monetarism

The term monetarism (from Latin moneta , coin, mint) stands for an economic theoretical and economic policy concept that was developed in the 1960s and 1970s primarily by Milton Friedman as an alternative to the demand-oriented Keynesianism . In doing so, he takes up theories of a supply-oriented economic policy as well as the quantity theory of money that had already been devised in the 1930s .

Monetarists see the regulation of the amount of money as the most important variable for controlling the economic process: " Money matters " - "It depends on the amount of money". They tie in with the long-term view of the neoclassical idea of a fundamentally stable economic process. Excessive expansion of the money supply leads to inflation , and too strong a slowdown in money supply growth leads to deflation . Short-term interventions by the state to control the economy selectively are rejected. Monetarism assumes a relatively stable demand for money.

history

Monetarism has its origins primarily in the quantity theory of Irving Fisher . Fisher saw a close connection between the monetary and real areas of an economy . Friedman's early work in the field of consumption theory eventually led to a fundamental critique of the Keynesian consumption function . Friedman criticized an allegedly unjustified fixation on current income as a central factor in consumer spending and put forward the thesis that consumption depends on expected lifetime income.

In the late 1940s, a confrontation with Keynesianism also gave rise to a monetary counter-position to Keynes, which led to the rehabilitation of quantity theory. In the 1950s, Friedman used empirical measurements to study the demand and supply of money in American history and found that the crisis of the 1930s was caused by tightening monetary policy. The monetarist position has been gaining influence especially since the early 1970s, when the oil price shocks resulted in unemployment and inflation at the same time. In addition to Milton Friedman as their most famous representative, the most important monetarists include Karl Brunner , Allan H. Meltzer, Phillip Cagan and Bennett T. McCallum.

In 1974 the Deutsche Bundesbank became the first central bank in the world to switch to monetary control. This turnaround in monetary policy was of outstanding importance for the economic history of the Federal Republic of Germany . The concept of the Deutsche Bundesbank for securing the internal value of the currency was a medium-term oriented money supply control with the aim of controlling the price increase by controlling the money supply. This should be done indirectly by influencing money market conditions. The idea behind this control concept is to enable such financing processes from the monetary side that lead to growth in production potential in the medium term . The money made available to the economy through the central bank and the large commercial banks with investment loans is intended to increase production potential and economic growth. The money supply is supposed to grow just as fast as the production potential, since lower growth can lead to weak economic growth. The Bundesbank used the production potential, the price level and the speed of circulation of money as orientation points for a monetary policy in line with stability . The optimal monetary growth rate should be determined from these basic elements of monetary policy . To do this, the Bundesbank used the quantity theory of money.

Development and characteristics

The position of monetarism developed out of a controversy with Keynesianism . The range of controversial questions ranges from the definition of the concept of money and the explanation of money creation to the determinants of monetary value and the processes of monetary effects as well as in monetary policy from effective strategies to the efficiency of various instruments.

If the term monetarism is interpreted narrowly, it is simply a new name for quantity theory . Thomas Meyer tried, however, as early as 1975 to summarize the claims of the monetarists in a clear manner.

Following the quantity theory of money, nominal income is mainly determined by monetary factors. Changes in the money supply as the dominant determinant of income development are an elementary component of monetarism.

The quantity equation is:

( Money supply M velocity of money V = price level P national income Y )

The theory says that changes in the velocity v are so small that they can be neglected, so that v represents a constant quantity. How often a quantity of money x is used for transactions within a time period y depends on the demand for money. A component of monetarism is the rule of constant growth of the money supply, i. H. if the demand for money is really constant, adjusted for trends, then a constant growth rate of the money supply would also lead to a constant growth rate of incomes.

From a monetarist point of view, the transmission focuses on two interest elasticities, the interest elasticity of money demand and the interest elasticity of aggregate demand. The first elasticity is explained in the context of the liquidity preference theory of money demand, the second by the relative cost of borrowing, i.e. H. the cost of borrowing in relation to the total investment cost.

According to the monetarist point of view, economic agents increase their expenditure when the real money supply increases and the fictitious interest rate for keeping the cash is reduced as a result. The interest on money demand (cash holding) falls, while the income from other investments remains constant.

In fact, the term "interest" is viewed as problematic because interest is a variety of long and short term rates. There is no relevant method of summarizing these interest rates into a single figure. The second difficulty is that not all the interest rates that are supposed to go into the interest rate can also be observed in the market. For example, the expected real interest rate, which cannot be observed on the market, is important for economic decisions. This is why the monetarists are of the opinion that the money supply is a much better measure in practice than the interest. Many monetarists assume that the nominal interest rate will only decrease very gradually as the money supply increases. It soon climbs back to its previous level and even surpasses it due to the Fisher effect .

The monetarists therefore see the expected real interest rate as fairly stable. Thus, one of the factors that can cause fluctuations in the demand for money, changes in the expected real interest rate, appears to be far less important to the monetarists than to the Keynesians. Another reason why monetarists consider the demand for money to be stable is the fact that they consider the propensity to spend and thus the expected real interest rate and demand for money to be more stable.

The monetarist thesis is that the dynamics of the private sector are basically stable and are due to stable money demand and an unstable money supply . Because of their belief in the stability of the private sector and the lack of need for state intervention, there is little reason for the monetarists to focus on the development of the various sectors. That is why the monetarists assume a well-functioning capital market. This leads to a distinction between the relative prices, which are influenced by the respective situation in the various areas, and the general price level, which is influenced by the money supply.

A central thesis of the monetarists is based on the aggregated method of price level observation. They attribute the changes in total demand to changes in prices and outputs. With this approach, the pricing of a single industry has no influence on the general price level, but only affects the relative prices. The complex reality is represented with the help of a greatly simplified system, also called "small structural model".

According to the monetarists' concept of monetary policy, the direction and strength of monetary policy is described by a variable that can be precisely controlled by the central bank. In addition, there should be a high correlation with the intermediate target variable (e.g. money supply). However, the money supply would be the best indicator for this, as it can be predicted based on changes in income.

Another component of monetarism is constant money supply growth, which is closely related to quantity theory, and the assumption that money demand is constant. That, in turn, would mean that a constant rate of growth in the supply of money would also lead to a constant rate of growth in income.

Another hallmark of monetarism is the aversion to government intervention. According to the monetarist view, fiscal policy is also not assumed to be very effective. Financing through taxes leads to a large displacement of private investments , which in extreme cases can be complete. When spending is financed through the creation of money, there is in truth no fiscal policy , but in truth a monetary policy that has the effects already mentioned above. In addition, so-called time lags exist in both fiscal and monetary policy measures.

Consequences for economic policy

The monetarist idea that the Phillips curve is based on real values and that there is therefore only a very limited interdependence between inflation and underemployment has an impact on economic policy . The argument is based on the three monetarist ideas already discussed: quantity theory, the stability of the private sector and the constant money supply growth rate, i.e. H. an increase in the money supply does not affect real income , but only prices, because it only changes the level of wages. Friedman argues that the negatively sloping Phillips curve is merely due to some kind of monetary illusion; This means that employees align their offers and wage demands with the expected price level. Since this is only relevant in the short term, there is no permanent trade-off between inflation and unemployment and the long-term Phillips curve is vertical.

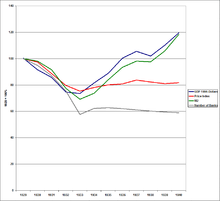

In A Monetary History of the United States, 1867-1960 , Friedman and Schwartz identified four episodes in which monetary shocks caused by a wrong monetary policy by the FED had negative consequences for gross domestic product and employment:

- the Fed's high interest rate policy from January to June 1920

- the Fed's high interest rate policy of October 1931

- the Fed's high interest rate policy from June 1936 to January 1937

- the contraction of the money supply ( deflation ) from 1929 to 1931, which the Fed accepted without doing anything.

reception

The monetarism founded by Milton Friedman puts monetary policy at the center. It is about the difference between money and credit , and above all about what is seen as the price of money. The Keynesian approach regards interest as the price of money, whereas the quantitative theory approach regards interest as the price of credit and the reversal of the price level as the price of money.

On the contrary, the Keynesians claim that economic agents hold more than their optimal money supply and therefore buy securities to offset marginal returns.

Another difference between the Keynesian and the monetarist transmission process is due to the different ways in which assets are viewed. The monetarists define an increase in the supply of money as a relative increase in the cash holdings of economic agents compared to the holdings of securities and all forms of real capital . In order to bring the marginal returns back into balance, the economic agents use the superfluous stock of money to acquire additional securities, capital and consumer goods.

The Keynesians, on the other hand, assume that an increase in the supply of money usually only affects investment and not consumption . They assume that the private sector is subject to unpredictable fluctuations, mainly due to longer-term expectations of companies.

Another point of contention in the debate between monetarists and Keynesians is the consideration of the price level.

literature

- Karl Brunner : The "Monetarist Revolution" in Monetary Theory. In: World Economic Archive . Vol. 105, No. 1, 1970, pp. 1-30, doi : 10.1007 / BF02708671 .

- Werner Ehrlicher , Wolf-Dieter Becker (Hrsg.): The monetarism controversy. An interim balance sheet (= supplements to credit and capital . H. 4). Duncker & Humblot, Berlin 1978, ISBN 3-428-04126-7 .

- Milton Friedman , Anna Jacobson Schwartz : A Monetary History of the United States 1867-1960 (= Studies in Business Cycles. 12, ZDB -ID 1187256-1 ). Princeton University Press, Princeton NJ 1963.

- James K. Galbraith : The Failure of Monetarism. From Milton Friedman's theories to the world financial crisis. In: Sheets for German and international politics . 9, 2008, pp. 69-80.

- Hauke Janssen: Milton Friedman and the “monetarist revolution” in Germany (= contributions to the history of the German-speaking economy. Vol. 29). Metropolis-Verlag, Marburg 2006, ISBN 3-89518-561-2 .

- Peter Kalmbach (ed.): The new monetarism. Twelve essays (= Nymphenburg Texts on Science. Model University. 12). Nymphenburger Verlags-Handlung, Munich 1973, ISBN 3-485-03212-3 .

- Bennett T. McCallum : Monetarism. In: The Concise Encyclopedia of Economics. 2008.

- Paul Samuelson : Reflections on the Merits and Demerits of Monetarism. In: James J. Diamond, Paul A. Samuelson, Tilford C. Gaines, Lawrence R. Klein , Arthur M. Okun , Robert Eisner (Eds.): Issues in Fiscal and Monetary Policy. DePaul University, Chicago IL 1971, pp. 7-21.

- Herbert Stein : Presidential Economics. The Making of Economic Policy from Roosevelt to Reagan and beyond ( AEI Studies. 473). 2nd revised edition. American Enterprise Institute for Public Policy Research, Washington DC 1988, ISBN 0-8447-3656-2 , pp. 294-306.

Individual evidence

- ↑ Phillip Cagan: Monetarism. In: Steven N. Durlauf, Lawrence E. Blume (Eds.): The New Palgrave Dictionary of Economics. Volume 5: Lardner - network goods (theory). 2nd edition. Palgrave Macmillan, Basingstoke et al. 2008, ISBN 978-0-230-22641-8 .

- ^ Milton Friedman, Anna Jacobson Schwartz: A Monetary History of the United States. 1963.

- ↑ Represent u. a. by James Duesenberry , Franco Modigliani , Paul Samuelson and James Tobin .

- ↑ The expression was published by Karl Brunner ( The Role of Money and Monetary Policy. In: Federal Reserve Bank of St. Louis. Review. Vol. 50, July 1968, ISSN 0014-9187 , pp. 8-24, ( digitized version (PDF ; 1.48 MB) )) introduced and by David I. Fand ( Monetarism and Fiscalism. In: Banca Nazionale del Lavoro. Quarterly Review. Vol. 23, No. 94, September 1970, ISSN 0005-4607 , pp. 276– 307, ( Digitalisat (PDF; 1.65) ); A monetarist model of the money effect process. In: Kredit und Kapital. Vol. 3, No. 4, 1970, pp. 361-385).

- ↑ Thomas Meyer: The structure of monetarism. In: Ehrlicher, Becker: The monetarism controversy. 1978, pp. 9-55.

- ↑ Thomas Meyer: The structure of monetarism. In: Ehrlicher, Becker: The monetarism controversy. 1978, pp. 9-55, here pp. 9-14.

- ↑ Thomas Meyer: The structure of monetarism. In: Ehrlicher, Becker: The monetarism controversy. 1978, pp. 9-55, here pp. 15-22.

- ↑ Horst Hanusch, Thomas Kuhn, Uwe Cantner : Economics. Volume 1: Basic Micro and Macroeconomics. 6th, improved edition. Springer, Berlin et al. 2002, ISBN 3-540-43288-4 .

- ↑ Milton Friedman: A Theoretical Framework for Monetary Analysis (= National Bureau of Economic Research. Occasional Paper. 112). Columbia University Press, New York NY et al. 1971, ISBN 0-87014-233-X .

- ↑ Thomas Meyer: The structure of monetarism. In: Ehrlicher, Becker: The monetarism controversy. 1978, pp. 9-55, here pp. 22-26.

- ^ Richard T. Selden: The Postwar Rise in the Velocity of Money. A sectorial analysis. In: Journal of Finance . Vol. 16, No. 4, 1961, pp. 483-545, doi : 10.1111 / j.1540-6261.1961.tb04235.x .

- ↑ Thomas Meyer: The structure of monetarism. In: Ehrlicher, Becker: The monetarism controversy. 1978, pp. 9-55, here pp. 35-40.

- ↑ P. Kalmbach: The new monetarism. 1973.

- ↑ The Phillips Curve. In: Bernhard Felderer , Stefan Homburg : Macroeconomics and new macroeconomics. 8th, revised edition. Springer, Berlin a. a. 2003, ISBN 3-540-43943-9 , pp. 244-245.

- ↑ Christina D. Romer , David H. Romer: Does Monetary Policy Matter? A New Test in the Spirit of Friedman and Schwartz. In: NBER Macroeconomics Annual. Vol. 4, 1989, pp. 121-170, doi : 10.2307 / 3584969 .