Hope & Co.

Hope & Co. was an Amsterdam trading company that developed into a premier financial institution during the 18th century.

history

In 1664 Archibald Hope (1664-1743) was baptized in the Scottish Church in Rotterdam . His father lost his luck in business and the family had to move to London, where they became increasingly impoverished. Archibald had more success in another attempt as a merchant in Rotterdam, and soon he owned four barges. The connection to the British Isles remained: in 1720 he owned three malt houses there, and contacts with an influential family of the same name in Scotland were maintained. Archibald Hope had two daughters, his six sons - Archibald jr. (1698–1734), Isaac, Zachary, Henry, Thomas (1704–1779), and Adrian (1709–1781) - also became merchants. They engaged in maritime transportation, storage, insurance, and credit business in Amsterdam and Rotterdam. Archibald Jr. followed in his father's footsteps in trade and maritime transport. together with Thomas, who was able to acquire a great reputation as a businessman. After Archibald Jr.'s early death, a brother took over his role and the company was named Thomas & Adrian Hope. Thomas saw a better future in Amsterdam for the company, which was growing slowly but surely, despite crises such as the one triggered by the stock market fraud in London in 1720 - known as the " South Sea Bubble ". Henry had started his own business during this time and moved to Boston - later a valuable contact. With Archibald sr. Isaac and Zachary had already worked together, and they inherited the Rotterdam house, which had specialized in crossings for emigrants to North America. Through their mediation, around 3,000 people from the Palatinate traveled to America via Rotterdam in 1753 . During the Seven Years' War (1756–1763) the Hope brothers were able to increase their sales significantly.

The company name was changed to Hope & Co. in 1762, when their Thomas' son Jan (John) (1737–1784) and the American nephew Henry Hope (around 1735–1811) - he may be regarded as the actual successor - joined. That year, the offices in Amsterdam were expanded to accommodate Henry and Jan at 448 Keizersgracht . Thomas lived in the neighboring buildings, 444–446. Zachary's son Archibald (1747-1821) became a member of the Dutch Parliament , a member of the Board of Directors of the West India Company (WIC), and owned the former Lange Voorhout Castle in The Hague . Towards the end of the century, the Englishman John Williams and the Dutchman Pierre César Labouchère also joined the company with 26 people.

In 1796, Labouchères was known as the "Hopesche Hochzeit" (Hopesche Hochzeit) and was married to the third daughter of Sir Francis Baring , Dorothy, as a putty between the companies Baring and Hope. The resulting connection to the British Foreign Minister, the Marquis of Wellesley , was used by the French Fouché and Ouvrard in 1810 in an attempt to negotiate peace with Napoleon . Although this mission failed, Ouvrard, Labouchère and his brother-in-law Alexander Baring were all the more successful in 1817 when the aim was to enable France to pay off its war debts by issuing a government bond.

Significant archive

The Hope Archive (1725–1940) is an important source for the history of Amsterdam and the Netherlands as the center of world trade in the 18th century. In 1977 the archive was transferred to the Amsterdam City Archives, where it is now accessible to the public. The archive of Hope & Co. is combined with the archive of the Dutch East India Company (VOC), since in 1752 one of the founding Hope brothers, Thomas Hope (1704–1779), became a member of the “17 delegates”, in Dutch “ Heeren XVII “, the board of directors of the VOC. Four years later he became chairman of the board of directors of the VOC and in 1766 spokesman for William V of Orange , the official head of the VOC. In 1770 Thomas retired and handed over his responsibilities to his son John (1737–1784), who stayed with VOC and Hope & Co. until his death.

Pierre Labouchère played an important role in negotiations with France, with whom he handled most of Holland's financial affairs. Adrian was a member of the Dutch Parliament and the Amsterdam City Council. Unlike today, the partners of Hope & Co. mixed their private business with the public business and those of the bank. Letters in the archive concern many matters at once. The earliest letters date from the 1720s and were addressed to Thomas and Adrian Hope. A particularly large part of the archive is made up of the correspondence from the period between 1795 and 1815, when Henry Hope was forced to leave the Netherlands and set up offices in London. The regular correspondence between the Amsterdam and London branches gives important insights into business negotiations of that time and their conduct.

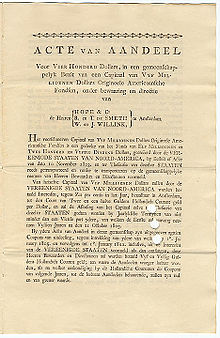

The day-to-day business of Hope & Co. in those days was in the hands of Thomas' American nephew Henry Hope (around 1735–1811), who did business with a wide variety of countries, including Sweden, Poland, Russia, Portugal, Spain, France and the United States. The almost princely framework of the company was made clear by its summer residence - the Welobile country house in Haarlem - with fifteen windows in width. Thanks to negotiations by Henry Hope and Francis Baring , Hope & Co. was able to issue shares to finance the Louisiana Purchase in 1804 .

Handling of profit sharing

Although they were primarily interested in commercial transactions from the start of their activities, the Hope brothers extended their interest to longer-term investments such as land ownership and works of art. During the 18th century Hope & Co. arranged a profit-sharing scheme for their partners to reduce the risk of all-encompassing bankruptcy due to a member's negligence, as had happened in 1772 at the rival bank Clifford & Sons. In order to be able to participate in the profit-sharing system, the company member had to learn the special method of bookkeeping by Hope & Co., developed by Adrian Hope, who had helped file the Clifford bankruptcy. The art ownership (and the rest of the capital investments) were evenly distributed in accordance with the personal capital investment. When it became clear that no sons of his own would continue the banking business after Henry Hope's death, he finally separated his share from the rest. Henry Hope died childless in 1811, his share divided between his sister's family and his American cousins. Soon Alexander Baring took over the business shares of the Hope descendants and had the situation outlined in a circular on January 1, 1815 for the re-establishment:

“We have the honor to inform you that with the death of Messrs. Henri and John Hope, bosses of our house, and as a result of the decision of all members of this respected family to leave the commercial career, the liquidation of the old business is an agreement with this family, Mr. Peter Cesar Labouchere, is the only one left. As a result, after he withdrew from our establishment three years ago, he became the immediate owner of it. The fortunate circumstances which brought about the liberation of Holland , and the prospect of more favorable times for the action, have determined us to renounce the decision to completely liquidate the house. The long-standing friendship between our Mr. Labouchere and Mr. Hieronimus Sillem , who has recently been the head of the old and respected house of Matthiessen & Sillem in Hamburg, has moved him to combine his interests with ours. We therefore have the pleasure to inform you that from today onwards, under his direction and those of Messrs A. van der Hoop and PF Lestapis, who have been running our business for more than three years, we are aiming to restore our old connections with our friends to tie in with all activity that the circumstances will allow. "

The actually less good relationship with "this family" made it necessary to relocate the offices to Doelenstraat, the narrower framework of the business also corresponded to Amsterdam's situation of having lost the top position as a European financial center to London. Hope's previous role in the credit sector passed to Rothschild after 1815 .

Art collection

Due to the profit-sharing system, the one art collection was jointly owned by several people. John Hope's son Thomas Hope (1769–1831) had helped to build up this joint collection and inherited a large part of it because of the property rights established by his father and grandfather. Adriaan van der Hoop (1778-1854), who worked with the company through the French occupation, inherited his Amsterdam share of the investments when Henry Hope died, together with the Amsterdam partner Alexander Baring , who then preferred land to art and to America moved. When Adriaan van der Hoop died, he owned 5 million guilders. His art collection went to the city of Amsterdam, which created a museum to house his collection after his death. Among the 250 works in this collection from the 18th and 19th centuries were The Jew's Bride by Rembrandt , Letter Reader in Blue by Jan Vermeer , Moederzorg by Pieter de Hooch and De molen bij Wijk bij Duurstede by Jacob van Ruisdael .

The last few years

In the 19th century Hope & Co. specialized in capital investments in the railroad sector in the United States and Russia. In the 20th century the emphasis shifted from international transport to Dutch investments.

In 1962 Hope & Co. merged with Mees & Zn. To form the Mees & Hope bank, which was bought by ABN Bank in 1975 . After the merger of ABN Bank and Amro Bank to ABN AMRO Bank, Bank Mees & Hope merged with Pierson, Heldering & Pierson (then fully owned by Amro Bank) in November 1992 to become MeesPierson and were subsequently sold to Fortis .

literature

- Marten Gerbertus Buist: At spes non fracta. Hope & Co. 1770-1815. Merchant Bankers and Diplomats at Work. Martinus Nijhoff, The Hague 1974, ISBN 90-247-1629-2 .

Individual evidence

- ↑ Marten G. Buist: At Spes non fracta. Hope & Co. 1770-1815. Den Haag 1974, p. 5. Buist preceded his 1974 work with the statement that up to that year no genealogist had provided irrefutable proof of the connection between the two families. (ibid .: p. 3)

- ^ Ernst Baasch: Dutch Economic History , Verlag von Gustav Fischer, Jena 1927, p. 167

- ↑ Otto Wolff : The business of Mr. Ouvrard. From the life of a brilliant speculator , Rütten & Loening, Frankfurt am Main 1932, p. 154

- ↑ Otto Wolff: The business of Mr. Ouvrard. From the life of a brilliant speculator , Rütten & Loening, Frankfurt am Main 1932, p. 190

- ↑ Otto Wolff: The business of Mr. Ouvrard. From the life of a brilliant speculator , Rütten & Loening, Frankfurt am Main 1932, p. 121

- ↑ Amsterdamer Stadtarchiv ( Memento of the original from October 1, 2011 in the web archive archive.today ) Info: The archive link has been inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Quoted from Marten G. Buist: At spes non fracta. Hope & Co. 1770-1815. The Hague 1974, p. 67

- ↑ Marten G. Buist: At Spes non fracta. Hope & Co. 1770-1815. The Hague 1974, p. 68