Annual surplus

The net income is the accounting resulting from the profit and loss account resulting positive difference between income and expenses of an accounting period . A negative annual surplus is called an annual deficit . Both performance indicators are also summarized under the neutral term annual result . The net profit is a profit after taxes , to shareholders of a corporation distributed or reinvested can be.Partnerships not determine a net income, but profit which the shareholders individually taxed.

General

The profit making intention of the merchants is realized through the annual surplus. In order to determine the annual surplus, the law requires that the merchant has to compare the expenses and income in an income statement at the end of the financial year ( balance sheet date ) ( Section 242 (2 ) HGB ). This comparison gives the annual surplus:

- .

If the expenses exceed the income, the annual surplus is negative. In this case one speaks of an annual deficit :

- .

The classification requirements of Section 275 (2) HGB ( total cost method ) and (3) HGB ( cost of sales method ) provide for the annual surplus / annual deficit as the final difference between all expenses and income and write this mandatory item as No. 17 or No. 16 of the profit and loss statement. Annual surplus / annual deficit form the end point of the profit and loss account.

detection

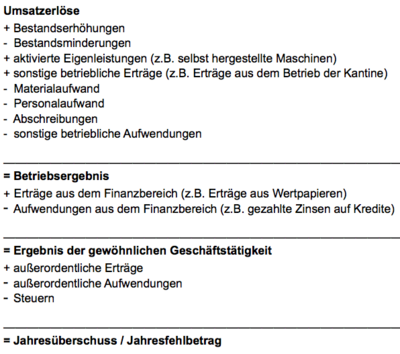

Based on the sales , all operational ("ordinary") and extraordinary expense and income items that affect income are summarized in a sum calculation with interim results in accordance with the HGB classification rule. This includes both the operating and the financial result as well as the effects of taxes on income and earnings. The last items in the classification are the other taxes , which are immediately followed by the annual surplus / annual deficit as the final total item.

The net profit after § 275 .. Para 2 No. 17 HGB goes from - no longer legally provided - Operating result and then takes into account the financial result and then the position # 14. Taxes on income and # 16. Other taxes (in brackets the number the position according to § 275 Abs. 2 HGB):

Betriebsergebnis +/- Finanzergebnis (7, 9-13) = Gewinn vor Steuern - Steuern vom Einkommen und Ertrag (14) = Ergebnis nach Steuern (15) - sonstige Steuern (16) = Jahresüberschuss/Jahresfehlbetrag (17)

The result after taxes therefore only includes income taxes , while other taxes ( cost taxes ) are only taken into account afterwards and ultimately lead to the annual surplus / annual deficit. In addition, annual surplus / annual deficit are a balance sheet item in equity according to Section 266 (3) A No. V HGB, which, as annual surplus, increases equity or, as annual deficit, reduces equity.

use

The appropriation of profits is only comprehensively regulated by law for corporations (in brackets the number of the item in accordance with Section 158 (1 ) AktG ):

Jahresüberschuss/Jahresfehlbetrag + Gewinnvortrag aus dem Vorjahr (1) oder - Verlustvortrag aus dem Vorjahr (1) + Entnahmen aus der Kapitalrücklage (2) + Entnahmen aus Gewinnrücklagen (3) - Einstellungen in Gewinnrücklagen (4) = Bilanzgewinn/Bilanzverlust (5)

Stock corporations must first transfer part of their annual surplus to the statutory reserve until this has reached 10% of the share capital ( Section 150 AktG). The remaining surplus will either be placed in voluntary reserves, carried over into the subsequent period as profit carried forward or distributed to the shareholders . In the case of stock corporations, the management board and supervisory board may allocate up to 50% of the annual net income to other revenue reserves in advance without the consent of the general meeting.

The annual deficit cannot be “used”. However, it is possible to cover an annual deficit with the profit carried forward from the previous year and by withdrawing it from reserves and even converting it into a balance sheet profit, for example in order to be able to make a distribution despite a negative result. In the group, it is also possible to offset losses through profit transfer agreements . Without this countermeasure, the net loss for the year reduces equity.

In the case of partnerships and sole proprietorships , the appropriation of profits is only regulated fragmentarily in commercial law. According to § 122 para. 1 HGB each shareholder can be considered on its capital share an interest rate of 4% from the profit of profit taking charge, while the retained earnings directly to the capital accounts of the shareholders will be credited. This regulation under commercial law is of little importance in practice because the distribution of profits is usually regulated in the articles of association . The shareholders therefore determine directly and exclusively about the appropriation of profits, because there is no other body that, like the general or shareholders' meeting of the corporations, has to decide on this. It takes place via withdrawals (including tax withdrawals ), while a waiver of this leads to self-financing (for corporations: “transfers to retained earnings”).

Key figures

The annual surplus / annual deficit is part of business indicators in the context of the balance sheet analysis . The annual surplus is one of the main goals of accounting policy . For example, the annual result can be improved through the sale of assets and the release of hidden reserves . In order to exclude these special effects in the balance sheet analysis, the adjusted net income can be determined. Further economic key figures that are based on the annual result ( EBIT , EBTA , EBITA and EBITDA ) also calculate the effects of taxation, interest and depreciation for analysis purposes .

The cash flow profitability is intended to provide information about the proportion of revenue-related surpluses in the total capital employed by a company:

In order to determine whether and how the use of the equity has paid off, it is compared to this position:

With the measure of return on equity which measures business owners , the return on equity from him.

profit after taxes

The profit after tax (after-tax profit; english earnings after taxes , EAT) refers to the profit , after deduction of income taxes were generated by a company. According to commercial law, it corresponds to the annual surplus.

General

The distinction between pre-tax and post-tax profit is necessary because internationally corporate profit as a type of income is subject to different taxation (in Germany: profit income ). Since the taxation of profits shows significant differences worldwide, it makes sense to compare the pre-tax profits with each other when comparing companies , because taxes as a data parameter cannot be influenced by the company. However, since only the profit after tax is available for use and distribution (distribution in the form of dividends or withholding as profit retention), it is also an important key figure.

identification number

In particular, when analyzing the appropriation of profits, profit after tax is used. A company will achieve high equity growth when its after-tax profit is particularly high. On the one hand, it will enable high profits to be retained and, on the other hand, it will also be able to contribute to a higher external capital increase through high distributions (dividends) .

The key figure EAT, which comes from international accounting methods IFRS or US-GAAP , stands for the annual result after taxes and is identical to the key figure profit after taxes:

Application in controlling and financial analysis

In contrast to profit before tax , profit after tax is rather unsuitable for comparing the profit of different accounting periods or companies due to its dependence on tax effects (such as back tax payments or tax reductions through loss carryforwards ). Due to this dependence on the general tax situation, profit after tax in relation to sales is - only to a limited extent - an instrument for measuring the profitability of a company.

Demarcation

The profit / loss is then not identical to the annual surplus / annual deficit if the accounting company has to transfer the annual surplus to the parent company as a subsidiary or receives an annual deficit from it. These income or expenses from profit transfer agreements must misleadingly be shown in a position before the annual surplus / annual deficit ( Section 277 (3) HGB), but in no way lead to an economically correct presentation of the annual surplus / annual deficit at the subsidiary. Profit transfer agreements usually ensure that the net profit is "zero". In reality, however, the company generated profits / losses that were siphoned off by the parent company. This is done via the “Expenses from transferred profits” and “Income from the assumption of losses”, which are to be shown separately in accordance with Section 277 (3) sentence 2 HGB. They form the adjustment item for the gains / losses actually incurred.

literature

- Adolf G. Coenenberg , A. Haller, W. Schultze: Annual financial statements and analysis of the annual financial statements: Business, commercial, tax and international principles - HGB, IFRS, US-GAAP, DRS. 21st edition, Stuttgart 2009, ISBN 978-3791027708 .

- Rudolf Heno: Annual financial statements in accordance with commercial law, tax law and international standards (IFRS). 6th edition, 2009, ISBN 978-3790823769 .

- Günter Wöhe , essay: The annual accounts. In: Introduction to general business administration. 24th edition, Munich 2010. ISBN 978-3800637959 .

Individual evidence

- ↑ Helmut Geyer / Bernd Ahrend, Crashkurs BWL , 2009, p. 200

- ^ Helmut Weber, Profitability, Productivity and Liquidity , 1998, p. 28

- ↑ Annual net income - young investors stock market knowledge. Retrieved February 27, 2019 .

- ↑ Ulrich Pape, Fundamentals of Financing and Investment , 2015, p. 228

- ↑ Horst Albach / Egbert Eymann / Alfred Luhmer / Marion Steven, Die Theorie der Unternehmens in Forschung und Praxis , 1999, p. 762

- ↑ Henner Schierenbeck / Michael Lister, Value Controlling: Fundamentals of Value-Oriented Management , 2002, p. 154 f.

- ↑ Hartmut Weber, Profitability, Productivity and Liquidity , 1998, p. 29