Economic crisis of 1837

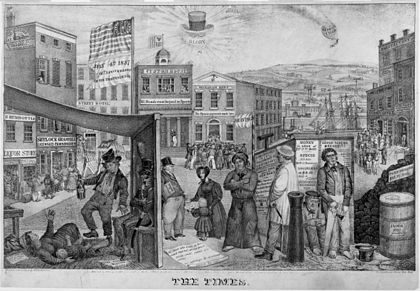

The economic crisis of 1837 was one of the largest economic crises in United States history . It was caused by a speculative bubble ; this burst on May 10, 1837 in New York , as each bank the convertibility of paper money in gold and silver was established. The crisis was followed by five years of economic depression, the permanent insolvency of many banks and high unemployment rates .

causes

The crisis was preceded by an economic boom based on Indian resettlement . The areas that had to be evacuated by the Indians under the Indian Removal Act of 1830 were sold to settlers by the US government (from March 4, 1829 to March 4, 1837 under Andrew Jackson ) . Large surpluses were achieved here; the federal budget in 1835, 1836 and 1837 showed a surplus.

Individual states of the Union reacted to this development with an expansive spending policy. They invested heavily in infrastructure measures such as traffic routes and assumed that these investments would be worthwhile through increasing property taxes. At the same time, there was a wave of bank foundations. These were often provided with capital by US states (especially in the southern states ). Both were financed through a massive increase in national debt through the issue of government bonds.

Between 1834 and 1836 the sale of public land increased fivefold. A large number of speculators bought large areas on credit. The banks financed this through mortgages and issued paper money in return .

The crisis

In 1837 the speculative bubble burst and the United States' biggest economic crisis to date (which had only been founded in 1776) began. One of the triggers of the crisis was the economic policy of US President Andrew Jackson . He mistrusted the uncovered paper money and therefore regulated in the " Specie Circular " (currency circular ) that purchases from Indian land were only permitted in gold and silver and not in banknotes. The withdrawal of state funds from the Second Bank of the United States also contributed to the uncertainty. Martin Van Buren , whom Jackson had chosen as his successor and who won the elections of 1836 , was therefore held responsible for the crisis. His refusal to take government action to save the economy also contributed to increasing the damage and duration of the crisis, according to critics.

The drop in property prices was probably more decisive. The expansion of the available space in the Indian regions led to a strong expansion of the supply; the bursting of the bubble resulted in a reduction in demand. As a result, land prices collapsed, the prices of agricultural products fell, mortgages could no longer be serviced and property tax revenues collapsed.

When the bubble burst, so did capital imports , particularly from the UK .

consequences

Within two months, the losses were due to bank failures in New York alone nearly 100 million US dollars .

"Out of eight hundred and fifty banks, three hundred and forty-three closed entirely, sixty-two failed partially, and the system of State banks received a shock from which it never fully recovered."

"Of 850 banks in the US, 343 closed their doors forever, 62 partially failed, and the state banking system received a shock from which it never fully recovered."

The inconvertibility phase

In contrast to the railroad crises of the 19th century, the crisis of 1837 quickly turned into a financial crisis . In order to avoid bank runs , the American banks were forced to suspend their obligation to exchange the issued banknotes for gold or silver. From May 10, 1837 to March 17, 1842, banknotes could not be exchanged for legal tender .

As a result, many banks collapsed. This led to a massive reduction in lending and an exacerbation of the crisis. The crisis was not over until 1843.

The sovereign debt crisis

As a result of the crisis, there was a sovereign debt crisis. The states complained about massive income losses due to the collapse of property tax revenues and lost the equivalent of the bank holdings.

In 1840 the national debt of the federal states had therefore increased massively in some cases. The front runner was the state of Florida , whose debt ratio was 77 percent. Florida and Mississippi suspended debt servicing altogether, while other states such as Arkansas , Louisiana, and Michigan partially. Almost half of the states failed to meet their contractual obligations. The prices of the government bonds they issued fell significantly.

The discussion about saving the states

After the crisis of 1837, an almost debt-free federal government faced a significant number of over-indebted member states. In 1841, the US had only about $ 5 million in debt, but the states over $ 200 million. On December 29, 1842, it was decided to found a special committee of the House of Representatives to discuss solutions to the crisis. On March 2, 1843, the committee recommended that the state debt be assumed by the federal government . There was no majority for this in either of the two major parties or in parliament.

Pressure from European creditor banks could not change this decision either. As early as 1840, Barings had asked the US government to assume liability for state debts. The major European banks followed suit in 1841. Rothschild , Gurney and Hope refused to take part in the marketing of the federal government bonds if the debt was not taken over.

When the federal government failed to assume debt, debt rescheduling agreements were made in the respective states and the (reduced) payments resumed, for example in 1845 in Pennsylvania , 1846 in Illinois , 1847 in Indiana and 1848 in Maryland .

See also

swell

- Carl-Ludwig Holtfrerich : Crisis! What crisis? ; in FAZ of June 17, 2011, page 9

literature

- Jessica M. Lepler: The Many Panics of 1837: People, Politics, and the Creation of a Transatlantic Financial Crisis. Cambridge University, New York 2013, ISBN 978-0-521-11653-4 .

- Alasdair Roberts: America's First Great Depression: Economic Crisis and Political Disorder after the Panic of 1837. Cornell University Press, Ithaca 2012, ISBN 978-0-8014-5033-4 .

- James Roger Sharp: Jacksonians Versus the Banks: Politics in the States After the Panic of 1837. Columbia University Press, New York 1970, ISBN 978-0-231-03260-5 .

- Reginald Charles McGrane: Panic of 1837. University of Chicago Press, Chicago 1966, ISBN 978-0-226-55858-5 .

Web links

- The economic crisis of 1837 (English)

Footnotes

- ^ The financial panic of 1837 ( English ) Publicbookshelf.com. Retrieved July 13, 2010.