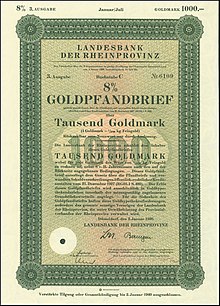

Landesbank of the Rhine Province

The Landesbank der Rheinprovinz (until 1871 Rheinische Provinzial-Hülfskasse ) was from 1854 a credit institute in the Rhine province . It is one of the predecessor institutes of WestLB .

history

Rhenish Provincial Aid Fund

The Rheinische Provinzial-Hülfskasse started its business activities in Cologne on February 7th, 1854 with an initial capital of 400,000 thalers on the basis of the statutes of November 24th, 1853. Their first place of business was in the government building in Cologne's Zeughausstrasse, which had been in use since November 22, 1832. As the first non-profit bank, it had the task of “supporting institutions, community buildings or commercial companies with loans, paying off community debts and promoting the savings bank system by accepting savings”.

Since September 1871, the Rhenish Provincial Parliament in Düsseldorf has been in charge of the Cologne Aid Fund. To this end, he founded a committee that, as a provincial board member based in Düsseldorf, oversaw the business of the Auxiliary Fund. On July 10, 1877, this led to the relocation of the headquarters of the Hülfskasse from Cologne to Düsseldorf against the resistance of the board of directors, as the latter valued Cologne as a business and banking center. At that time, there were numerous banks in Cologne that also operated nationwide, such as the Sal. Oppenheim bank (founded in 1789; in Cologne since 1798), the JH Stein bank (1790), the A. Schaaffhausen'scher Bankverein (1791) and the bank A. Levy & Co. (1858) active.

Landesbank of the Rhine Province

The Landesbank der Rheinprovinz emerged from the Düsseldorf Institute in February 1888 . On November 1, 1919, this Landesbank of the Rhine Province founded a branch in Cologne with Hans Dittmer, a former Reichsbank official, as its director. A press release from July 1931 reveals that the Landesbank “has given the municipalities and municipal associations of the Rhine Province a total of 678 million RM in long-term and short-term loans. The city of Cologne received a total of 78 million RM (11.51%) of the entire loan. ”At the time of the German banking crisis , the Landesbank was no longer able to cope with the heavy deposit withdrawal that began in May 1931. Since it had granted short-term municipal loans on a large scale at the same time and the illiquid municipalities could no longer repay these loans, the Landesbank der Rheinprovinz had to stop its payments on July 11, 1931. The function of the Girozentrale was therefore transferred in August 1931 to a branch of the Deutsche Girozentrale (DGZ) set up in Cologne, which Fritz Butschkau took over in October 1931 . The Cologne DGZ branch recruited the staff of the previous Landesbank and received liquidity assistance from the Reichsbank in the amount of 100 million Reichsmarks, which it mainly passed on to the savings banks. The DGZ branch was characterized by increasing business activity in 1934, with the majority of its deposits flowing into the Rhenish savings banks. After the redevelopment of the Cologne DGZ branch, Butschkau joined the board of directors of the newly founded Rheinische Girozentrale and Provinzialbank in Düsseldorf in April 1935, and took over as chairman of the board in 1945. This bank was the legal predecessor of today's WestLB .

See also

Individual evidence

- ↑ Hans Pohl, Die Rheinischen Sparkassen , 2001, p. 109

- ^ Hans Pohl, Von der Hülfskasse from 1832 to Landesbank , May 1982, p. 45

- ^ Hans Pohl, Economy, Enterprises, Credit System, Social Problems: Essays , 2005, p. 969

- ↑ Hans Pohl, Von der Hülfskasse ..., p. 48

- ↑ Hans Pohl, Wirtschaft, Unternehmen ...., P. 970

- ↑ Konrad Adenauer Foundation, press release from 23./24. July 1931

- ↑ Dietrich Goltz, Das Liquiditatsproblem bei den Girozentralen , 1956, p. 134

- ^ Gerhard Zweig, Die Deutsche Girozentrale - Deutsche Kommunalbank , 1986, p. 59

- ↑ Klaus-Wilhelm Lege, On the position and function of the Deutsche Girozentrale , 1970, p. 223