Tax revenue (Germany)

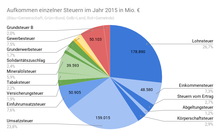

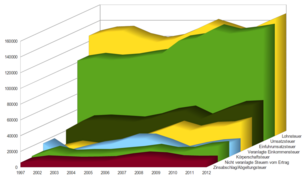

Under tax revenue is defined as the sum of a certain period of time in a particular region (municipality, state, federal) in public funds received (arisen) taxes. This tax revenue (in addition to borrowing) makes up the largest part of the public sector's financial resources. A few types of tax contribute disproportionately to the total tax revenue . More than two thirds of the total tax revenue is accounted for by income tax and sales tax.

In 2018, the federal, state and municipal tax revenue amounted to around 776 billion euros. Tax revenues of around 908 billion euros are expected for 2023.

The following table shows the tax revenue in Germany broken down by tax type:

Total tax revenue

| year | € million BMF | Million € IB | Population (in millions) Germany |

Taxes IB (per person in €) |

GDP in € million DE | Tax share of GDP |

|---|---|---|---|---|---|---|

| 1950 | 10,783 | 59,251 | 51 | 1,162 | 49,690 | 21.70% |

| 1952 | 16,992 | 84,988 | 52 | 1,634 | 69,750 | 24.36% |

| 1962 | 44.166 | 191,074 | 57 | 3,352 | 184,460 | 23.94% |

| 1972 | 100,726 | 320.114 | 62 | 5.163 | 436,370 | 23.08% |

| 1982 | 193,627 | 372.391 | 62 | 6.006 | 860.210 | 22.51% |

| 1987 | 239,622 | 426,700 | 61 | 6,995 | 1,065,130 | 22.50% |

| 1992 | 374.128 | 572,683 | 81 | 7,070 | 1,648,400 | 22.70% |

| 1997 | 407,577 | 552,655 | 82 | 6,740 | 1,912,600 | 21.31% |

| 2002 | 441.705 | 1,099,290 | 83 | 13,244 | 2,132,200 | 20.72% |

| 2003 | 442.238 | 556.614 | 83 | 6.706 | 2,147,500 | 20.59% |

| 2004 | 442,838 | 548.591 | 83 | 6,610 | 2,195,700 | 20.17% |

| 2005 | 452.079 | 551.220 | 82 | 6,722 | 2,224,400 | 20.32% |

| 2006 | 488,444 | 586,758 | 82 | 7.156 | 2,313,900 | 21.11% |

| 2007 | 538.243 | 632.044 | 82 | 7,708 | 2,428,500 | 22.16% |

| 2008 | 561.182 | 642.281 | 82 | 7,833 | 2,473,800 | 22.67% |

| 2009 | 524,000 | 597.932 | 82 | 7,292 | 2,374,200 | 22.07% |

| 2010 | 530,587 | 598,861 | 82 | 7,303 | 2,495,000 | 21.27% |

| 2011 | 573.351 | 633.817 | 80.3 | 7,893 | 2,609,900 | 21.97% |

| 2012 | 600.046 | 650.321 | 80.5 | 8,079 | 2,666,400 | 22.50% |

| 2013 | 619.711 | 662.361 | 80.8 | 8,198 | 2,737,600 | 22.67% |

| 2014 | 643,600 | 681.083 | 81.2 | 8,388 | 2,932,470 | 21.95% |

| 2015 | 673,300 | 708.968 | 82.2 | 8,625 | 3,043,650 | 22.12% |

| 2016 | 705,800 | 739.492 | 82.5 | 8,964 | 3,144,050 | 22.45% |

| 2017 | 734,500 | 758.189 | 82.5 * | 9,190 | 3,263,350 | 22.51% |

| 2018 | 776.300 | |||||

| 2019 | 793,700 * | |||||

| 2020 | 818,000 * | |||||

| 2021 | 847,000 * | |||||

| 2022 | 877,800 * |

* - BMF estimate, as of May 2019

Tax revenue by type of tax

Tax revenue is given in nominal terms ( not adjusted for inflation ).

| Tax type | Tax revenue (million euros) | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1997 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2015 | 2016 | 2017 | |

| income tax | 127.144 | 132.190 | 133,090 | 123,895 | 118,919 | 122,612 | 131,773 | 141,895 | 135,165 | 127.904 | 139,749 | 149.065 | 178,890 | 184,826 | 195,524 |

| Assessed income tax | 2,947 | 7,541 | 4,568 | 5,394 | 9,765 | 17,566 | 25,027 | 32,685 | 26,430 | 31,179 | 31,996 | 37,262 | 48,580 | 53,833 | 59,428 |

| Income taxes not assessed | 7,513 | 14,024 | 9.001 | 9,919 | 9,952 | 11,904 | 13,791 | 16,575 | 12,474 | 12,982 | 18,136 | 20,060 | 17,944 | 19,452 | 20,918 |

| Interest discount / withholding tax since 2009 (including former interest discount) | 5,828 | 8,478 | 7,632 | 6,773 | 6,990 | 7,633 | 11,178 | 13,459 | 12,442 | 8,709 | 8,020 | 8,234 | 8,258 | 5,940 | 7,333 |

| Corporation tax | 17.009 | 2,864 | 8,275 | 13,123 | 16,333 | 22,898 | 22,929 | 15,868 | 7.173 | 12,041 | 15,634 | 16,935 | 19,583 | 27,442 | 29,259 |

| value added tax | 102.225 | 105,463 | 103.162 | 104,715 | 108,440 | 111,318 | 127,522 | 130,789 | 141.907 | 136,459 | 138,957 | 142,439 | 159.015 | 165.932 | 170,499 |

| Import sales tax | 20,946 | 32,732 | 33,834 | 32,651 | 31,273 | 35,370 | 42.114 | 45,200 | 35,084 | 43,582 | 51,076 | 52,196 | 50.905 | 51,157 | 55,857 |

| Total community taxes | 283,611 | 303.291 | 299,563 | 296,470 | 301,673 | 329,302 | 374.334 | 396.472 | 370,676 | 372.857 | 403,568 | 426.190 | 490.584 | 508,582 | 538.817 |

| Insurance tax | 7.223 | 8,327 | 8,870 | 8,751 | 8,750 | 8,775 | 10,331 | 10,478 | 10,548 | 10,284 | 10,755 | 11,138 | 12,419 | 12,763 | 13,269 |

| Tobacco tax | 10,816 | 13,778 | 14.094 | 13,630 | 14,273 | 14,387 | 14,254 | 13,575 | 13,366 | 13,492 | 14,414 | 14,143 | 14,920 | 14,186 | 14,399 |

| Coffee tax | 1,147 | 1,091 | 980 | 1,025 | 1.003 | 973 | 1,086 | 1.008 | 997 | 1.002 | 1,028 | 1,054 | 1,031 | 1,040 | 1,057 |

| Liquor tax | 2,384 | 2.149 | 2,204 | 2,194 | 2.142 | 2,160 | 1,959 | 2.126 | 2,101 | 1,990 | 2.149 | 2.121 | 2,069 | 2,070 | 2,094 |

| Alcopop tax | - | - | - | 1 | 10 | 6th | 3 | 3 | 2 | 2 | 2 | 2 | 2 | 1 | 2 |

| Sparkling wine tax | 560 | 420 | 432 | 436 | 424 | 421 | 371 | 430 | 446 | 422 | 448 | 450 | 429 | 401 | 368 |

| Inter-product tax | 29 | 30th | 28 | 27 | 27 | 26th | 25th | 27 | 26th | 21st | 15th | 14th | 14th | 15th | 17th |

| Mineral oil tax / from 2006 energy tax | 33,749 | 42.192 | 43,188 | 41,782 | 40.101 | 39,916 | 38,955 | 39,248 | 39,822 | 39,838 | 40,036 | 39,305 | 39,593 | 40.091 | 41,022 |

| Electricity tax | - | 5,097 | 6,531 | 6,597 | 6,462 | 6,273 | 6,355 | 6.261 | 6,278 | 6.171 | 7,247 | 6,973 | 6,592 | 6,569 | 6,944 |

| Motor vehicle tax a | - | - | - | - | - | - | - | - | 3,803 | 8,488 | 8,422 | 8,443 | 8,804 | 8,952 | 8,948 |

| Solidarity surcharge | 13,238 | 10,403 | 10,280 | 10,108 | 10,315 | 11,277 | 12,349 | 13,146 | 11,927 | 11,713 | 12,781 | 13,624 | 15,930 | 16,855 | 17,953 |

| swap. Import duties | 5 | 5 | 5 | 3 | 2 | 1 | 1 | 2 | 3 | 2 | 3 | 2 | 2 | 2 | 2 |

| Air, core, otherwise. | 1,496 | −6.141 | |||||||||||||

| Total federal taxes | 69,160 | 83,494 | 86,609 | 84,554 | 83.509 | 84.215 | 85,690 | 86,302 | 89,318 | 93,426 | 99.134 | 99,794 | 104.204 | 104,441 | 99,934 |

| Wealth tax | 898 | 239 | 230 | 80 | 97 | 27 | 5 | −7 | 7th | 1 | −4 | −1 | −1 | 0 | 0 |

| Inheritance tax | 2,076 | 3,021 | 3,373 | 4,283 | 4,097 | 3,763 | 4,203 | 4,771 | 4,550 | 4,404 | 4,246 | 4,305 | 6,289 | 7.007 | 6.114 |

| Real estate transfer tax | 4,666 | 4,763 | 4,800 | 4,669 | 4,791 | 6.125 | 6,952 | 5,728 | 4,857 | 5,290 | 6,366 | 7,389 | 11,248 | 12,408 | 13,139 |

| Motor vehicle tax a | 7,372 | 7,592 | 7,336 | 7,739 | 8,673 | 8,937 | 8,898 | 8,842 | 4,398 | - | - | - | - | - | - |

| Racing betting and lottery tax | 1,489 | 1,844 | 1,861 | 1,885 | 1,813 | 1,775 | 1,702 | 1,536 | 1,511 | 1,412 | 1,420 | 1,432 | 1,712 | 1,809 | 1,837 |

| Fire protection tax | 363 | 306 | 328 | 353 | 331 | 322 | 319 | 327 | 324 | 325 | 365 | 380 | 413 | 442 | 451 |

| Beer tax | 868 | 811 | 786 | 787 | 777 | 779 | 757 | 739 | 730 | 712 | 702 | 696 | 676 | 678 | 664 |

| State taxes total | 17,732 | 18,576 | 18,713 | 19,774 | 20,579 | 21,729 | 22,836 | 21,937 | 16,375 | 12,146 | 13,095 | 14,201 | 20,338 | 22,343 | 22.205 |

| Business tax | 24,849 | 23,487 | 24,129 | 28,544 | 32,129 | 38,357 | 40.114 | 41,090 | 32,450 | 35,737 | 40,424 | 42,345 | 50.103 | 50.097 | 52,872 |

| Property tax A | 329 | 337 | 340 | 347 | 349 | 352 | 354 | 355 | 355 | 360 | 368 | 375 | 393 | 394 | 404 |

| Property tax B | 7,598 | 8,915 | 9,317 | 9,591 | 9,896 | 10,043 | 10,359 | 10,447 | 10,587 | 10,956 | 11.306 | 11,642 | 13,258 | 13,260 | 13,561 |

| Real estate transfer tax | 172 | 75 | 41 | 23 | 0 | 0 | 0 | 0 | 0 | 0 | - | - | - | - | - |

| Other municipal taxes | 599 | 623 | 640 | 646 | 565 | 551 | 572 | 624 | 671 | 742 | 836 | 1,037 | ? | 1,562 | 1,657 |

| Total community taxes | 33,547 | 33,448 | 34,477 | 38,981 | 42,941 | 49,319 | 51,401 | 52,468 | 44,028 | 46,489 | 52,531 | 55,398 | 63,754 | 65,313 | 68,495 |

| duties | 3,528 | 2,896 | 2,877 | 3,059 | 3,378 | 3,880 | 3,983 | 4,002 | 3,604 | 4,378 | 4,571 | 4,462 | 5,158 | 5.113 | 5063 |

| post Casino taxes b | 572 | 649 | 590 | 596 | 563 | 484 | 418 | 235 | 173 | 129 | 145 | ? | |||

Notes:

a As of July 2009, vehicle tax is a federal tax.

b 1987: 344 million euros, 1992: 499 million euros

For visualization of tax revenue by tax types is also the control coil used, which publishes the Treasury every year.

See also

Individual evidence

- ↑ a b Tax estimate of the Federal Republic of Germany: Tax revenues in Germany from 2018 to 2023 according to the tax estimate (in billion euros, estimated from 2019) from May 10, 2019. In: Statista.com. May 10, 2019, accessed August 30, 2019 .

- ↑ Tax revenue by type of tax 2006–2009 from the Federal Ministry of Finance

- ↑ Overviews on financial development - Federal Ministry of Finance - Monthly report of the BMF June 2018. Accessed on June 27, 2018 (German).

- ^ Publisher: State & Society - Population level - Population level - Federal Statistical Office (Destatis). Retrieved June 27, 2018 .

- ↑ Federal Statistical Office: National Accounts - Domestic Product Calculation - Long Series from 1970. June 1, 2018, accessed on June 27, 2018 .

- ↑ Tax revenue (excluding pure municipal taxes) in 2009 and 2010 ( Memento from May 16, 2011 in the Internet Archive ) from the Federal Ministry of Finance

- ^ Federal Statistical Office, Wiesbaden: Finances and Taxes. Tax budget. 2012. Released April 24, 2013

- ↑ a b Federal Statistical Office - Fach Series 14 Series 4 Tax Budget 2017. Accessed on August 18, 2018 .

- ↑ a b c Federal Statistical Office Real Tax Comparison - Fachserie 14 Reihe 10.1 - 2010 , accessed on May 26, 2012.

- ↑ a b c Federal Statistical Office Real Tax Comparison - Fachserie 14 Reihe 10.1 - 2016. Retrieved on August 16, 2018 .

- ↑ casino taxes - BupriS

Web links

- Customs: taxes

- Federal Ministry of Finance: Tax Estimation & Tax Revenue

- Federal Ministry of Finance: Development of Tax Income - Current Data and Historical Time Series

- Federal Ministry of Finance: Treasury tax revenue by type of tax 1950 to 2016