Output gap

The term output gap (also output gap , English output gap ) refers to the deviation of the realized gross domestic product (GDP) by production potential (PP). If this gap is narrowed, economic resources are used efficiently within the scope of their possibilities (full capacity). As soon as there is a negative or positive difference, i. H. the resources (labor, capital) are not used properly or beyond their capacity (overwork), the gap becomes larger. In theory, this implies that the prices of production factors rise despite low productivity, which leads to inflation .

meaning

This gap comprises the unused capacities of an economic area . The term originally comes from the economic theories on business cycles .

The central banks determine the value of the output gap taking into account speculative bubbles, among other things. The output gap, like the real interest rate , inflation expectations and the difference between the current inflation rate and the target rate, also play a role in the orientation of the key interest rate policy. Imperfect competitive conditions in the markets are considered to be the main cause of the creation of an output gap. This applies to both the labor market and the capital market and in each case in connection with a rigid price and wage bond.

The output gap is usually expressed as a percentage of the potential added value of an economy. One speaks of a negative output gap when the current gross domestic product (GDP) is below the potential gross domestic product. This then has the following effects:

- falling inflation rate,

- rising unemployment and

- decreasing imports .

A positive output gap has the opposite effect. The output gap is based on the potential added value of an economy, so that ostensibly normal capacity has to be determined on the basis of statistical data for a country.

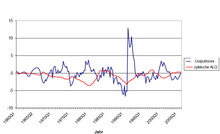

The graph shows the negative output gap that occurs when an economy operates on unemployment resources. The problem of the negative output gap could be unemployment.

A positive output gap occurs when the actual production of an economy is higher than their potential output. This seems impossible and, in the long term, an economy cannot actually produce more than productive capacities allow. For a short while, however, it is possible, namely when the workers work overtime, some workers who are not normally involved in the work process , step into it and the machines are used to the maximum. In the long term, however, this situation cannot be maintained unless the AS (aggregate supply) increases. The graph above shows the positive output gap and an increase in AD (aggregate demand), which causes an increase in AS that is above the potential output and the price increase from P to P1. In fact, countries with positive output back often experience strong inflation.

calculation

The calculation of the output gap is as follows:

PP indicates the production potential and GDP the realized gross domestic product. Thus, with a positive output gap, current output is above potential output, which can be with growing economies. One can also define a relative output gap. This results as

- .

The output gap is also used to calculate the cyclical government deficit , which is permitted under the debt brake (Germany) .

Okunse's law

The Okun's Law is called a rule for the empirical relationship between the cyclical unemployment and the output gap: A cyclic unemployment of 1% corresponds to an output gap of approximately -2% of the potential GDP. So if, say, full employment corresponds to an unemployment rate of 6% and the actually observed unemployment rate is 8%, the output gap is −4%. A reduction in the cyclical unemployment rate by one percent therefore requires an increase in GDP of roughly two percent.

The Okun's Law describes the empirical correlation between unemployment and output gap and declared no causal law. In other words, GDP fluctuates more strongly than the unemployment rate over the course of the economy. During a recession, companies do not theoretically adjust their number of employees completely to the reduced production volumes, as they try to avoid the loss of company -specific know-how . On the other hand, companies try to increase production only by working overtime in order to avoid hiring additional employees when the economy is good.

literature

- Olivier Blanchard , Gerhard Illing : Macroeconomics . 4th edition. Pearson Studies, Munich 2006, ISBN 978-3-8273-7209-3 .

- Rudiger Dornbusch , Stanley Fischer : Macroeconomics . 6th edition. McGraw-Hill, Frankfurt am Main 1995, ISBN 3-486-22800-5 (Original title: Macroeconomics . Translated by Ulrich K. Schittko).

- Paul De Grauwe: The Economics of Monetary Integration . 2nd Edition. 1994 (English).

- Katharine S. Neiss, Edward Nelson: Inflation Dynamics, Marginal Cost, and the Output Gap: Evidence from Three Countries . In: Journal of Money, . tape 37 , no. 6 , December 2005, p. 1019-1045 (English).

- Carl E. Walsh: Speed Limit Policies: The Output Gap and Optimal Monetary Policy . In: The American Economic Review . tape 93 , no. 1 , March 2003, p. 265-278 (English).

- Arthur M. Okun: Potential GNP: Its Measurement and Significance . In: American Statistical Association (Ed.): Proceedings of the Business and Economic Statistics Section . 1962, p. 98-104 (English).

Web links

- www.uni-duesseldorf.de ( Memento from March 6, 2009 in the Internet Archive ) (PDF; 2.9 MB)

- www.frbsf.org (PDF; 165 kB)

- www.vwl.unibe.ch (PDF; 673 kB)