Risk premium

The risk premium (RP, English risk premium ; depending on the sign also called risk discount or risk premium ) is generally in the economy the compensation for a financial risk assumed by the risk taker .

General

In concrete terms, the risk premium is the equivalent contained in the profit for the general entrepreneurial risk in cost accounting . Especially when it comes to capital investments , risk-averse investors have to build a risk premium into their expectations of the real interest rate if there is uncertainty about the development of inflation . For example, the expected equilibrium return on a share is made up of the risk-free base rate and the risk premium. In foreign trade theory , the risk premium is the difference between the expected return on an investment in foreign currency and the return on a comparable investment in domestic currency. From an actuarial point of view, the risk premium is the most important imputed component of the insurance premium (gross premium), which is set by the insurer for the sole purpose of assuming risk .

Financial Mathematics and Decision Theory

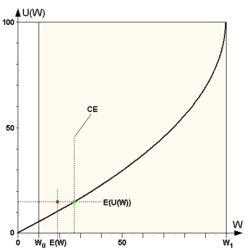

In financial mathematics and decision theory , the risk premium is the difference between the expected value of an uncertain asset , e.g. B. securities ( lottery ticket , share , bond , savings account ), and the individual security equivalent ( English certainty equivalent ) of this asset, that is, those secure payout CE , z. B. immediately and in cash, which subjectively promises the same benefit to the person concerned (and is therefore worth the same) as the insecure wealth :

The decisive factor for the amount and sign of the risk premium RP is therefore primarily the ratio between the mathematical expected value E (W) , which is always the same for one and the same asset w, and the individual security equivalent CE of the relevant market participant:

- If E (w)> CE , the risk premium RP becomes positive, ie the person concerned is willing to pay a premium for it to those who relieve him of the risk of uncertain wealth (and thus the risk of a possible real loss of wealth). The best-known example of such transactions are insurance contracts, in which the risk premium RP is also referred to as the insurance premium .

Market participants whose security equivalent CE is usually less than the expected value E (w) of their uncertain assets are called risk averse or risk averse . Decisive for risk-averse decisions is the higher weighting of possible asset losses compared to possible asset gains. - If E (w) = CE , the risk premium RP becomes zero, i.e. H. the person concerned is neither willing to pay someone else a premium for assuming their own financial risk nor, conversely, to buy someone else's financial risk.

Market participants whose security equivalent CE usually coincides with the expected value E (w) of their uncertain assets are called risk-neutral . The equal weighting of possible asset losses and gains is decisive for risk-neutral decisions. - If E (w) <CE , the risk premium RP becomes negative, i.e. H. conversely, the person concerned is now prepared to pay a premium for it to those who cede the risk of their uncertain wealth (and thus the prospect of a possibly real wealth gain). The best known example of such transactions are practically all real ones, i.e. H. From a mathematical point of view, always “unfair” lotteries, the ticket price of which regularly remains above their expected value E (L) .

Market participants whose security equivalent CE is usually greater than the expected value E (w) of their uncertain assets are called risk- loving or risk-affine . Decisive for risk-related decisions is the higher weighting of possible asset gains versus possible asset losses.

Formal description

A real, measurable and reversible utility function u (w) together with its inverse w (u) and an uncertain capacity x , composed of a certain initial capacity and a random variable with the expected value E (X) = 0, are given . The following then applies to the expected value of the uncertain assets :

Is the equation

The real number thus defined is called the risk premium (or the security equivalent of the random variable X ) for a given initial asset .

Is the utility function u (w) reversible as required, e.g. B. increasing strictly monotonically, the risk premium can be calculated using the inverse utility function u (w) as follows:

interpretation

- The positive risk premium is the discount that a risk-averse decision maker (with a concave utility function that applies to him) is willing to accept in order to avoid the risk of the random variable X with a fixed average return .

- The negative risk premium is the surcharge that a risk-conscious decision-maker (with a convex utility function that applies to him) is willing to pay in order to be able to take on the additional risk of the random variable X with a fixed average return .

Risk premium and Arrow-Pratt measure of absolute risk aversion

As John W. Pratt showed in 1964, the risk discount (the required minimum risk premium) for small values of the variance and the expected value for any continuously differentiable utility function can be approximated as follows:

Examples

A coin is thrown and, depending on the result of the coin toss, either a payout of € 1.00 or nothing. The expected value E (w) would therefore be € 0.50, the price of a ticket if the lottery was fair would also be € 0.50.

- If the player now prefers to have an amount of less than € 0.50 paid out in cash instead of the uncertain profit distribution, e.g. For example, selling his own ticket to someone else for such a lower amount is called risk averse or risk averse, and the risk premium of whoever buys the ticket is positive (he will statistically make a profit).

- If, on the other hand, the player sells his ticket to someone else for exactly € 0.50, i.e. if he is undecided (indifferent) whether he should participate in the lottery or not, he is called risk-neutral, and the risk premium of the person who buys the ticket from him, remains zero (statistically speaking, it will not make a profit or a loss).

- If the player is only then willing to sell his ticket to someone else if he pays him an amount> € 0.50 on the spot, such a player is called risk-loving or risk-loving, and the risk premium of the person who buys the ticket from him , is negative (it will statistically make a loss).

Dependence of the risk premium on the risk type

example 1

A risk- shy player with the risk benefit function and its reverse function takes part in a raffle , in which the chances of a main prize of 2500 € are at 1%, while those for a consolation prize of only 25 € are with the remaining 99%.

The expected value of the uncertain assets w and the expected benefits for participation in the raffle are thus:

Security equivalent of uncertain assets w and risk premium of the raffle are calculated in order for the player as follows:

The risk-averse player would be willing to spend a maximum of € 29.70 on a ticket or, conversely, to resell it for € 29.70 (or more), whereby the buyer would make an average profit of € 20.05, as the average return of the lot, as shown, is € 49.75.

Example 2

A risk- joyful player with the risk utility function and its inverse function assume the same raffle in part, in which the chances of a prize of 2500 € again at 1%, representing a consolation prize of only 25 €, however in the remaining 99%.

The expected value of the uncertain assets w and the expected benefits for participation in the raffle are thus:

The security equivalent of the uncertain asset w and the risk premium are now calculated for the player as follows:

The risk-taker would be willing to spend a maximum of € 251.23 on a ticket or, conversely, to resell it for € 251.23 (or more), with the buyer making an average loss of € 201.48 because of the average return of the lot, as shown, is only € 49.75.

Dependence of the risk premium on the initial assets

The position of the expected value of the uncertain asset w that goes into the formula for the risk premium is a. determined by the initial capacity w 0 .

example 1

A risk-averse player with the risk utility function and its inverse function would only have one lottery ticket, on which a winnings of € 7 would be paid out with a probability p = 0.5, while his initial wealth w 0 would be zero.

The expected value of the uncertain asset w = w 0 + L and the expected benefit when participating in the lottery are thus:

The security equivalent of the uncertain assets w = w 0 + L = L and the risk premium are thus calculated for the player as follows:

As you can see, the lottery ticket would be worth € 1.75 less to the penniless player than its purely arithmetical value corresponds: Although the ticket promises an average profit of € 3.50, the penniless player would be ready for € 1.75 to resell the ticket to someone else or to buy it yourself for a maximum of this € 1.75, as the risk of losing the total stake outweighs the prospect of winning in this case.

Example 2

Another risk-averse player with the same risk benefit function and its reverse function would also have the same lottery ticket again, on which a profit of € 7 would be paid out with a probability of p = 0.5, but now a safe starting wealth w 0 of € 9.

The expected value of the uncertain asset w = w 0 + L and the expected benefit when participating in the lottery are thus:

The security equivalent of the uncertain assets w = w 0 + L and the risk premium are thus calculated for the player as follows:

As you can see, the same lottery ticket would only be worth € 0.25 less to the "wealthy" player than its purely arithmetical value: Although the ticket promises an average profit of € 3.50, the "wealthy" player would be because of it Risk averse, however, only willing to spend 3.25 € on it yourself or resell it for 3.25 € (or more).

Dependence of the risk premium on the profit margin

The location of the influent in the risk premium formula expectation of uncertain assets Another factor w affected, is the span of the in prospect profit.

example 1

A risk-averse player takes part in the final round of a TV show, in which the players finally have to choose between two doors, behind which one time nothing is hidden, the other time € 1600. Alternatively, instead of having to choose between the doors, each player can immediately receive € 800 in cash as a consolation prize. Both this cash payment and the game with the doors have the same calculated expected value of € 800. A so-called A risk-neutral player who wouldn't care about the risk of choosing the wrong door would now be undecided (indifferent) whether he should decide to play with the doors or the safe cash payment - a risk-averse player, on the other hand, will always receive the safe € 800 prefer.

Assuming that the risk- benefit function of the risk-averse player and its inverse function are and , the expected value of the profit at door guessing w = T and the expected benefit can be calculated as follows:

The security equivalent and risk premium of guessing doors are then calculated as follows:

As can be seen, there is no reason for risk-averse players with a risk benefit function like the one above to opt for door guessing: The "perceived" benefit of the expected average game win of € 800 is just the same as that of a secure immediate payment of 400 €, so much lower than the alternative of 800 € offered by the showmaster.

Example 2

If the showmaster was only dealing with such players (and most people are risk averse), the show would soon be over. In view of this, one of the possibilities to persuade the players to take the risk could be to double the profit from € 1,600 to € 3,200, and thus also its expected value from € 800 to € 1,600:

The security equivalent and risk premium of guessing doors also double:

In the new situation, however, it would still not be clear whether the players would actually opt for the average profit from guessing doors of € 1,600 or would rather opt for the secure payout of € 800, as their "perceived" benefit will be now just balances that of the security equivalent of the expected rate gain E (T) . Definitely in favor of door guessing, the tide would therefore only turn if profits> € 3200.

Dependence of the risk premium on the course of the individual risk benefit function

In addition to the position of the expected value and the spread of the uncertain asset w , the course of the risk benefit function u (w) itself, namely its increase and / or its curvature behavior, plays a decisive role in determining the risk premium.

example 1

A risk-averse market participant with a saved fortune of € 100,000 learns from his doctor that he can, in the worst case, lose 90% of his fortune due to an illness, the treatment costs of which are not covered by his health insurance company, if this illness breaks out in him, even if only with it a probability of 1:10. The choice he faces is:

- A) to take out a corresponding additional insurance and thus to ensure that the insurer relieves him of his future worries, to accept an, albeit small, immediate loss of assets (in the form of the insurance premium to be paid), or else

- B) not to take out any additional insurance, to save the money for the insurance premium and to bear the entire risk of medical expenses yourself, i.e. to risk an uncertain loss of wealth , which in this case is not all that probable, but all the more serious .

The expected value E (w) of the uncertain asset w of the market participant is calculated as follows, taking into account the above starting values and probabilities:

- w 0 = 10,000; w 1 = 100,000; p (w 0 ) = 10%

(w) = p * w 0 + (1-p) * w 1 = 10% * 10,000 + 90% * 100,000 = 91,000

Everything else now depends on the individual utility function of the market participant - is it a risk-averse market participant with one of the two utility functions shown here or , for example, the following scenarios would be possible:

- The behavior of the market participant is described by the utility function with the inverse . The utility of the two corner assets w 0 and w 1 as well as the expected utility of the uncertain assets w are then calculated as follows: The security equivalent of the uncertain assets of the market participant and the resulting risk premium are thus calculated for this case:

- The behavior of the market participant is described by the utility function with the inverse . The utility of the two basic assets w 0 and w 1 as well as the expected utility of the uncertain assets w are then calculated as follows: The security equivalent of the uncertain assets of the market participant and the resulting risk premium are calculated in this case as:

As can be seen, the security equivalent of uncertain assets for the market participant in the first case is another € 4,212 below the expected value of his assets of € 91,000 - he would therefore be willing to pay up to € 13,212 in total to avoid the risk of medical expenses (in Amount of 9,000 €). In the second case, the security equivalent of the market participant is even lower - the price of the insurance could rise to up to € 28,460 due to the risk aversion of the insured person, of which € 19,460 would be the average net premium of the insurer for giving the insured person the risk of medical expenses (amounting to of 9,000 €).

Example 2

A risk-taking market participant with a saved fortune of € 10,000 is offered to take part in a risk bet in which he could increase his fortune tenfold, if only with a probability of 1:10. The choice he faces is:

- A) to buy a lottery ticket and that the betting game operator gives him the chance of a tenfold increase in its assets, if one also small immediate safe to accept loss of assets (in the form of betting fee), or

- B) not to buy a betting slip and thus to save the money for it, but also to miss the chance of an uncertain , but all the more considerable, capital gain.

The expected value E (w) of the uncertain asset w of the market participant is calculated as follows, taking into account the above starting values and probabilities:

- w 0 = 10,000; w 1 = 100,000; p (w 1 ) = 10%

E (w) = (1 − p) w 0 + p w 1 = 90% 10,000 + 10% 100,000 = 19,000

Everything else now depends on the individual utility function of the market participant - if it is a risk-taking market participant with one of the two utility functions shown here or , for example, the following scenarios would be possible:

- The behavior of the market participant is described by the utility function with the inverse . The utility of the two corner assets w 0 and w 1 as well as the expected utility of the uncertain assets w are then calculated as follows: The security equivalent of the uncertain assets of the market participant and the resulting risk premium are thus calculated for this case:

- The behavior of the market participant is described by the utility function with the inverse . The utility of the two basic assets w 0 and w 1 as well as the expected utility of the uncertain asset w are then calculated as follows: The security equivalent of the market participant and the resulting risk premium are thus calculated for this case:

As can be seen, the security equivalent of the uncertain assets w of the market participant in the first case is about € 14,015 above the average expected wealth of € 19,000 itself - the market participant would therefore be willing to spend up to € 33,015 on the opportunity Fortune to increase tenfold. In the second case, on the other hand, the security equivalent is only around € 8,085 above the expected value - here the price of the betting slip could therefore only be a maximum of € 27,085, of which € 8,085 would be the average net premium of the competition organizer for giving the player the chance to win (in the amount of of 90,000 €).

economic aspects

The risk premium is directly related to the risk attitude of a decision maker . The following risk settings can therefore be assigned to the risk premium :

The attitude to risk in banking and insurance is of great importance . Credit institutions must that of private investors be entered into financial risk of an investment in a suitability statement prior to the conclusion of a security order in accordance with § 64 para. 4 WpHG , as confirmed consistent with the risk tolerance of the investor while the asset class and risk category have to be considered. Risk-neutral investors expect a return in the amount of the risk-free interest rate, because they do not demand a risk premium and assign a disuse to the risk. Risk-averse investors, on the other hand, prefer investments that pay a risk premium. In turn, risky investors even receive a risk premium from the counterparty . In the insurance market , the risk attitude of a potential policyholder is important, whether and to what extent he is willing to subject an existing risk to insurance cover or not. A risk-averse customer will only be willing to take a insurance premium to pay, under the expected value of the damage is: a risk-averse is willing to pay a higher than expected value premium: will be ready while spending a risk-neutral economic subject insurance premium exactly the expected value of the risk corresponds to: . The expected value of the damage ( ) is the decision parameter for the policyholder.

See also

Individual evidence

- ↑ Springer Fachmedien Wiesbaden (ed.), Compact Lexicon Internationale Wirtschaft , 2013, p. 320

- ↑ Springer Fachmedien Wiesbaden (ed.), Gabler Volkswirtschafts-Lexikon , 1997, p. 513

- ↑ Springer Fachmedien Wiesbaden (ed.), Gabler Volkswirtschafts-Lexikon , 1997, p. 570

- ↑ Springer Fachmedien Wiesbaden (ed.), Gabler Volkswirtschafts-Lexikon , 1997, p. 931

- ↑ Dieter Farny / Elmar Helten / Peter Koch / Reimer Schmidt (eds.), Handwortbuch der Versicherung HdV , 1988, p. 525 f.

- ↑ Helmut Laux: Decision Theory ; Springer-Verlag 2005, ISBN 3-540-23576-0 , p. 216 ff.

- ↑ Cf. Rudi Zagst: Portfolio Theory and Asset Pricing (lecture script , 2008), p. 61. ( Memento of the original from December 17, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Peter Kischka: Lecture Statistics II, chap. IV: Introduction to Decision Theory ; Jena, WS 2005/2006, p. 21.

- ↑ Helmut Laux: Decision Theory ; Springer-Verlag 2005, ISBN 3-540-23576-0 , pp. 227-229.

- ↑ Florian Bartholomae / Marcus Wiens, Game Theory: An application-oriented textbook , 2016, p. 11

- ↑ Matthias Kräkel, Organization and Management , 2007, p. 70

- ↑ Florian Bartholomae / Marcus Wiens, Game Theory: An application-oriented textbook , 2016, p. 11

- ↑ Hans-Bernd Schäfer / Claus Ott, textbook on economic analysis of civil law , 1986, p. 257