Electricity trading

Under current trade refers to the activity of a company to buy electricity on the wholesale market and sell it. A distinction must be made between electricity trading and sales activities on the end customer market, where products for end consumers are sold, usually as a full supply contract together with network use and schedule management.

Framework

With the regulatory reorganization of the energy industry through the EnWG in 1998 , end customers were given the freedom to choose their supplier. This was done through the sovereign separation of the market roles of electricity traders (generation and sales companies) and network operators . While the customer continues to be supplied via the network of his local distribution network operator, he can now freely choose his energy supplier. It has also been made possible for every supplier and every public utility company to buy the needs for their end customers from any dealers on the energy markets.

The core of the regulatory market design that has existed since 1998 and made such energy trading possible for the first time is what is known as balancing group management . This stipulates that every trader has a virtual account with the transmission system operator called the balancing group , in which he proves to the transmission system operator every day for the following day that he has actually obtained the best possible forecasted demand for his delivery points from various sources on the energy markets. The energy trader is also billed to the energy trader by the transmission system operator for his balancing group as balancing energy . This market design enables electricity to be traded between electricity traders from balancing group to balancing group in a similar way to securities, while at the same time ensuring that the network is actually physically in equilibrium at the time of delivery.

Energy trading within the meaning of this article is therefore trading at balancing group level.

Futures market

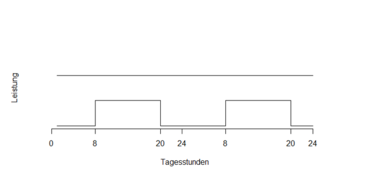

The most important contracts on the so-called futures market , on which electricity is traded for the next few years, are the standardized monthly, quarterly and annual contracts Base and Peak. Base refers to a tape delivery in which the seller delivers the same service to the buyer every quarter of an hour of the delivery period. In the case of a peak contract, the seller delivers the nominal performance Monday through Friday from 8 a.m. to 8 p.m. There is no delivery at all other times.

With futures market contracts, a producer can secure the future generation of his power plants at a price known today and thus secure his gross margin. The electricity supplier's sales department can secure the quantities required for its customers on the futures market in advance at a fixed price and pass this on to its customers plus its margin. Large consumers (e.g. industrial companies) can also purchase electricity at fixed prices directly on the futures market.

In addition to trading participants who are interested in their physical position as producers or distributors / consumers, there are speculative participants , often banks. If, for example, more power plant capacity is offered on the market at an early stage than is demanded by the distributors at this point in time, speculative participants buy up this energy and hold it as a speculative position until there is demand on the market, although they naturally hope to sell it at a higher price can when they bought them.

A high level of liquidity is necessary for a functioning futures market . The German electricity market is extremely liquid. The volume of the wholesale trade was already estimated at 10,600 TWh in 2010; more than seventeen times the actual electricity demand in Germany.

A very large part of futures trading is made up of bilateral transactions (so-called OTC transactions). These are in turn brokered to a very large extent via broker platforms of the established financial brokers (ICAP, GFI, Tullett Prebon ...). The European electricity exchange EEX continues to be an important trading center for Germany . Together with the Scandinavian electricity market and the Netherlands, Germany forms a region with very active electricity trading.

Spot market

While the futures market serves to secure generation and demand in the long term, the spot market is used to optimize the generation or sales / consumption portfolio for the, usually, next day. With spot market transactions, the electricity trader fulfills his obligation to balance his own balancing group for the following day on the basis of current load forecasts and the currently planned use of power plants.

While futures trading enables long-term earnings protection from generation and sales, quantity balances are balanced to the hour on the spot market. The actual mode of operation of a power plant is decided on the basis of the spot prices (see power plant utilization optimization ). The bid is made at short-term marginal costs, including in particular fuel costs (including ancillary costs, e.g. for transport), the value of the required emission certificates and other variable costs (e.g. for wear and tear). Selling on the market is only worthwhile if at least these costs are generated. The fixed costs do not play a role for the short-term production decision as well as for the pricing on the spot and futures markets.

On the other hand, if a power plant has already sold its generation for the future, it still takes part in the spot market: At spot prices that do not cover the marginal costs, it is worthwhile not to run the power plant and buy back the electricity at cheaper prices. To achieve this, a purchase bid is placed on the market at the short-term marginal costs of the power plant.

Trading on the futures market and spot market thus serves to minimize risks for producers and consumers in the liberalized market and still achieve a cost-minimal use of the power plant fleet in the overall system.

While the base and peak futures market products only allow a rough hedge of the approximate purchase or consumption structure, electricity can be purchased and sold on the spot market on a 1/4 hour basis. This is necessary because the balancing group for the following day must be balanced on a quarter-hourly basis.

Trading takes place on both power exchanges and off-exchange trading venues (so-called OTC trading , which are usually electronic trading platforms operated by brokers ). The central platforms for spot trading, however, are the hourly and quarter-hourly auctions of EEX, which determine a market-clearing price on the basis of incoming limited bids every hour or every quarter of an hour of the following day. The price development of the spot auctions reflects the physical situation of the electricity markets. The prices vary greatly depending on wind feed, solar feed, power plant availability, etc. With these auctions, EEX provides the central marketplace on which the balancing group of suppliers and producers can actually be balanced on a 1/4 hour basis, as required by the rules of balancing group management.

Intraday market

In the intraday market, after the end of day-ahead trading, short-term transactions are still carried out in order, for example, to be able to react to deviations in the load from the forecast or to failures of power plant units and to reduce the schedule deviation. The European power exchange EEX enables intraday transactions up to 30 minutes before delivery.

In OTC trading, in the event of power plant failures - across control areas - business can still be done up to 15 minutes before the start of delivery. Within the control area, deviations from the load and forecast can be balanced bilaterally up to 4 p.m. on the following working day. The basis for this is Section 5 (3) of the Electricity Network Access Ordinance. The subsequent settlement is called day-after trading and is generally carried out at the EEX spot price.

Market integration of renewable energies

The remuneration of renewable energies according to the Renewable Energy Sources Act provides either a fixed price remuneration in which the transmission system operator receives the generated quantities, remunerates them at a fixed price, markets them on the spot market and transfers the differential costs to the consumers, or direct marketing of the renewable energy by the producers, The difference between the spot market revenues of a typical feed-in profile and the statutory fixed price is paid out as a so-called market premium. Both systems mean that the generation of renewable energies is marketed on the spot market if the operator does not want to enter into speculative positions. This means that energy suppliers who want to secure their long-term sales on the futures markets are only offered around 80% of the expected generation for the delivery period. Renewable generation is only visible on the spot market.

Negative electricity prices

Negative electricity prices arise on the electricity exchange when there is a high supply and a low demand. The combination of discontinuously working wind and solar systems (systems with high capital costs but practically no variable costs) in connection with inflexible conventional power plants (especially lignite and nuclear power plants) as well as fixed remuneration (fixed tariffs) sometimes leads to negative prices for the German market in spot trading on the European Energy Exchange . This means that the purchase of electrical energy and the thermal conversion into heat loss or the storage of the excess energy (e.g. in pumped storage power plants ) are remunerated. In the first half of 2013, negative electricity prices occurred in 36 hours (out of 4,380 hours in total). During these hours, 778 GWh of electrical energy were exported, including 176 GWh at negative prices. The total value of the electricity traded with negative prices was minus 12.6 million euros. The exported electricity was worth minus 2.2 million euros.

Market coupling

The day-ahead auctions of European countries are linked to one another by means of so-called market coupling. Cross-border capacities of the transmission network are used to the best possible extent in order to balance prices between different countries. This is done via so-called implicit auctions. The market participants themselves only take part in the auctions in their respective country. As part of the auction process, cross-border bids and, as a result, deliveries are automatically generated by the system, which adjust the resulting prices of the two countries, as far as available cross-border capacities permit. If, for example, separate auctions in Germany and Scandinavia mean that the daily price in Germany is lower than in Scandinavia, the exchanges concerned automatically generate a delivery from Germany to Scandinavia, which either fully aligns the price or - if this is not possible - at least all short-term cross-border capacities from Germany to Scandinavia are fully utilized. Thus, the best possible adjustment of short-term prices is always achieved. The coupling of the intraday markets is intended and is currently being planned. Due to the fluctuation of renewable energies in particular, short-term trading requires a sophisticated system in order to integrate cross-border capacities more efficiently into the individual control areas and market areas.

International history of electricity trading

The oldest power exchange is Nord Pool Spot . It goes back to Foreningen Samkjøringen , an exchange which was founded in 1932 by Eastern Norwegian electricity suppliers on the initiative of Augustin Paus and which soon included all electricity suppliers in Eastern Norway. In 1971 it merged with regional exchanges in other parts of Norway. In 1988 it had 118 electricity suppliers as members and was then called Samkjøringen av kraftverkene i Norge . In 1991 the Norwegian Parliament decided to establish market structures in the Norwegian energy industry.

Early experiments with energy market designs and privatization of the energy industry were carried out in Chile in the 1980s, along with other market-oriented reforms by the Chicago Boys . The Chilean model was seen as successful in creating rationality and transparency in electricity pricing. Argentina adopted the Chilean model, imposed strict limits on market concentration and optimized the structure of payments to units that were held in reserve for system stability. A major goal of introducing market structures was to privatize generating plants (which had expired under the government monopoly, resulting in frequent failures) and to raise capital for the restoration of the plants and the expansion of the system.

The World Bank helped launch a number of hybrid markets in other Latin American nations, including Peru, Brazil, and Colombia, in the 1990s.

The privatization of the electricity industry by the English government under Margaret Thatcher was groundbreaking for Europe. The English way also became a model or at least a catalyst for a new regulatory design of the energy industry in various other Commonwealth countries, in particular Australia and New Zealand and for regional markets such as Alberta. In many cases, however, the establishment of energy markets took place without the extensive privatization with which the English example went hand-in-hand.

For decades, there was no reason in the USA to question the traditional model of a vertically integrated electricity industry with a network that was designed to supply its own customers. With increasing dependence on a reliable electricity and gas supply, electricity was transported over ever greater distances, electricity pools formed and connections established. Transactions were relatively rare and were generally planned for the long term.

In the last decade of the 20th century, however, some US politicians and academics sought market structures in the electricity industry, and independent transmission system operators and distribution network operators were established. They were seen as a tool to manage the vastly increased number of transactions that would take place in a competitive environment. Some states actually decided to establish energy markets, some of which withdrew after the California electricity crisis (2000–2001).

China is one of the countries that have recently established energy markets in the energy industry.

The structures created differed in terms of institutions and market design, but they have certain basic concepts in common. Recurring elements are the separation of potentially competitive functions such as sales and generation from the natural monopoly functions of transmission and distribution, as well as the creation of energy trading and sales markets. The role of energy trading is to enable trade between producers, distributors and other intermediaries for short-term (spot market) and long-term (futures market) energy products.

International electricity exchanges

- North pool spot

- European spot market (Germany, France, Austria): EPEX Spot

- Austria, Germany: EXAA Energy Exchange

- Germany: European Energy Exchange EEX

- Hungary: Hungarian Power Exchange HUPX

- India: Power Exchange India Limitet, PXIL

- Eastern Europe: PXE-Power Exchange Central Europe

- Ireland: SEMO

- Italy: GME

- Korea: KPX

- Netherlands, UK, Belgium: APX / ENDEX

- Philippines: Philippine Wholesale Electricity Spot Market

- Portugal: OMIP

- Singapore: Energy Market Company (EMC)

- Turkey: Turkish Electricity Market

- Great Britain: Elexon

- USA: PJM , New York Market , Midwest Market , California ISO , Southwest Power Pool

See also

- Energy market # Electricity trading in Europe

- Energy balance (energy industry)

- Change of electricity provider

- Balancing group management

- Power plant utilization optimization

literature

- Prof. Dr. Hans-Peter Schintowski: Handbook of energy trading . Erich Schmidt Verlag GmbH & Co, ISBN 3-503-15438-8 .

Web links

Individual evidence

- ↑ Contract Specifications. (PDF; 1.69 MB) Version 0069a. EEX, October 17, 2019, accessed on November 19, 2019 .

- ↑ Bundesnetzagentur / Bundeskartellamt: Monitoring report 2011. Accessed on August 10, 2016 .

- ↑ auction . eex.com. Retrieved November 10, 2019.

- ↑ Intraday market with delivery in one of the German control areas. Retrieved August 10, 2016 .

- ^ Ordinance on access to electricity supply networks (Stromnetzzugangsverordnung - StromNZV). Retrieved August 10, 2016 .

- ↑ Market integration of electricity from renewable energies through inclusion in the competition for customers. (PDF) Retrieved August 31, 2016 .

- ↑ Bernward Janzing : Negative prices on the electricity exchange: Energy not even given away . In: The daily newspaper: taz . December 27, 2018, ISSN 0931-9085 ( taz.de [accessed December 28, 2018]).

- ↑ Negative Prices - Frequently Asked Questions. EEX, accessed in August 2016 .

- ↑ Coal-based power generation at times of low electricity prices ( Memento of the original from October 16, 2013 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF; 1.9 MB). Fraunhofer ISE . Retrieved November 11, 2013.

- ^ The changing energy market in Great Britain. (No longer available online.) Archived from the original on September 2, 2016 ; accessed on September 1, 2016 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Factsheet Australia. (No longer available online.) AHK German-Australian Chamber of Commerce and Industry, archived from the original on September 2, 2016 ; accessed on September 1, 2016 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Factsheet New Zealand. (No longer available online.) AHK presentation of the German economy, archived from the original on September 2, 2016 ; accessed on September 1, 2016 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Andreas Knorr: New Zealand's regulatory model, a role model for Germany? 1997.

- ↑ ENERGY EFFICIENCY AND WATER EFFICIENCY IN INDUSTRIAL APPLICATIONS IN CANADA - FOCUS ALBERTA. AHK - German Canadian Chamber of Commerce and Industry, accessed on November 19, 2019 .

- ↑ The California Energy Crisis. (No longer available online.) Archived from the original on September 2, 2016 ; accessed on September 1, 2016 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ China's electricity market reform. Accessed September 1, 2016 (English).