Valovis Commercial Bank

| Valovis Commercial Bank AG | |

|---|---|

|

|

| Country |

|

| Seat | Neu-Isenburg |

| legal form | Corporation |

| colspan = "2" style = "display: none" | Template: Infobox_Kreditinstitut / Maintenance / ID_ Fehlerhaft | |

| founding | 1990 |

| resolution | September 22, 2011 |

| Website | www.vcbank.de |

| management | |

| Board | Axel Frein (Chair) Peter Rosenberger |

| Supervisory board | Robert K. Gogarten (Chairman) Theodor Knepper Karl-Heinz Pitz |

The Valovis Commercial Bank AG (1990 to 1993 Optimus Bank für Finanzservice GmbH , to 2002 "Optimus Bank für Finanz-Service GmbH", to 2004 Karstadt Quelle Bank GmbH , to 2010 "KarstadtQuelle Bank AG") was a bank operating in the private customer sector with the Headquarters in Neu-Isenburg .

history

The bank was founded in 1990 by Karstadt AG or its then subsidiary Hertie . In 1993 the Berliner Bank acquired a 50% stake, which, according to press releases from October 1994, it sold to Hertie. In the meantime it was a subsidiary (100% participation) of KarstadtQuelle Finanz Service GmbH, which in turn belonged to Arcandor and the ERGO insurance group . On April 1, 2009 it became a subsidiary of Valovis Bank (formerly Karstadt Hypothekenbank AG ), which is wholly owned by KarstadtQuelle Employee Trust e. V. is held.

In addition to direct business (via the Internet and telephone), the bank did its sales through 9 branches located in Karstadt department stores. The branches were gradually closed until the end of 2009.

It mainly offered consumer loans and fixed income savings products. The bank was also a major issuer of the Mastercard credit card. As of 2010, the bank had issued around 900,000 Mastercard credit cards, making it the largest issuer in Germany.

On March 8, 2010, the bank was renamed “Valovis Commercial Bank AG”. With effect from April 1, Axel Frein was appointed as a new member of the Board of Management, he took over the functions of Samuel Peter, who left on April 30, as well as the newly created CEO. From May 1, 2010 until the merger, Peter Rosenberger was a member of the Management Board.

In January 2011 it was announced for the first time that the Valovis Commercial Bank was to be merged with the parent company Valovis Bank. The merger was approved at the annual general meeting on August 15, 2011. It will take effect retrospectively from January 1, 2011 upon entry in the commercial register. After the merger was entered in the commercial register of the acquiring Valovis Bank on September 16, 2011, the Valovis Commercial Bank was deleted on September 22, 2011.

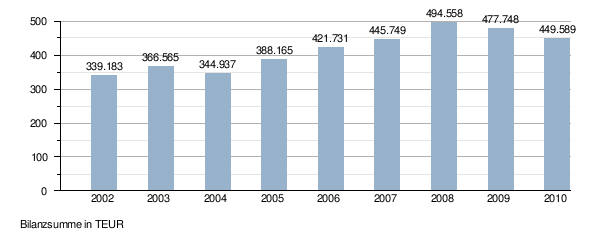

Development of total assets

Web links

Individual evidence

- ↑ a b c d The management of Valovis Commercial Bank. Archived from the original on September 16, 2011 ; accessed on June 11, 2016 .

- ↑ a b c Imprint. Valovis Commercial Bank, archived from the original on September 16, 2011 ; accessed on June 11, 2016 .

- ↑ Handelsblatt No. 198, October 13, 1994, p. 23.

- ↑ VALOVIS BANK AG and Valovis Commercial Bank AG initiate the merger process. Valovis Bank, January 12, 2011, accessed June 11, 2016 (press release).

- ↑ Goods, money and travel are protected ( memento from February 11, 2013 in the web archive archive.today ), Stuttgarter Zeitung from June 9, 2009.

- ↑ a b The credit card is the safest means of payment. In: FAZ. November 22, 2009, accessed June 11, 2016 .

- ↑ We come from the trade. In: The trade. April 8, 2010, accessed June 11, 2016 .

- ↑ Committees decide to merge to form Valovis Bank AG. Valovis Bank, August 16, 2011, accessed June 11, 2016 .