Energy Exchange Austria

| EXAA, Energy Exchange Austria

|

|

|---|---|

| legal form | Corporation |

| founding | 2001 |

| Seat | Vienna , Austria |

| management |

Jürgen Wahl (Member of the Board of Directors) Rudolf Schneider (Member of the Board of Directors) |

| Branch | Exchanges , energy |

| Website | www.exaa.at |

The Energy Exchange Austria (EXAA) is an electronic marketplace for energy trading . It acts as an Austrian energy exchange and is in the Austrian APG - control area and in all four German control areas ( Amprion , TenneT , TransnetBW , 50Hertz active). Since December 2012, trading in green electricity has also been carried out on EXAA in all five control areas.

In addition to the classic stock market agendas, EXAA takes care of the settlement of financial transactions ( clearing ) and assumes the risk that market participants do not buy or sell the values underlying the transactions as agreed ( counterparty risk ).

history

With the complete liberalization of the Austrian electricity market on October 1, 2001, the legal framework for the establishment of an electricity exchange was created. Trading began on March 21, 2002, for individual hours in the APG Regezone , with twelve market participants. EXAA spot trading now includes around 70 electricity trading companies from over 13 countries.

The trading areas and agendas have been continuously expanded:

- 2003: Introduction of block products and post-trading

- 2004: Opening of the TenneT control area (then: E.ON)

- 2005: Opening of the Amprion control zone (then: RWE) & start of trading with CO 2 certificates

- 2002–2006: Auction Office for capacity auctions (handled by RIECADO , a company of the former CISMOgroup merged with smart technologies )

- 2006: Opening of the Swiss control area (discontinued later)

- 2008: Change of the algorithm for the more reliable execution of market orders & execution and publication of regular market analyzes of the power spot market by EXAA to increase transparency

- 2009: Opening of the TransnetBW (then: EnBW) and 50Hertz (then: Vattenfall) control areas & start of the "training for energy and environmental markets" program "teem"

- 2011: Takeover of the operational business for the Hungarian market area by EXAA from the Prague energy exchange PXE & start of the cooperation agreement with Greenmarket Exchange (subsidiary of the Bavarian stock exchange) on the CO 2 market and simultaneous shutdown of the CO 2 spot market on EXAA

- 2012: Introduction of the green electricity market EXAA Green Power & end of support for the Hungarian day-ahead market PXE by EXAA

- 2013: Introduction of negative prices at EXAA (price limits: - 150 EUR / MWh to + 3,000 EUR / MWh)

- 2014: Start of the first 1/4 hour auction in Europe

- 2015: Identification of EXAA as one of the first European market participants according to the REMIT regulation as RRM ( English Registered Reporting Mechanism ) by the electricity regulation authority ACER ( Agency for the Cooperation of Energy Regulatory Authorities ) in February, which authorizes data to be transmitted directly and without detour via a service provider to report to the ACER & start of data reporting in accordance with the data reporting obligation under REMIT regulation and appointment of EXAA for NEMO ( English Nominated Electricity Market operator ) in Austria by the e-Control

- 2018: Introduction of two separate auctions for the market areas Austria and Germany, which were separated on October 1, 2018

- 2019: Successful market launch of physical location spread products for the virtual coupling of the Austrian and German market areas

Trading platform

The main goal when operating an electronic trading platform with an auction system is to optimally bundle liquidity . In addition, the efficiency of trading activities is promoted by significantly reducing the cost of concluding transactions compared to bilateral trade. The neutrality of an energy exchange , the guaranteed anonymity of the bids and the immediate publication of price information contribute significantly to promoting fairness in the entire market. The stock exchange is an organized trading venue whose processes are subject to statutory provisions.

Traded products

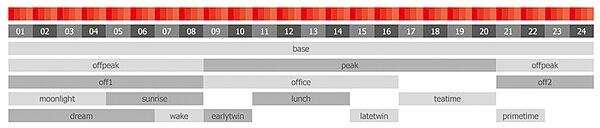

In principle, they can be traded individually on EXAA every 24 hours a day. The standard blocks Base , Peak , Offpeak as well as other special blocks according to the needs of the market participants were defined as block products (combining several hours into a common block) . In addition, every 96¼ hours of a day can be traded on the EXAA. The physical fulfillment of the transactions takes place either in one of the four control areas in Germany ( Amprion , TenneT , TransnetBW or 50Hertz ) or in the Austrian APG control area. In the auction at 10:15 am, the bids for all German control areas and for the Austrian control area are merged and a price for Germany and a price for Austria are then determined. On trading days from Monday to Friday, the orders of the individual market participants are collected in a closed order book . Thereafter, one auction for gray and green electricity per market area (Austria, Germany) is held every day . The price obtained at the auction ( English Market Clearing Price, MCP ) and the individual market participants assigned amounts are those reported immediately after the auction. The physical fulfillment of the trades takes place on the next day (day-ahead trading).

Trading system

The products of the EXAA spot markets are traded in auctions. A web browser is all that is required on the merchant's side to transmit the buy or sell bids . This avoids software installation and maintenance on the dealer's IT systems as well as expensive dedicated lines. Access to the system is secured with electronic keys ( RSA tokens ) and thus without any hardware connection on the trader's PC .

10.15 a.m. Auction: two market areas, two market clearing prices - with virtual coupling

With the price zone split on October 1, 2018, the cross-border market area Austria - Germany that had existed for years was abolished and a capacity bottleneck was introduced. Since that day, EXAA has been offering 2 separate auctions for the two market areas Austria and Germany at the same time, in the course of which a market clearing price for Austria and a market clearing price for Germany are determined. There is still the option of registering a schedule for shops from the EXAA auction in Austria ( APG ) and in all four German control areas ( Amprion , TenneT , TransnetBW , 50Hertz ), which makes access to the EXAA market very attractive and easy power. Companies that already have balancing group contracts for the German network can trade on EXAA without restriction.

On March 5, 2019, EXAA successfully expanded its product range to include physical location spreads , which allow the two price zones Austria and Germany to be linked virtually. In addition to their bids for blocks, hours and quarter hours, traders can also use a new spread editor to place bids on the price difference between Austria and Germany, and buy or sell this spread with or without a limit. If a spread bid wins the auction, a quantity of the same amount is bought in one price zone and sold in the other price zone at the same time. The price of the spread is determined by the simultaneous auctions in the Austrian market area and the German market area, taking into account the entire order books. The spread is fulfilled physically in the respective market area.

TEEM training

Since January 2009, EXAA has been offering courses on electricity and gas trading under the brand name teem - training for energy and environmental markets . The range of individually bookable TEEM modules is aimed at newcomers to the industry as well as specialized employees. The training courses are presented in German and take place in Vienna.

Ownership structure

The shareholders hold the following shares in EXAA:

- APCS Power Clearing and Settlement AG (34.55%)

- Wiener Börse AG (25.12%)

- Oesterreichische Kontrollbank AG (8.06%)

- smart technologies Management Beratungs- und Beteiligungsgesellschaft mbH (8.06%)

- Verbund Trading AG (3.04%)

- ENERGIEALLIANZ Austria GmbH (3.04%)

- KELAG-Kärntner Elektrizitäts AG (3.04%)

- Energie Steiermark Business GmbH (3.04%)

- TIWAG-Tiroler Wasserkraft AG (3.04%)

- illwerke vkw AG (3.04%)

- Energie Graz GmbH & Co KG (2.98%)

- OMV Gas & Power GmbH (2.98%)

Web links

Individual evidence

- ↑ Trading participant , Energy Exchange Austria (EXAA)

- ^ Company News , Energy Exchange Austria (EXAA)

- ↑ a b EXAA trading concept ( Memento of the original from October 22, 2013 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved October 21, 2013

- ↑ training for energy and environmental markets from October 21, 2013

- ↑ EXAA shareholders , accessed on February 25, 2017.