Dollarization

Dollarization is the introduction of the US dollar as a substitute for the national currency of a state , i.e. a case of currency substitution in which the dollar is recognized as a means of payment and transaction as well as for the store of value within the national territory. A distinction must be made between informal and official dollarization .

Reasons for dollarization

There are three main reasons for dollarization to occur. First, colonization , second, when a country introduces this medium independently, and third, as a means of fighting a crisis.

Dollarization in itself is not a new phenomenon. At the turn of the millennium, globalization , tariff dismantling , freedom of capital and the increase in international trade volumes contributed to the development of the capital markets and to the actual dollarization. There is also debate in academia about how globalization is forcing small economies to give up their monetary policies.

The trilemma of the exchange rate regime is that free capital flows, a fixed exchange rate and an independent monetary policy are incompatible. This is now applicable to Ecuador, for example.

Developing countries' access to foreign loans , which have to take out their debts in foreign currencies, is a specialty . According to Tobias Roy , the fact that developing or highly indebted countries cannot borrow in their own currency provides the explanation for dollarization. Countries with persistent current account deficits are also vulnerable to dollarization. He also explains that developing country currencies are usually overvalued due to high levels of debt. In particular, the term "dollarization" was not coined until the 1990s, due to the increasing number of countries that replaced their legal tender with other currencies (especially the US dollar). The number of countries whose investments in foreign currency account for more than 30% of the total investments increased from 7 in 1990 to 46 countries in 2000.

The concept of dollarization includes different forms of dollarization. In the literature, dollarization is divided into two phenomena. Dollarization is considered currency substitution or "currency substitutability" and asset substitution or "asset substitutability". So there are different definitions of dollarization. It can also be explained as a substitution of assets and substitution of currency. Asset substitution takes into account profitability and risk. This happens when a foreign currency is used as a store of value. Currency substitution also occurs when individuals prefer a currency other than the local currency as a means of payment for their transactions.

A dollarization occurs primarily when political instability and hyper inflation prevail. Dollarization is a result of long-term monetary policy mismanagement. In addition, the term "dollarization" is defined by Andrew Berg and Eduardo Borensztein as follows: "as the holding by residents of foreign currency and foreign currency-denominated deposits at domestic banks". This phenomenon is particularly noticeable in Latin America and other transition economies.

The devaluation as monetary policy can be seen as a lack of functionality of the decision-making system. Long-term use of such a policy is not justified because: “If a government is in possession of a devaluation option, those who own money issued by the government face the prospect of having their property rights confiscated in an arbitrary, ad hoc manner via devaluations. Accordingly, governments that fail to protect the value of their money are guilty of not abiding by the rule of law. "

In addition, it is to be expected that a dollarization process will take place under such conditions. Calvo and Vegh understand a dollarization process when a foreign hard currency assumes the three most important functions of money: currency, store of value and value measurement function. As a result, the country is replacing the weak or barely existing domestic “Rule of Law” with a stronger foreign one. According to Milton Friedman , Robert Mundell and Friedrich von Hayek , dollarization is then justified because it stabilizes the expectations of economic actors.

This picture was particularly repeated in developing countries , which had difficulty determining the exchange rate and experienced high inflation rates. Dollarization is an irreversible phenomenon when it is derived as a result of the choices made by individuals.

Dollarization can occur in a floating exchange rate when the risk of currency depreciation is very high. The historical developments of devaluations or revaluations also contribute to dollarization. One should also take into account that a fixed exchange rate also entails a certain risk, namely when the value of a currency with its fixed exchange rate no longer corresponds to the macroeconomic fundamentals. When the currency is in need of adjustment, the need arises among individuals to replace the currency.

The main elements that facilitate dollarization are described by Naranjo as follows: “The facts that explain dollarization, especially in Latin America, are macroeconomic instability, low development of financial markets, loss of credibility of the stabilization program, globalization of the economy, high Past inflation rates and the institutional aspects. ”Dollarization is a long-term process in which people lose confidence in the state. They question the state's ability to meet its obligations. These are states in which attempts are made to correct the imbalances in the national balance sheets through inflation and money creation.

In addition, a dual currency system is being created . This means that two different currencies take over the money functions within a country. The banks offer two different interest rates; one interest rate in local currency and the other in foreign currency. Due to the risk of inflation and the resulting depreciation of the local currency, the interest rate of the depreciated currency must hedge this depreciation. That is, it consists of the foreign currency interest rate plus the expected inflation rate. As a result of dollarization, a country renounces its monetary independence and is therefore forced to adopt foreign monetary policy - in this case the US.

Informal Dollarization and Its Consequences

As mentioned above, dollarization needs a consolidation phase before it can even be recognized as such. In addition, a distinction is made between official and unofficial dollarization. The latter is also known as semi- or informal dollarization. In general, dollarization occurs when a population has lost confidence in their own currency.

Schuler defines informal dollarization when: “… residents of a country extensively use the US dollar or another foreign currency alongside or instead of the domestic currency. Unofficial dollarization occurs when individuals hold foreign currency bank deposits or notes (paper money) to protect against high inflation in the domestic currency. Official dollarization occurs when a government adopts foreign currency as the predominant or exclusive legal tender. "

Fischer writes that informal dollarization “… is the result of a period of economic instability in the past, generally a period of high inflation. In such circumstances, economic agents will want to hold safer assets, and the economic and political systems will produce them. That can be done by allowing the banking system to offer foreign currency, or exchange-rate-linked, accounts; and the banking system in turn will want to lend in a similar form. "

The process of informal dollarization also has different stages of development: first, the assets are substituted, and the foreign currency takes over the function of storing value. The economic representatives choose foreign bonds or move their savings abroad. This is also known as capital flight. In a second phase, the foreign currency takes over the payment and exchange function. That means that the foreign currency is mainly traded. The third phase occurs when the prices of various goods or services, such as a house, car, or television, or renting an office, are shown in US dollars. These three phases do not necessarily have to be consecutive, they can also appear together.

According to Naranjo, there are two major drawbacks to informal dollarization. First, the loss of control over money, and second, the increasing pressure on the exchange rate. Informal dollarization makes the demand for money within the business community unstable and difficult to control. In this way, the US dollar becomes part of the money in circulation that cannot be precisely regulated. The amount of money is difficult to determine. In countries of the Andean Community, informal dollarization reaches around 80% to 90%.

In principle, as the demand for the US dollar increases, its value increases. As a result, the national currency is devalued. In addition, incomes or wages in local currency are also reduced because purchasing power decreases.

Ultimately, the weaker social classes are most affected, as their low incomes offer no protection from inflation and devaluation. Other groups in society also suffer losses, but the consequences are not so serious for them because they have more resources. High inflation slows down investment and production offers. That means projects are delayed or not carried out at all. Therefore there is further unemployment . It should also be mentioned that through the semi-dollarization, the profit made by the state through the coinage or seignorage shrinks, because the demand for money in local currency also decreases.

To avoid an unexpected devaluation of a currency, central banks can, for example, raise interest rates. This largely prevents the pressure of devaluation. However, this instrument cannot always be used, because credibility plays an important role. For example, it can lead to a vicious circle: inflation leads to devaluation, and this also promotes inflation. In such scenarios, speculation increases and dollarization is now intensified. The exchange rate is destabilizing. The large fluctuations in the exchange rate make loans in foreign currency more expensive and increase the real cost of national loans. The distortions lead to economic chaos.

It is questionable whether a country's economy can withstand such a process in the long term. The financial system can collapse. Banks need to take more risk to mitigate the depreciation of local currency assets. In the end, when the economy is in critical condition, the state must take over the financial apparatus to prevent the chaos from spreading. This is done, for example, through the intervention of the central bank as the lender of last resort . After government intervention, an alternative must be found. Usually a currency reform then takes place.

Official dollarization

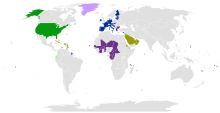

Dollarization is only official when the state officially recognizes the foreign currency as legal tender. That is, when the foreign currency takes over the one hundred percent role of money. The difference to informal dollarization are the framework conditions and instruments that the state has at its disposal. Today, Panama , Ecuador and El Salvador are among the only Latin American countries that have introduced the US dollar as a currency substitute.

An economy that introduces a foreign currency as legal tender functions similarly to the gold standard before the First World War in 1913 , with the so-called “price-specie flow mechanism”. According to David Hume, this system requires a combination of political guidelines and flexibility in prices and wages. Keynes said lowering wages is a very unpopular policy in modern economics. Lowering wages is not intended to be a solution to correcting the exchange rate. Fiscal deficits should not be balanced by a local currency devaluation. Central bank policy should not be characterized by more money making. This is not a long-term solution. For this reason the economy has to be solvent. Official dollarization is also easier to analyze than informal.

The official dollarization is based on four pillars: The currency is completely exchanged for the US dollar; the money supply is expressed in US dollars (the state needs sufficient foreign currency reserves for this). There is a free movement of capital. Funds can flow into and out of the country without great government intervention. The central bank is losing its role as the lender of last resort .

Compared to informal dollarization, official dollarization offers certain advantages:

First, the exchange rate risk disappears. External shocks will only be a burden for the affected sector and not, as before, for the entire economy. In addition, the entire economy becomes more transparent. Investors can plan long-term investments without having to pay special attention to the depreciation of their money. Second, inflation rates are the same as in North America. That means that inflation must remain in the single digits. This goal was achieved in Ecuador. Third, by reducing inflation, interest rates will reach international levels.

Another advantage of dollarization is the world integration of the economy in the financial markets through, for example, lower transaction costs and more transparency:

“Financial integration plus official dollarization give banks a worldwide field in which to make loans in dollars. Consequently, the location of loans is not closely linked to the location of deposits. The ability to switch dollar funds without currency risk between the domestic economy and the rest of the world tends to minimize the booms and busts that often arise in countries having independent monetary policies and financial systems not well integrated into the world system. "

For the state, dollarization means financial discipline. The fiscal deficits can no longer be financed through inflation or currency devaluation, but only through targeted taxes or government bonds.

In a dollarized economy, the money supply is not determined by the government or the central bank , but only by the demand for money. In addition, political instability cannot directly affect the exchange rate. As a disadvantage of dollarization de jure, the country foregoes its own currency policy. The economy adapts to external shocks from product markets with the help of the financial system instead of adjusting the exchange rate.

Minda sums up the most important advantages of an official dollarization: monetary credibility and falling interest rates, economic stability and lowering of inflation, world and trade integration, integration of the internal financial system, fiscal and budgetary discipline, stability of the political regime. Disadvantages are: renouncing an independent monetary policy, renouncing a devaluation strategy, loss of seigniorage and loss of the lender of last resort.

De-dollarization

The dominant role of the dollar in international monetary transactions is encountering resistance in some countries. In addition to efforts by the euro countries and China, for example, to break the hegemony with their own currency, less powerful countries and regions are sometimes trying to reduce the importance of the dollar in their areas of power. For example, in Latin America, where the dollar is still used in many places to pay larger amounts (e.g. buying cars and real estate), some governments have made greater efforts to promote the use of their own currency and also the volume of credit denominated in dollars to lower. For example, Bolivia's government under President Evo Morales (Spanish: desdolarización ) since 2006 has been particularly successful . Today , the dollar is practically irrelevant for consumer credit (previously almost 100%) and for savings accounts the share has been reduced from over 90% to below 20% .

Literature and individual references

- Marco P. Naranjo Chiriboga: Dolarización oficial y regímenes monetarios en el Ecuador. Colegio de Economistas de Pichincha, Quito 2005, ISBN 9978-44-628-1 .

- Tobias Roy: Causes and Effects of the Dollarization of Developing Countries. An explanatory approach with special consideration of Bolivia. Metropolis-Verlag, Marburg 2000, ISBN 3-89518-314-8 , ( Studies on Monetary Economy 26), (At the same time: Berlin, Freie Univ., Diss.).

- Željko Bogetić: Full dollarization: fad or future? In: Challenge. Vol. 43, 2, 2000, ISSN 0577-5132 , pp. 17-48.

- ↑ Yilmaz 2006: 12

- ^ Andrew Berg and Eduardo Borensztein: The pros and cons of full dollarization . International Monetary Fund, 2000. p. 3

- ↑ Hanke 2003: 133

- ↑ Hanke 2003: 135

- ↑ Kurt Schuler: 2000: 15

- ↑ Stanley Fischer: Dollarization . 2006: 3

- ^ Aramburú in Comunidad Andina 2001: 59

- ↑ Solimano 2002: 11

- ↑ a b Željko Bogetić: Official dollarization: current experiences and issues . In: The Cato journal , Vol. 20, 2, 2000, ISSN 0273-3072 , p. 189

- ↑ Alexandre Minda: Full Dollarization: a last resort solution to financial instability in emerging countries? In: The European journal of development research. Vol. 17, 2, 2005, ISSN 0957-8811 , pp. 289-316

- ↑ [1] IMF Presentation on Desdolarización in Bolivia and the World (Spanish), July 18, 2018, accessed on September 4, 2019