Standard rate regulation

| Basic data | |

|---|---|

| Title: | Ordinance on the implementation of Section 28 of Book Twelve of the Social Code |

| Short title: | Standard rate regulation |

| Abbreviation: | RSV |

| Type: | Federal Ordinance |

| Scope: | Federal Republic of Germany |

| Issued on the basis of: | § 40 SGB XII |

| Legal matter: | Social law , special administrative law |

| References : | 2170-1-23 |

| Issued on: | June 3, 2004 ( BGBl. I p. 1067 ) |

| Entry into force on: | January 1, 2005 |

| Last change by: |

Art. 17 G of March 2, 2009 ( Federal Law Gazette I p. 416, 432 ) |

| Effective date of the last change: |

July 1, 2009 (Art. 19 para. 3 G of March 2, 2009) |

| Expiry: | January 1, 2011 (Art. 12 para. 1 G of March 24, 2011, Federal Law Gazette I p. 453, 495 ) |

| Please note the note on the applicable legal version. | |

The standard rate regulation (RSV), in the long title regulation for the implementation of § 28 of the twelfth book of the social security code , regulated the content, assessment and structure of the standard rates of social assistance as well as their continuation in Germany until the end of 2010 . The standard benefit of SGB II ( unemployment benefit II ) was largely based on these standard rates .

The ordinance was replaced with effect from 1 January 2011 by the Ordinance Requirement Investigation Act (RBEG).

Composition and calculation of the standard rates

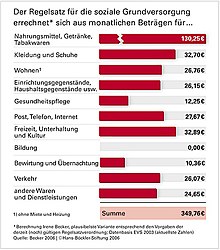

The standard rates laid down in the standard rate ordinance were most recently derived from the income and expenditure sample (EVS) 1 from 2003; For the RSV, the spending behavior of the bottom 20 percent of the recorded consumer groups was taken into account. To determine the standard rate, the expenses determined in the EVS were grouped into ten departments and proportionally reduced using a complex key. The rule set was composed of the following ten departments:

| Expense items | percentage | Single person | Child from the age of 14 | Child up to the age of 14 |

|---|---|---|---|---|

| Food, beverages, tobacco products | approx. 37% | 128.39 | 102.86 | 76.96 |

| Clothing, shoes (including cleaning, washing, repairs) | approx. 10% | 34.70 | 27.80 | 20.80 |

| Living (without rental costs) i.e. electricity, hot water preparation & apartment maintenance (renovation) |

approx. 8% | 27.76 | 22.24 | 16.64 |

| Furniture, apparatus, household appliances | approx. 7% | 24.29 | 19.46 | 14.56 |

| Health care | approx. 4% | 13.88 | 11.12 | 8.32 |

| Transport (public transport and bicycles as well as accessories) | approx. 4% | 13.88 | 11.12 | 8.32 |

| Telephone, fax, mail and courier services. | approx. 9% | 31.23 | 25.02 | 18.72 |

| Leisure, entertainment, culture (including stationery and school supplies) | approx. 11% | 38.17 | 30.58 | 22.88 |

| Accommodation and catering services | approx. 2% | 6.94 | 5.56 | 4.16 |

| Other goods and services | approx. 8% | 27.76 | 22.24 | 16.64 |

| to hum | 100% | 347.00 | 278.00 | 208.00 |

The standard monthly rate for food, beverages and tobacco products corresponded to daily rates of € 4.28, € 3.43 and € 2.57, respectively. According to calculations by the Research Institute for Child Nutrition Dortmund, the actual food requirement for an 11-year-old child was € 5.71. The standard monthly rate for leisure, entertainment and culture corresponded to daily rates of € 1.27, € 1.02 and € 0.76, respectively.

The standard rate did not include the entire livelihood; for example, it could be supplemented in other life situations according to Section 73 SGB XII according to the special needs by one-off grants.

The standard rates were also the basis for the amount of any additional needs recognized.

height

Since July 1, 2006, the standard benefit and standard rate (also known as the basic standard rate ) in the new federal states have been raised to the level of the old federal states; the level of benefits has been the same in the old and new federal states since then. Previously, the basic standard rate in the old federal states was € 345, in the new federal states € 331. From July 1, 2007 to June 30, 2008, the basic standard rate was € 347. Since July 1, 2008 it has been € 351. On July 1, 2009 the standard rate was increased to € 359 per month. On January 1, 2011, after a long discussion as part of the 2011 Hartz IV reform, standard requirement levels were introduced instead of the standard rate and an amount of 364 euros was set for level 1.

See also

Web links

Individual evidence

- ↑ See Art. 1 of see Art. 1 of the Act on Determining Standard Needs and Amending the Second and Twelfth Volumes of the Social Code (EGRBEG) of March 24, 2011 (Federal Law Gazette I, p. 453) .

- ↑ SGB XII, Ninth Chapter Help in other situations

- ↑ Announcement on the amount of the standard benefit according to Section 20, Paragraph 2, Clause 1 of Book Two of the Social Security Code for the period from July 1, 2007 from June 18, 2007 ( Federal Law Gazette I p. 1139 )

- ↑ Annual announcements of the standard rates

- ↑ Archived copy ( memento of the original from June 13, 2011 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.