Market dynamics

In economics, market dynamics are understood to mean the changes in the market due to market entries and exits, as well as the reaction of economic agents to the profits / rents, which are decisive for the formation of market prices .

The term has gained increasing importance since the 1980s, as political framework conditions and technological innovations influence the demand behavior of the actors and the reaction speed of companies in ever shorter cycles.

Historical development of the term

Basically, the interplay between supply and demand with the " invisible hand " according to Adam Smith (1723–1790) is explained. The resulting market prices should always lead to a market equilibrium . In his work " The Wealth of Nations ", Smith also describes the market as self-regulating. However, he realized that an equilibrium is temporary and that this process is subject to constant change.

Schumpeter described in his well-known work " Theory of Economic Development " that the market process is in a firmly established cycle. Changes to this equilibrium are only possible through exogenous influences, so endogenous mechanisms would have no effects. Schumpeter later revised his statements and in 1942 described the process of creative destruction , which is considered to be the essential core of capitalism . It also describes a strong upswing when a large number of imitators enter the market, which after a while clearly weakens again.

In historical retrospect, Schumpeter is seen as a pioneer in the theoretical explanation of economic developments. Some economists, u. a. Baumol , Stewart (1971) with their corporate behavior view, or Nelson (1991), who looked at the effects of decisions over time, based Schumpeter's theory. In addition, this was expanded with additional indicators such as market performance, intensity of competition or degree of innovation.

Economic theory of market dynamics

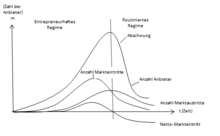

The graphic shows a model to explain the dynamics prevailing in the market in the form of industrial cycles. When a market is at the beginning of its development, a large number of market entries take place, in the so-called introduction and growth phase. The number of net market entries is positive in this case. In this phase, only limited specific knowledge about the new product is known, which is why competition is initially mainly based on the quality of the products. Due to the fact that a large number of providers, especially small businesses, have entered, this phase is called the “Entrepreneurial Technological Regime” or the “Schumpeter Mark I Regime”.

In the second phase, the products are adapted. The quality is now at an approximately balanced level, which consequently means that competition now takes place on the basis of price. As the graphic shows, the market development is now in the "routine regime" or "Schumpeter Mark II regime". There is a significant downturn, which means that a large number of providers are leaving the market. The established, small number of existing companies, with their economies of scale, ensure that market entry is hardly possible. The number of net entries is now negative.

Market example

The current automotive industry is an example of a routine regime. The barriers to market entry are high here. The reason for this is a very capital- and research-intensive production, which makes it difficult to enter the market. By connecting smaller, specialized companies with the large corporations, the chances for a new company to prevail against the established ones are very slim. However, innovation in a new transportation technology / facility is possible.

An entrepreneurial regime a. internet economics since the 1990s. This shows that the usual barriers to market entry have been greatly weakened. Institutional restrictions such as customs duties, standards, etc. can be bypassed on the Internet. Market participant-related obstacles such as cost advantages, capital requirements, etc. are also reduced. Newcomers can gain quick access to the market at low costs and leave the market quickly. Conventional, capital-intensive investments are no longer necessary.

Relevance of the current market changes for companies

The theory and the examples have illustrated the process of market change by the participating economic agents. The decisive factor is the trend that has developed around the time factor. It turns out that the time span from the sustained boom to the downturn continues to decrease. From the point of view of the company, the reaction time to changes in the market has therefore decreased significantly over time.

It is therefore important for the corporations to develop a strategy with which they can react quickly to new innovations and trends without being forced out of the market.

See also

- Economic development theory

- Competition (economy)

- Kondratiev cycle

- Product life cycle

- Time competition

literature

- Marietta Babos: Evolutionary Consideration of Market Dynamics: Markets and Companies in the Evolution Test. 2013, ISBN 978-3-658-10360-6 , pp. 15-24.

- K. Bleicher: On the temporal in corporate cultures. In: The company. Vol. 40, No. 4, 1986, pp. 259-288.

- Michael Fritsch: Entrepreneurship - theory, empiricism, politics. 2015, ISBN 978-3-662-45393-3 , pp. 30-32.

Individual evidence

- ↑ H.-G. Baum, AG Coenenberg, T. Günther: Strategic Controlling. 4th edition. Schäffer-Poeschel, Stuttgart 2007, p. 138.

- ↑ K. Bleicher: On the temporal in corporate cultures. In: The company. 40th volume, No. 4, 1986, pp. 259ff.

- ^ KE Boulding: What is evolutionary economics? In: Journal of Evolutionary Economics. Volume 1, No. 1 1991, p. 12.

- ↑ Jerry Ellig, Daniel Lin: A Taxonomy of Dynamic Competition Theories in Dynamic Competition and Public Policy: Technology, Innovation, and Antitrust. 2001, p. 22.

- ↑ Anke Mönning: The automotive industry - good growth prospects despite future challenges. In: GWS Topic Report. No. 2, 2011, p. 12.

- ↑ Wolfgang Fritz: Market Entry Strategies in the Internet Economy. (= Working paper. No. 99/21). Technical University of Braunschweig, Institute for Marketing, 1999, pp. 15–17.