Hybrid forms of equity are a hybrid between equity and debt and are therefore also called mezzanine capital .

Accounting

In accounting , the type of origin and maturity of the debt financing is required under accounting law. In accordance with Section 266 (3) of the German Commercial Code ( HGB) , external financing is to be posted on the liabilities side of the balance sheet, separated into provisions (Section 266 (3) B) and liabilities (C). There are also separate balance sheet items for prepaid expenses (item D) and deferred taxes (item E). In accordance with Section 268 (5) of the German Commercial Code (HGB), debt financing with a remaining term of <1 year and> 1 year must be stated in the balance sheet ; in accordance with Section 285 No. 1 of the German Commercial Code, information on remaining terms of> 5 years as well as the scope, type and form of the collateral provided are to be given in the notes close. The medium-term debt financing results from the subtraction of the short-term and long-term liabilities.

Key figures

External financing is the subject of a large number of key business figures in the context of balance sheet analysis . These include vertical school thinking figures as debt ratio , or leverage ratio and horizontal indicators such as the degree of liquidity . One of the most important is the debt capital ratio, which provides information about the proportion of debt financing in total financing (= total assets ):

A high proportion of external financing increases the earnings risks because of the high debt servicing, because more profits are used for interest expenses and thus the break-even point rises with increasing debt ( cost leverage ). As a result, a high debt capital ratio brings employment risks with it. In addition, a high debt capital ratio contributes to an increase in future liquidity and refinancing risks and vice versa. If the debt ratio is low, the creditors' risk of default falls because their claims are increasingly covered by company assets. The level of the debt capital ratio is heavily dependent on the industry . While credit institutions have the highest debt capital ratio with around 85%, it accounts for 72.1% in the construction industry , 62.1% in retail , 60.5% in wholesale , 52.3% in the food and textile industry , 49.4% in the paper industry , 45 in the chemical industry , 7%, manufacturing 44.3%, optical industry 40.8% or automotive industry 38.9% of total assets (2008).

Individual evidence

- ↑ Dietrich Härle, Financing Rules and Their Problems , in: Series for Credit Management and Financing, Volume 4, 1961, p. 34

- ↑ Andreas Hoerning, Hybrid Capital in the Annual Financial Statements , 2011, p. 26 ff.

- ↑ Werner Pepels, Expert-Praxislexikon business indicators , 2008, p. 61

- ^ Deutsche Bundesbank, Ratios from the annual financial statements of German companies from 2007 to 2008 , March 2011, p. 32 ff.