Export subsidy

Export subsidies are state services for goods exports in order to make otherwise non-competitive goods competitive on the world market . It is a foreign trade instrument . In connection with the EU's export subsidies , one speaks of export subsidies or export refunds .

Alternative definition

Export subsidies are government grants to local companies or individuals who deliver goods abroad. The aim is to enable cheaper exports. This enables exporters to be more competitive with their competitors in the export markets. Such grants are often linked to the economic policy goal of stimulating or maintaining domestic production and employment. Such subsidies violate the international competition rules of the GATT (General Agreement on Tariffs and Trade).

The term export refund denotes an export subsidy for certain agricultural goods within the framework of EU market regulation law .

Effects of an export subsidy on the terms of trade

Certain behavior patterns have been observed in which states have a preference for domestic goods. The US spends about 90 percent of its income on domestic goods and only about 10 percent on imports. Such behavior is also caused by trade barriers. The two main artificial barriers to trade are import tariffs and export subsidies. The decisive factor is that they create a difference between the domestic market price (internal prices, internal prices) and the price at which goods are traded on the world market (external prices, external prices). Thus, the terms of trade must be carefully defined . The terms of trade measure the rate at which the home country can exchange goods with the foreign country. They are therefore measured according to the outside - not according to the internal prices. Therefore, the analysis of export subsidies is concerned with the effect of relative supply as a function of external prices.

Subsidies are often equated with tariffs as a similar policy measure because both help domestic producers. However, both instruments have opposite effects on the terms of trade. Let us assume that the home country pays a subsidy of 30 percent on textile exports. This increases the relative price of clothing compared to food in Germany by 30 percent. This prompts domestic producers to produce more textiles and less food.

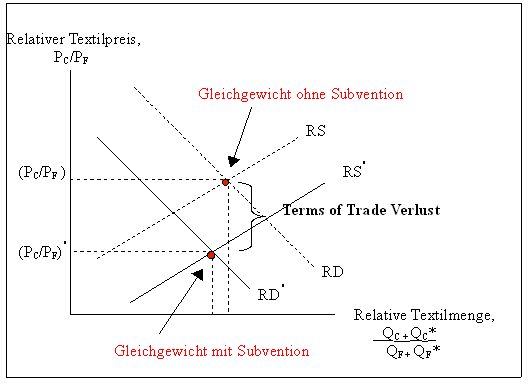

The figure shows that a subsidy increases the relative world supply of clothing (from RS to RS ') and decreases the relative world demand for clothing (from RD to RD'). An export subsidy thus worsens the domestic terms of trade and improves those abroad.

Theory of an Export Subsidy

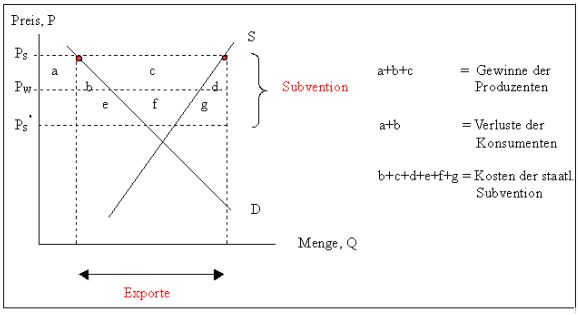

With an export subsidy made available by the state, the suppliers export the goods until their domestic price exceeds the foreign price. A subsidy can be determined either by quantity or by value. The following figure illustrates the effects of an export subsidy.

In the exporting country the price rises from PW to HP and in the importing country it falls from PW to HP '. The price increase is therefore less than the subsidy. Consumers are worse off in the exporting country, while producers win and the state is clearly the loser because it has to pay for the subsidy. An export subsidy shows that it creates a loss of welfare (area b + d + e + f + g) and that the costs for the consumers far exceed the benefits.

International regulations

A number of international agreements limit the ability of states to grant export subsidies. Above all, GATT should be mentioned here. The Uruguay Round led to a significant reduction in export subsidies.

Export subsidies in the EU

The export promotion policy in the field of foreign trade has become part of the common commercial policy within the framework of Art. 133 EC, after the member states failed to comply with their obligation to standardize the export aid systems from the EC Treaty in the transitional period (until 1970). The EU's export refunds are the central instrument of export subsidies.

The agricultural policy of the European Union

A highly controversial topic (see the catchphrase agricultural dumping ) is the common agricultural policy of the European Union (GAP) (see agricultural market organization ). Today's EU is of great importance in terms of trade policy. On the one hand it has abolished all customs barriers and on the other hand it has grown into an enormous export subsidy project in the field of agriculture. This project arose after the 1970s, because the minimum prices set in Brussels meant that more agricultural products were produced than consumers were willing to buy. Thus the EC bought large quantities of food and so that the storage quantities were not too high, it subsidized the export of these goods.

The following figure shows that the minimum price is above the world market price and above the price that would result from supply and demand without imports. An export subsidy is granted so that the generated surplus is exported. This balances out the difference between the European and the world market price. However, the subsidized exports have a negative effect on the world price and subsidies rise again.

Scope and reimbursement

The payment of the export refunds is made by the member countries and their authorities specified in their export refund regulations. In Germany this is the customs administration or the main customs office in Hamburg-Jonas.

In 2009, this main customs office paid export refunds in the amount of € 51,939,437. Milk and milk products accounted for around € 20.7 million.

As part of the reforms of the EU's common agricultural policy , export refunds for agricultural products were completely abolished by 2014.

Export subsidies for sugar

Another key element of the subsidies is the European sugar market regime . Today, however, the sugar regime can no longer survive without export subsidies. In the years 2004/05 the production quotas fell and there were important reforms in this area. The sugar factories have been restructured as sugar production in the EU has been reduced. A price support of 36 percent was also granted in a phase of over 4 years. Farmers received a compensation payment of 64.2 percent of the price cut. Funds were sold to weed out production shares. The EU Agriculture Commissioner Franz Fischler (1995-2004) has agreed to abolish all export subsidies by 2013 in order to reduce these enormous costs. Nevertheless, European protection for the sugar market is high. The import tariff is to be reduced to 36 percent, but is still at a considerable level. There is an “ Everything but Arms ” agreement so that developing countries (especially the ACP countries (Africa, Caribbean, Pacific)) can gain a competitive advantage in trade with the EU and other developing countries ( e.g. Brazil, the world's largest sugar exporter) with the European Union. They receive a duty-free allowance and by lowering import duties, the subsidies from existing trade preferences for the ACP countries are reduced.

Human rights activists criticize the fact that this agreement in Cambodia resulted in sugar companies driving small farmers off their land.

other industries

Other areas would be food exports such as beef, pork or poultry. Other sectors are shipbuilding, the steel industry and high-tech areas (examples are microelectronics, genetic engineering or communication technologies)

In the USA

There are also extensive export subsidies in the USA, especially for agricultural products. The most important export subsidy program in the USA is the Export Enhancement Program (EEP) and the Dairy Export Incentive Program (DEIP) with a volume of over one billion US dollars.

literature

- Mike Artis, Frederick Nixson (Eds.): The Economics of the European Union. 4th edition. Oxford Univ. Press 2007. ISBN 0-19-929896-3

- Hans Hinrich Glismann (and others): Foreign trade and currency policy (= Weltwirtschaftslehre , Vol. 1). 4th edition. Vandenhoeck and Ruprecht, Göttingen 1992. ISBN 3-8252-1424-9 (UTB)

- Paul Krugman , Maurice Obstfeld, Marc Melitz: International Economy. Theory and Politics of Foreign Trade. 10th edition. Pearson, Hallbergmoos 2015.

- Klaus-Dieter Schroth: The little lexicon of foreign trade. Verlag Wirtschaft und Finanz, Düsseldorf 1993. ISBN 3-87881-081-4

See also

- Production subsidy

- Anti-subsidy measures

- Subsidy Code

- Safeguard Code

- Arbitration and dispute settlement procedures

Web links

- http://www.germanwatch.org/tw/dk04mw.htm

- http://www-classic.uni-graz.at/vwlwww/lehre/lv-wohlfahrt/wf-eep-Kapitel%208.pdf (PDF file; 295 kB)

- Export subsidies in Germany (2004 - relative figures) ( Memento from October 5, 2007 in the Internet Archive ) (archive.org)

Individual evidence

- ↑ Gerhard Laudwein: Dictionary of export, customs and logistics: definitions . Forum Verlag Herkert, 2009 (3rd edition). ISBN 3865861105 . P. 42.

- ↑ a b Zoll.de: Export refund for market regulation goods. Retrieved November 24, 2014 .

- ↑ bmel.de: End of export refunds in Europe decided. (No longer available online.) Archived from the original on October 23, 2016 ; accessed on October 23, 2016 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ bmel.de: Development of EU export refunds from 1993 to 2013. Accessed on October 23, 2016 .

- ↑ https://www.regenwald.org/regenwaldreport/2015/432/zucker-fuer-die-eu-verwuestet-unser-land

- ↑ https://www.regenwald.org/aktion/1012/kein-landraub-fuer-zucker