Excise tax

As excise duties are tax types referred to on the consumption of any or all goods and services are collected. So they tie in with the use of income .

Delimitation and definition

Consumption taxes can be levied as a general consumption tax on all goods or as a special consumption tax on individual goods.

Consumption taxes can be levied on goods and services in a broader sense. In a narrower sense, the term refers exclusively to goods, the corresponding tax on services is then referred to as expense tax .

It is difficult to differentiate between consumption taxes and transport taxes . Transaction taxes are linked to legal acts (e.g. the stock exchange turnover tax on a stock exchange transaction), consumption taxes to added value (e.g. the sparkling wine tax on the sales proceeds of the sparkling wine). The collection of consumption taxes is now typically linked to the legal act of placing on the market. In the example, the sparkling wine tax is due to the legal act of the sale. In public finance , therefore, the cumulative effect or the avalanche effect is typically chosen as the yardstick for differentiation. In the example of the stock exchange sales tax, the tax is payable again the next time it is sold (traffic tax), the sparkling wine tax is only charged once (consumption tax).

A number of taxes are discussed as borderline cases in the financial literature. In the literature , insurance and dog taxes are only partially counted as consumption taxes.

Sometimes a different definition is used; According to this, consumption taxes are those that only burden private consumption within the meaning of the national accounts . See also consumption tax .

The tax can be levied as quantity tax or value tax .

Economic effect of special consumption taxes

Neoclassical view

Special consumption taxes change the supply, demand and sales of these goods.

In the case of a quantity tax, the gross price is the sum of the net price and the tax amount :

- .

The basic economic assumption is that the demanders orientate themselves on the gross price (which they have to pay) and the suppliers on the net price (which they receive).

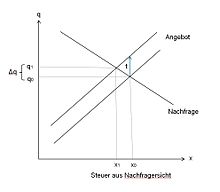

From the supplier's point of view, the tax acts like a decrease in demand. The demand curve shifts (as shown in Figure 1) down by the tax amount . This reduces the offered quantity from to , and the net price drops by . However, the net price does not decrease by the amount of the tax, but by a smaller amount.

From the point of view of the consumer, the tax acts like an increase in the price of supply. The supply curve shifts (as shown in Figure 2) up by the tax amount . This increases the gross price and decreases it . However, the gross price does not increase by the amount of the tax, but by a smaller amount. The tax is therefore typically not completely passed on to the consumer. Overall, therefore, the turnover of the good decreases, the gross price increases and the net price decreases.

The question of the extent to which a pass-through takes place the tax on the final consumer, depends on the supply , and the demand elasticity.

With a completely inelastic elasticity of demand (demand is independent of price) the tax would be passed on in full. For example, if a special consumption tax were levied on the fee for the TÜV, drivers would drive to the TÜV just as often as without this tax. The tax would be passed on in full.

In practice, however, there is only a partial transfer. The ratio to is called the load distribution measure and indicates how high the transferred share is.

rating

From a neoclassical point of view, the introduction of a special consumption tax causes welfare losses, all other things being equal , because the turnover of the relevant consumer is lower and the consumer price higher than under the conditions of a perfect market . A general consumption tax is therefore preferable from this point of view, since the market distortions between differently taxed goods are eliminated.

Since the conditions of a perfect market do not exist in practice, special consumption taxes can nevertheless lead to an increase in welfare in some cases from an economic point of view. Examples are:

- Special consumption taxes can serve to internalize external effects

- Reduced rates for consumption taxes for certain products can correct the insufficient demand for merit goods .

- Excise duties on luxury goods ( luxury tax can) the redistribution serve

Motivation for the introduction of consumption taxes

Excise taxes are among the oldest taxes. One reason for this is the simple (for some products) recording of the tax base and the taxation of a small number of taxable manufacturers or dealers. The oldest consumption tax on German soil is likely to have been the salt tax , which was already levied in the Frankish Empire . Since salt production was concentrated in a small number of places, the technical processing of the tax was easy.

The central motive for collecting consumption taxes is the fiscal motive. In addition to the taxation of income and the taxation of wealth, the collection of consumption taxes is the most important source of income for states.

Special consumption taxes are also justified with a steering effect desired by the state: They are intended to promote health (e.g. tobacco tax ), protect the environment (e.g. CO 2 tax ) or improve morale (e.g. Casino tax ).

Contrary to the overall coverage principle , it is often argued that special consumption taxes are a payment for infrastructure (e.g. mineral oil tax) or for increased state costs (e.g. dog tax).

Types of excise duties

In principle, excise taxes on goods and services of all kinds are conceivable. Without claiming to be exhaustive, here are a number of consumption taxes:

- Alcopop tax

- Beer tax

- Liquor tax

- Energy tax

- Natural gas tax

- Acetic acid tax

- Coffee tax

- Nuclear fuel tax

- Lamp tax

- Mineral oil tax

- Mineral water tax

- Salt tax

- Sparkling wine tax

- Playing card tax

- Electricity tax

- Tobacco tax

- Tea tax

- Sugar tax

- Ignition goods tax

- Inter-product tax

Excise taxes in individual countries

Individual evidence

- ↑ Stefan Homburg : General Taxation. 7th edition. 2015, ISBN 978-3-8006-4922-8 , pp. 12-15.

- ↑ Stefan Homburg: General Taxation. 7th edition. 2015, ISBN 978-3-8006-4922-8 , p. 96 ff.