Tobacco tax (Germany)

The tobacco tax is levied on tobacco products of all kinds in Germany (since 1906; since 1993 no longer on snuff and chewing tobacco ; levied via tax codes ) - but not only . It is an indirect tax , a consumption tax to which the federal government is entitled as federal tax according to Article 106, Paragraph 1, No. 2 of the Basic Law , and a mixed form of quantity tax and value tax . The legal basis is the Tobacco Tax Act .

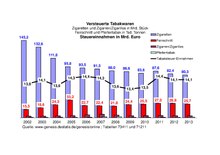

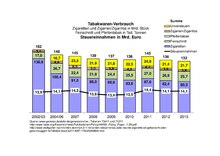

The tobacco tax has been raised several times in recent years. For example, in 2002 and 2003 the tax was increased by 1 cent per cigarette. The revenue in 2014 was 14.3 billion euros. In 1970 it was 6.5 billion euros. This makes the tobacco tax the most profitable consumption tax after the energy tax (formerly: mineral oil tax ). In 2017, the tobacco tax in Germany raised 14.4 billion euros in taxes. At 12.3 billion euros, the finished cigarette makes up the majority. In 2013, every ninth cigarette (21.7 billion pieces) was counterfeit or smuggled, with the result that the state lost 2.1 billion euros in tax revenue. The tobacco tax flows exclusively to the federal budget . In 2006, 4.2 billion euros flowed from tobacco tax to the health insurance companies, which has since been reduced.

If you buy a pack of cigarettes (19 pieces) for 5.00 euros since January 2015, a total of 3.75 euros is paid as tax (2.95 euros tobacco tax + 0.80 euros sales tax). This corresponds to a share of 75% of the purchase price. Since parts of the tax are calculated per cigarette, this tax portion is variable per pack and is up to 90% for discount cigarettes.

In 1906 about a billion cigarettes were taxed, about 1/10 of the amount in 2006.

Legal basis

The tobacco tax is levied on the basis of the Tobacco Tax Act. This regulates which products must be taxed, how they are defined and how high the respective tax rates are. The framework is provided by Council Directive 2011/64 / EU of June 21, 2011 on the structure and rates of excise duties on tobacco products, which were created to harmonize Europe-wide. To achieve this goal, there are EU-wide definitions for tobacco products, a uniform tax structure and minimum taxes.

Tax items

The tobacco tax is subject to cigars, cigarillos, cigarettes and smoking tobacco ( fine cut and pipe tobacco) as well as products equivalent to tobacco products that consist wholly or partially of substances other than tobacco ( Section 1 TabakStG).

Cigarettes are rods of tobacco that are immediately suitable for smoking and are not cigars or cigarillos as described below. Cigarettes or smoking tobacco also include products which instead of tobacco consist entirely or partially of other substances and which meet the other requirements for cigarettes or smoking tobacco (e.g. " herbal cigarettes ").

Smoking tobacco (fine cut and pipe tobacco) is cut or otherwise comminuted tobacco that is suitable for smoking without further industrial processing. Smoking tobacco is fine-cut if more than 25% of the weight of the tobacco parts are less than 1.5 millimeters long or wide, and pipe tobacco if it is intended for self-production of cigarettes.

Shisha (water pipe tobacco) is considered smoking tobacco for tax purposes .

Cigars or cigarillos are tobacco rods suitable for smoking, which consist entirely of natural tobacco or are provided with a wrapper made of natural tobacco or, if the wrapper consists of reconstituted tobacco, a piece weight of at least 2.3 grams to max. Have 10 grams.

Products that are made up of other substances instead of tobacco and that meet the other requirements (e.g. tobacco-free water pipe tobacco, herbal cigarettes) are assimilated to the above. For these products - provided they are not used for medical purposes - the tobacco tax is also levied at the same level as for tobacco products. Smoking pastes intended for shisha pipes are also taxable; they are considered smoking tobacco.

Tobacco tax amount

With the tobacco tax, the quantity is taxed. A special feature is that the value of the goods is also used to calculate the tax ( Section 3 TabakStG). To calculate the tobacco tax, the retail price is required for each pack in addition to the quantity in pieces (for cigarettes, cigars and cigarillos) or in grams (smoking tobacco). This information is printed on the control code. The retail price is determined by the manufacturer or importer as the retail price for cigars, cigarillos and cigarettes per piece and for smoking tobacco per kilogram. It must be in full euros and cents.

Tax rate from February 15, 2020 to February 14, 2021

For cigarettes and fine cut three calculations have to be made. According to a) the regular tax rate is to be calculated, according to b) and c) the minimum tax rate, which must not be fallen below:

a) The tax on cigarettes is 9.82 ct / item plus 21.69% of the retail price ( Section 2 (1) No. 1a TabakStG); for fine cut 48.49 euros per kilogram plus 14.76% of the retail price of the taxable fine cut ( Section 2 Paragraph 3 No. 1a TabakStG).

b) According to § 2 (2) (cigarettes) and 3 (fine cut) TabakStG, the total tax burden plus sales tax is to be determined on the weighted average retail price minus sales tax of the retail price of the taxable goods. The weighted average retail selling price is published annually in the Federal Gazette . From February 15, 2020 to February 14, 2021, it is 30.1491 cents per cigarette or 152.2906 euros per kilogram of fine cut. The resulting total tax burden due to tobacco tax and sales tax (threshold value for the minimum tax calculation) is 21.172 cents per cigarette or 95.283 euros per kilogram of fine cut.

c) Furthermore, the minimum tax according to § 2 Paragraph 1 No. 1 g (cigarettes) and Paragraph 3 No. 1 g (fine cut) TabakStG must be taken into account. For cigarettes, the result of the calculation is: "19.636 cents per item less sales tax on the retail price of the taxable cigarette" during the period of validity is always lower than the minimum tax rate mentioned in b) (21.172> 19.636). It is the same with fine cut (95.233> 95.04).

The minimum tax for cigars, cigarillos and smoking tobacco results from the individual paragraphs of the tax rate (see calculation example). The minimum tax applies to low-priced products and is adjusted regularly.

Calculation example

If you take a pack of 20 cigarettes at 6.50 euros, you get the following calculation:

20 pieces * 0.0982 euros + 6.50 euros * 21.69% = 1.9640 euros + 1.4099 euros = 3.3739 euros tobacco tax. In addition, the minimum tax must now be checked: The value listed under b) of 20 pieces * 0.21172 euros - 6.50 euros * 19% / 119 = 4.2344 euros - 1.0378 euros = 3.1966 euros. The standard tax rate listed first of 3.3739 euros applies.

The piece-related tax portion applies up to a length of the tobacco rod of eight centimeters. For tobacco rods with a length of more than eight centimeters, the piece-related tax portion is levied for every three centimeters started beyond that.

For pipe tobacco , 15.66 euros per kilogram and 13.13 percent of the retail price, at least 22 euros per kilogram, are due.

For cigars or cigarillos , the tax is 1.4 cents per item and 1.47 percent of the retail price, at least 5.760 cents per item less the sales tax on the retail price of the taxable cigar or cigarillo.

Tax increases from 2002 to 2015

After tobacco tax increases in 2002 and 2003 to finance counter-terrorism measures and three increases in 2004 and 2005 to financially support health insurance funds, a further five tobacco tax increases were decided in 2010. These took place on May 1, 2011, January 1, 2012, January 1, 2013, January 1, 2014 and January 1, 2015. The tariffs can be found in Section 2 TabStG.

Tax origination

The aim of excise duty is to tax the consumption of excise goods. For reasons of simplification, however, the point in time of consumption by the individual consumer is not taken into account, but rather the point in time of entry into the economic cycle in the German tax area ( Section 15 TabakStG). There are tax warehouses , which are approved by the competent main customs office, where goods subject to excise duty may be manufactured, processed or processed, stored, received or dispatched under tax suspension. The tax arises when the goods are removed from the tax warehouse.

Control characters

In contrast to other types of consumption tax, tobacco tax is paid by using German tax characters (also known colloquially as "banderoles") ( Section 17 TabakStG). "Use" means the application of the control characters to the retail packages; they are to be affixed in such a way that the tobacco products cannot be removed without visible damage to the tax code or the package and the control code cannot be removed undamaged. The manufacturer or the importer has to order the tax characters according to the officially prescribed form and to calculate the tax character liability himself. The tax character debt then arises with the purchase of the tax characters in the amount of their tax value. In simplified terms, the process can be imagined as buying postage stamps: The value of the “tax stamps” bought corresponds to the tobacco tax.

Development, objectives and effects of the tobacco tax

The collection of a tobacco tax also has a very long tradition in Germany. The idea of taxing tobacco consumption goes back to King James I of England (1566–1625), who initiated the introduction of a tobacco tax of 2 pence per pound of tobacco. In Germany, the city of "Cölln" has been levying a kind of tax since 1638, in which six thalers had to be paid for every 15 quintals of tobacco leaf imported

In 1819 Prussia paid the tobacco manufacturers one thaler (three marks) per hundredweight of raw tobacco. In the following decades these taxes gradually rose to 45 marks. In 1906, the Prussian finance minister Johannes von Miguel discovered how smokers can be charged directly and introduced the "banderole tax" that is still common today in the German Empire. This was initially 0.15 pfennigs each for cheap cigarettes and 0.5 pfennigs for more expensive five-pfennig cigarettes. In the following 20 years this tax was increased to 1.28 pfennigs or 2.32 pfennigs per cigarette. Even after 1948 it was increased further. In 1953, a 7.5-pfennig cigarette earned 4.15 pfennigs and a ten-pfennig cigarette 5.7 pfennigs taxes. In 1967 the then CDU / SPD government increased the tax rate by around ten percent. In 1972 a further increase followed to relieve the federal treasury by ten billion marks.

On June 1, 1982, the tobacco tax on factory cigarettes was increased by 39 percent. That was the strongest increase since the tax came into existence. According to the calculations of the Federal Ministry of Finance, the increase should bring 1.4 billion marks more revenue in the first year. In fact, there was a shortfall of around 450 million marks because consumers of branded cigarettes were not prepared to pay that much more tax. Sales fell suddenly in June, July and August compared to the previous year by almost 30 percent. A new market with low-cost brands arose from discounters and grocery chains. They developed their own brands such as “Die Weißen” with above-average nicotine and condensate values. These "no-name" products already made up seven percent of the factory cigarette business in October 1982. The trade along the Dutch, Belgian and Luxembourg borders suffered sales losses of up to 50 percent because cigarettes were now significantly cheaper in neighboring countries. In travel, German citizens bought nine billion cigarettes, twice as many as before the tax increase. Another winner was fine-cut tobacco, whose sales volume rose by 50 percent despite the 150 percent tax increase. Der Spiegel therefore assessed the consequences of the tax hike negatively in terms of fiscal and health policy.

On January 1, 1992, after several minor adjustments, there was another tax increase. The finance minister hoped for additional income of 1.6 billion marks from the increase. However, this hit the lower-income smokers from East Germany particularly hard. Therefore, this time too, consumers switched to cheap brands and hand-rolled cigarettes. The increase also brought about market innovation in the form of “rolls”. These were cigarettes that were made by putting together pre-rolled tobacco and casing including filters, but had a significantly lower tax burden than finished cigarettes. At the same time, the price increases led consumers to stock up on legal and illegal imported goods from neighboring countries. Tax revenue fell and did not return to the level before the tax hike until 1994.

On January 1, 2002 and January 1, 2003, the tobacco tax was increased again in order to support the Bundeswehr in the fight against terrorism with the additional income. On March 1, 2004, December 1, 2004 and September 1, 2005, further increases were made to finance parts of the health reform. However, the politicians' expectations of increasing revenues were initially not fulfilled. According to a study by the Hamburg World Economic Institute (HWWI), the proportion of untaxed cigarettes rose from 16 to 20 percent in 2008. This corresponded to around 23 billion cigarettes that were not taxed in Germany and accounted for around four billion euros in tax losses every year.

According to a situation report by the customs authorities on cigarette smuggling, the increase in the tobacco tax had hardly any positive effects. Higher taxes do not associate smokers with “health-political or fiscal reasons”, but they would “make an even more conscious decision to switch to illegal cigarettes”. The great demand ensures a higher supply, easier availability and undermines efforts to make it difficult for children and young people to have access to tobacco. Since contraband is produced without state quality control, it is more harmful to health. The tobacco tax increase also makes no sense for fiscal reasons, because despite further increases, the state received around 300 million euros less tobacco tax in 2010 than in 2002. Sales of taxed cigarettes fell between 2003 and 2009 from around 133 to 87 billion pieces. The difference of around 46 billion cigarettes is largely offset by illegal goods.

From 2011 to 2015 the tobacco tax was further increased in five steps in order to finance tax simplifications and to relieve energy-intensive companies from the ecological tax . The tax increases were justified with declining tobacco tax revenues. A reversal of this trend was not expected in the medium term because of the declining sales of taxed tobacco products. The reason for this was the consistently high level of untaxed cigarettes due to smuggling and legal border purchases. Other reasons were shifts in favor of tobacco products with lower taxes, as well as abstinence from consumption and smoking bans.

To reverse the downward tax trend, tax increases were decided on May 1, 2011, January 1, 2012, January 1, 2013, January 1, 2014 and January 1, 2015. The tax increase was designed in such a way that the tax burden on fine cut increases more than the tax burden on cigarettes. In the case of Feinschnitt, a change was also made to the minimum tax, which leads to a disproportionate tax burden at lower price levels. These measures reduce the price spread in the fine cut area and at the same time reduce the price gap between fine cut and cigarettes. Consumers' evasive movements from cigarettes to cheap fine-cut products are therefore less attractive. The aforementioned measures were flanked by the introduction of a minimum tax on cigars and cigarillos. This is to prevent the price gap between cigarettes and fine cut to the very cheap cigars and cigarillos from becoming too great. A minimum tax was also introduced for pipe tobacco in order to comply with the EU-wide minimum tax for all price ranges in the pipe tobacco sector. The tax increases are intended to prevent consumers from turning increasingly to smuggling and legal border purchases and from counteracting the increases in minimum taxes achieved at the level of the European Union, which are intended to reduce the price gap between the individual member states. At the same time, the tax increases lead to a stabilization and an increase in income and thus contribute to the consolidation of the federal budget.

The problem of cigarette smuggling and organized crime emerged as part of the tax increases from 2002 to 2005. According to Focus Online, 21.7 billion cigarettes were not taxed in 2013, which corresponds to a tax loss of 4 billion euros.

Health policy

The tobacco tax is the subject of ambiguity. While the Ministry of Health sees the tobacco tax as a so-called steering tax , which is supposed to bring about a reduction in tobacco consumption, the Ministry of Finance has an interest in the highest possible tax revenue to cover the state budget.

In the Federal Republic of Germany, the increase in tobacco tax, together with increased information for smokers and increasing smoking bans in workplaces, appears to be successful. The tobacco consumption fell sharply and many smokers stopped smoking on. A causal connection, however, cannot be proven.

The presumption of a steering effect of the tobacco tax increase is also controversial: Critics argue that the decline in tax revenue after a tax increase may not indicate reduced tobacco consumption, but merely an increased relocation of the acquisition of tobacco products to neighboring countries bordering Germany, some of which are considerably lower Prices, especially in Poland and the Czech Republic, in the form of personal 'own imports' within the scope of the quantities permitted by customs law and in the enormously lucrative cigarette smuggling. Denmark, Norway and Sweden are also struggling with this problem, as the tobacco tax there is still significantly higher.

On the other hand, in the course of the tobacco tax increases, the smoking rate among 12 to 17 year olds fell from 28 percent in 2000 to 7.8 percent in 2015.

Protection of minors

According to the 2016 drug affinity study by the Federal Government's Drug Commissioner, 7.8 percent of young people between the ages of 12 and 17 currently smoke. The quota of smokers in this age group is at the lowest level of all studies that the BZgA has carried out since the 1970s. At the same time, the number of young people who have never smoked in their lives continued to rise and is now at its highest level at 79.1 percent. The smoking rate among 18 to 25-year-olds is also higher at 26.2 percent declining, while the never-smoking quota rose to 38.8 percent.

Comparison of tax revenues and social costs

There is controversy about how much of the tobacco tax collected is left after the financial losses suffered by the state from the damage caused by smoking.

Prohibitions

The following are prohibited or restricted for trading:

- the sale of cigarettes by the piece (the sale of cigars and cigarillos by the piece is permitted under certain conditions) ( Section 25 TabStG);

- exceeding or falling below the retail price (fixed price; this does not apply to the free delivery as samples or for advertising purposes, § § 26 to § 28 TabStG; the retail price is determined by the manufacturer, § 3 TabStG);

- commercial display of tobacco products ( Section 29 TabStG);

- Coupled sale (no other goods may be added, § 24 and § 26 TabStG).

See also

Web links

- Federal Statistical Office (Destatis): Tobacco tax statistics ( Memento from October 12, 2018 in the Internet Archive )

- Tobacco Tax Act in the version applicable from April 1, 2010

- Tobacco Tax Ordinance in the version applicable from April 1, 2010

- Zoll.de with information on tobacco tax

Individual evidence

- ↑ Ulrike Fokken, Carsten Germis : Combating Terror: Higher Taxes for More Security Der Tagesspiegel, September 19, 2001

- ↑ Federal Statistical Office Statistics on Tax Revenue, Table 1.3 ( Memento from September 7, 2018 in the Internet Archive )

- ↑ Federal Statistical Office ( Memento from April 25, 2016 in the Internet Archive )

- ↑ Tax revenue by type of tax in the years 2014–2017. (PDF; 81 kB) In: https://www.bundesfinanzministerium.de/ . Federal Ministry of Finance, August 28, 2018, p. 2 , accessed October 8, 2018 .

- ↑ Markus Grabitz: Every ninth cigarette is counterfeit or smuggled. In: Stuttgarter Nachrichten. August 22, 2014, accessed April 14, 2019 .

- ↑ https://www.zoll.de/DE/Fachthemen/Steuern/Verbrauchsteuern/Alkohol-Tabakwaren-Kaffee/Steuerartikel-Besonderheiten-Wein/Tabak/tabak_node.html Customs online equivalent products accessed on May 16, 2020

- ↑ https://www.zoll.de/SharedDocs/Fachmektiven/Aktuelle-Einzelmmeldung/2020/vst_rauchpaste.html Zoll Online Rauchpaste accessed on May 16, 2020

- ^ Pipe tobacco: The tobacco tax and customs ( Memento of August 4, 2012 in the Internet Archive ) In: Comprehensive information on the consumption of tobacco. Compiled by the participants of the newsgroup de.alt.fan.tabak and other authors. www.daft.de

- ↑ STEERING: Truck used . In: Der Spiegel . No. 39 , 1971, p. 74 ( online - 20 September 1971 ).

- ↑ tobacco tax: Fancy Lomita . In: Der Spiegel . No. 52 , 1982, pp. 36 f . ( online - December 27, 1982 ).

- ↑ Judith Reicherzer: Bonn wants to increase the tobacco tax: Smoking for Waigel . In: The time . No. 11/1991 , March 8, 1991 ( online ).

- ↑ http://www.hwwi.org/fileadmin/hwwi/Publikationen/Policy/HWWI_Policy_Paper_1-28.pdf

- ↑ Thomas Öchsner: Money that goes up in smoke. In: sueddeutsche.de. October 26, 2010, accessed June 23, 2018 .

- ↑ TOBACCO TAX: Long gone . In: Der Spiegel . No. 32 , 2011, p. 14 ( online - August 8, 2011 ).

- ↑ http://dipbt.bundestag.de/dip21/btd/17/040/1704052.pdf

- ↑ Mafia: These factories produce illegal cigarettes - video. In: Focus Online . May 17, 2014, accessed October 14, 2018 .

- ↑ a b Smoking rate among adolescents: Declining drug consumption among young people ( Memento from April 17, 2016 in the Internet Archive )