Operational accounting sheet

The operating accounting sheet is a tool that is used in the context of cost and performance accounting , especially in small and medium-sized companies . It is a subsequent cost control calculation in the form of a tabular cost center calculation . The BAB is used to distribute certain types of costs - primarily overhead costs - across the cost areas to the individual cost centers . A cost center in the sense of the BAB describes a "consumption point" of the costs. For example, general costs such as rent, electricity or administration costs are actually used proportionally by all cost centers.

overview

A tabular structured form is used for internal accounting , nowadays mostly within a spreadsheet software. In this table, the individual types of costs (heating, electricity, management costs, etc.) are listed in rows with the values incurred. The individual cost centers are listed in columns. The costs per cost type are now usually distributed with an allocation key in each line to the cost centers that caused the corresponding costs. It is important to ensure that the costs can be clearly assigned to the person who caused them. This may happen in several stages. A typical example of this is the allocation of overhead costs to a generally available cost center. The administration of a company, for example, has its own electricity consumption, which is included in the administration costs. The administration in turn serves the cost centers of manufacturing, sales, etc. Thus, the administrative costs must be assigned to sales, manufacturing, etc. At the end, the costs of each cost center are added up.

Cost areas or cost centers

Main cost centers

- Manufacturing : construction, parts manufacturing, assembly , final inspection

- Material: procurement, material testing, storage

- Distribution: sales, agent commission , advertising

- Administration: Directorate (= management), accounting, human resources , organization

Auxiliary cost centers

- the costs are not charged directly to the cost units, but rather allocated to the cost centers using the allocation key.

General cost center

- General cost centers (overhead costs caused by the entire operation)

- Energy supply, vehicle fleet, company canteen, etc.

- Auxiliary cost centers (overhead costs that are only caused by sub-areas, e.g. production)

- IT service, maintenance, medical service, security guards, in-house repair service, production preparations, etc.

tasks

- Billing of overheads

- Formation of cost rates

- Actual cost recording

- Standard cost recording (based on the past)

- Overview of costs incurred; enables cost control

- Preparation for any calculations

Extended and multi-level company accounting sheet

In the case of an extended operating accounting sheet, overhead costs can be distributed to the respective cost objects with the help of distribution keys. The overriding goal here is to show all direct costs and overhead costs of a billing period both as a whole and according to individual cost objects.

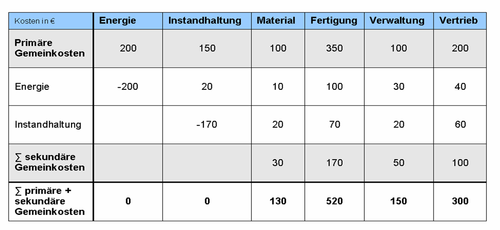

Example of a multi-level or extended company accounting sheet based on the step-ladder procedure:

| Art | Cost in euros |

Distribution key |

|---|---|---|

| Raw materials and supplies | 120,000 | 1: 2: 3: 2: 0: 0: 0 |

| wages | 640,000 | 1: 3: 8: 7: 4: 6: 3 |

| Social security contributions | 60,000 | 3: 4: 3: 4: 2: 10: 4 |

| Depreciation (depreciation for wear and tear ) | 250,000 | 1: 5: 6: 7: 2: 1: 3 |

| Taxes | 51,000 | 1: 2: 2: 3: 2: 3: 4 |

| Rent | 72,000 | 0: 0: 5: 7: 1: 3: 2 |

| maintenance | 36,000 | 4: 2: 7: 2: 1: 0: 2 |

| General cost center | 62,000 | 6: 12: 8: 4: 6: 4 |

| Manufacturing locations A and B | 6: 4 |

| Costs in thousands of euros | |||||||

| Overhead | general cost center | Production aid | Manufacturing sites | Material location | Administrator position | Representative office | |

| A. | B. | ||||||

| Auxiliary materials and supplies 120 | 15th | 30th | 45 | 30th | 0 | 0 | 0 |

| Salaries 640 | 20th | 60 | 160 | 140 | 80 | 120 | 60 |

| Social security 60 | 6th | 8th | 6th | 8th | 4th | 20th | 8th |

| Depreciation 250 | 10 | 50 | 60 | 70 | 20th | 10 | 30th |

| Taxes 51 | 3 | 6th | 6th | 9 | 6th | 9 | 12 |

| Rent 72 | 0 | 0 | 20th | 28 | 4th | 12 | 8th |

| Maintenance 36 | 8th | 4th | 14th | 4th | 2 | 0 | 4th |

| Total 1229 | Total 62 | Total 158 | Total 311 | Total 289 | Total 116 | Sum 171 | Total 122 |

| > | 9.3 | 18.6 | 12.4 | 6.2 | 9.3 | 6.2 | |

| Total 167.3 | 100.38 | 66.92 | - | - | - | ||

| Sums from results of the insurance providers | |||||||

| 1229 | 0 | 0 | 429.98 | 368.32 | 122.2 | 180.3 | 128.2 |

Web links

- Video: Editing a company accounting sheet and calculating the overhead surcharge rates . Jakob Günter Lauth (SciFox) 2013, made available by the Technical Information Library (TIB), doi : 10.5446 / 17892 .