Power exchange

An electricity exchange is an organized market for electricity that functions in a similar way to a stock exchange . Temporary amounts of electricity are traded as products. The advantage of trading electricity on the exchange is the bundling of supply and demand , which means that high liquidity can be achieved. Standardized products enable regulated trading and create simple comparison instruments, which reduce transaction costs.

Electricity from Austria, France and Germany is traded on the EEX (European Energy Exchange) in Leipzig, electricity from five Scandinavian countries on the Nord Pool exchange . Spain and Portugal, the Czech Republic and Slovakia have an exchange; also Hungary, Italy and Slovenia. Great Britain and Ireland have so far traded their electricity on a purely national basis. At the beginning of October 2013, the EU Commission submitted a proposal to the EU member states to create a uniform European electricity exchange (see also internal market ) by the end of 2015.

Emergence

As a result of the liberalization of the European electricity markets, the issue of electricity trading has become increasingly important for energy suppliers . Before liberalization, electricity was mostly obtained from a few suppliers and resold to customers in the respective supply areas. These long-term supply contracts gave way to more and more short-term contracts.

Power and power futures exchanges were set up, like other exchanges, to enable or facilitate the conclusion of contracts at fair market prices. A driving factor was the economic dogmatics prevailing in the 1990s, according to which markets are always efficient and guarantee an optimal allocation of resources. With the establishment of the electricity exchange, pricing based on the marginal costs of electricity generation increasingly replaced the pricing based on the average costs of electricity generation that was prevalent at the beginning of liberalization .

The pioneering role in this area of the European electricity industry has been taken over by the Scandinavian electricity exchange Nord Pool , which was created through the early liberalization of the electricity market in Scandinavia in 1993.

In Amsterdam in 1999, the Amsterdam Power Exchange ( APX founded), 2000, the Energy Exchange European Energy Exchange (EEX) in Frankfurt and Leipzig Power Exchange (LPX), which in 2002 on the EEX, based in Leipzig merged (Leipzig Energy Exchange) . The EEX spot market was incorporated into EPEX SPOT SE (based in Paris) in 2009 .

Since the liberalization of the Austrian market in 2001 there has also been an electricity exchange in Austria, the Energy Exchange Austria (EXAA).

Trade procedure

Different trading procedures are used to take into account the technical conditions of the electricity and electricity market. The most common auction procedure at power exchanges is the double auction , on which both sides of the market act and buy and sell orders are possible at the same time.

The time availability is an important criterion for power exchanges, as z. B. Power distributors react immediately to weather forecasts in order to be able to satisfy the different demands. In continuous trading, it is possible to react permanently to new information, whereas this is not possible with trading at fixed times. The disadvantage of continuous trading is that it can increase volatility , i.e. fluctuations in the price of electricity . Trading at fixed times bundles liquidity (the amount of goods offered or in demand) and thereby reduces volatility. Most of the time, volatility is viewed as negative because price does not always reflect value. However, this makes hedging and speculative strategies possible.

Electricity labeling

On the power exchange, gray electricity , i.e. H. unmarked electricity sold. However, the Austrian EXAA offers an electricity auction under the label GreenPower @ EXAA, in which, in addition to the physical electricity, certificates of origin for TÜV-Süd-certified green electricity are supplied.

Products on the power exchange

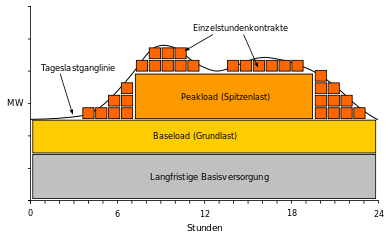

Demand in the electricity market is primarily characterized by consumer behavior that differs over time ( load profile ). In order to do justice to this fact, the products offered on an electricity exchange differ primarily in the length of time of delivery. The block products further simplify trading on the stock exchange.

Long-term transactions with a term of up to several years are carried out on the futures market . This allows the participants to guarantee a secure basic supply over a longer period of time. However, since electricity cannot be stored economically, products with a shorter term are traded on the spot market. Baseload blocks should cover the basic load of one day.

A 24-hour block means the delivery of electrical energy with constant power from midnight to midnight. The trading unit is 24 MWh, which corresponds to a constant output of 1 MW. In order to take into account the greater demand during the day compared to the night, peak load blocks ( peak load ) are offered between 8:00 a.m. and 8:00 p.m. with a trading unit of 12 MWh, which in turn corresponds to 1 MW of constant output. In order to enable even finer gradations in the daily load line, individual hourly contracts can also be traded. The blocks before and after a peak load block are referred to as off-peak , i.e. from 0:00 a.m. to 8:00 a.m. and from 8:00 p.m. to 12:00 a.m.

Control energy is the reserve kept ready by transmission system operators to balance between electricity demand and supply, which is used by a grid company depending on the current load fluctuations. The primary control automatically and immediately compensates for fluctuations in the seconds range by regulating the turbine output; with the secondary control, the setpoint of the frequency should be reached again within 15 minutes; this is done by using additional power plant capacities. The tertiary control is activated manually today when the secondary control is no longer sufficient. In addition to the long-term futures and short-term spot markets, the balancing energy market is the real-time market.

forecast

An important area of research in connection with electricity exchanges are forecasting methods . These are intended to generate important information such as price developments in order to enable meaningful power plant operating times and price hedging. Load profiles are forecast in order to determine optimal purchase quantities. To enable price hedging, the revenues must cover at least the marginal costs per type of power plant. Hydropower plants usually have low marginal costs , thermal power plants ( thermal power plants ) medium and pumped storage power plants high marginal costs . In the long term, of course, the full costs must be covered on the market .

criticism

Employees of the US energy company Enron - it went bankrupt in 2001 - temporarily manipulated the price of electricity on the futures and spot markets in California . As a result, electricity market regulations were improved.

In the summer of 2005, there were suspicions that the large German energy companies ( E.ON , EnBW , RWE , Vattenfall Europe ) were manipulating the price of electricity. It was also criticized that the electricity exchange on which German electricity is traded is not subject to any official supervision that could prevent insider trading and market manipulation. The European Commission opened antitrust proceedings against E.ON in 2007 for an artificial price increase.

The trading volume on EEX is criticized in discussions (as of 2008). In 2008, 1,319 TWh were traded on the futures market, where the price of generation and sales is secured in the long term (for comparison: net electricity consumption in Germany approx. 530 TWh). In 2006, 89 TWh were traded on the EEX spot market.

Power exchanges in Europe

- Amsterdam Power Exchange , Netherlands, UK

- Belpex , Belgium

- Borzen , Slovenia

- BSP Southpool , Slovenia, Serbia, Macedonia

- Energy Exchange Austria , Austria

- EPEX SPOT , Germany, France, Austria, Switzerland

- GME or IPEX , Italy

- Nord Pool , Scandinavia, Baltic States

- OMIE , Iberian electricity market spot trading (MIBEL), OMIP for futures (formerly OMEL for Spain and OMIP for Portugal)

- Opcom , Romania

- PXE , Czech Republic

- PolPX , Poland

See also

Individual evidence

- ↑ Hendrik Kafsack, Brussels: EU wants a uniform electricity exchange. In: FAZ.net . September 25, 2013, accessed December 13, 2014 .

- ↑ wirtschaftsblatt.at September 27, 2013: Brussels calls for EU-wide electricity exchange ( memento of October 19, 2013 in the Internet Archive )

- ↑ Kevin Canty: Fair electricity prices: Basics and need for action. Created for the Federal Ministry for the Environment, Nature Conservation and Nuclear Safety. (PDF; 821 kB) (No longer available online.) InfraCOMP, 2009, archived from the original on January 31, 2012 ; Retrieved January 9, 2009 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. P. 8 ( Memento of the original from January 31, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ www.greenpeace-energy.de ( Memento of the original from January 12, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ www.exaa.at

- ↑ Holger Schmidt: Industry considers the electricity exchange to be a manipulated market. In: FAZ.net . July 8, 2005, accessed December 13, 2014 .

- ↑ a b Kevin Canty and Volker Lüdemann: Electricity price formation without supervision. In: FAZ.net . November 23, 2010, accessed December 13, 2014 .

- ↑ www.blogspan.net ( Memento of the original from December 17, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ www.bdew.de ( Memento of the original from December 17, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ European Energy Exchange: Press release: EEX presents record numbers ( Memento of the original from May 1, 2007 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. , March 27, 2007

- ↑ www.apxgroup.com

- ↑ www.belpex.be

- ↑ www.borzen.si

- ↑ www.bsp-southpool.com

- ↑ www.mercatoelettrico.org

- ↑ www.nordpoolspot.com

- ↑ OMIE - Information on the company (English)

- ↑ www.opcom.ro

- ↑ www.pxe.cz

- ↑ wyniki.tge.pl