Vertical integration

Under vertical integration is understood in the economics a form of corporate concentration at which the production depth is increased by a plurality of businesses with sequential processing or levels of trade unite. Vertical integration is therefore also referred to as vertical corporate concentration. The counterpart is horizontal integration .

General

In general, it is a form of organization with the aim of optimizing a company's value and supply chains .

A fashion company , for example, is not alien to produce leaves and not only goods through third parties in the retail sale, but the products themselves manufactures and own stores offering is referred to as vertically integrated.

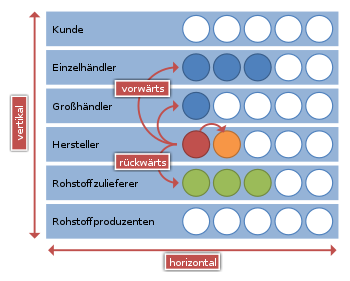

Depending on whether, from the perspective of the acquiring company, the expansion to a preliminary stage or a subsequent stage takes place, one speaks of forward or backward integration.

term

In concrete terms, vertical integration means that a company internalizes upstream or downstream production stages ( processing or trading stages ) in a production process .

The concept of vertical integration is closely related to the classical economic question of house production or external reference ( English Make or Buy? ) Together. The transaction cost economics , largely developed by Oliver Williamson , further develops the make-or-buy decision and examines it in connection with management and control structures in companies, which are ultimately reflected in the make-or-buy decision.

The planning of vertical integration and the vertical integration of a company depends on whether it is more economical to provide a service themselves or buy from third parties. The purpose of vertical integration is therefore to improve internal business processes in the short term and thereby secure the company's existence and long-term success in the long term.

Degree of vertical integration

definition

The vertical integration of a company can use the depth of production are measured as a degree of vertical integration:

The value added is measured here from the difference between the turnover of a company and its externally procured services, i.e. the main components are profit, gross wages and ancillary wage costs.

context

Basically, the less the company procures externally, the higher the degree of vertical integration, i.e. the degree of integration tends towards one (high degree of vertical integration).

Conversely, this means that the lower the vertical range of manufacture, i.e. the higher the proportion of purchased components and services, the degree of integration tends towards zero because this reduces the added value (lower degree of vertical integration).

Vertical integration strategies

The vertical integration of a company can be divided into the following two strategies according to the direction of integration:

Backward integration ( backward integration )

Backward integration means that a company takes over one or more upstream production stage (s) itself. Backward integration relates to the company's input situation. This means that the company itself produces or extracts the goods it has purchased so far, which are then further processed by the company.

Forward integration ( forward integration )

Forward integration means that a company takes over one or more subsequent production stage (s) itself. This means, for example, that a previous goods producer now sells his goods himself. The prerequisite for forward integration is that the end user is not yet reached with the company's production stage, but that there are further production process stages in between, which the company can integrate. Forward integration relates to the downstream production and trading levels.

to form

In practice, the vertical integration of a company can be divided into four forms, but these flow into one another.

| 1 <─────────────────── degree of integration ───────────────────> 0 |

|---|

| 1. Full integration ──── 2. Partial integration ──── 3. Quasi-integration ──── 4. Contracts |

1. Full integration

A production process is said to be fully integrated when a large part of the production process takes place internally. That means the degree of integration is higher than 0.85.

2. Partial integration

A production process is referred to as partially integrated when a partial purchase takes place. The degree of vertical integration is then between average values up to 0.85.

3. Quasi-integration

A production process is called quasi-integrated when, although a large number of additional purchases are made and the added value is consequently very low, the company has sufficiently high market power vis-à-vis the suppliers so that they are "quasi" integrated.

4. Contracts

The form of vertical integration is called “contracts” if the degree of integration is as low as 0, because many components are obtained from outside. The situation with regard to the company's own added value is therefore very similar to that of quasi-integration, but here there is no market power over the suppliers.

Historical context

As early as the 19th century, companies tried to achieve economies of scale in this way . Until the middle of the 20th century, the focus was more on the seamless and reliable supply of vital inputs . At the end of the 20th century, competition in the individual economic sectors increased sharply. This led to numerous company reorganizations, which manifested themselves in vertical disintegration .

rating

Even if the advantages and disadvantages of vertical integration have to be weighed up on a sector-specific and company-specific basis, the following selection of typical and frequently occurring advantages and disadvantages can be formulated:

Advantages of vertical integration

- Time and cost advantages for the company compared to competitors, that is, the company saves transport time and costs through vertical integration, for example, which can increase the company's competitiveness

- Pre-products can be better coordinated with end products

- Access to goods with key functions is better guaranteed because the company is less dependent on its suppliers or customers, and their bargaining power is also minimized

- Securing differentiation objectives (e.g. capacity utilization, prevention of downtimes, quality controls and quick product modifications)

- Opportunity to expand to more profitable levels of the value chain

- the company's know-how can develop further and synergy effects arise within the production process stages

- Better access to market information and new product developments can be kept secret more easily

- The PIMS study showed empirically that there is a positive correlation between vertical integration and return on investment or cash flow , but this only applies in stable and mature markets (if this is not the case, a negative correlation was found )

Disadvantages of vertical integration

- Destruction of the cost advantages that arise from division of labor and specialization

- internal control and coordination costs due to lack of experience

- increasing organizational and bureaucracy costs due to growing company size

- It is often necessary to compensate for the loss of autonomy of the integrated companies in order to avoid management problems

- Changed competitive situation for the company (former suppliers or customers become competitors)

Dependence on the question of integration

A company can have the competencies and the potential to take a higher level in the value chain. Furthermore, a company will integrate vertically if the following applies for the same manufacturing / sales costs:

Internal control and coordination costs (KKK) <External KKK

Further determinants for the use of vertical integration are:

- Number of suppliers

- Dependency between supplier and buyer

- Relationship between supplier and customer

- Size, network and experience advantages

See also

- In-house production or external procurement

- lateral integration

- Transaction costs

- Transaction cost theory

literature

- Dietrich Adam: Production Management. 8th edition. Gabler-Verlag, Wiesbaden 1997, ISBN 3-409-69116-2 .

- Katrin Alisch: Gabler's economic dictionary part: SZ. 16th edition. Gabler-Verlag, Wiesbaden 2004.

- Thomas Gerhardt: Theory and Reality of Economic Organization. 1st edition. Deutscher Universitäts-Verlag and Gabler Verlag, Wiesbaden 1995, ISBN 3-8244-6183-8 .

- Hans-Jörg Hoitsch: Production Management . 2nd Edition. Vahlen, Munich 1993, ISBN 3-8006-1619-X .

- Martin K. Perry: Handbook of Industrial Organization. 7th edition. North Holland, Amsterdam a. a. 2003, ISBN 0-444-70434-5 .

- John R. Schermerhorn: Management. 9th edition. John Wiley & Sons, USA 2008, ISBN 978-0-470-07835-8 .

Individual evidence

- ^ Karlheinz Küting , Vertical Entrepreneurial Mergers , in: Wolfgang Lück (Ed.), Lexikon der Betriebswirtschaft, 1983, p. 1175

- ↑ Ronald H. Coase: The Nature of the Firm . In: Economica . tape 4 , 1937, pp. 386-405 , doi : 10.1111 / j.1468-0335.1937.tb00002.x .

- ↑ Oliver E. Williamson: Markets and Hirarchies - Analysis and Antitrust Implications . Free Press, New York 1975, ISBN 0-02-934780-7 .

- ↑ Oliver E. Williamson: Transaction cost economics: how it works; where it is headed . In: Economist . tape 146 , 1998, pp. 28-58 .

- ^ Dietrich Adam: Production Management . 8th edition, Gabler, Wiesbaden 1997, p. 91

- ^ Dietrich Adam: Production Management . 8th edition. Gabler, Wiesbaden 1997, p. 92

- ^ A b Hans-Jörg Hoitsch: Production Management . 2nd Edition. Vahlen, Munich 1993, p. 145

- ^ Dietrich Adam: Production Management . 8th edition. Gabler, Wiesbaden 1997, pp. 92-93

- ↑ 12manage.com