Conversion (corporate law)

The legal concept of transformation describes the corporate reorganization of companies.

Conversions are often the result of company mergers or disposals, restructuring in corporations and corporate groups (without group structure) or tax optimization considerations in the context of succession planning in medium-sized companies.

Legal basis

In Germany , the conversion is usually based on the Transformation Act (UmwG). In addition, conversions outside of the Transformation Act can be carried out if necessary, e.g. B. accruals , contributions (for these, the principles of contributions in kind apply regularly under civil law ) or association law provisions.

The tax consequences of a conversion are mainly regulated in the Conversion Tax Act.

The equivalent legal basis in Austria is the Reorganization Tax Act (UmgrStG), which regulates the tax aspects of the conversion in Section II (Sections 7-11). In terms of corporate law, the Austrian Commercial Code (UGB) applies.

Types of conversion

The transformations under the UmwG include the following legal institutions: mergers, demergers (spin-off, split-off, spin-off), change of legal form and transfer of assets. Depending on the target direction and purpose of reduction of the conversion process, the UmwG determined as civil result, the overall or special succession ( s. U. ).

Convertible legal entities are both transferring, accepting or new legal entities:

- Commercial partnerships and partnerships ;

- Corporations ;

- registered cooperatives ;

- registered associations ;

- cooperative auditing associations ;

- Mutual insurance associations .

The following are convertible to a limited extent:

- economic associations insofar as they are transferring legal entities;

- natural persons who as sole shareholders of a corporation take over its assets.

merger

A merger is understood to mean the merger through the transfer of the entire assets of a legal entity to another, either already existing or to be newly established legal entity by way of universal succession (by dissolution without liquidation), whereby the shareholders of the transferring and expiring legal entity participate in the exchange of shares is granted to the acquiring or new legal entity.

The following variants are available, for example:

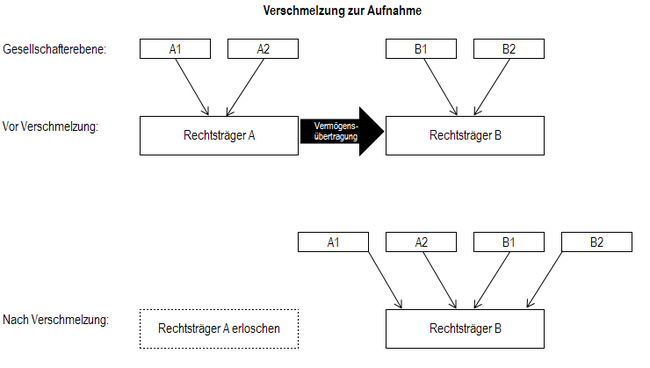

Fusion for inclusion

In the initial situation, there are two legal entities, A and B. Through a merger agreement, legal entity A transfers its assets with dissolution without liquidation to legal entity B, who thereby enters into all legal relationships of legal entity A as legal successor ( universal succession ) - and that without the contracting parties' approval to have to ask. The shareholders of the transferring legal entity A receive shares in the absorbing legal entity B, so that the value of the former shareholders of the transferring legal entity A (excluding special effects caused by the merger) in the value of the entire company B corresponds to the value of the shares in the single legal entity A.

After the merger for inclusion, only legal entity B continues, legal entity A has expired.

For clarification, the following schematic representation:

Merger to establish a new company

In the initial situation, there are again two legal entities, A and B. Through a merger agreement, both legal entities, A and B, transfer their assets with dissolution without liquidation to the newly established legal entity C. Legal entity C thus becomes the universal successor in all legal relationships of the transferring legal entity A. and B a; the shareholders of legal entity A and those of legal entity B participate in the new legal entity C in proportion to the value of the shares of the transferred legal entities.

After the merger to form a new entity, legal entity C will continue to exist, legal entities A and B have expired.

For clarification, the following schematic representation:

cleavage

The split is often seen as the opposite of the merger. The law provides for three types of this:

Splitting up

In the case of a split, a transferring legal entity splits up its entire assets with dissolution without liquidation and transfers them by way of special legal succession to at least two other, either existing or newly established legal entities, as in the case of a merger against the granting of shares to the acquiring or new legal entity to the shareholders of the transferring legal entity . The transferring legal entity ceases to exist in the event of the split.

For clarification, the following schematic illustration for a split, in which part of the assets of the split legal entity A is split into legal entity B, which was newly established in the course of the split, and another part of the assets is split into the already existing legal entity C. The shareholders A1 and A2 are subsequently involved in both legal entities B and C, legal entity A has expired:

Spin-off

The spin-off is economically more significant because it occurs more frequently. In this case, the transferring legal entity remains in existence and only transfers part of its assets (regularly a business, several businesses or essential operating bases in the sense of e.g. a property in preparation for a business split) by way of special legal succession to one or more other, existing or new legal entities against the granting of shares of the acquiring or new legal entities to the shareholders of the transferring legal entity.

The following scheme for clarification: The legal entity A with the shareholders A1 and A2 has a sub-operation B, which is to be split off to the already existing legal entity B with the shareholder B1. After the transfer of assets by way of the spin-off, A1 and A2 still hold a stake in legal entity A. In return for the transfer of the partial business, A1 and A2 receive shares in the legal entity B taking over. B1 continues to only hold a stake in legal entity B.

Outsourcing

The spin-off corresponds economically to the spin-off, since the transferring legal entity continues to exist. In contrast to the spin-off, the shares of the new or absorbing legal entity granted as countervalue are not granted to the shareholders of the transferring legal entity, but rather to the transferring legal entity itself. The latter therefore exchanges the spun off asset for shares in the absorbing or new legal entity. The stakes in the transferring legal entity will not be directly affected by the spin-off. This process is of considerable practical importance , especially as a spin-off for the establishment of a subsidiary .

For a simplified representation of a spin-off to an existing legal entity, see the following scheme:

Change of form

The change of legal form is limited to changing the legal form of a legal entity while preserving its legal identity and retaining its previous shareholders ( no legal succession - entry in public registers such as the land register takes place by correcting a register that has become incorrect due to the change in legal form ).

Typical cases are the change of form of capital in partnerships to prepare a generation change in medium-sized or shape change in the frame / as a result of a squeeze-out or delistings for corporations.

Transfer of assets

The transfer of assets involves the transfer of all assets by way of universal succession with dissolution without liquidation to another legal entity - however, the shareholders of the transferring legal entity are not granted a share in the acquiring legal entity, but rather a consideration (e.g. compensation) in another form. This can be due to the fact that the acquiring legal entity cannot grant shares (e.g. in the case of a transfer of assets to the public sector or between insurance companies).

Transformations outside of the Transformation Act

In some cases, conversions are carried out outside of the Transformation Act. This need arises particularly if the parties involved are not convertible , for example foundations or unregistered associations , or the formal requirements of the Transformation Act are impractical for the desired transformation. The following presentation is inevitably incomplete due to the large number of conceivable designs.

Growth model

With this model, there is a partnership ( commercial partnership or partnership under civil law ) in the starting position . If one of the partners is to take over the entire assets, all other partners leave the company (possibly against compensation); alternatively, all other shareholders can also transfer their share rights in the company to the acquiring partner. All assets and debts increase with the departure of the penultimate partner or with the unification of all share rights in one hand by law to the remaining partner, since in German law a one-piece partnership, i.e. H. a partnership with only one (member) member is not intended. The accretion is a case of universal succession .

In a variation, a target right holder, e.g. B. a foundation , in the still existing company, whereupon all other parties involved leave the partnership and the assets grow to the target right holder.

Transformations under association law

Unregistered associations can exist for many years without impairment. If the general assembly decides that the board of directors should carry out the registration, the then registered association takes on all legal positions of the unregistered predecessor association without the need for individual transfer acts regarding the association's assets.

literature

- Jürgen Hegemann, Torsten Querbach: Transformation law. Basics and Taxes . Gabler Verlag, Wiesbaden 2007, ISBN 978-3-8349-0569-7 .

- Burkhard Heuel-Fabianek: Transfer of nuclear licenses for the spin-off and spin-off of parts of the company . in: The new radiation protection law - exposure situations and disposal, 49th annual conference of the Association for Radiation Protection, 09. – 12. October 2017 in Hanover, proceedings, pp. 31–34, ISSN 1013-4506

- Jens Kuhlmann, Erik Ahnis: Group and transformation law (= focus area . Vol. 25). 3., completely reworked. Edition CF Müller Verlag, Heidelberg 2010, ISBN 978-3-8114-8180-0 .

- Siegfried Widmann, Dieter Mayer (Hrsg.): Transformation law. Comment . Stollfuß Medien, Bonn, ISBN 978-3-08-258100-1 (loose-leaf work, basic work with 151 supplementary delivery , 2015).