Skimming strategy

The absorption strategy , even Skimmingstrategie , (Engl. Price skimming by skimming for skimming) is a pricing strategy in which a product is first introduced with a high price which is lowered progressively later (see pricing policy ; classical pillar of the marketing mix ).

Skimming strategy and penetration strategy were first described by Joel Dean ( Managerial Economics , 1951).

Both are also known as price sequencing strategies or dynamic strategies. The skimming strategy is not a high-price strategy , as the price is not set high in the long term, but rather price changes over time are explicitly taken into account.

The skimming strategy is related to the term skimming price .

Price skimming should not be confused with cream skimming , which only serves certain customers (groups).

principle

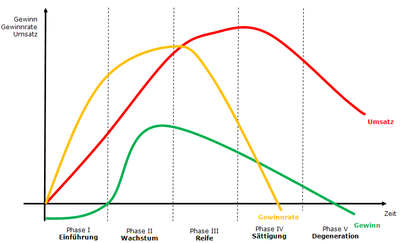

The price for a product is initially set high and corrected downwards as the market penetrates or as a result of technical progress. Due to the high entry price, only lower sales volumes are usually achieved, but at the same time relatively high profit margins are realized per unit. The aim of the skimming strategy is to “skim off” customers who are willing to pay a high price for a new product. H. to keep the consumer surplus as low as possible.

The skimming strategy is particularly recommended if the new products are genuine innovations that are in great demand due to their novelty. Therefore, the first-time customers who pay the high price are also called innovators or early adopters .

A classic example of the application of skimming strategies can be found on the hardware market ( graphics cards , hard drives ) or consumer electronics market ( mobile phones , televisions ), where new, innovative products are brought onto the market at relatively high prices, but after a short time (a few months to a year) cheaper.

Theoretical economic background

Since the willingness of consumers to distributors is unknown, these mobile for tradable goods can no classification of consumers, for example, by income, marital status conduct, education and age to a partial digestion to get on the willingness to pay. Only the initial price setting remains at a high level in order to cover consumers who are willing to pay. In contrast to this, such a classification is possible for immovable goods such as cinema, zoo, theater and so-called social prices, whereby the providers are allowed a classifying price discrimination - but only if there is a sufficiently positive correlation between the classification characteristics and the individual willingness to pay and furthermore the standard deviation within the class is small compared to that between the classes.

Network effects and experience curve effects

The network effects of consumption should be as small as possible or even negative. This is the case, for example, with luxury goods that are status symbolic and that would devalue the product through mass ownership. The experience curve effects of production should also be small, since otherwise setting prices at a lower level would increase the (cumulative) production volume and thus enable cost advantages.

There is a risk that, due to the high price and the associated attractive unit profit, competitors will act as laggards. Because of this risk, the market entry barriers for competitors must be raised. The market entry barriers of competitors can be reinforced, for example, by having one's own know-how advantage and expanding one's own market power .

Empirical knowledge

Martin Spann, Marc Fischer and Gerard Tellis analyze the frequency and choice of dynamic pricing strategies in a complex dynamic market with 663 products (digital cameras) 79 different brands. The empirical analysis shows that, contrary to the recommendations in the literature, the majority of products do not follow a skimming or penetration strategy. There are five different price strategies: skimming (20% frequency), penetration (20% frequency) and three variants of a market price strategy (60% frequency) in which the products are introduced at the market price. With a skimming strategy, the products are launched on average 16% above the market price. With a penetration strategy, the market launch occurs on average 18% below the market price. In this market, companies usually pursue a mix of strategies across their product portfolio. The choice of a certain strategy for a product depends on market, company and brand characteristics such as the intensity of competition, position as a market pioneer, brand reputation and experience curve effects.

Individual evidence

- ^ Willy Schneider: Marketing , Physica-Verlag, 1st edition, 2007, ISBN 3790819417 , page 126

- ↑ High-price strategy - definition in the Gabler Wirtschaftslexikon

- ↑ 10.4.2 Dynamic strategies - Chapter in the course: Marketing for medium-sized companies at teialehrbuch

- ^ M Spann, M Fischer, GJ Tellis: Skimming or Penetration? Strategic Dynamic Pricing for New Products . In: Marketing Science . 34, No. 2, 2015, pp. 235–249. doi : 10.1287 / mksc.2014.0891 .

- annotation

- ↑ The strategic decision in pricing a ... product is the choice between: (1) a policy of high initial price that skim the cream of demand; and (2) a policy of low prices from the outset serving as an active agent for market penetration. , quoted from George Djolov: The economics of competition: the race to monopoly , Best Business Books, 2006, ISBN 0789027895 ; see also GoogleBooks

Web links

- Skimming strategy - definition in the Gabler Wirtschaftslexikon

- 10.4.2 Dynamic strategies - chapter in the course: Marketing for medium-sized companies at teialehrbuch