Return on investment

The term return on investment (short ROI , and return on assets , return on assets , return on capital , investment profitability , return on investment , return on assets ) is an economic indicator for measuring the return on a business activity, as measured by income divided by employed capital . Due to the different ways in which successes are calculated, there are numerous variants for calculating the ROI. The ROI therefore also includes return ratios as return on equity (return on equity, ROE short) or the return on assets (return on assets, short ROA). The ROI is usually the top key figure in key figure systems, since companies or their investors often strive to maximize their return on investment. By splitting the ROI into various components, starting points for increasing returns can be identified.

Calculations

The ROI can be broadly defined as

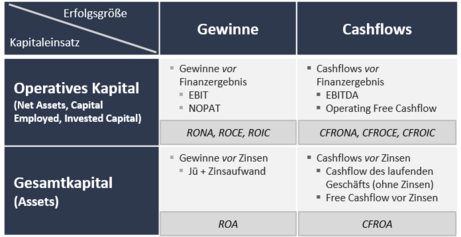

The requirement for the consistency of key figures requires that the numerator and denominator be in an objectively meaningful relationship. This is guaranteed if the capital employed is used when considering a performance variable. In addition, the generated return (ROI) is regularly compared with the required return of the investor ( cost of capital ). A consistent comparison of the return on capital and the cost of capital should be based on a uniform delimitation of the considered capital input and a uniform consideration of taxes.

Due to the different depiction of corporate success, there are numerous variants for calculating the ROI. In Germany, returns on capital are usually calculated on the basis of calculated or reported profits (balance of income and expenses). In international corporations, cash flows (balance of incoming and outgoing payments) are often used to measure success . Profits are regularly distorted by the latitude in accounting (e.g. when calculating depreciation, measuring provisions, etc.). For a better definition, the return on investment calculated in this way is also referred to as cash flow return on investments ( CFROI ). The calculation of CFROI is particularly important for capital-intensive companies, where the depreciation shown does not realistically reflect the depreciation of the assets.

Particular attention is often paid to the analysis of the operational profitability of a company. The denominator of the ROI is used to analyze performance indicators before interest payments (more precisely before financial results). Operating profits (such as EBIT or NOPAT ) or operating cash flows (such as EBITDA ) are not influenced by success in the financial business (reflected in financial assets and investments), by the framework conditions on the capital market (reflected in net interest income ) or the specific tax situation of the company. As a result, operating returns on capital are very well suited for time comparisons on an international level. Operating returns on capital are also better suited for assessing the performance of management, as many earnings components are hidden that management has little influence on ( interest income , investment income , taxes).

ROI as return on assets

Traditionally, the ROI is calculated based on the total capital shown on the balance sheet. The total capital is divided between the owner and the lender, which means that the success factor must be represented by success before interest in the denominator of the ROI . Performance figures before interest payments describe an increase in assets for all investors in a period. The ROI in the form of the return on investment is calculated accordingly

example

Apple Inc. had total capital of $ 338.5 billion at the end of 2019. Net income including interest paid in 2019 was USD 58.8 billion. This results in a total return on investment of 58.8 / 338.5 = 17.9%.

Appreciation

The total return on investment can be calculated quickly and easily from a company's (published) business figures. However, the meaningfulness of the return on investment is limited in many cases:

- Non-operational components: Both the successes and the capital figures contain non-operational components. Assets that are not required for business operations are assets that can be sold at any time without impairing the company's performance. These are usually non-operational financial assets (short-term, long-term), non-operational cash and, if applicable, non-operational real estate. Accordingly, the return on total capital is a mixed return on business and non-business assets. However, the management of a company has little influence on the successes from non-operational assets; they are primarily driven by developments in the financial or real estate markets. As a result, the return on investment is less suitable for assessing management performance over a period. Comparing the ROI of different companies is also skewed by the non-operational components.

- Use of capital at book values: The balance sheet values (book values) of the assets hardly correspond to the assets actually tied up by the investors. Accounting was developed for companies of the industrial age. However, many companies (especially from the service sector) also have significant assets in the form of brand names, human capital, software they have created, licenses, customer loyalty, etc. These intangible assets are often not recorded in the balance sheets due to their lack of tangibility. In addition, in accordance with the principle of prudence , the assets invested are reported too low. The market values of the companies in the German DAX share index areroughly three times their book values. As a result, the total return on capital regularly overestimates the actual return on investors' capital currently tied up at market values.

ROI as return on capital employed (return on invested capital, return on net assets)

Due to the weaknesses of the total return on capital, it is mainly operating returns on capital that are calculated today. Operational results “before interest” are also used. Note, however, that the “before interest” does not only refer to the interest paid, but more comprehensively to the overall financial result. Interest income or the investment result are therefore also hidden. Operational results such as EBIT or NOPAT reveal the earning power of a company's original business and are an expression of management skills and the company's positioning in competition. In contrast, management has little influence on the financial result (net interest income and investment income). Operating results are not influenced by the company's financing, or to put it another way, they are independent of the company's capital structure. When considering the EBIT in the numerator of the ROI, it is a return on investment before taxes or when considering the NOPAT, it is a return on investment after taxes.

Return on investment before tax (based on the EBIT result) is more suitable for assessing management performance and is easier to compare internationally (tax rates can differ significantly). Return on capital after tax, on the other hand, is more realistic about the ultimate return on investment for investors, since taxes will undoubtedly drain and not create value. Return on capital after tax (based on the NOPAT result) is therefore regularly used as part of value-based corporate management.

The identification of the operating results is quite easy, since the profit and loss account provides for a division of the results into operating (operating result) and non-operating components (financial result). Please note, however, that accounting is not designed to determine sustainable success. One-off effects or extraordinary effects can superimpose the reported successes and should be adjusted if necessary.

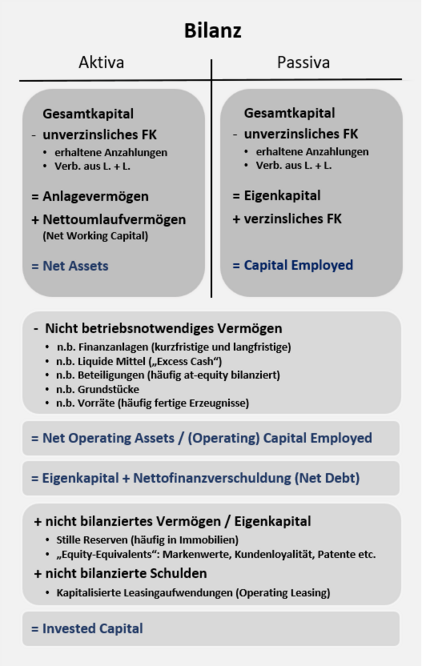

From an analytical point of view, however, it is problematic that the division of the assets in the balance sheet does not correspond to the division of the success in the income statement. The structure of the balance sheet is geared towards the needs of the creditors. The division into short-term and long-term assets or debts enables a meaningful analysis of the solvency / liquidity of a company. The breakdown according to maturity does not correspond to the presentation in the income statement. In the income statement, success is broken down according to the sources of success (performance area, finance area). For a meaningful comparison of success and capital expenditure, the balance sheet must be adjusted accordingly. This is illustrated in the illustration on the right.

When using operational performance indicators such as EBIT or NOPAT, it must also be taken into account that the operational performance also includes financing costs from non-interest-bearing liabilities (advance payments received, trade payables). The pre-financing from suppliers is reflected in correspondingly higher invoice amounts or material costs and reduces the reported operational success of the company. A consistent determination of the capital size requires that the non-interest-bearing liabilities should then no longer be regarded as part of the debt capital. With the reduced operational success, only a correspondingly reduced external capital has to be serviced. Therefore, only interest-bearing debt should be included in the calculation of capital quantities.

The consideration of the capital values on the basis of the balance sheet makes it clear that the capital employed can be calculated in two ways: using the assets side ("asset approach") and using the liabilities side ("financing approach"). The two variants also illustrate the two different ways of interpreting the ROI. The ROI calculated on the basis of the assets side shows how the capital tied up in the operating process pays off. This capital tied up in the operating process after deducting non-interest-bearing borrowed capital is also known as net assets or the corresponding return on investment as return on net assets (RONA). The net assets of a company in the investment assets plus net working capital (net working capital). This perspective is particularly relevant for assessing the performance of management. The performance of the management should be measured by how it yields interest on the capital originally used in the operating process.

The capital employed calculated on the basis of the liabilities side shows how the capital invested by the lenders (owners and lenders) pays off. This capital investment is also referred to as capital employed or the corresponding return on capital employed (ROCE). The capital employed of a company is then composed of the reported equity and the interest-bearing debt. The ROI is therefore also an indicator of how the capital provided by the investors pays off. They want at least a return that covers their cost of capital ( WACC ). Because the assets and liabilities side of the balance sheet are equal in value, ROCE regularly corresponds to RONA.

The ROCE or RONA calculations are based on the valuations in the balance sheet. The informative value of these key figures is considerably limited if there are substantial assets or liabilities that are not disclosed in the balance sheet. This includes assets in the form of hidden reserves (especially in real estate) as well as off-balance sheet assets such as brand names, human capital, customer loyalty or self-created software and patents. These intangible assets are not regularly recorded in the balance sheets (exception: purchase prices paid for acquisitions and purchase price allocation of the assets in accordance with IFRS 3). Such adjustments are also referred to in Anglo-Saxon as "shareholder conversions" or as an approach of "equity equivalents".

Modern forms of financing (operating leasing) are often not adequately represented on the liabilities side of the balance sheet. The present value of off-balance leasing obligations is only to be taken into account, however, if the observed successes have also been adjusted upwards by the interest income in the leasing expenses (this is rarely the case). The capital employed adjusted for off-balance sheet assets and debts is also referred to as invested capital or the return on investment as return on invested capital (ROIC). Due to the wide range of options for adjustment, there are correspondingly many calculation schemes for the ROIC in practice. Adjustments of this kind have now also become established when calculating ROCE or RONA. In this respect, the terms for the operating return on capital (ROCE, RONA, ROIC) are often used synonymously.

Examples

For Apple, the return on capital employed is 46.4% before taxes and 39.0% after taxes. The return on the market value of the entire assets (including brand values, customer values, etc.), on the other hand, was only 12.7% before taxes and 10.7% after taxes. The delimitation of the capital employed therefore largely determines the calculated return.

Appreciation

Operating return on investment is the most important indicator of how profitable a company's core business is. The profitability in the original business of a company is for all stakeholders of the company are of particular interest. When calculating the success and capital figures, however, there are many degrees of freedom that can severely limit the informative value and comparability.

When determining a suitable return on investment, one must always keep in mind the purpose for which the calculation is being carried out. For the assessment of the management's performance, the capital size should represent the value of the capital originally used in the operating process. The management must be measured by how efficiently it yields interest on the capital originally made available. The approach of assets that are not required for business operations should therefore be undertaken rather cautiously. Hidden reserves in assets (e.g. due to increased real estate values) or brand values are often based on market properties (e.g. market entry barriers) for which management cannot be held responsible. Against this background, the net assets or capital employed can also be justified in terms of capital quantities, as they come very close to the originally invested capital.

For investors, on the other hand, it makes sense to map all assets as comprehensively as possible in capital size . Investors think in terms of alternatives (opportunities). You want to see the extent to which all of your invested capital is yielding interest compared to alternative investments. In the case of listed companies, it can therefore also make sense to use the market value of the assets required for operations ( enterprise value ) as the capital figure.

ROI as return on equity (ROE)

The return on equity (short: EKR , including: return on equity ; English return on equity , abbreviated ROE ) reveals how the equity of a company within an accounting period interest. An entrepreneur or partner ( shareholder ) should use the return on equity to recognize whether his invested capital is profitably invested in the company. For the calculation, one sets a profit after interest (usually the annual surplus ) in relation to the equity available in the period :

example

For Apple, based on equity of USD 89.5 billion and net income of USD 57.5 billion, a return on equity of 64.2% was calculated at the end of 2019.

Appreciation

The return on equity can be calculated quickly and easily from a company's (published) business figures. However, the meaningfulness of the return on equity is limited in many cases. The balance sheet values (book values) of the equity hardly correspond to the actually tied assets of the owners. Intangible assets such as brand names, human capital, self-created software, licenses, customer loyalty, etc. are regularly suppressed in the balance sheets. In addition, in accordance with the principle of prudence , the net assets (equity) are reported too low. The return on equity therefore hardly reflects the actual return on the tied-up capital of the owners. The key figure is unsuitable for corporate management, as the management not only has equity but also outside capital with which it has to work in the operating process. In practice, the return on equity is therefore of secondary importance.

Breakdowns of the ROI

Split into return on sales and capital turnover

The breakdown of the return on investment (ROI) into the factors return on sales and capital turnover enable first insights into the development of capital returns in companies:

- .

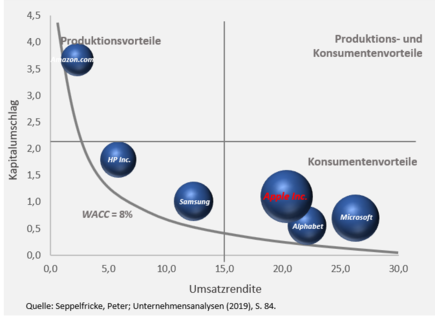

The return on investment (ROI) results as a factor from the profit margin and the capital turnover. The profit margin ( profit / turnover ) results from the entire operational activities. An efficient use of capital can be seen comprehensively in the capital turnover ( turnover / capital employed ).

The adjacent figure shows the capital turnover, sales margin and the resulting ROI for various technology companies in 2019. A WACC of 8% (roughly corresponds to the company's average cost of capital) is shown for orientation. Above-average returns on sales indicate particular successes in the sales market. Companies like Apple or Microsoft have great pricing power for their products and can enforce high margins with their customers. The margins at Amazon.com are significantly lower in retail. Due to the efficient use of capital and the high turnover of capital, the market leader in Internet trading can also achieve a very high return on investment.

Breakdown into key figure systems

The breakdown of successes can be further advanced with the help of key figure systems. A key figure system describes a set of key figures that are in a factually meaningful relationship to one another. With the help of a key figure system, the influences on the higher-level key figure can be worked out more precisely. The top key figure in key figure systems is regularly the ROI, since the capital providers or the companies strive to maximize the return on investment.

The development of the first system of indicators goes back to 1919, when the American chemical company Dupont developed the "Dupont System of Financial Control". The starting point is the division of the ROI into the key figures return on sales and capital turnover. The further breakdown provides information on the composition of the successes and the capital employed. Today there are numerous variants of the DuPont key figure system. In international corporations, key figure systems based on the cost of sales method dominate today. In accounting according to IFRS , the cost of sales method is common practice and under US GAAP the total cost method is even prohibited.

Appreciation

Key figure systems are easy to understand and provide valuable insights into the composition of the overall success. It can be easily implemented in the external analysis, since the required data can be easily taken from the income statement and balance sheet. On the other hand, a key figure system is always an examination of the past. Key figures that can lay the basis for future success (e.g. expansion investments or research expenses) are regularly hidden. The system is more oriented towards accounting and only splits expenditure and capital quantities. This directs attention to the efficient use of resources (costs, capital employed). Market influences and successful strategies on the sales market are hardly taken into account. This is also made clear by the fact that there is no breakdown into various sales components. For a comprehensive understanding of the value drivers, it is therefore imperative to also carry out analyzes of the market, the products and the company's strategies.

Empirical results for time, company and industry comparisons

The current time, company and industry comparisons for the ROI (NOPAT / Capital Employed) are shown in the adjacent figure. The empirical analysis enables various insights:

- Positive trend : the return on investment has increased both nationally and internationally in recent years. This is an indication of a decrease in the intensity of competition due to concentration processes in various industries. Oligopolistic or even monopolistic structures allow providers to have greater pricing power and regularly lead to higher margins. The positive trend is also due to the fact that sectors (Internet, telecommunications) that have comparatively high market entry barriers have grown in recent years.

- Dependence on size : larger companies in the MSCI World can achieve higher returns than smaller companies in the DAX , MDAX or SDAX . This is evidence of the existence of economies of scale and scope. It is also interesting that the returns on investments of larger companies are more stable in times of crisis. This is probably due to the fact that larger companies are often more broadly positioned.

- Dependence on the industry : It is noticeable that technology companies, service companies and pharmaceutical companies in particular can achieve well above-average returns. This is due to the significant barriers to market entry in these sectors.

Return on investment for assessing individual investments

This modern, expanded view of the ROI differs from the original variant according to DuPont mainly in that it does not consider the total capital of a company, but individual investments in the context of entrepreneurial activity. However, a distinction should be made between calculation (determination of the pure numerical value) and analysis (systematic examination of the return flows). When calculating the ROI in relation to an individual investment, it is generally assumed that the return flows from the investment are already known from a previous analysis.

In principle, a calculation of the ROI is only interesting if the investment can also contribute to the company's success, i.e. This means that amortization is achieved within the useful life . In the information and communication industry, for example, the fact that the useful life of hardware and software products is comparatively short, usually three years, must be taken into account. The rule of thumb is that only investments with an amortization of less than three years are advantageous. If a break- even achieved within 12 months, the investment is budget neutral. In accordance with these short-term planning horizons , it makes sense to be able to calculate the ROI in advance of an investment, which makes a calculation for the entire useful life appear sensible.

Differences in the calculation

There are therefore two different approaches to the calculation method. However, these allow a different interpretation of the result or are suitable for assessing certain investments in different ways. When determining the ROI for the entire service life , the predicted return flows are the all-important variable.

Long-term calculation taking into account the total success

This method is particularly useful if a periodic reference appears unsuitable due to the low useful life . The ROI is thus calculated for a longer planning horizon, for example for the entire period of use. This usually takes place in the run-up to an investment and is a decision criterion for a possible selection process.

Total success

In order to determine the total success or the capital value of an investment at a certain point in time, it is first necessary to forecast the return flows of the investment. These arise, for example, through higher revenues and / or savings, but are reduced accordingly by the amount of the operating costs of the investment, especially for property , plant and equipment . If the return flows from the investment are discounted accordingly to the present value and offset against the investment costs on balance, this corresponds to the net present value. Simplified and with a correspondingly short useful life , it is also possible to dispense with discounting or the consideration of an internal rate of return . If a very rapid amortization is expected, for example 12 months, the closest periodic value, in this case two years, can also be estimated. If the investment is a success, the result should be a positive net present value. If the net present value is zero, the investment has amortized exactly within the estimated period.

Investment costs

The investment costs are the total capital tied up in an investment . In doing so, all costs should be taken into account that are incurred once and promptly for the acquisition . Consequently, costs, for example when purchasing a machine, for professional installation must also be included in the calculation. Other examples would be training costs as part of the introduction of new software or transport costs.

interpretation

The ROI thus expresses the relationship between the expected added value and the costs of an investment. If the investment costs are specified, a statement is made about the economically interesting total success at a certain point in time. It is therefore no longer a key figure to be determined periodically. The result should always be a positive percentage, unless the investment has not yet amortized by the estimated time.

Periodic determination

This type of calculation is most similar to the Du-Pont principle and is particularly useful for a long-term investment , i.e. when no short-term amortization can be expected. This form of calculation is also useful if it is difficult to plan the return flows in advance of the investment. As a result, already achieved returns, for example from the first period, are used to calculate the ROI. The longer this period seems to be, the less useful it is to plan with the returns from the first period without discounting them accordingly to the present value. Equally important is the consideration of a learning curve effect, which reduces productivity and thus the returns achieved in the first period accordingly, which makes further planning more difficult. However, most investments are not subject to the effects of such an effect.

interpretation

With the result, conclusions can be drawn regarding the duration of the amortization . It is expressed which part of the investment periodically returns. One could therefore also speak of an annuity .

literature

- Adolf G. Coenenberg et al .: Cost accounting and cost analysis 6th edition, Schäffer-Pöschel, Stuttgart 2007.

- Johann Steger: Key figures and key figure systems 3rd edition, NWB Verlag, Herne 2017.

- Helmut Schmalen, Hans Pechtel: Basics and problems of business administration 13th edition, Schäffer-Pöschel, Stuttgart 2006.

- Peter Seppelfricke: Corporate Analysis: How to Predict the Future of a Company , Schäffer-Pöschel, Stuttgart 2019.