Corporate real estate

Corporate real estate , also known as mixed-use commercial real estate (English industrial real estate ), offers space for business operations. In a narrower sense, it is about real estate that provides the structural shell for processes in logistics , light industry , heavy industry , but also research and application technology . In a broader sense, it includes all real estate used for business purposes, or business real estate for short .

use

They incorporate operational processes and functions such as: research , administration, production , storage , repairing , selling and / or exhibiting. While pure office real estate is hardly suitable for other purposes, most corporate real estate is planned in such a way that it is reusable, convertible and reversible - that is, storage space can be converted into office space, production facilities into laboratory space, etc. Corporate real estate in Germany is typically owned by one or more medium-sized companies of various sizes and orientations.

Corporate real estate inside and outside Germany

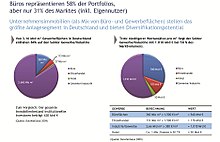

Of the 3.16 billion square meters of commercial space in Germany, 2.66 billion square meters belong to the commercial / industrial segment. With an estimated market value of 1,100 billion euros, corporate real estate is by far the largest segment of the German commercial real estate market.

The total stock of corporate real estate in 2010 was around 520 billion euros or 922 million square meters of usable space. By the end of 2012, the value had increased by 3.5 percent to 538.3 billion euros. The usable area is currently around 932.2 million square meters (+1.1 percent). In terms of area, corporate real estate accounts for approx. 36 percent of the total stock of commercial and industrial space in Germany.

Under the name “Light Industrial”, corporate real estate in the Anglo-American region established itself as an asset class early on : Compared to Germany, corporate real estate in the USA, for example, has a significantly higher share of new investments with institutional investors at 21 percent . They are also an integral part of the asset allocation there.

Types of corporate real estate

Transformation real estate

These properties are often former production sites with a building structure that has grown organically for operational reasons. Some of them have a campus character, are relatively centrally located in urban areas and are subject to a higher-level management. During the transformation process, the existing rental income facilitates renovation, expansion and renovation measures with the aim of converting a one-party property with uniform use into a multi-party property with mixed use.

Logistics real estate

Against the background of supply chain management , modern logistics properties no longer only function as storage and transshipment locations or for the picking of goods. The existing infrastructure and technology (e.g. affiliated office and social rooms, warehouses, conveyor technology , IT, service areas, workshop, etc.) can be quickly adapted to new requirements.

Business parks

Business parks are already designed for mixed use. A combination of offices, service, storage and open spaces is offered for rent in a building complex equipped with management. Modern properties are characterized by central locations and smaller dimensions, while older business parks are more easily accessible outside the core cities. Basically, different generations can be identified in business parks: The first generations were characterized by a very small proportion of office space. Over time, the office space became more and more dominant and reached up to 80 percent of the total area. This trend has now clearly decreased in favor of other areas.

Production real estate

Production properties are buildings for the non-disruptive manufacturing industry. This does not include, for example, industrially used areas with high emissions . Today's production properties are more likely to be found in modern location clusters with good urban connections. They usually combine several surface types: z. B. Production, logistics and storage areas as well as smaller office areas.

Production properties make up the largest subgroup in terms of property value at 55 percent (see figure). Existing logistics properties account for almost a quarter, while modern logistics properties account for almost twelve percent. Transformation properties still account for 7.8 percent of the volume, while industrial parks only make up a marginal 1.7 percent.

Corporate real estate as investment objects

Around 90 percent of German corporate real estate is owned by users. Investors only own about ten percent. According to a study by Ernst & Young Real Estate, around twelve percent of German medium-sized companies can imagine part or all of their real estate in the future. A sale is usually a sale-and-rent-back transaction. The company sells either the entire or parts of the company building. The company itself then becomes the tenant of the space, but - unlike with traditional real estate leasing - no longer has to worry about the maintenance of the space. This task, as well as the management of the building space in general, then falls to the new owner or the investor's asset manager . The prices for corporate real estate are usually based on the standard land values , the achievable rent, the term of the lease and the restoration costs. Since the purchase prices for corporate real estate are far below the level of offices or retail properties, comparatively higher dividend yields can be achieved in this segment.

Not all corporate real estate is suitable for an investment. The investment suitability depends heavily on the type of property in question and ranges from 40 percent for production properties to 90 percent for business parks. All in all, around 49 percent of corporate real estate can be classified as investable. This corresponds to a property value of around 261 billion euros or around 457 million square meters of usable space.

Individual evidence

- ↑ a b c cf. bulwiengesa AG et al .: Commercial and industrial real estate in Germany, joint study, Berlin 2010, ( PDF ).

- ↑ a b bulwiengesa AG, 2013, estimate based on the RIWIS real estate database.

- ↑ a b Beos Survey 02: Corporate real estate: inventory and investment structures, series of analyzes with bulwiengesa AG, March 2013 ( PDF ( Memento of the original from July 14, 2014 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this note. ).

- ↑ See CB Richard Ellis: The logic of logistics: Supporting a bigger role in institutional portfolios, April 2012, ( PDF ). See Prologis: Opportunities in the European Industrial Market, October 2012, ( PDF ).

- ↑ a b c d See Beos Survey 01: Corporate Real Estate: Quarters for SMEs, series of analyzes with bulwiengesa AG, November 2012, ( PDF ( Memento of the original from July 14, 2014 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this note. ).

- ↑ See Ernst & Young Real Estate: Agenda Mittelstand: Operational real estate management in medium-sized companies, joint research project with the Technical University of Darmstadt, 2008.

- ↑ See Börsen-Zeitung of May 22, 2012: Corporate real estate as a yield hit. See bulwiengesa AG et al .: Commercial and industrial properties in Germany, joint study, Berlin 2010.

literature

- Thomas Glatte : [1] The Importance of Corporate Real Estate Management in overall Corporate Strategies Whitepaper by CoreNet Global Inc., Atlanta, Georgia / USA, 2013.

- Stephan Bone-Winkel : [2] Corporate real estate : An Asset Class of High Potential in: Tobias Just, Wolfgang Maennig (Ed.): Understanding German Real Estate Markets, pp. 423–437, Regensburg, 2016.

- Stephan Bone-Winkel : [3] Corporate real estate as an asset class Win: Malte-Maria Münchow (Ed.): Kompendium der Logistikimmobilie, 2nd edition, pp. 123–142, Wiesbaden, 2016.

- Stephan Bone-Winkel : [4] Project development in: Karl-Werner Schulte, Stephan Bone-Winkel, Wolfgang Schäfers (Eds.) Real Estate Economics I Business Basics, 5th edition, pp. 173–248, Regensburg, 2015.